This version of the form is not currently in use and is provided for reference only. Download this version of

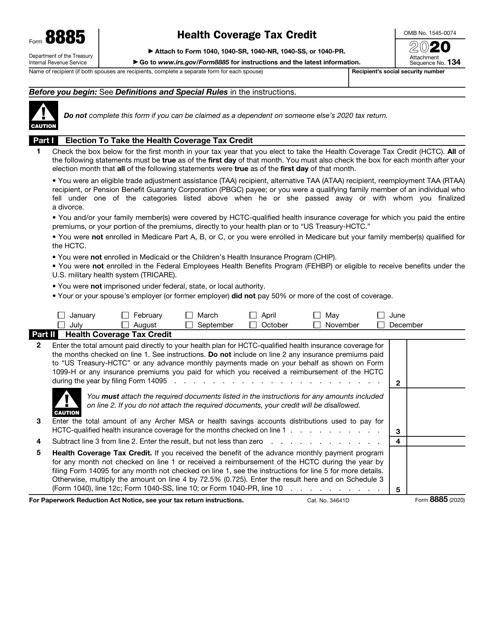

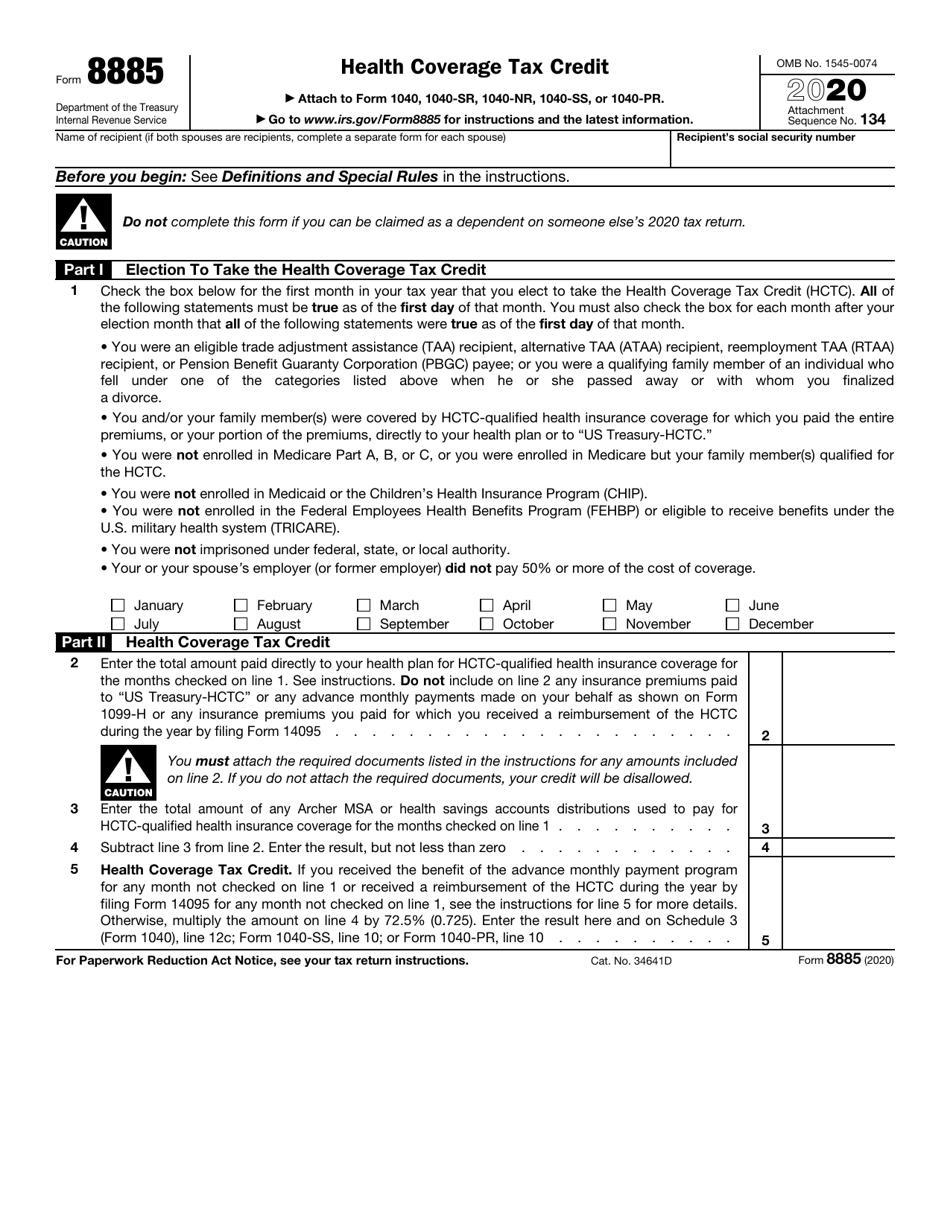

IRS Form 8885

for the current year.

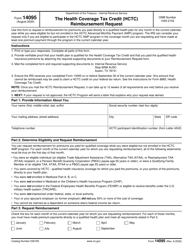

IRS Form 8885 Health Coverage Tax Credit

What Is IRS Form 8885?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8885?

A: IRS Form 8885 is a tax form used to claim the Health Coverage Tax Credit (HCTC).

Q: What is the Health Coverage Tax Credit (HCTC)?

A: The Health Coverage Tax Credit (HCTC) is a tax credit designed to help eligible individuals and families afford health insurance.

Q: Who is eligible for the Health Coverage Tax Credit (HCTC)?

A: To be eligible for the Health Coverage Tax Credit (HCTC), you must meet certain criteria, such as being a trade-affected worker, receiving certain pension benefits, or being a family member of an eligible individual.

Q: Why would I need to file IRS Form 8885?

A: You would need to file IRS Form 8885 to claim the Health Coverage Tax Credit (HCTC) and receive the tax credit for your health insurance expenses.

Q: When is the deadline to file IRS Form 8885?

A: The deadline to file IRS Form 8885 is usually the same as the deadline for filing your federal income tax return, which is April 15th.

Q: Can I e-file IRS Form 8885?

A: Yes, you can e-file IRS Form 8885 if you are using an approved tax preparation software.

Q: What documents do I need to file IRS Form 8885?

A: To file IRS Form 8885, you will need information about your health insurance coverage and any premium payments you made.

Q: What if I have questions about IRS Form 8885?

A: If you have questions about IRS Form 8885 or need assistance in completing it, you can contact the IRS or seek help from a tax professional.

Q: Does filing IRS Form 8885 guarantee that I will receive the Health Coverage Tax Credit (HCTC)?

A: Filing IRS Form 8885 is the first step to claim the Health Coverage Tax Credit (HCTC), but eligibility and approval are determined by the IRS based on your circumstances.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8885 through the link below or browse more documents in our library of IRS Forms.