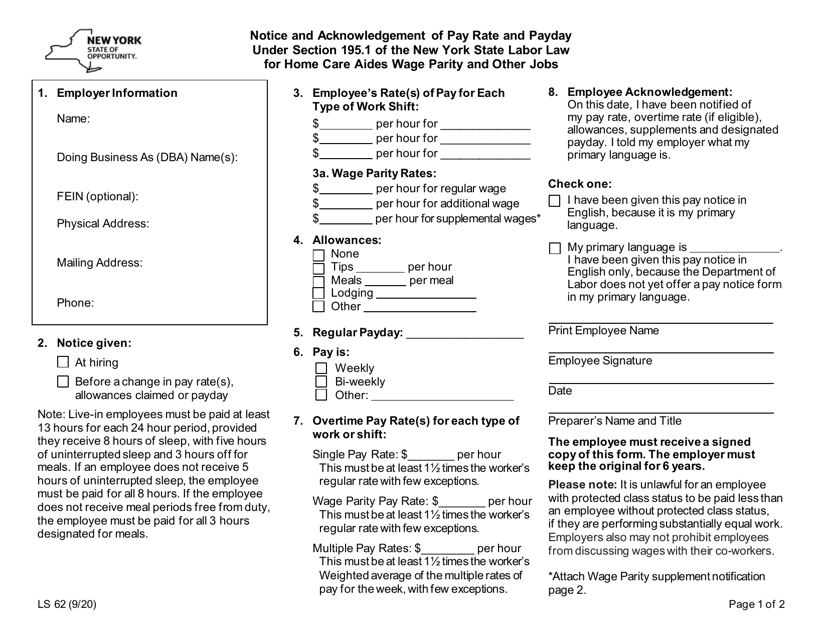

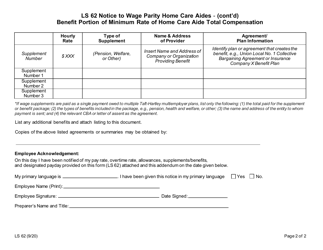

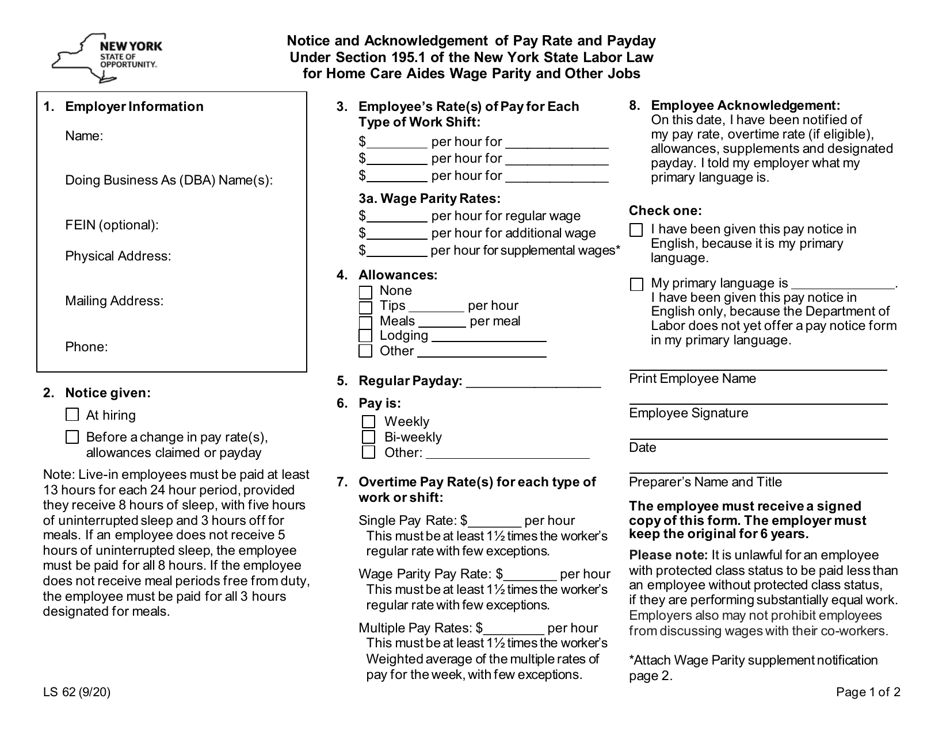

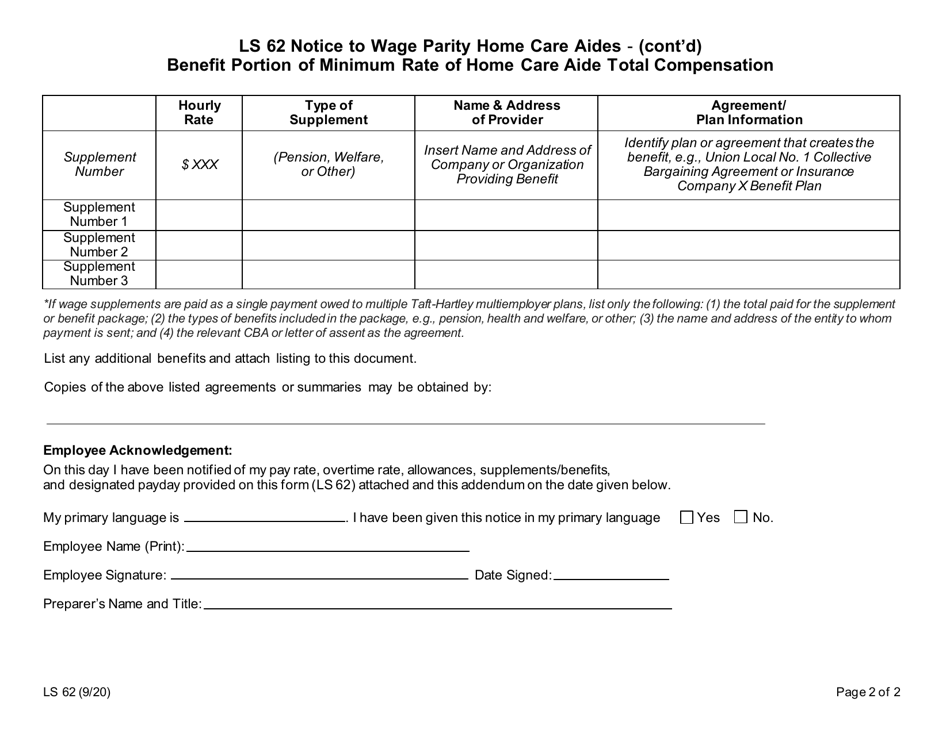

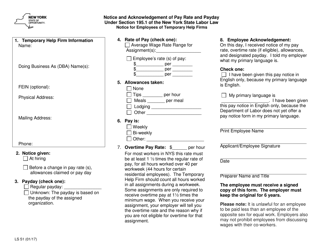

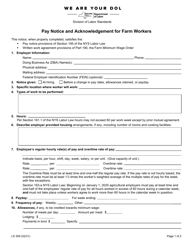

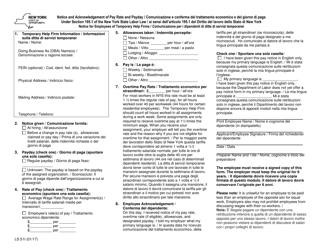

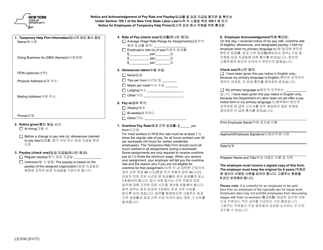

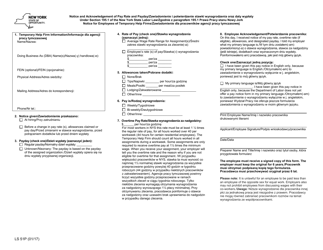

Form LS62 Notice and Acknowledgement of Pay Rate and Payday for Home Care Aides Wage Parity and Other Jobs - New York

What Is Form LS62?

This is a legal form that was released by the New York State Department of Labor - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LS62?

A: Form LS62 is the Notice and Acknowledgement of Pay Rate and Payday for Home Care Aides Wage Parity and Other Jobs.

Q: Who is required to use Form LS62?

A: Employers in New York who employ home care aides and other jobs covered under the Wage Parity law are required to use Form LS62.

