This version of the form is not currently in use and is provided for reference only. Download this version of

Form 6

for the current year.

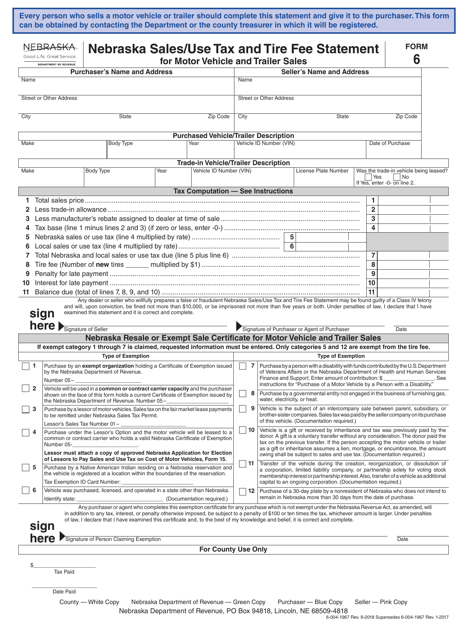

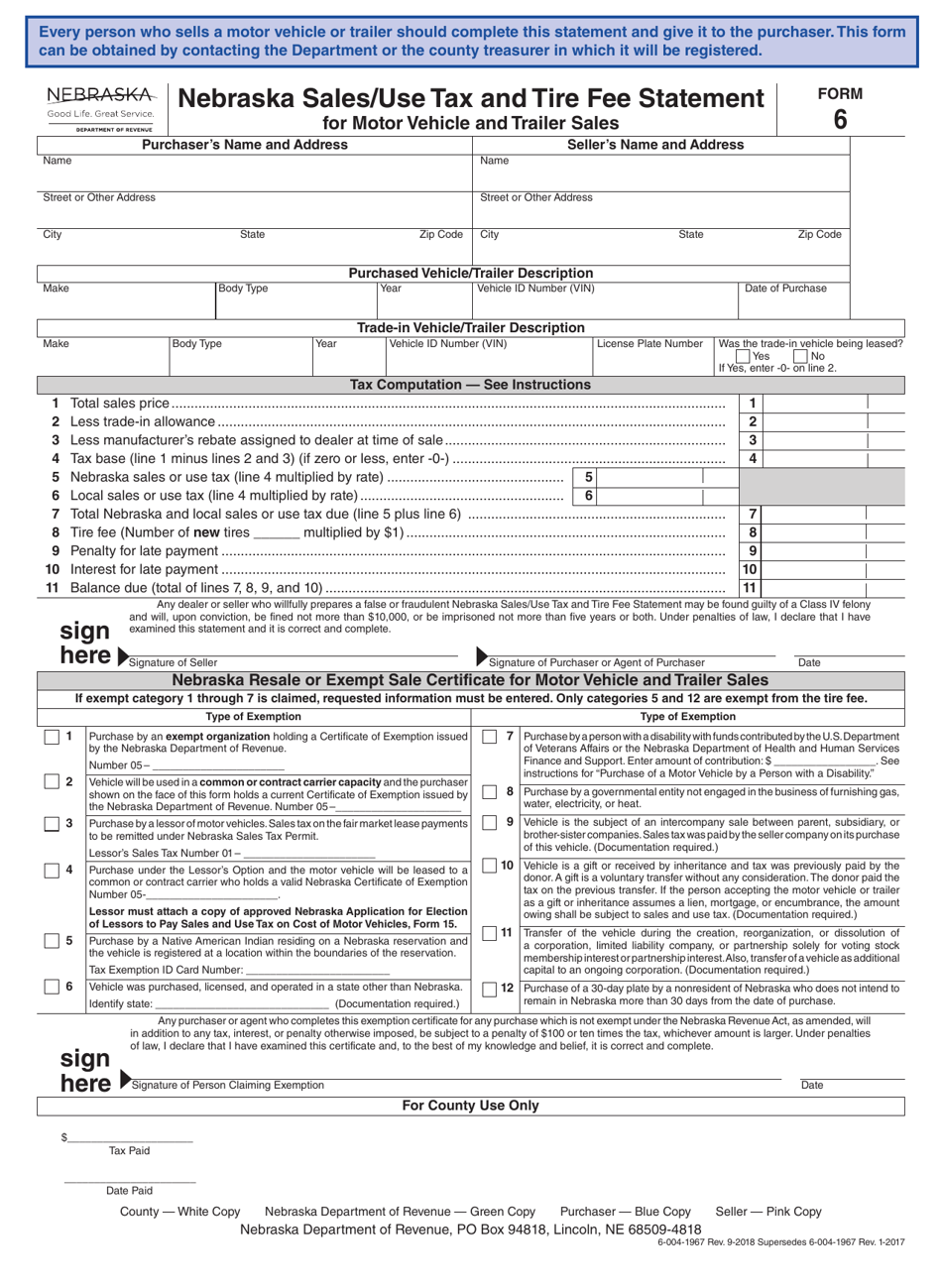

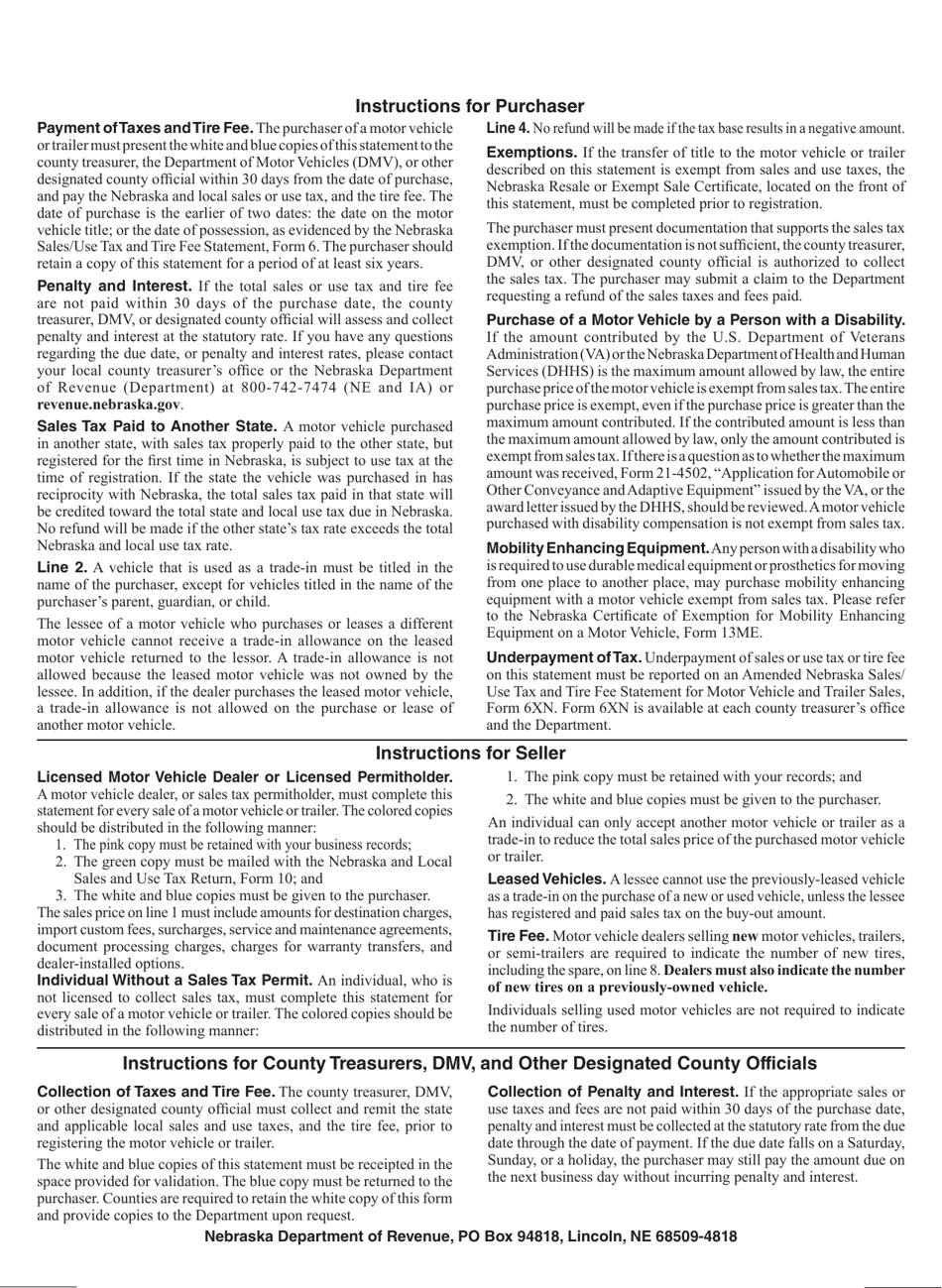

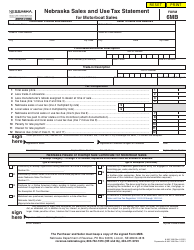

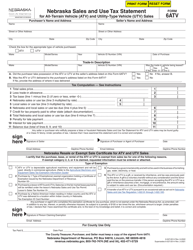

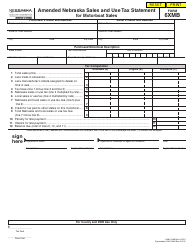

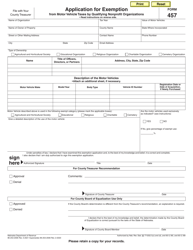

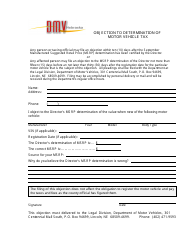

Form 6 Nebraska Sales / Use Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales - Nebraska

What Is Form 6?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 6 Nebraska Sales/Use Tax and Tire Fee Statement?

A: Form 6 is a document used in Nebraska for reporting sales/use tax and tire fees on motor vehicle and trailer sales.

