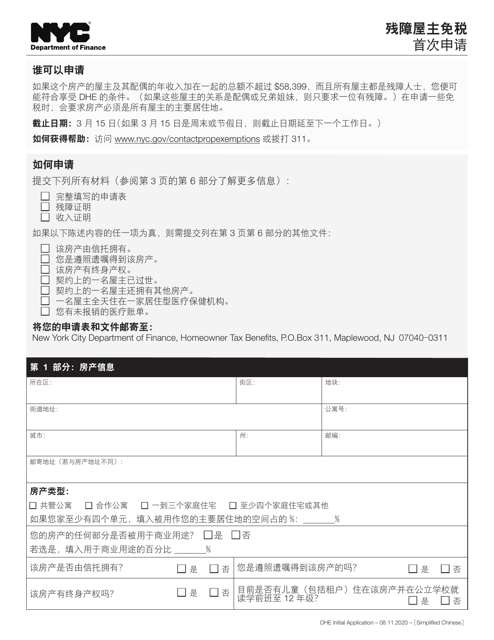

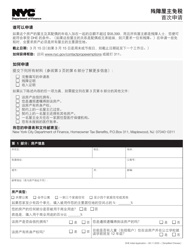

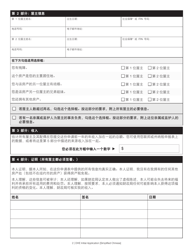

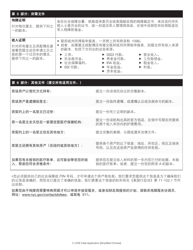

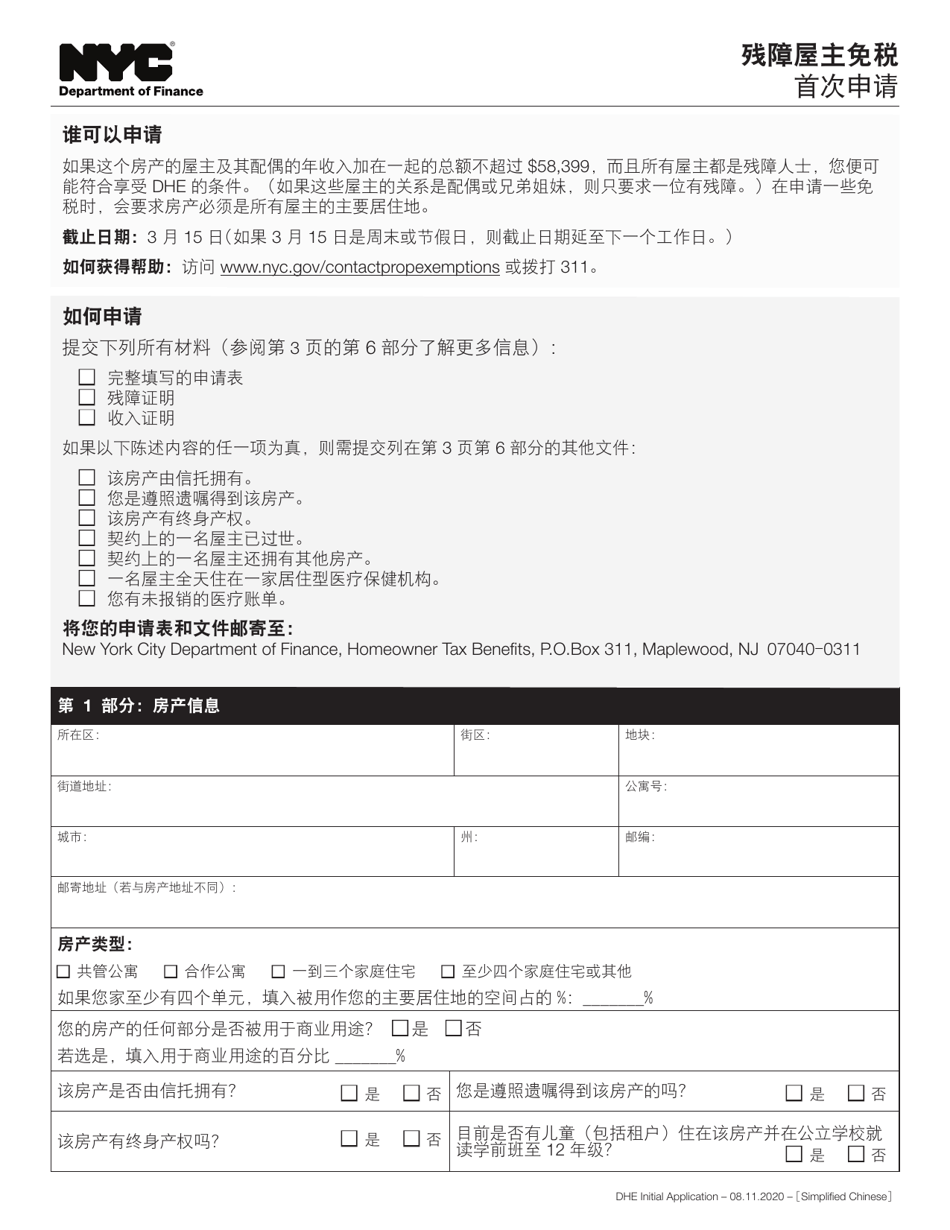

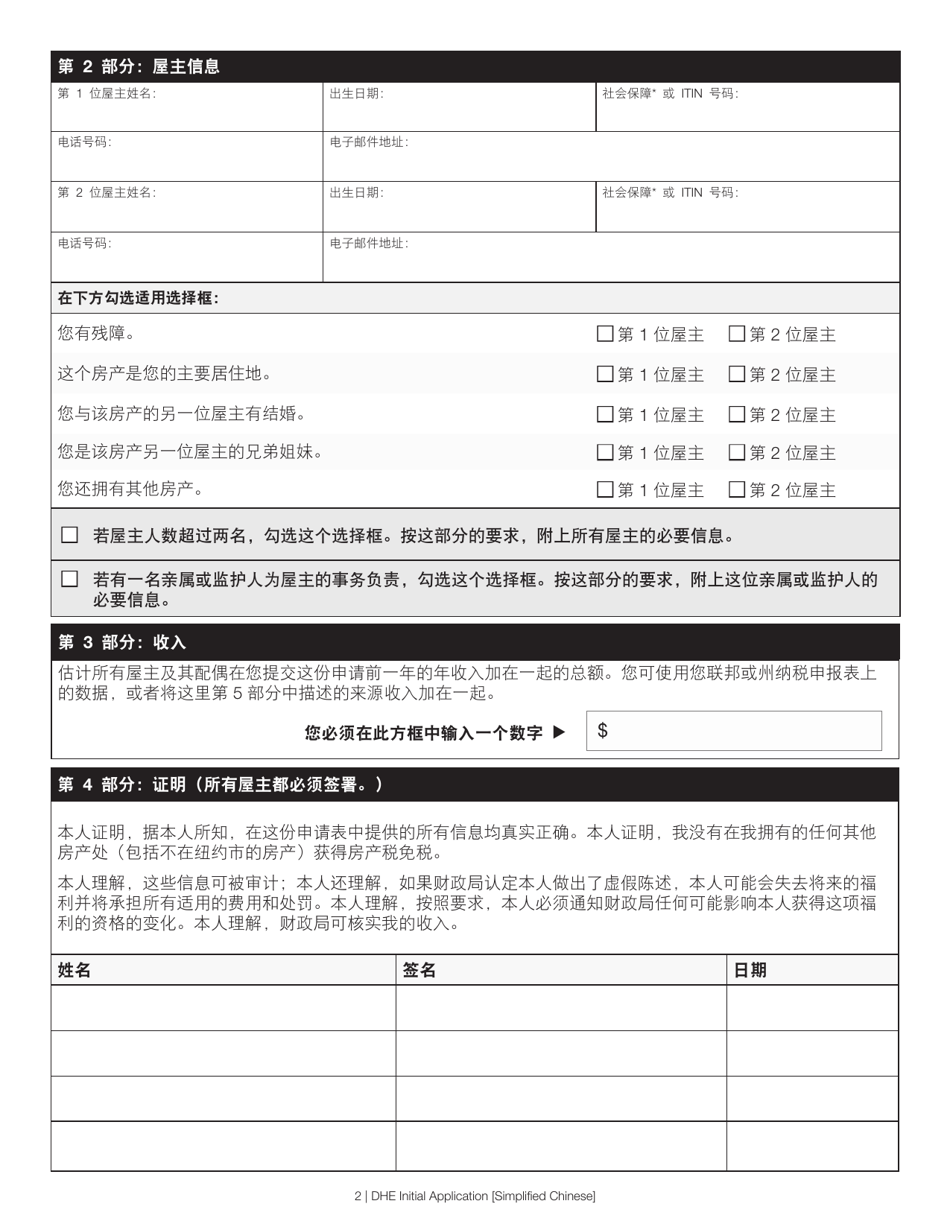

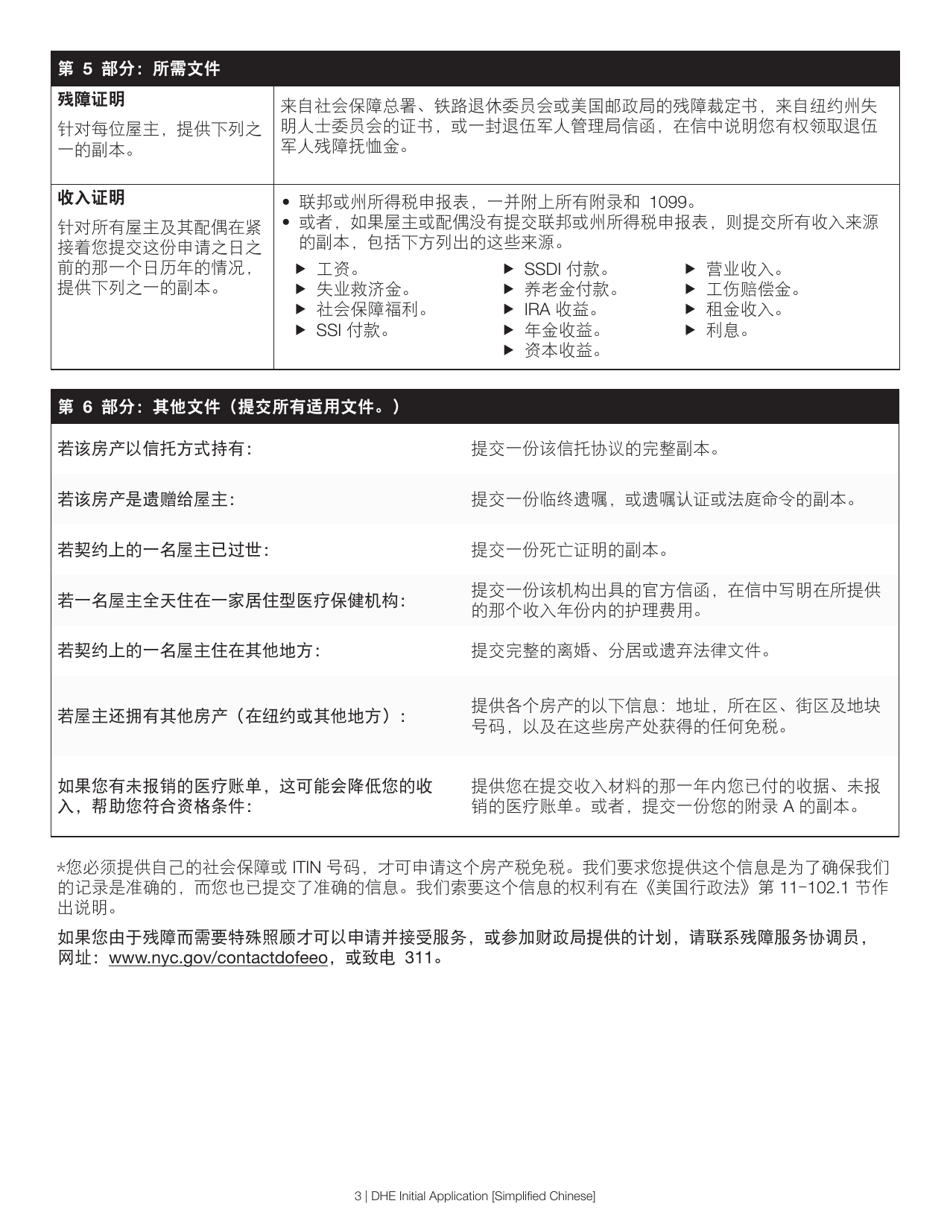

