This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form W-7

for the current year.

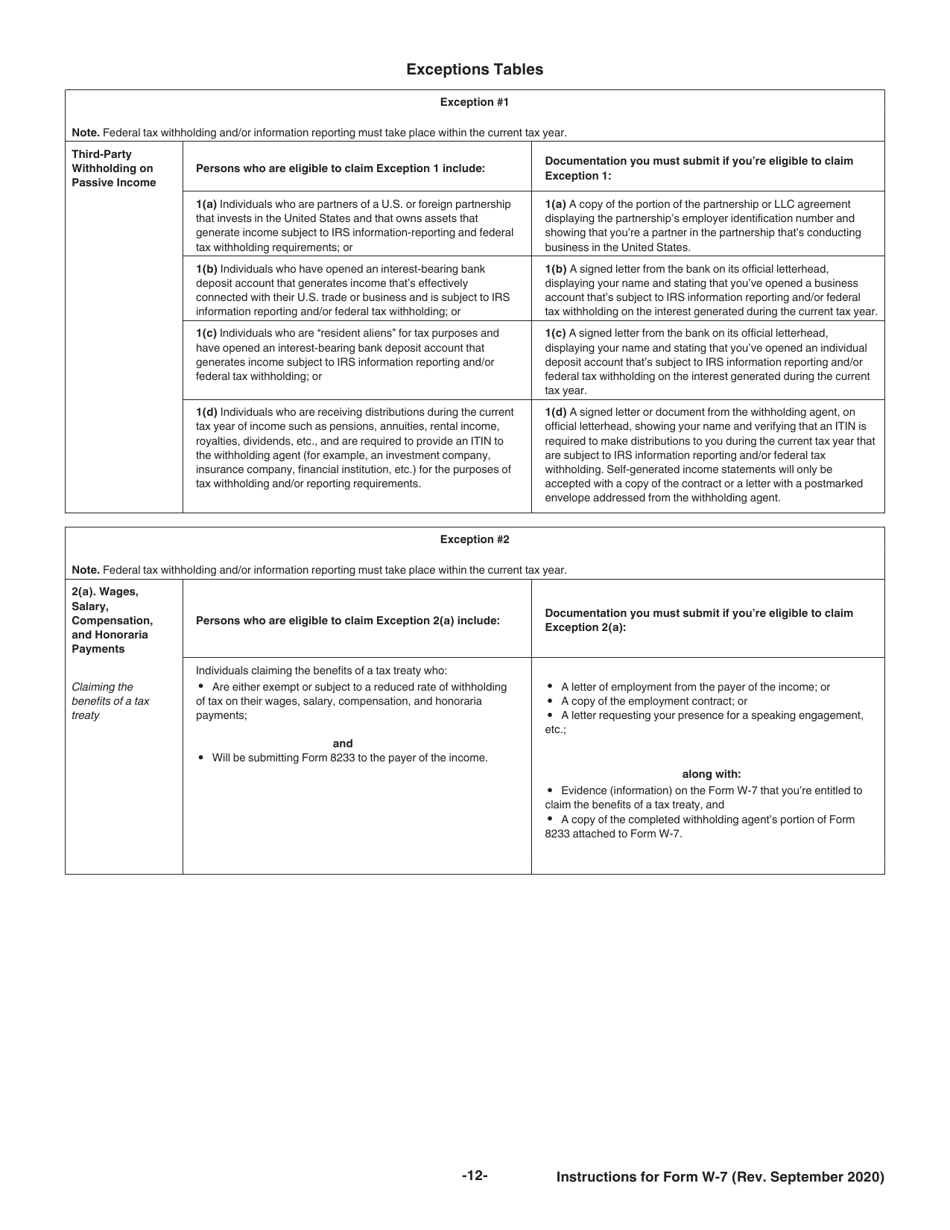

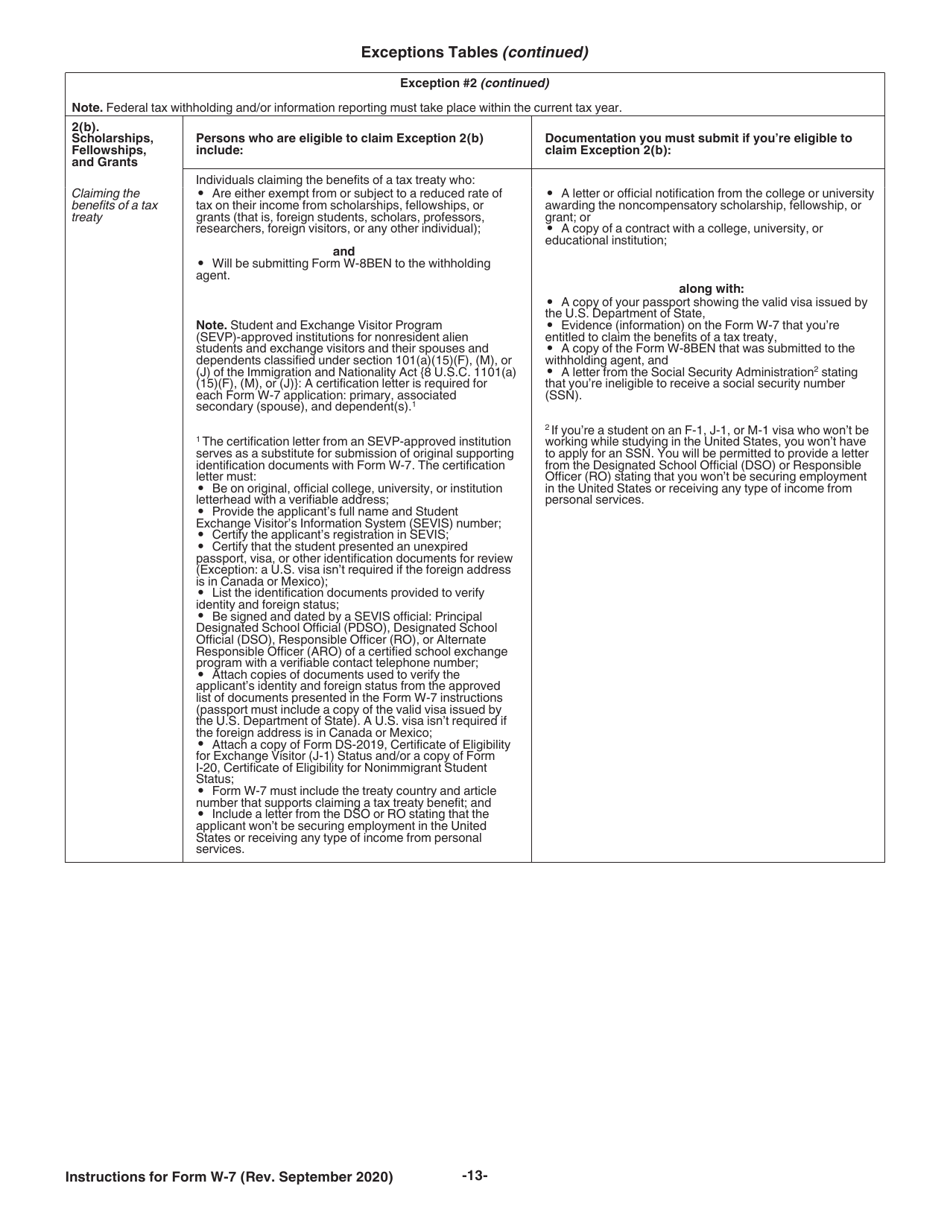

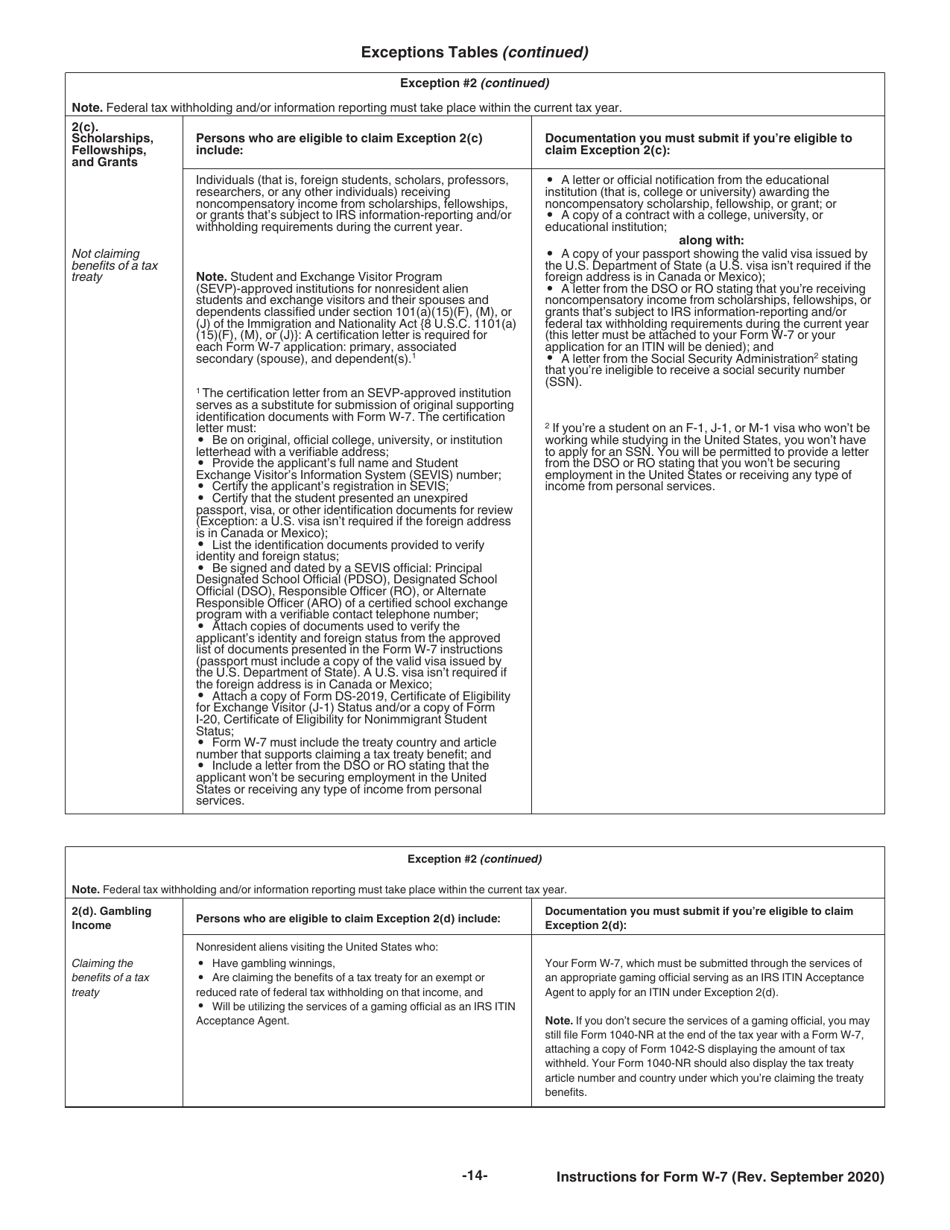

