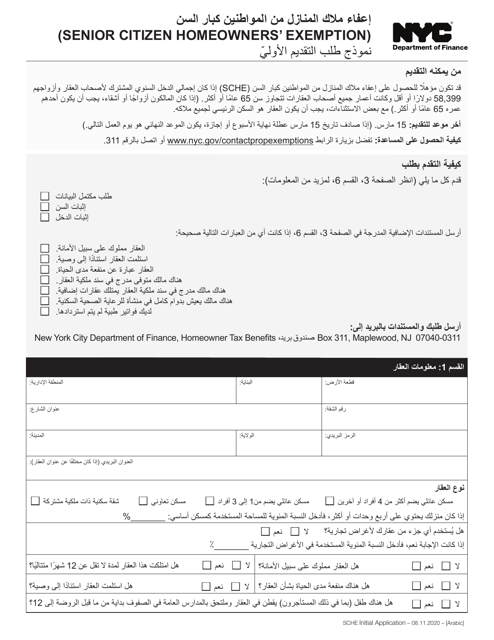

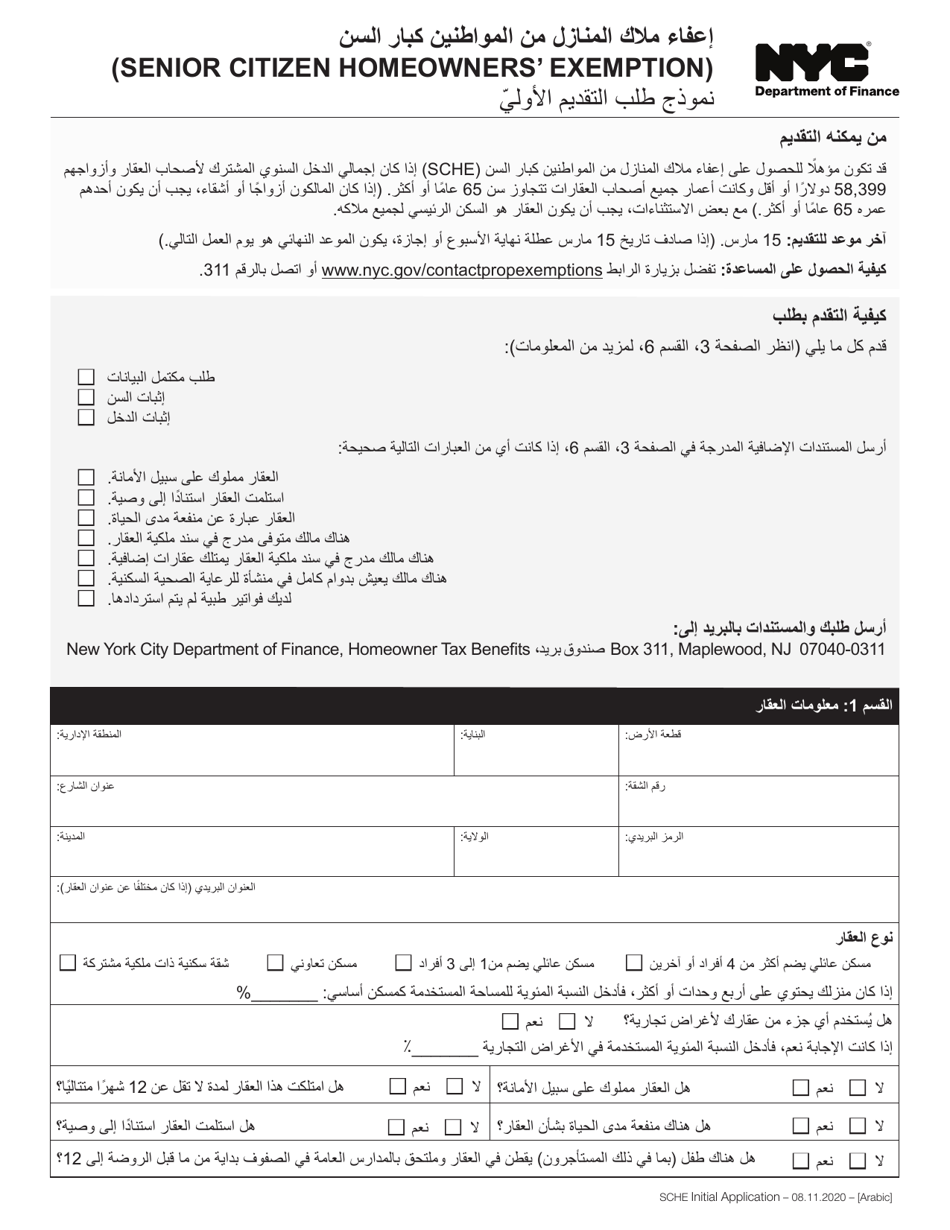

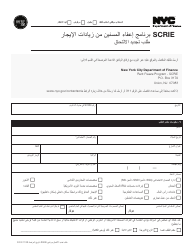

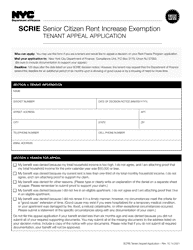

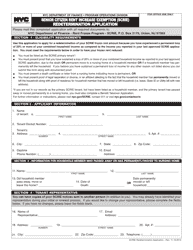

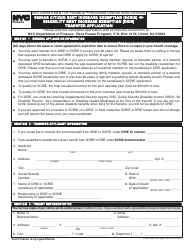

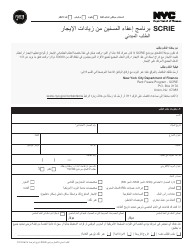

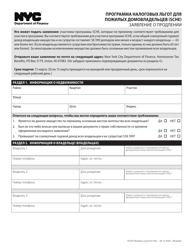

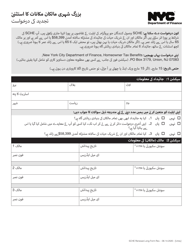

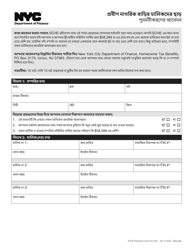

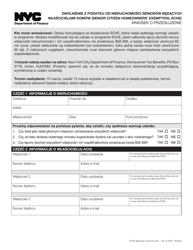

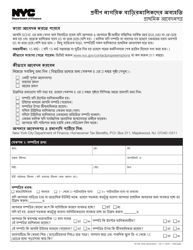

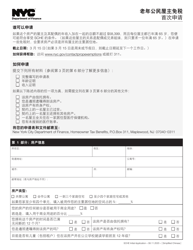

Senior Citizen Homeowners' Exemption Initial Application - New York City (Arabic)

This is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

The document is provided in Arabic.

FAQ

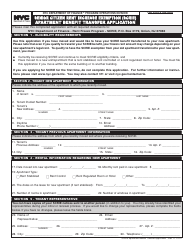

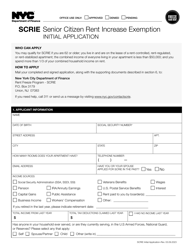

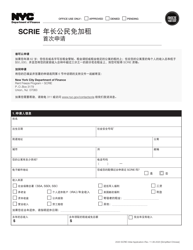

Q: What is the Senior Citizen Homeowners' Exemption Initial Application?

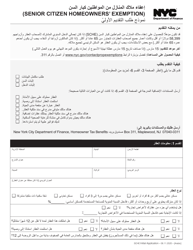

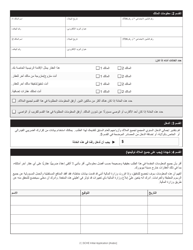

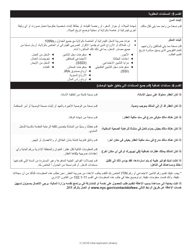

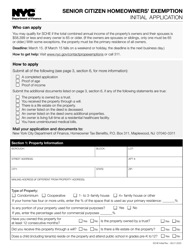

A: The Senior Citizen Homeowners' Exemption Initial Application is a form that eligible senior citizens in New York City can fill out to apply for a property tax exemption.

Q: Who can apply for the Senior Citizen Homeowners' Exemption?

A: Senior citizens who are 65 years or older with combined household income below a certain threshold can apply for the Senior Citizen Homeowners' Exemption.

Q: What is the purpose of the Senior Citizen Homeowners' Exemption?

A: The Senior Citizen Homeowners' Exemption is designed to provide property tax relief to eligible senior citizens in New York City.

