This version of the form is not currently in use and is provided for reference only. Download this version of

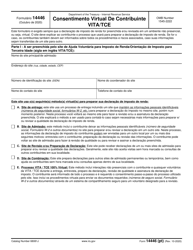

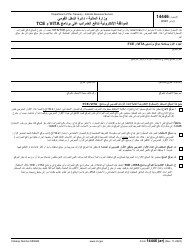

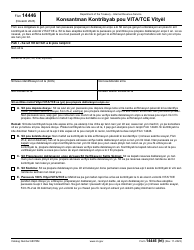

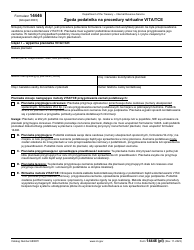

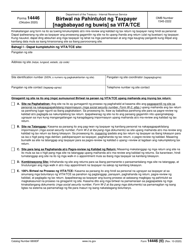

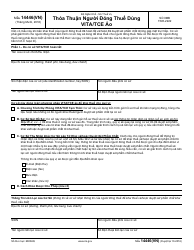

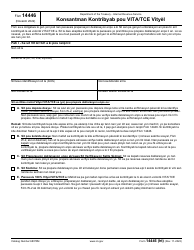

IRS Form 14446

for the current year.

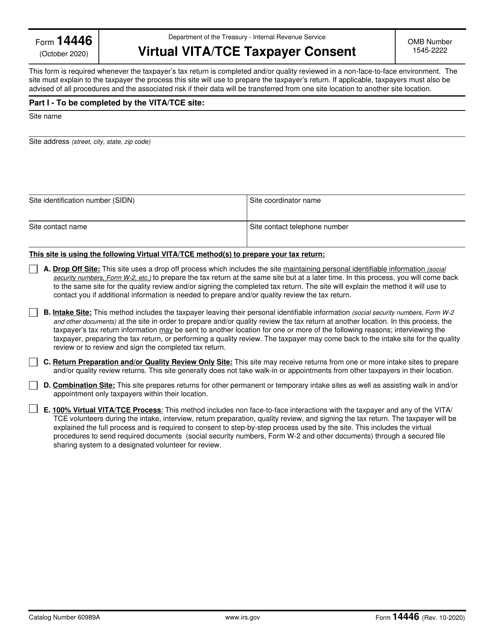

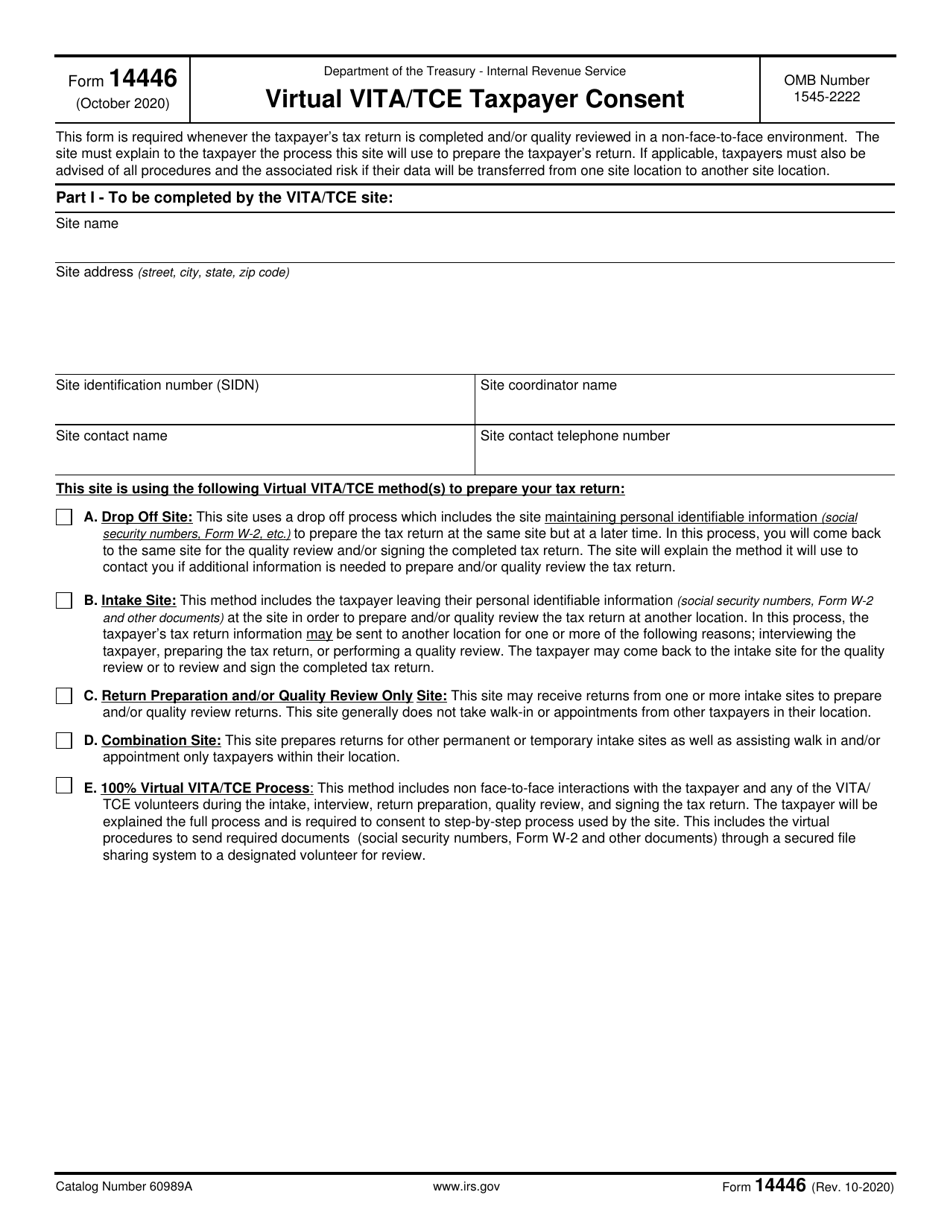

IRS Form 14446 Virtual Vita / Tce Taxpayer Consent

What Is IRS Form 14446?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2020. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14446?