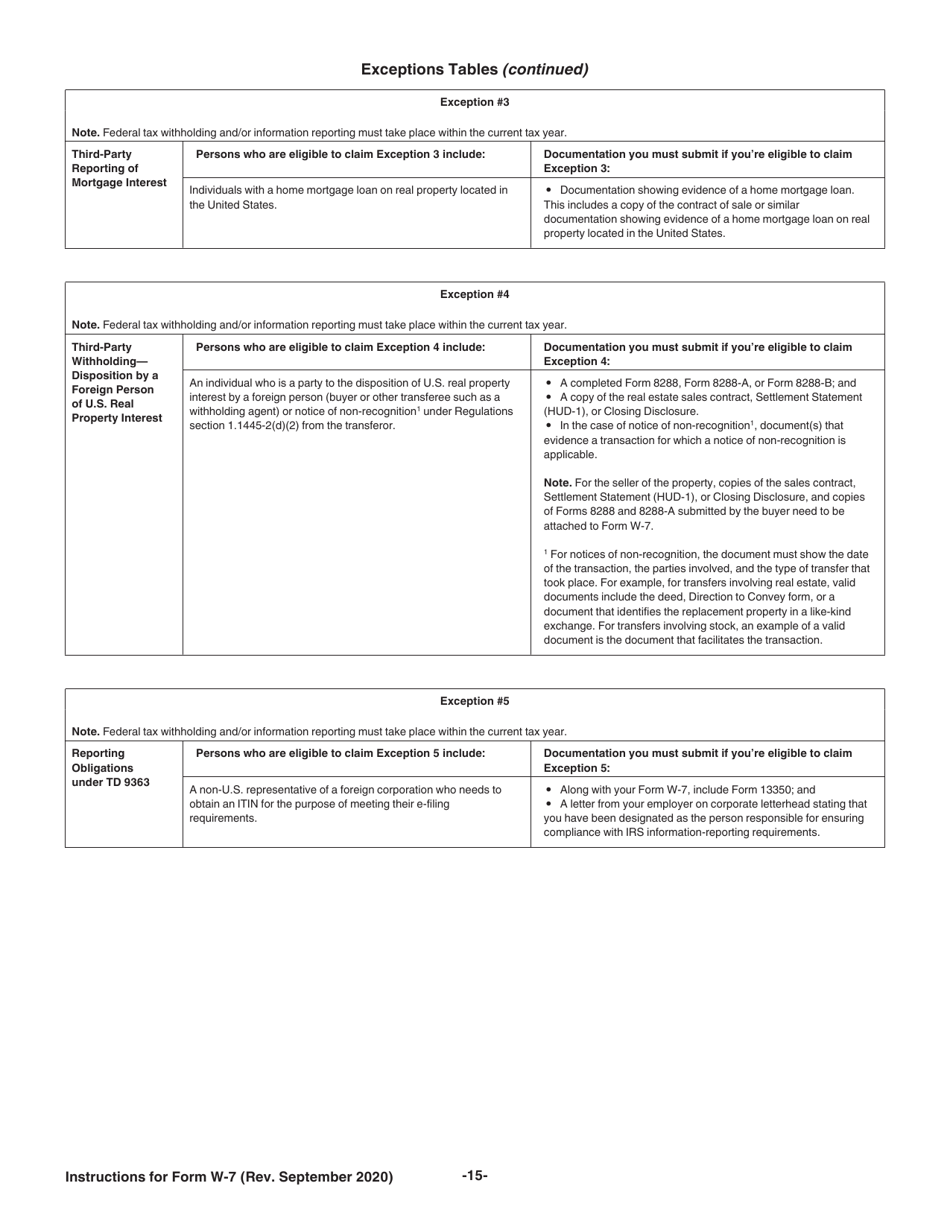

Instructions for IRS Form W-7 Application for IRS Individual Taxpayer Identification Number

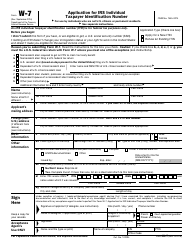

This document contains official instructions for IRS Form W-7 , Application for IRS Individual Taxpayer Identification Number - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form W-7 is available for download through this link.

FAQ

Q: What is IRS Form W-7?

A: IRS Form W-7 is the Application for IRS Individual Taxpayer Identification Number.

Q: Who needs to fill out IRS Form W-7?

