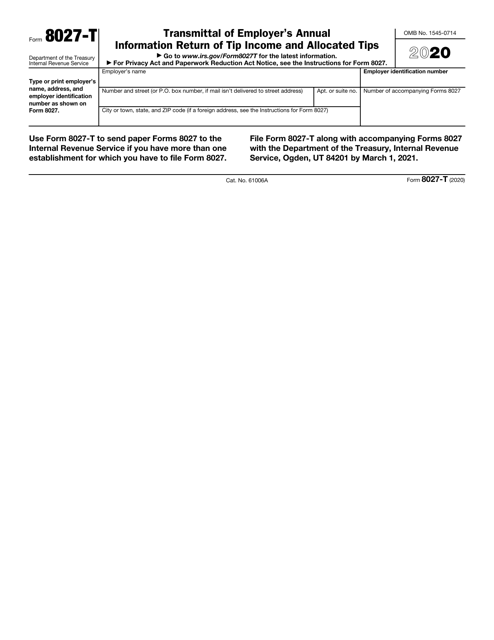

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8027-T

for the current year.

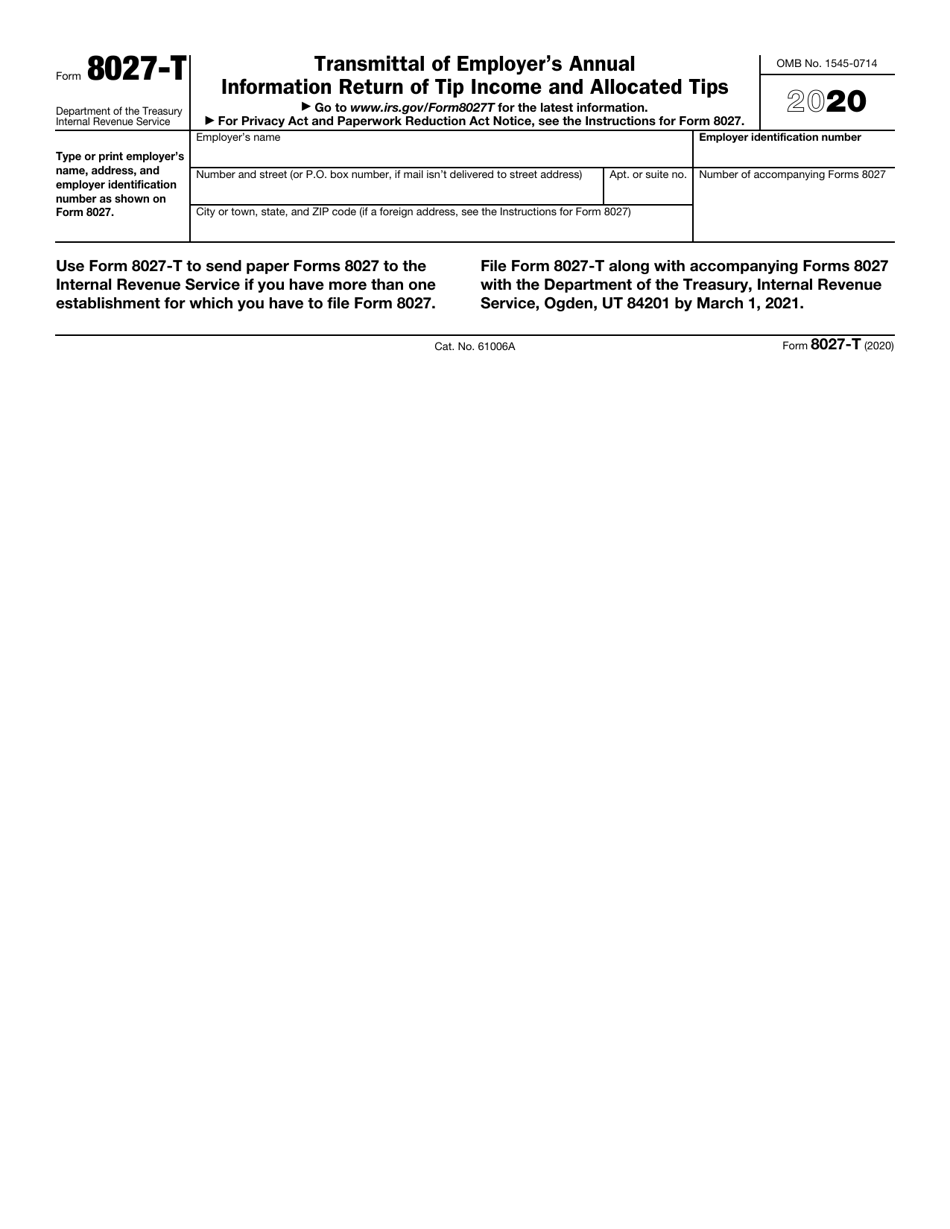

IRS Form 8027-T Transmittal of Employer's Annual Information Return of Tip Income and Allocated Tips

What Is IRS Form 8027-T?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8027-T?

A: IRS Form 8027-T is the Transmittal of Employer's Annual Information Return of Tip Income and Allocated Tips.

Q: Who needs to file IRS Form 8027-T?

A: Employers who operate large food or beverage establishments where tipping is customary and who are required to file IRS Form 8027 must also file Form 8027-T.

Q: What is the purpose of IRS Form 8027-T?

A: IRS Form 8027-T is used to transmit the IRS Form 8027, which is the Employer's Annual Information Return of Tip Income and Allocated Tips.

Q: When is IRS Form 8027-T due?

A: IRS Form 8027-T is due on or before the last day of February following the calendar year for which the employer's annual return is being filed.

Q: Are there any penalties for not filing IRS Form 8027-T?

A: Yes, there may be penalties for not filing IRS Form 8027-T or for filing it late. It is important to file the form on time to avoid any potential penalties.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8027-T through the link below or browse more documents in our library of IRS Forms.