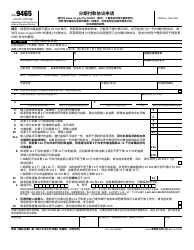

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 9465

for the current year.

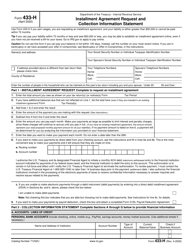

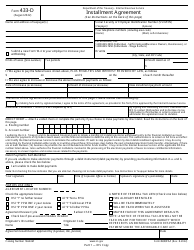

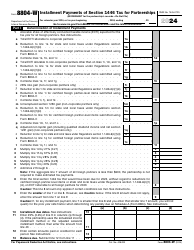

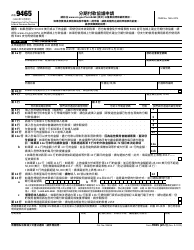

Instructions for IRS Form 9465 Installment Agreement Request

This document contains official instructions for IRS Form 9465 , Installment Agreement Request - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 9465 is available for download through this link.

FAQ

Q: What is IRS Form 9465?

A: IRS Form 9465 is used to request an installment agreement with the Internal Revenue Service (IRS).

Q: What is an installment agreement?

A: An installment agreement is a payment plan that allows you to pay your tax debt over time.

Q: How do I request an installment agreement?

A: You can request an installment agreement by filling out and submitting IRS Form 9465.

Q: What information do I need to provide on Form 9465?

A: You will need to provide your personal information, details about your tax debt, and your proposed monthly payment amount.

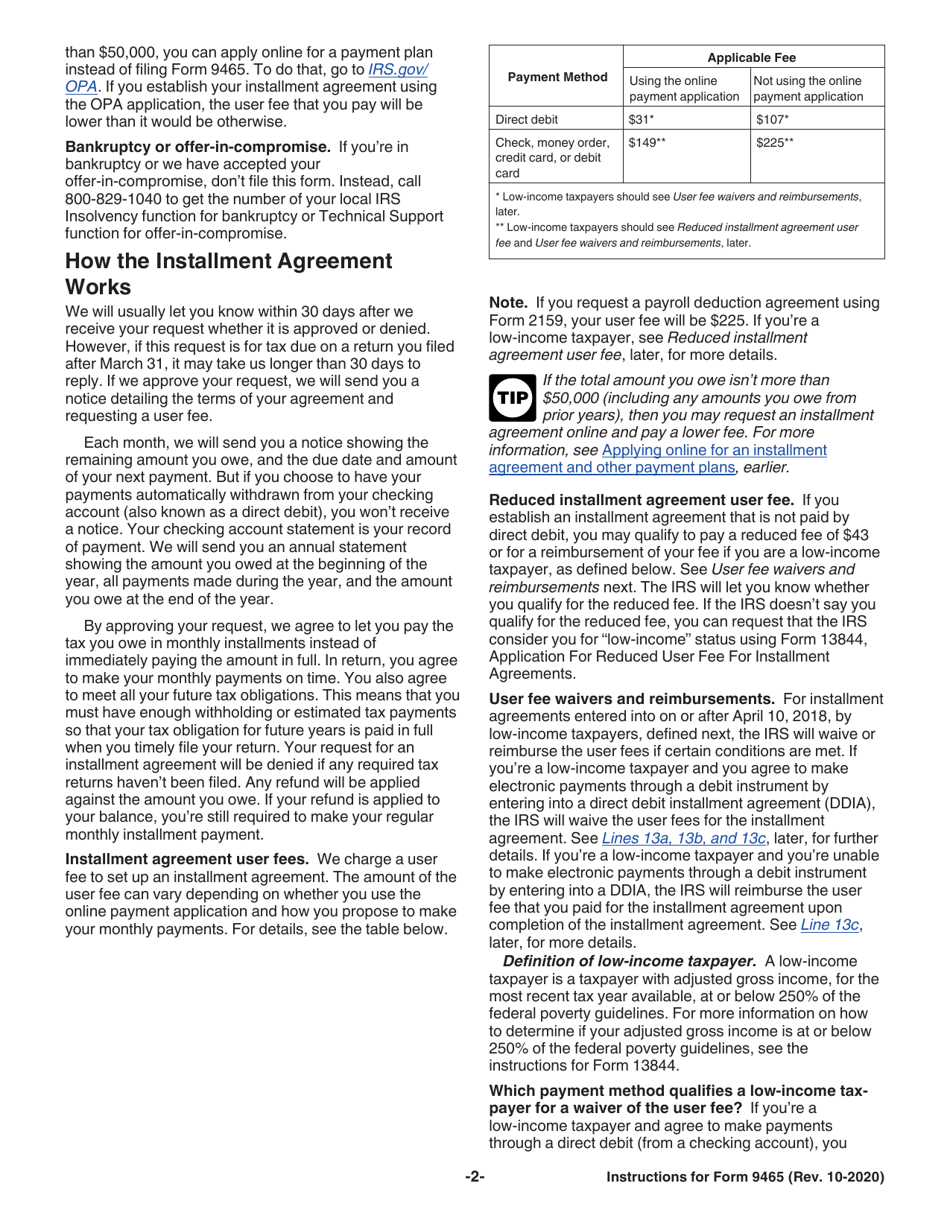

Q: Is there a fee for requesting an installment agreement?

A: Yes, there is a fee for setting up an installment agreement, which can vary depending on your payment method and the specific terms of your agreement.

Q: Can I e-file Form 9465?

A: No, you cannot e-file Form 9465. It must be mailed to the IRS.

Q: How long does it take to get a response to my request?

A: It can take up to 30 days for the IRS to respond to your request for an installment agreement.

Q: What happens if my request is approved?

A: If your request is approved, you will receive a confirmation letter outlining the terms of your installment agreement and the payment schedule.

Q: What happens if my request is denied?

A: If your request is denied, you may need to explore other options for resolving your tax debt, such as an offer in compromise or a partial payment installment agreement.

Q: Can I make changes to my installment agreement after it is approved?

A: Yes, you can make changes to your installment agreement, such as adjusting the monthly payment amount, but you will need to contact the IRS to request any changes.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.