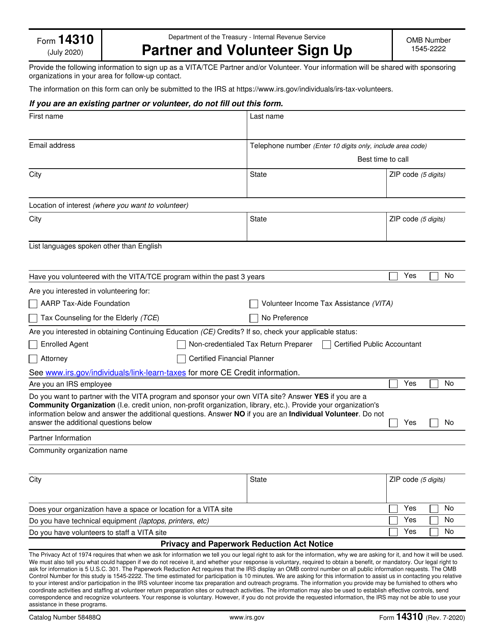

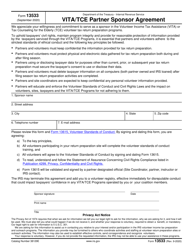

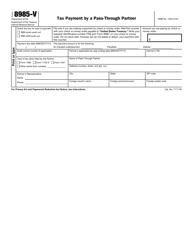

IRS Form 14310 Partner and Volunteer Sign up

What Is IRS Form 14310?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on July 1, 2020. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14310?

A: IRS Form 14310 is the Partner and Volunteer Sign up form.

Q: Who should use IRS Form 14310?

A: Individuals or organizations who want to partner with or volunteer for the IRS should use Form 14310.

Q: What information is required on IRS Form 14310?

A: IRS Form 14310 requires basic personal information, such as name, contact details, social security number or taxpayer identification number.

Q: Is IRS Form 14310 mandatory?

A: No, IRS Form 14310 is not mandatory. It is only required if you wish to partner with or volunteer for the IRS.

Q: What will happen after I submit IRS Form 14310?

A: After you submit IRS Form 14310, the IRS will review your application and contact you regarding partnership or volunteer opportunities.

Q: Do I need to pay any fees to submit IRS Form 14310?

A: No, there are no fees associated with submitting IRS Form 14310.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14310 through the link below or browse more documents in our library of IRS Forms.