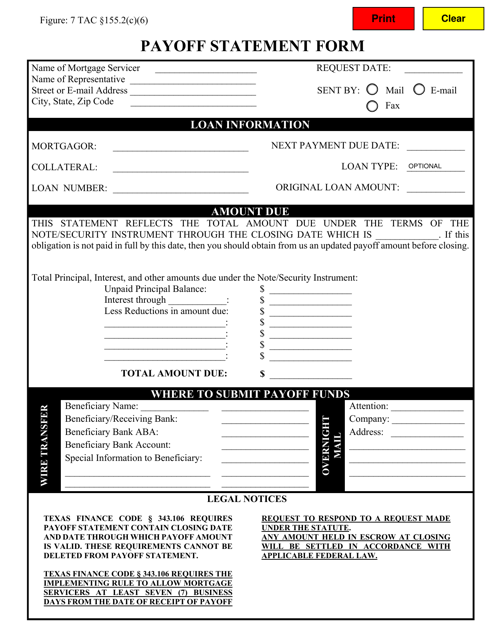

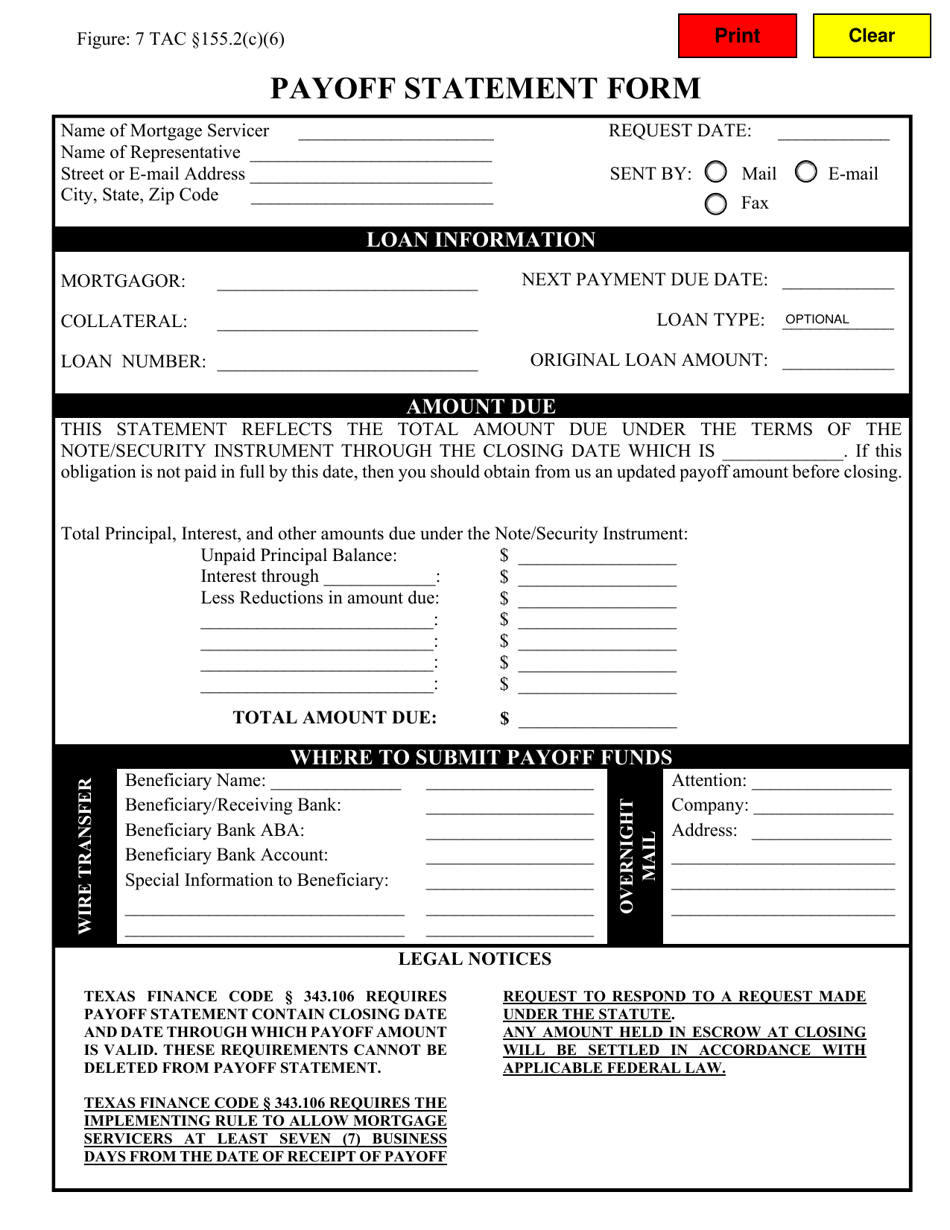

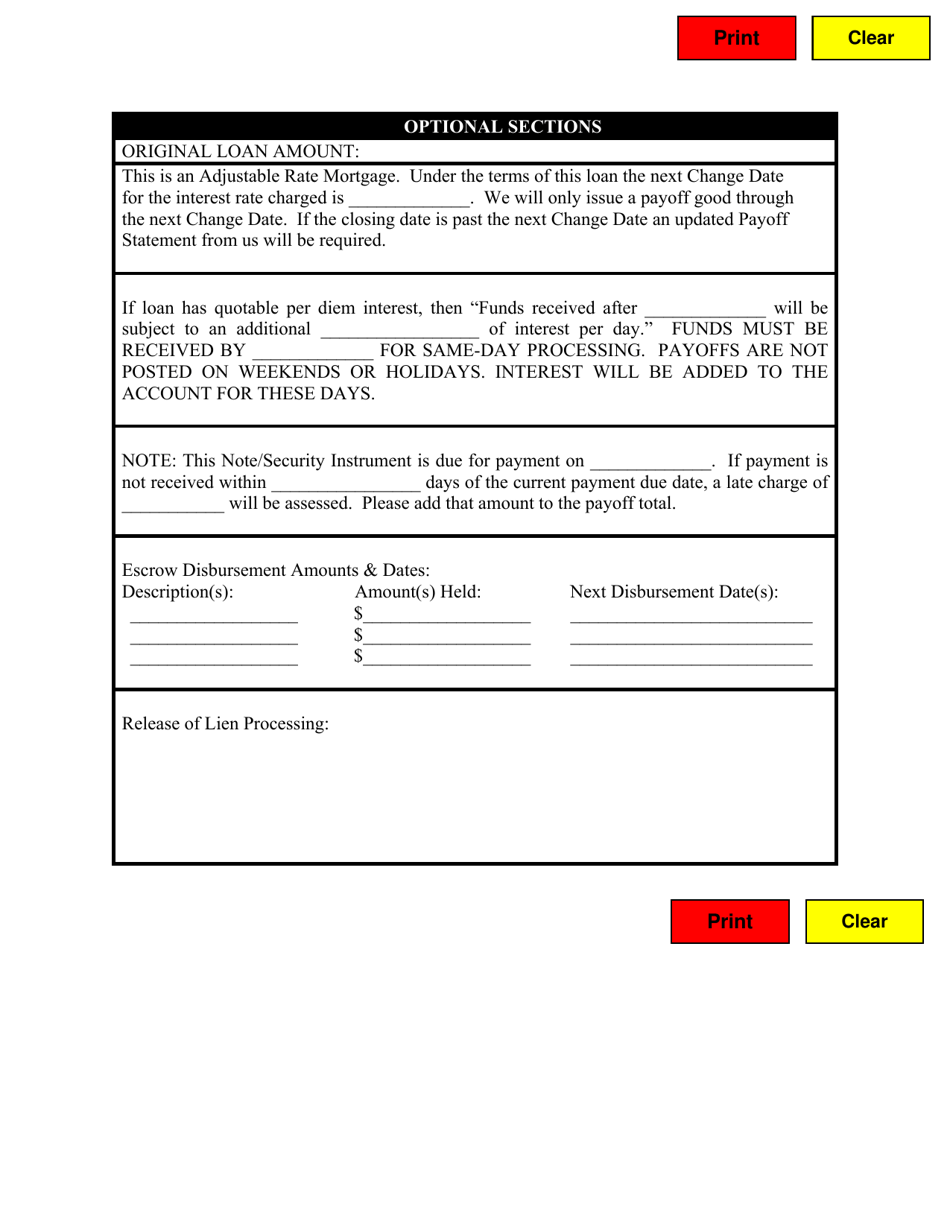

Payoff Statement Form - Texas

Payoff Statement Form is a legal document that was released by the Texas Department of Savings and Mortgage Lending - a government authority operating within Texas.

FAQ

Q: What is a payoff statement?

A: A payoff statement is a document that shows the remaining balance on a loan or mortgage.

Q: Why would I need a payoff statement?

A: You may need a payoff statement when selling a property, refinancing a loan, or paying off a loan in full.

Q: How can I request a payoff statement?

A: You can typically request a payoff statement from the lender or mortgage company.

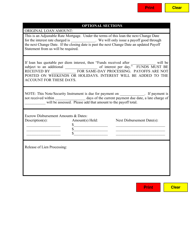

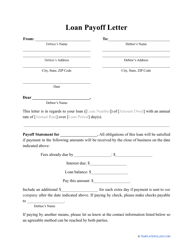

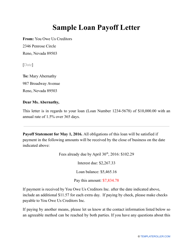

Q: What information is included in a payoff statement?

A: A payoff statement includes the loan balance, interest owed, any fees or charges, and the date that the payoff amount is valid until.

Q: Is there a fee for obtaining a payoff statement?

A: Lenders may charge a fee for providing a payoff statement, so it's important to inquire about any associated costs.

Q: How long does it take to receive a payoff statement?

A: The timeframe for receiving a payoff statement can vary, but it is often provided within a few business days.

Q: Can a payoff statement be used to negotiate a lower payoff amount?

A: In some cases, a payoff statement can be used as a negotiation tool to potentially reduce the total amount owed on a loan.

Q: What happens after I receive a payoff statement?

A: Once you receive a payoff statement, you can proceed with the necessary steps to pay off the loan or mortgage in accordance with the statement's instructions.

Form Details:

- The latest edition currently provided by the Texas Department of Savings and Mortgage Lending;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Texas Department of Savings and Mortgage Lending.