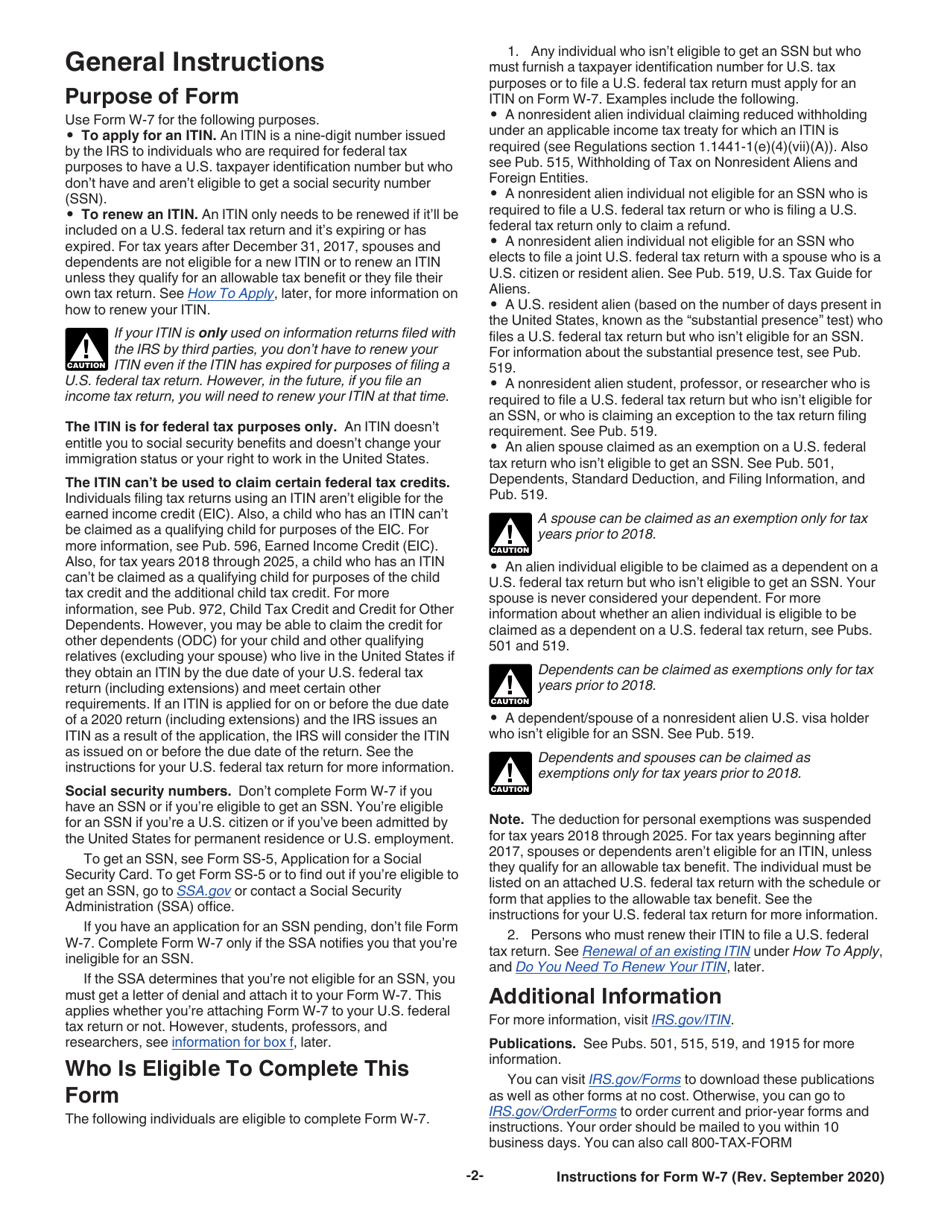

A: Individuals who are not eligible for a Social Security number but need to have a taxpayer identification number for tax purposes.

Q: Why would someone need an Individual Taxpayer Identification Number?

A: An Individual Taxpayer Identification Number (ITIN) is required for individuals who are not eligible for a Social Security number but have a federal tax filing requirement.

Q: Do I need to provide supporting documents with IRS Form W-7?

