This version of the form is not currently in use and is provided for reference only. Download this version of

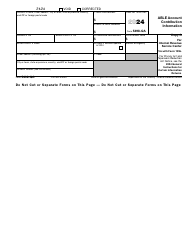

Instructions for IRS Form 5498-ESA

for the current year.

Instructions for IRS Form 5498-ESA Coverdell Esa Contribution Information

This document contains official instructions for IRS Form 5498-ESA , Coverdell Esa Contribution Information - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 5498-ESA is available for download through this link.

FAQ

Q: What is the IRS Form 5498-ESA?

A: IRS Form 5498-ESA is a form used to report contributions to a Coverdell Education Savings Account (ESA).

Q: Who needs to file the IRS Form 5498-ESA?

A: Financial institutions that hold Coverdell ESAs must file Form 5498-ESA for each account holder who made contributions or received contributions during the tax year.

Q: What information is reported on IRS Form 5498-ESA?

A: Form 5498-ESA reports the account holder's name, address, and taxpayer identification number (TIN), as well as the contributions made to the account during the tax year.

Q: When is the deadline to file IRS Form 5498-ESA?

A: Form 5498-ESA must be filed with the IRS by May 31st of the year following the tax year being reported.

Q: Do I need to attach IRS Form 5498-ESA to my tax return?

A: No, you do not need to attach Form 5498-ESA to your tax return. It is for informational purposes only.

Q: Are there any penalties for not filing IRS Form 5498-ESA?

A: There can be penalties for not filing Form 5498-ESA, so it is important to ensure that the form is submitted accurately and on time.

Q: Can I e-file IRS Form 5498-ESA?

A: No, Form 5498-ESA cannot be e-filed. It must be filed by mail to the IRS.

Q: What should I do if there is an error on IRS Form 5498-ESA?

A: If there is an error on Form 5498-ESA, you should contact the financial institution that filed the form and request a corrected version.

Q: What other forms should I be aware of when filing taxes related to a Coverdell ESA?

A: In addition to Form 5498-ESA, you may also need to file Form 1040 or 1040A to report any distributions or rollovers from your Coverdell ESA.

Instruction Details:

- This 2-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.