This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8554

for the current year.

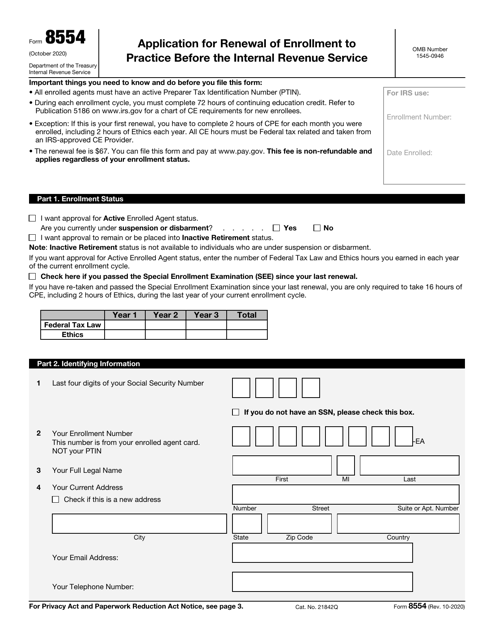

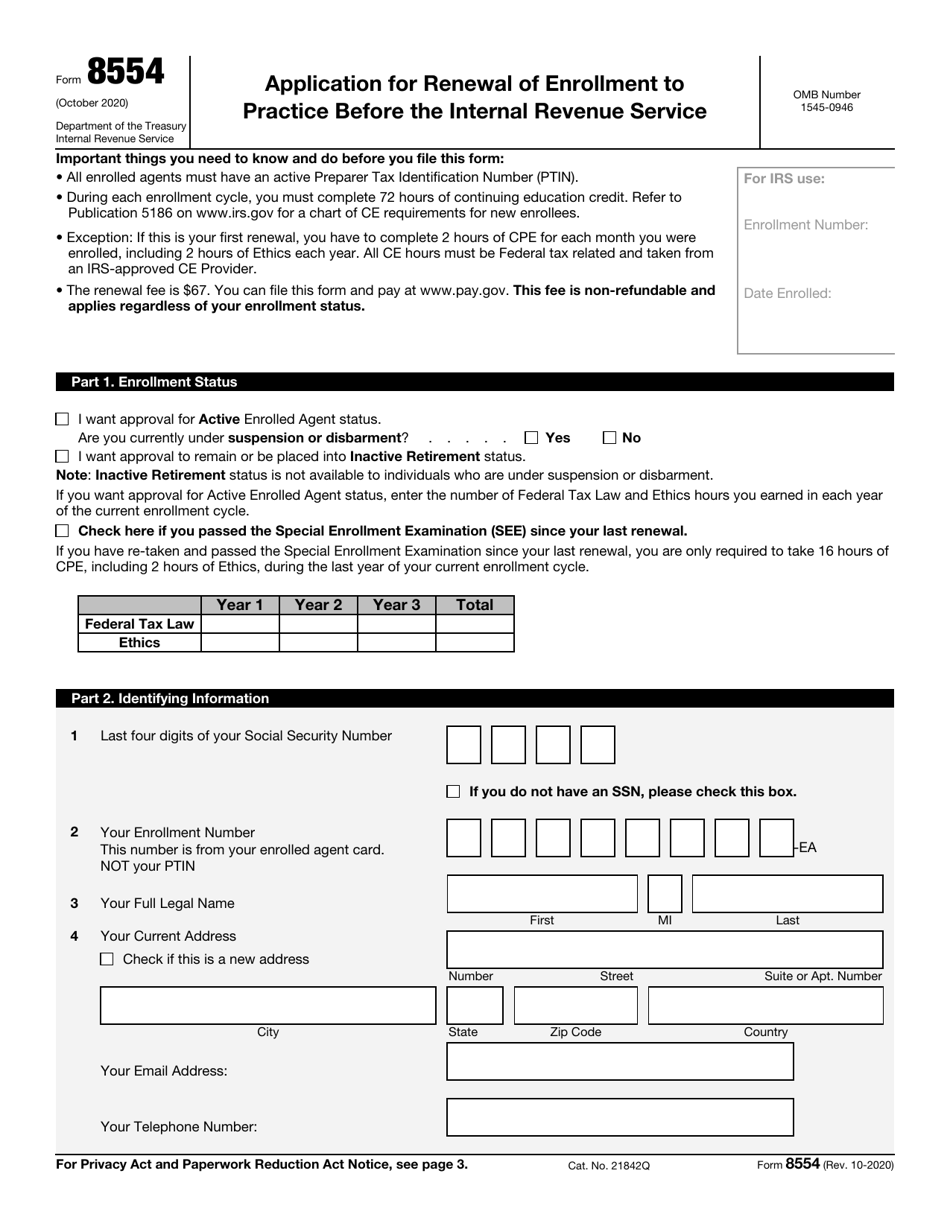

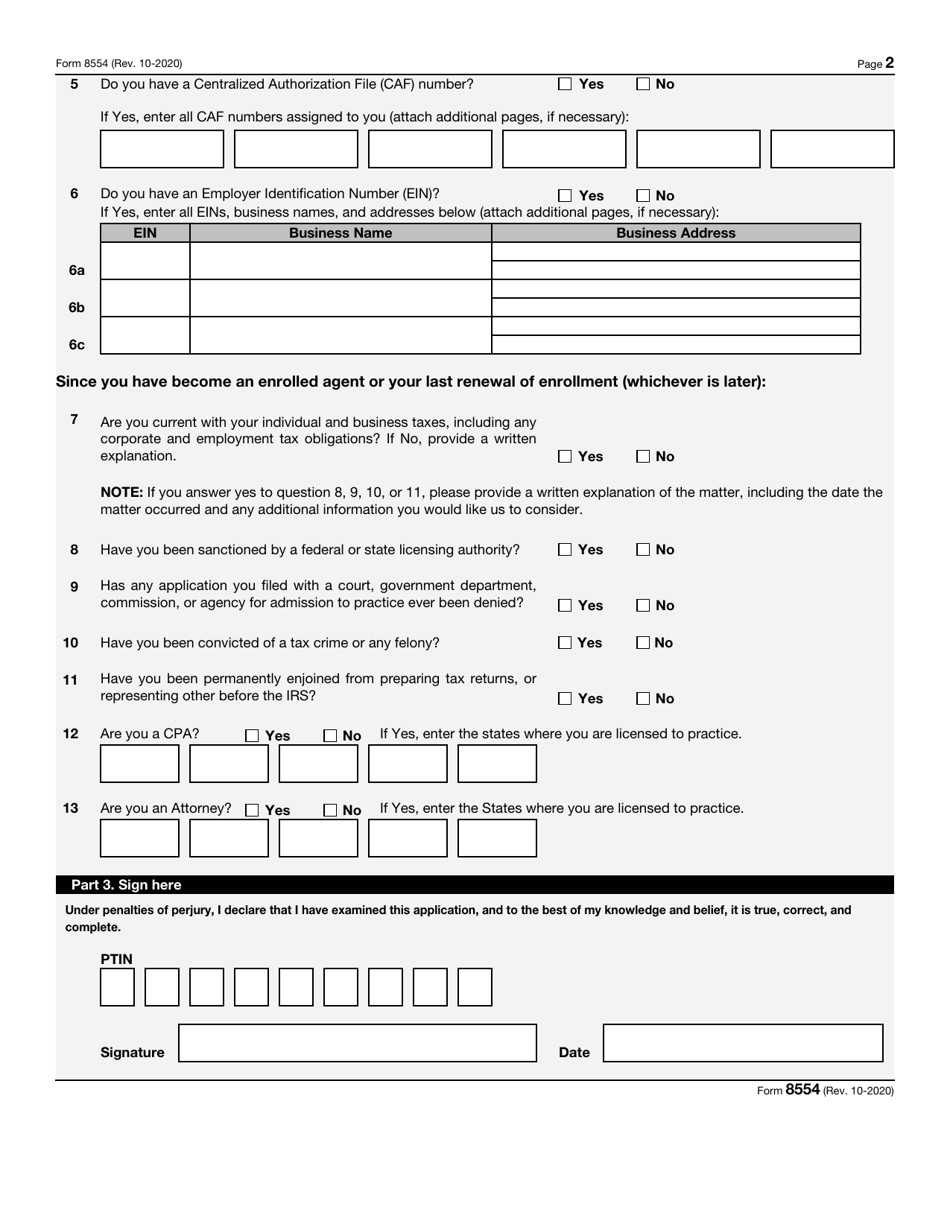

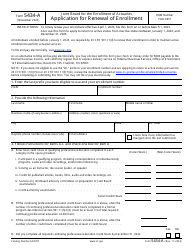

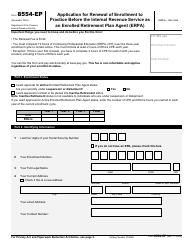

IRS Form 8554 Application for Renewal of Enrollment to Practice Before the Internal Revenue Service

What Is IRS Form 8554?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2020. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8554?

A: IRS Form 8554 is the Application for Renewal of Enrollment to Practice Before the Internal Revenue Service.

Q: Who needs to file IRS Form 8554?

