This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1095-A

for the current year.

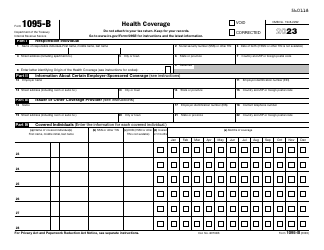

Instructions for IRS Form 1095-A Health Insurance Marketplace Statement

This document contains official instructions for IRS Form 1095-A , Health Insurance Marketplace Statement - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1095-A is available for download through this link.

FAQ

Q: What is Form 1095-A?

A: Form 1095-A is a statement provided by the Health Insurance Marketplace...

Q: Who receives Form 1095-A?

A: If you enrolled in a health plan through the Health Insurance Marketplace...

Q: What information is included in Form 1095-A?

A: Form 1095-A includes information about your health insurance coverage...

Q: When will I receive Form 1095-A?

A: Form 1095-A should be provided to you by January 31st of the following year...

Q: Why do I need Form 1095-A?

A: Form 1095-A is needed to reconcile any advance payments of premium tax credits...

Q: How do I use Form 1095-A?

A: You will use the information on Form 1095-A to complete Form 8962...

Q: What happens if I don't receive Form 1095-A?

A: If you do not receive Form 1095-A by February 15th...

Instruction Details:

- This 3-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.