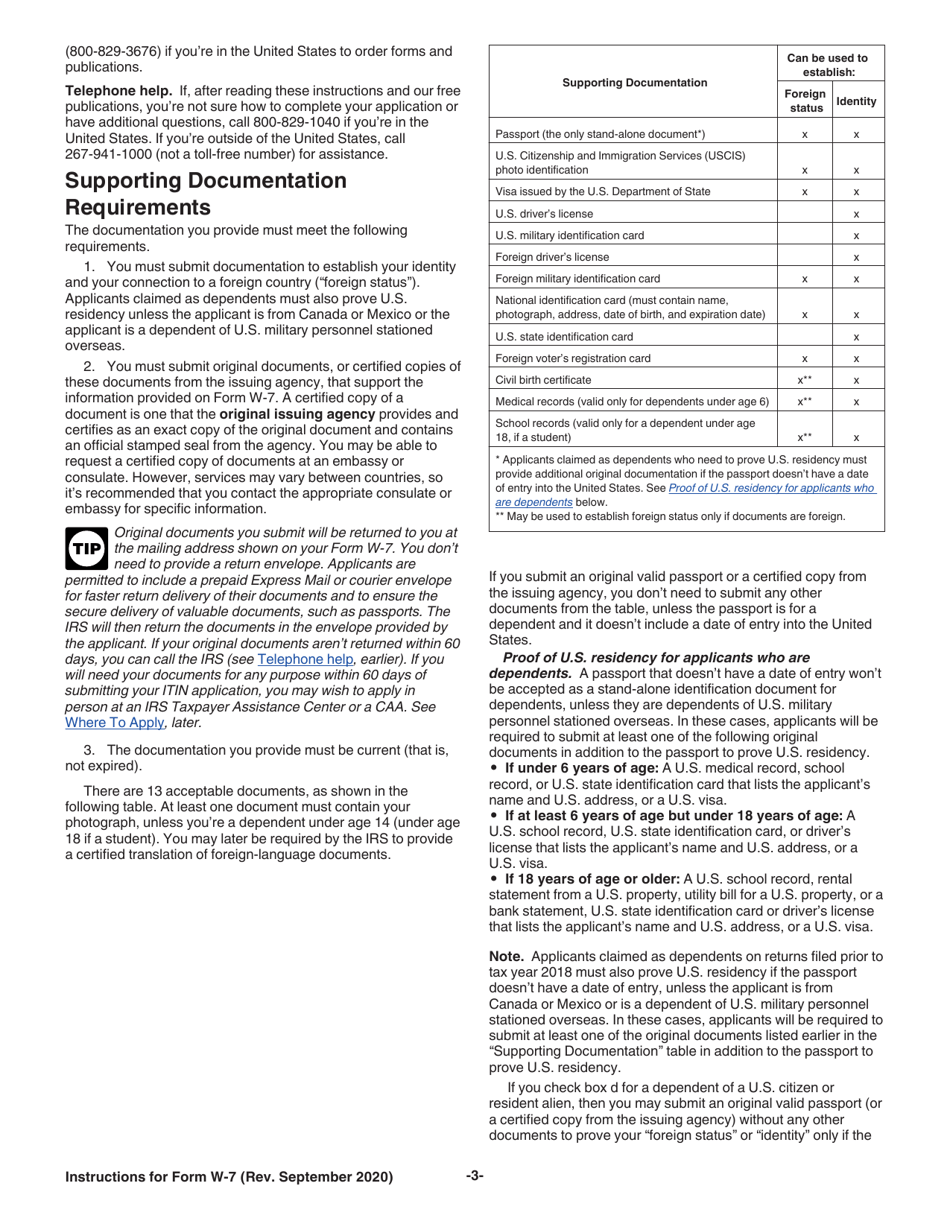

A: Yes, you need to provide supporting documents to prove your identity and foreign status when submitting IRS Form W-7.