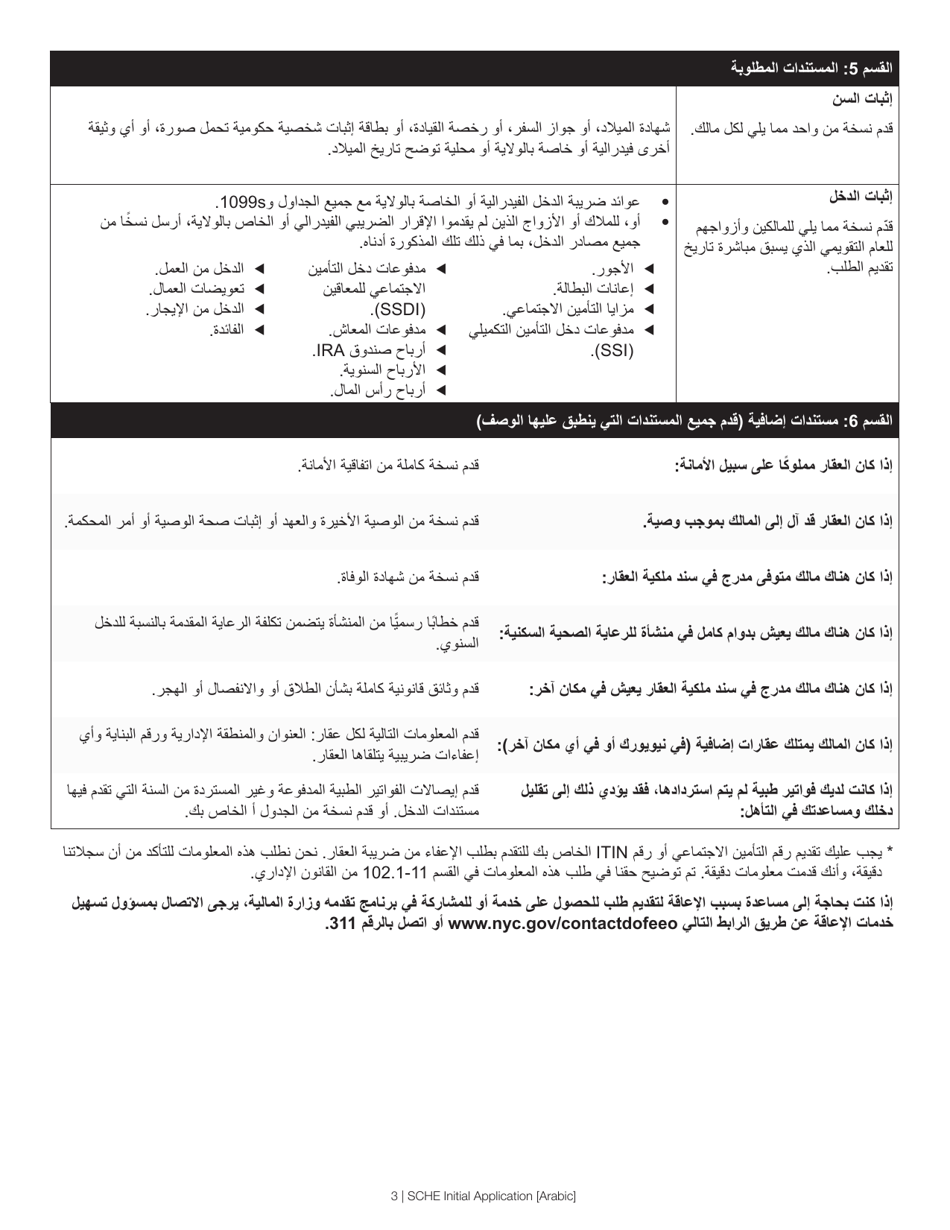

Q: What documents do I need to submit with the Senior Citizen Homeowners' Exemption Initial Application?

A: You will need to submit proof of age, proof of income, and proof of property ownership along with the application form.

Q: How long does it take to process the Senior Citizen Homeowners' Exemption Initial Application?

A: Processing times can vary, but it typically takes several weeks to process the application.

Q: What happens if my Senior Citizen Homeowners' Exemption Initial Application is approved?

A: If your application is approved, you will receive a property tax exemption that reduces the amount of property taxes you have to pay.

Q: What happens if my Senior Citizen Homeowners' Exemption Initial Application is denied?

A: If your application is denied, you will be notified and given the reason for the denial. You can appeal the decision if you believe it was made in error.

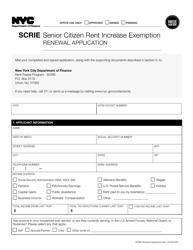

Q: Do I need to renew the Senior Citizen Homeowners' Exemption every year?

A: No, once your initial application is approved, you will receive the exemption automatically each year. However, you may need to update your information if there are any changes to your circumstances.

Q: Can I apply for the Senior Citizen Homeowners' Exemption if I am a renter?

A: No, the Senior Citizen Homeowners' Exemption is only available to senior citizens who own their homes in New York City.

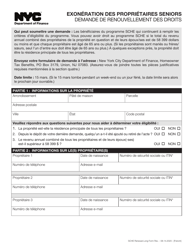

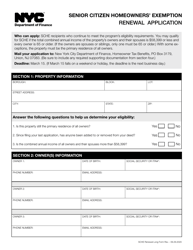

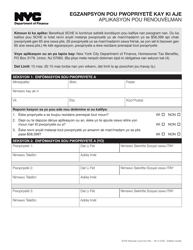

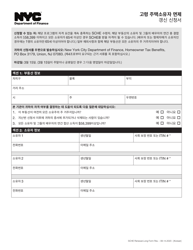

Form Details:

- Released on August 11, 2020;

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.