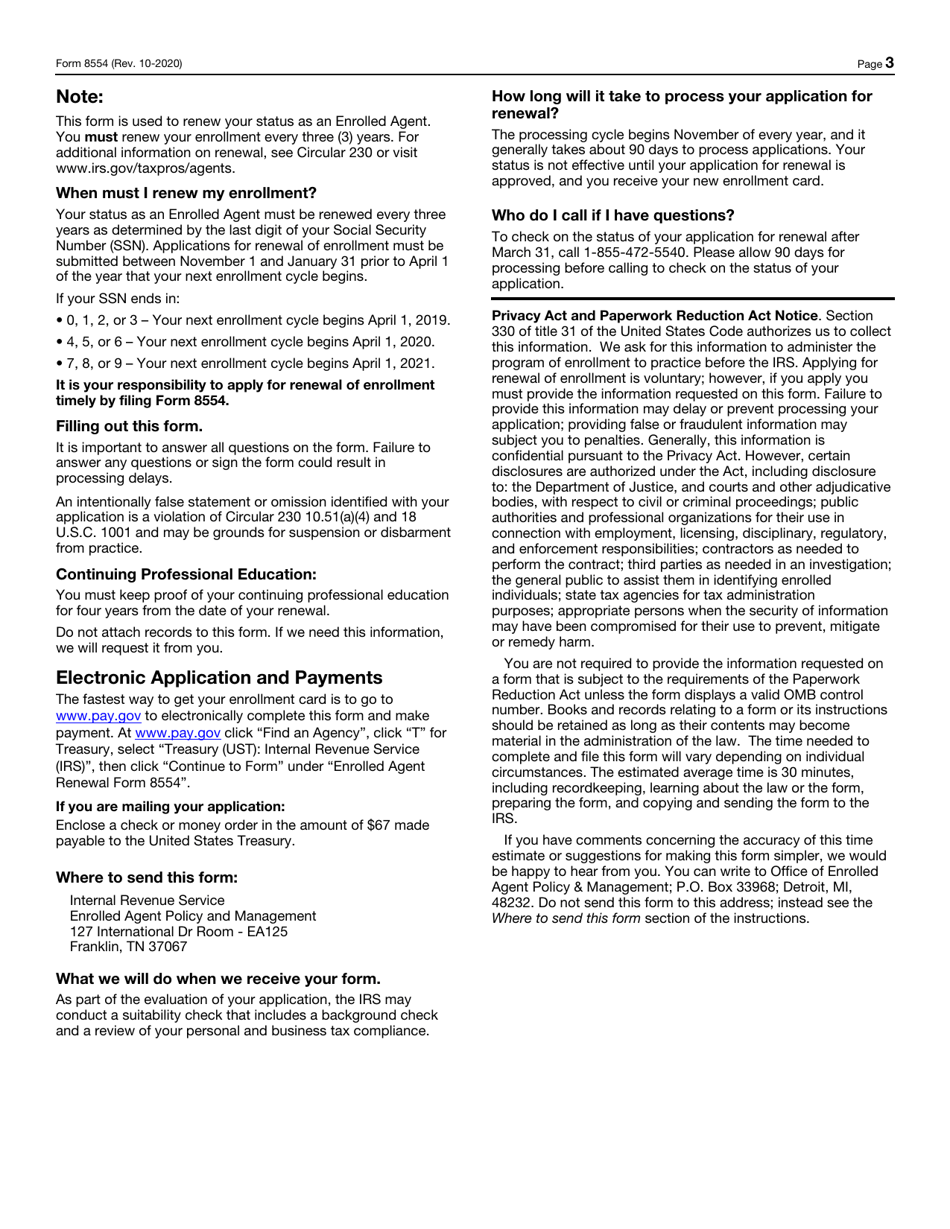

A: Enrolled Agents and other tax professionals who wish to renew their enrollment to practice before the IRS need to file Form 8554.

Q: What is the purpose of IRS Form 8554?

A: The purpose of Form 8554 is to renew the enrollment of tax professionals who are authorized to represent taxpayers before the IRS.

Q: When should I file IRS Form 8554?

A: Form 8554 should be filed at least 30 days before your current enrollment expires.

Q: What information do I need to provide on IRS Form 8554?

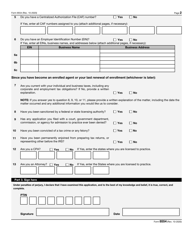

A: You will need to provide your personal information, enrollment information, and sign the form to certify its accuracy.

Q: Is there a fee for filing IRS Form 8554?

A: No, there is no fee for filing Form 8554.

Q: Can I file IRS Form 8554 electronically?

A: No, Form 8554 must be filed by mail or in person at an IRS office.

Q: What happens if I don't file IRS Form 8554?

A: If you don't file Form 8554, your enrollment to practice before the IRS may expire and you will need to reapply.

Q: Can I make changes to my enrollment information on IRS Form 8554?

A: Yes, you can make changes to your enrollment information on Form 8554 if needed.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8554 through the link below or browse more documents in our library of IRS Forms.