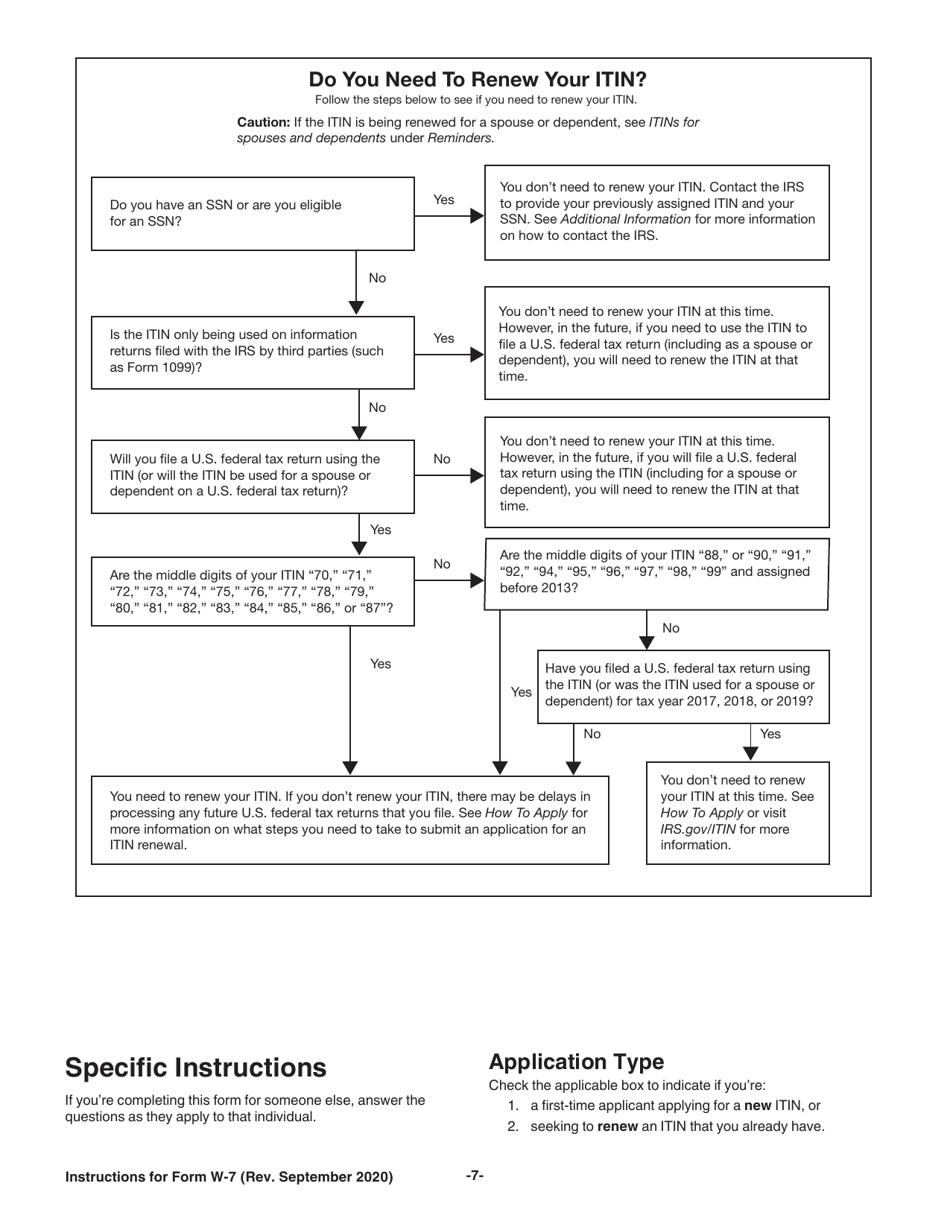

Q: How long does it take to receive an ITIN after submitting IRS Form W-7?

A: It usually takes about 7 weeks for the IRS to process an ITIN application and issue the ITIN.

Q: Is there a fee for applying for an ITIN using IRS Form W-7?

A: No, there is no fee for applying for an ITIN using IRS Form W-7.

Q: Can I use an ITIN instead of a Social Security number for employment purposes?

A: No, an ITIN is not valid for employment purposes. It is only used for federal tax purposes.

Instruction Details:

- This 15-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.