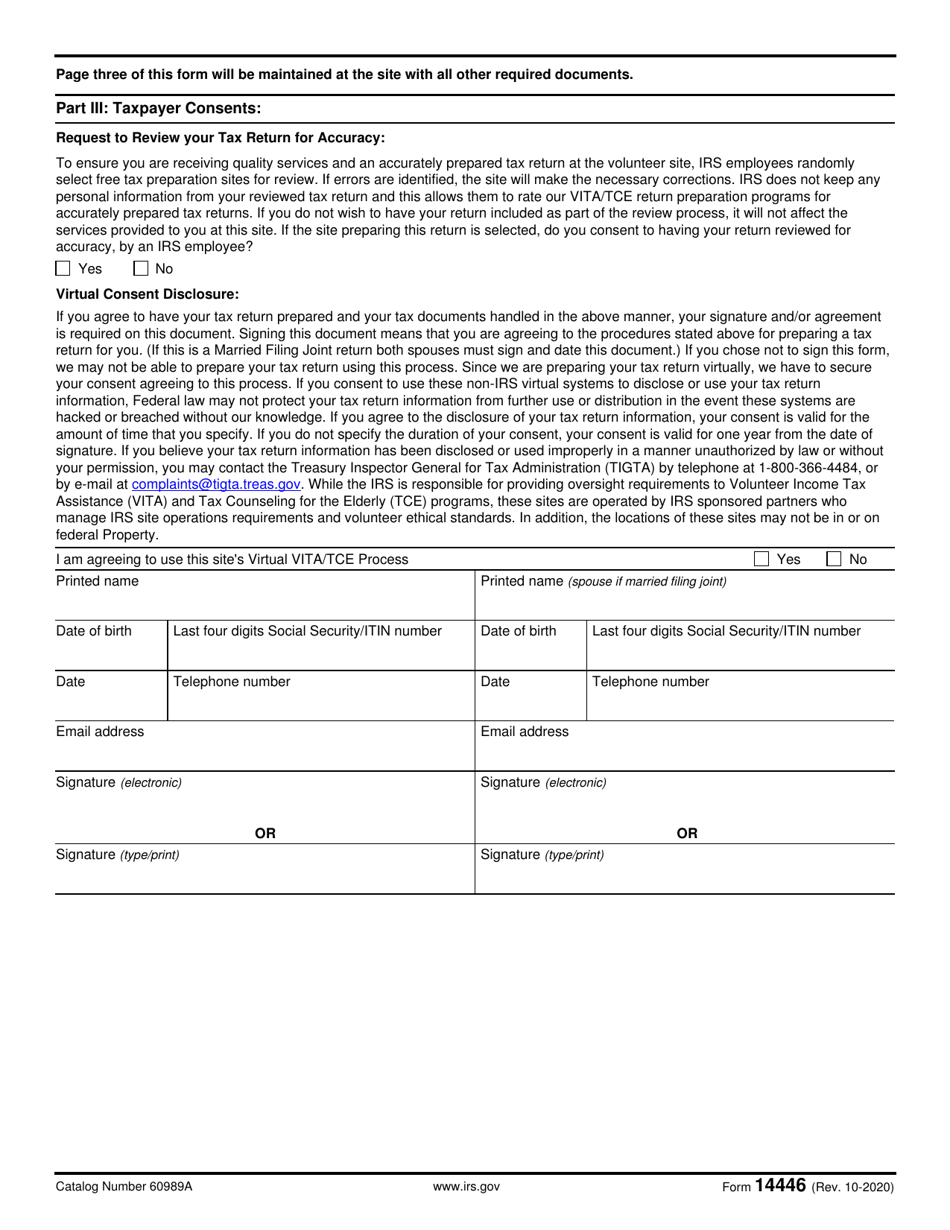

A: IRS Form 14446 is a consent form for taxpayers who participate in the Virtual VITA/TCE program.

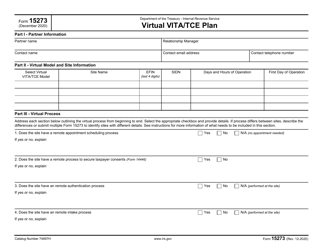

Q: What is the Virtual VITA/TCE program?

A: The Virtual VITA/TCE program is an IRS program that provides free tax preparation and assistance to eligible taxpayers.

Q: Why do I need to fill out IRS Form 14446?

A: You need to fill out IRS Form 14446 to provide your consent for participating in the Virtual VITA/TCE program.

Q: Who can participate in the Virtual VITA/TCE program?

A: Eligible taxpayers, including low-to-moderate-income individuals, elderly individuals, persons with disabilities, and limited English proficient individuals, can participate in the Virtual VITA/TCE program.

Q: How do I fill out IRS Form 14446?

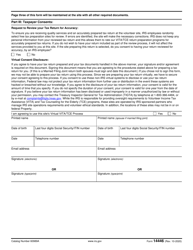

A: You need to provide your personal information, signature, and indicate your consent on the form. Follow the instructions provided on the form.

Q: Is there a deadline for submitting IRS Form 14446?

A: There may be specific deadlines for submitting IRS Form 14446, which vary depending on the Virtual VITA/TCE program. Check the instructions or contact the program coordinator for more information.