Q: What is the purpose of Form LS62?

A: The purpose of Form LS62 is to notify home care aides and other covered employees in New York about their pay rate and payday.

Q: What is Wage Parity?

A: Wage Parity is a law in New York that sets minimum pay rates for home care aides and certain other jobs in the healthcare industry.

Q: Do I need to keep a copy of Form LS62?

A: Yes, both the employer and the employee must keep a copy of the completed Form LS62.

Q: Can an employer change the pay rate or payday without notifying the employee?

A: No, employers are required to provide written notice to employees at least 7 calendar days before any changes to the pay rate or payday take effect.

Q: What happens if an employer fails to provide Form LS62 to employees?

A: Employers who fail to provide Form LS62 to employees may be subject to penalties and fines.

Q: Are home care aides the only employees covered under Form LS62?

A: No, Form LS62 is also used for other jobs covered under the Wage Parity law in New York.

Q: Is Form LS62 specific to New York only?

A: Yes, Form LS62 is specific to the state of New York.

Q: Is Form LS62 required for all employers in New York?

A: Form LS62 is required for employers in New York who employ home care aides and other jobs covered under the Wage Parity law.

Q: What should an employee do if they have not received Form LS62?

A: If an employee has not received Form LS62, they should contact their employer or the New York State Department of Labor for assistance.

Q: Can an employee refuse to sign Form LS62?

A: While an employee can refuse to sign Form LS62, they should be aware that it may jeopardize their employment.

Q: Are there any exceptions to the requirement of using Form LS62?

A: There are no specific exceptions mentioned for using Form LS62, but it is always recommended to consult with the New York State Department of Labor for any unique situations.

Q: What other information is included on Form LS62?

A: In addition to the pay rate and payday, Form LS62 may also include information about deductions, allowances, and overtime rates.

Q: Can an employer provide Form LS62 electronically?

A: Yes, employers can provide Form LS62 electronically as long as it meets the requirements of state and federal law.

Q: Can an employee request a copy of Form LS62?

A: Yes, employees have the right to request a copy of Form LS62 from their employer at any time.

Q: Is Form LS62 the same as a pay stub?

A: No, Form LS62 is a separate document that notifies employees about their pay rate and payday, while a pay stub provides detailed information about the employee's earnings for a specific pay period.

Q: What should an employee do if they believe their employer is not complying with the Wage Parity law?

A: If an employee believes their employer is not complying with the Wage Parity law, they should contact the New York State Department of Labor to file a complaint.

Q: What are the consequences for employers who violate the Wage Parity law?

A: Employers who violate the Wage Parity law may be subject to fines, penalties, and other legal consequences.

Q: Can Form LS62 be modified or customized by employers?

A: Employers are not allowed to modify or customize Form LS62. It must be used in its original format as provided by the New York State Department of Labor.

Q: Can an employer be exempt from the Wage Parity law?

A: There are no specific exemptions mentioned for employers in the context of the Wage Parity law. Employers should consult with the New York State Department of Labor for any questions regarding exemptions.

Q: What is the deadline for providing Form LS62 to employees?

A: Form LS62 must be provided to employees at least 7 calendar days before any changes to the pay rate or payday take effect.

Q: Is Form LS62 required for part-time employees?

A: Yes, Form LS62 is required for all employees covered under the Wage Parity law, including part-time employees.

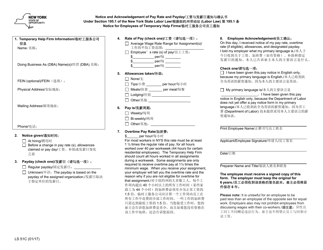

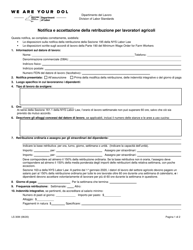

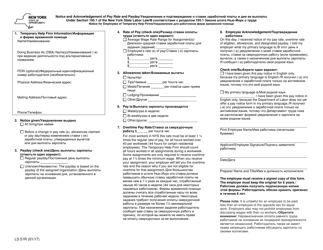

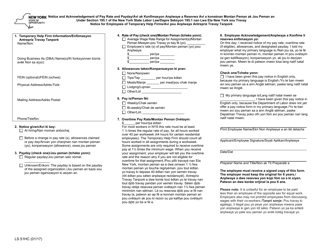

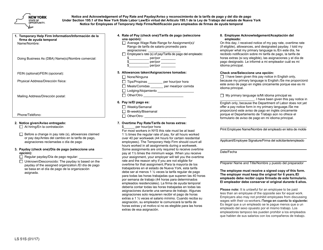

Q: Is Form LS62 required to be in English?

