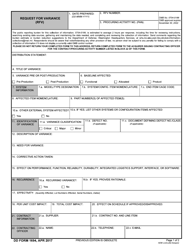

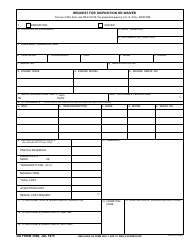

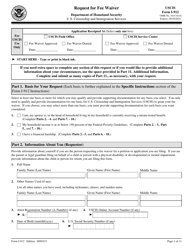

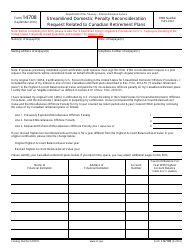

Form PWR Request for Waiver of Penalty - Alabama

What Is Form PWR?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

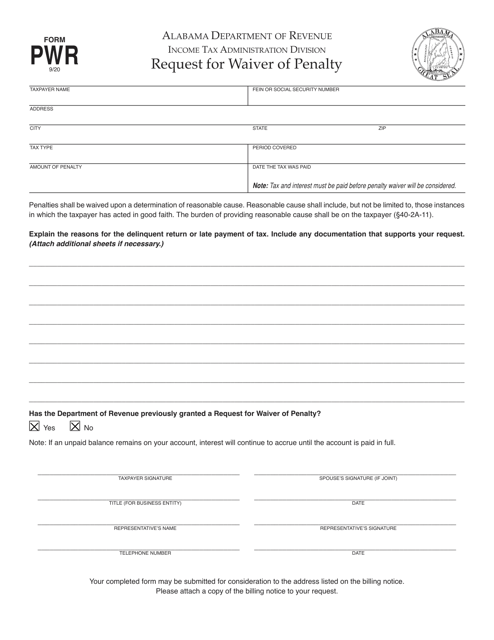

Q: What is the Form PWR Request for Waiver of Penalty?

A: Form PWR Request for Waiver of Penalty is a form used in Alabama to request a waiver of penalty for certain tax liabilities.

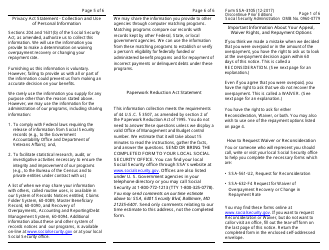

Q: Who can use the Form PWR Request for Waiver of Penalty?

A: Any individual or business entity that has incurred penalties for tax liabilities in Alabama can use the Form PWR Request for Waiver of Penalty.

Q: What is the purpose of the Form PWR Request for Waiver of Penalty?

A: The purpose of this form is to request the Alabama Department of Revenue to waive the penalties that have been assessed for certain tax liabilities.