Form Details:

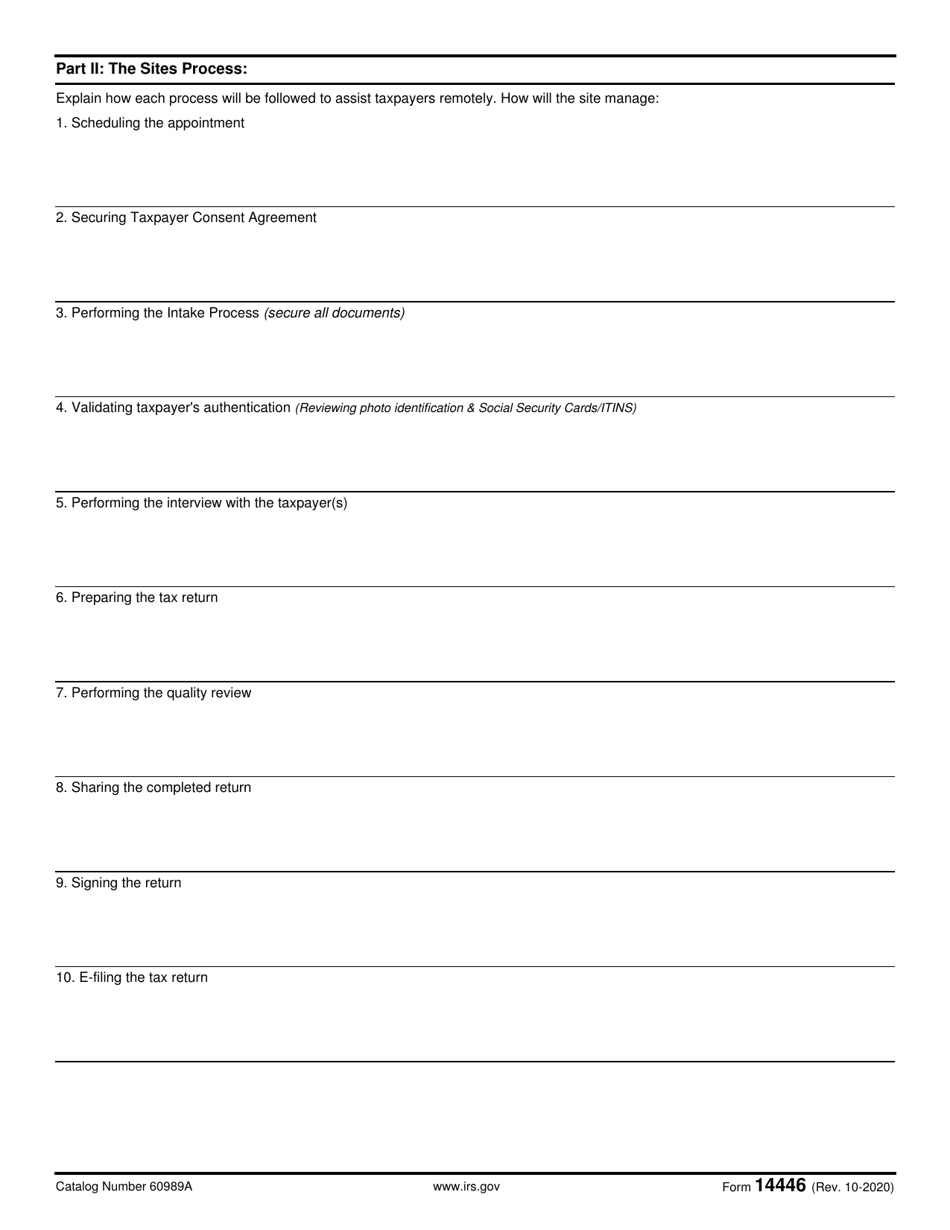

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

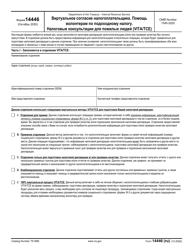

- A Spanish version of IRS Form 14446 is available for spanish-speaking filers;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14446 through the link below or browse more documents in our library of IRS Forms.