A: Form LS62 must be provided to employees in a language the employees understand, which is often English.

Q: What if an employee does not understand the language in which Form LS62 is provided?

A: If an employee does not understand the language in which Form LS62 is provided, the employer should make reasonable efforts to provide a translated version.

Q: Are there any penalties for employees who refuse to sign Form LS62?

A: There are no specific penalties mentioned for employees who refuse to sign Form LS62.

Q: Can an employee be terminated for refusing to sign Form LS62?

A: While an employee can technically be terminated for refusing to sign Form LS62, it may be considered unfair or illegal depending on the circumstances.

Q: How long should an employer keep copies of Form LS62?

A: Employers should keep copies of Form LS62 for at least six years.

Q: Is there a specific format or template for Form LS62?

A: Yes, the New York State Department of Labor provides a specific format and template for Form LS62 that employers must use.

Q: What should an employee do if they believe the information on Form LS62 is incorrect?

A: If an employee believes the information on Form LS62 is incorrect, they should contact their employer to request a correction.

Q: Can an employer charge employees for the cost of providing Form LS62?

A: No, employers are not allowed to charge employees for the cost of providing Form LS62.

Q: Is Form LS62 applicable to all industries in New York?

A: No, Form LS62 specifically applies to employers in New York who employ home care aides and other jobs covered under the Wage Parity law.

Q: Can an employer refuse to give a copy of Form LS62 to an employee?

A: No, an employer must provide a copy of Form LS62 to each employee, and the employee has the right to request a copy at any time.

Q: What information should be included in Form LS62?

A: Form LS62 should include the employee's name, employer's name, pay rate, payday, deductions, allowances, and overtime rates.

Q: Can Form LS62 be used for employees working in other states?

A: Form LS62 is specific to the state of New York and may not be applicable or legally enforceable for employees working in other states.

Q: Is there a fee for obtaining Form LS62 from the New York State Department of Labor?

A: No, there is no fee for obtaining Form LS62 from the New York State Department of Labor.

Q: What if an employer fails to provide accurate information on Form LS62?

A: If an employer fails to provide accurate information on Form LS62, it may lead to legal consequences or disputes with employees.

Q: Is Form LS62 available in languages other than English?

A: Form LS62 is primarily available in English, but employers should provide translations for employees who do not understand English.

Q: What should an employee do if they have questions about the information on Form LS62?

A: If an employee has questions about the information on Form LS62, they should contact their employer or seek clarification from the New York State Department of Labor.

Q: Can an employer require employees to sign Form LS62 before starting employment?

A: Yes, an employer can require employees to sign Form LS62 before starting employment as a way to ensure compliance with the Wage Parity law.

Q: Is Form LS62 only for home care aides?

A: No, Form LS62 is also applicable to certain other jobs covered under the Wage Parity law in New York.

Q: What if an employer fails to provide employees with Form LS62 in a language they understand?

A: If an employer fails to provide employees with Form LS62 in a language they understand, it may be a violation of their rights, and the employees should contact the New York State Department of Labor.

Q: Can employers provide Form LS62 in electronic format?

A: Yes, employers can provide Form LS62 in electronic format as long as it meets the requirements of state and federal law.

Q: What if an employer fails to provide Form LS62 within the required timeframe?

A: If an employer fails to provide Form LS62 within the required timeframe, it may be a violation of the Wage Parity law, and the employees should contact the New York State Department of Labor.

Q: Is there a deadline for employees to return Form LS62 to their employer?

A: There is no specific deadline for employees to return Form LS62 to their employer, but it is recommended to do so promptly.

Q: Can an employer modify the contents of Form LS62?

A: No, employers are not allowed to modify the contents of Form LS62 as provided by the New York State Department of Labor.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the New York State Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form LS62 by clicking the link below or browse more documents and templates provided by the New York State Department of Labor.