Q: What is the purpose of Form 6 Nebraska Sales/Use Tax and Tire Fee Statement?

A: The purpose of Form 6 is to calculate and report the sales/use tax and tire fees on motor vehicle and trailer sales in Nebraska.

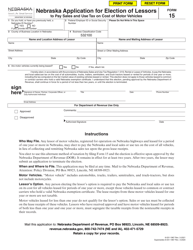

Q: Who needs to fill out Form 6 Nebraska Sales/Use Tax and Tire Fee Statement?

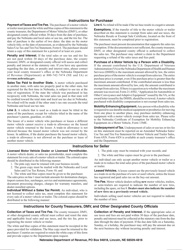

A: Any individual or business selling or leasing motor vehicles or trailers in Nebraska needs to fill out Form 6.

Q: What information is required on Form 6 Nebraska Sales/Use Tax and Tire Fee Statement?

A: Form 6 requires information such as the seller's name and address, buyer's name and address, vehicle details, sale price, and applicable tax and fee amounts.

Q: When is Form 6 Nebraska Sales/Use Tax and Tire Fee Statement due?

A: Form 6 is due within 30 days of the sale or lease date of the motor vehicle or trailer.

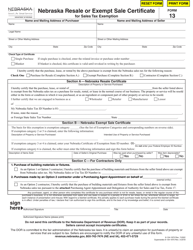

Q: Are there any exemptions or deductions available on Form 6 Nebraska Sales/Use Tax and Tire Fee Statement?

A: Yes, there are certain exemptions and deductions available on Form 6. Consult the instructions or contact the Nebraska Department of Revenue for more information.

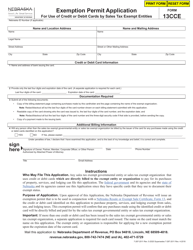

Q: What if I have questions or need assistance with Form 6 Nebraska Sales/Use Tax and Tire Fee Statement?

A: If you have questions or need assistance with Form 6, you can contact the Nebraska Department of Revenue for guidance.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 6 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.