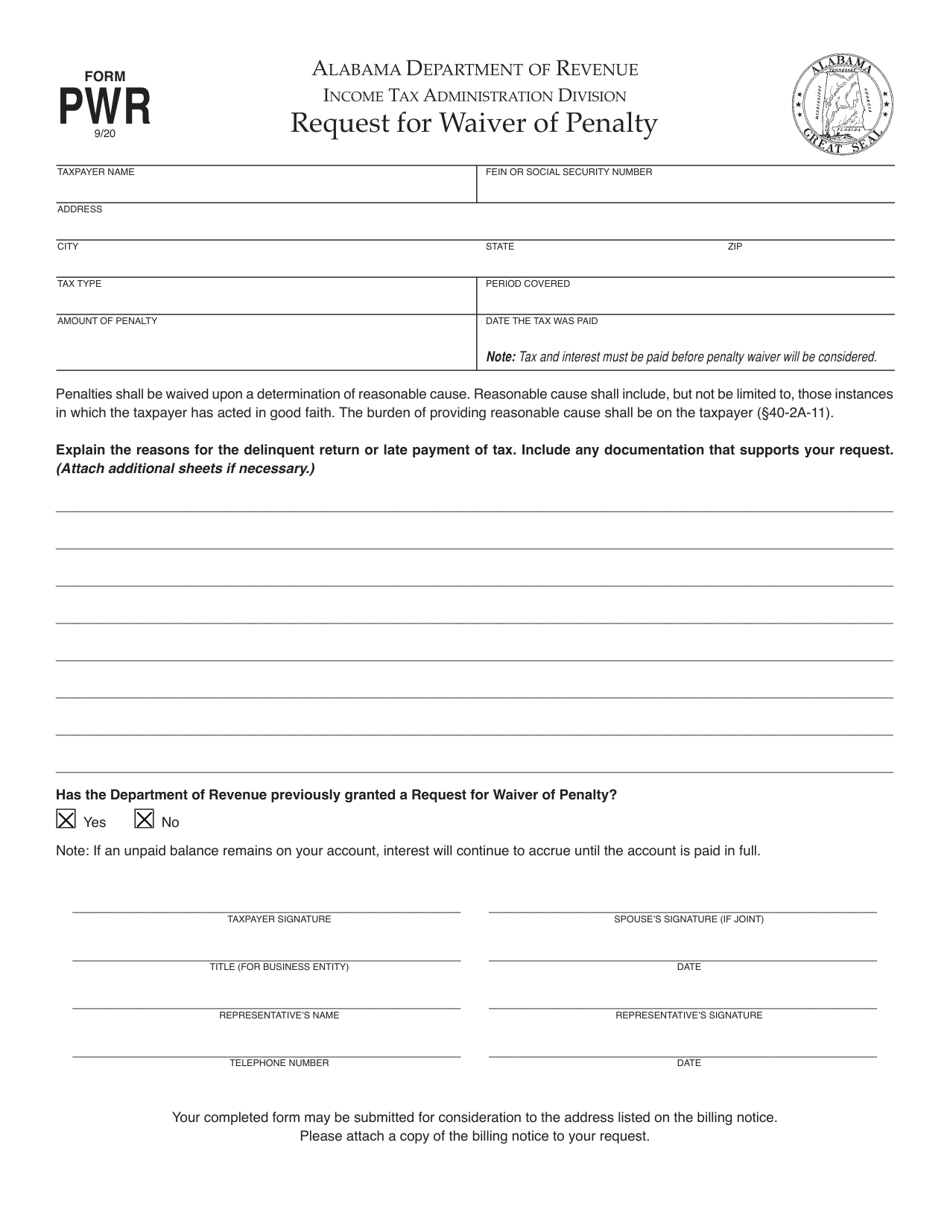

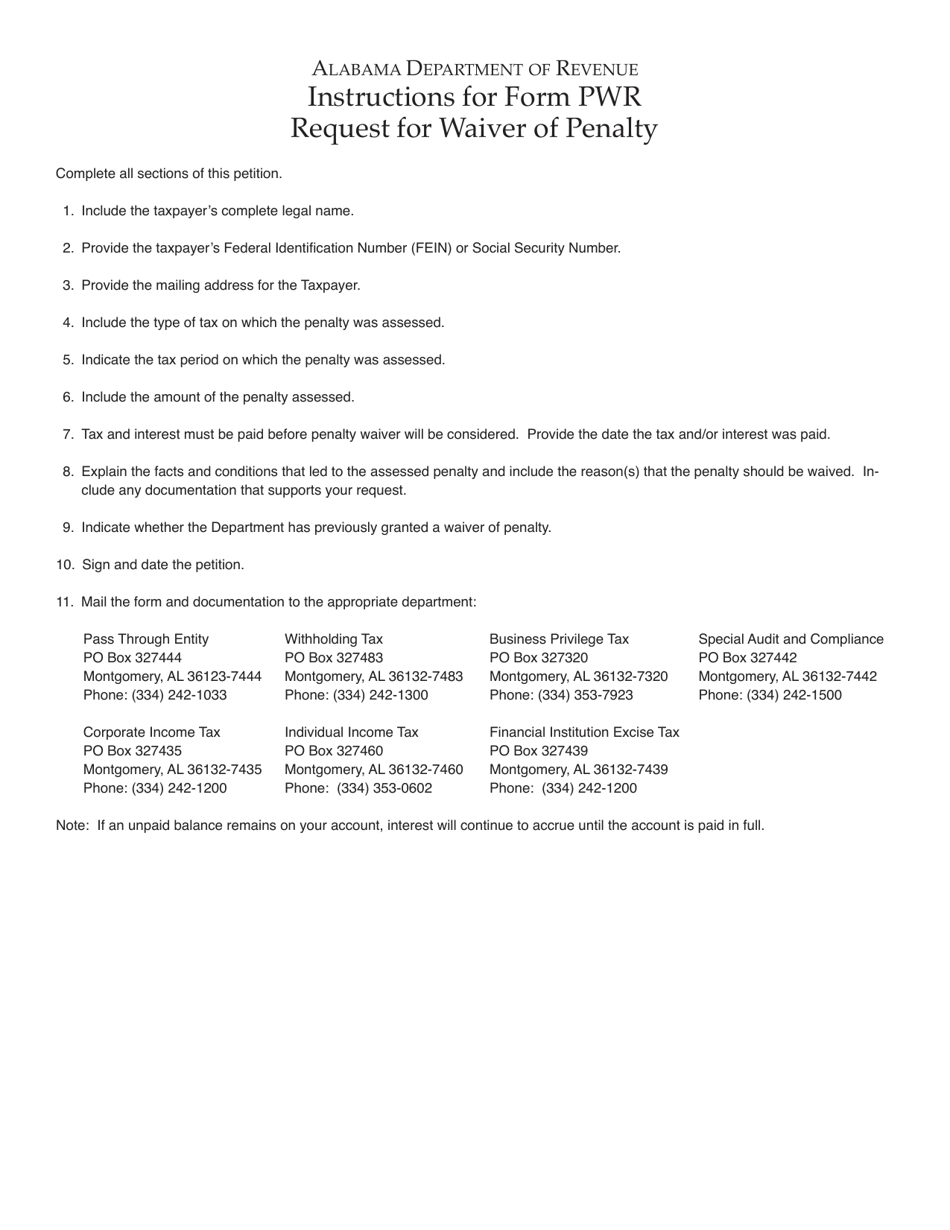

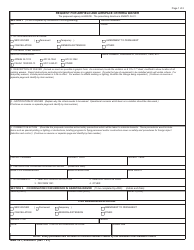

Q: What information do I need to provide on the Form PWR Request for Waiver of Penalty?

A: You will need to provide your personal or business information, details of the tax liabilities for which penalties were assessed, and justification for requesting the waiver of penalty.

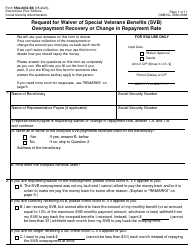

Q: Is there a deadline for submitting the Form PWR Request for Waiver of Penalty?

A: Yes, there is a deadline for submitting the form. The specific deadline will be mentioned on the notice of penalty from the Alabama Department of Revenue.

Q: What happens after I submit the Form PWR Request for Waiver of Penalty?

A: After you submit the form, the Alabama Department of Revenue will review your request and make a decision on whether to waive the penalties or not.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PWR by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.