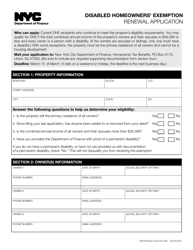

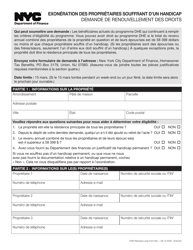

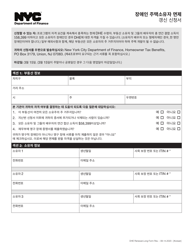

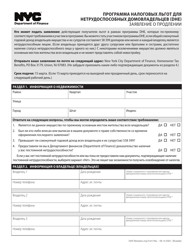

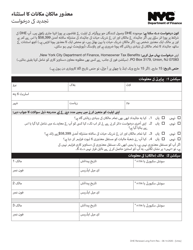

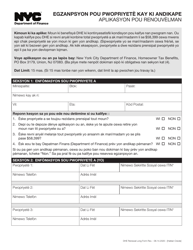

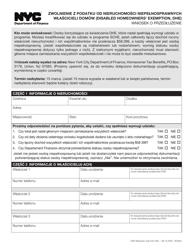

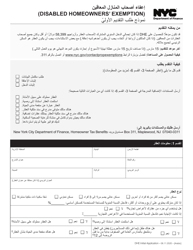

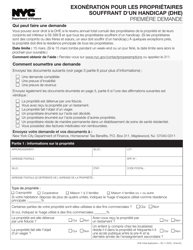

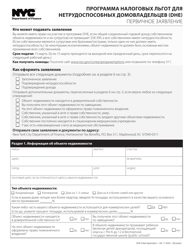

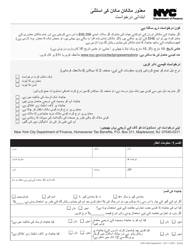

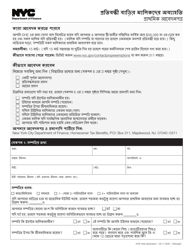

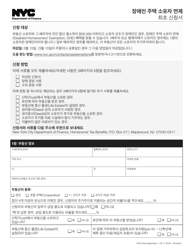

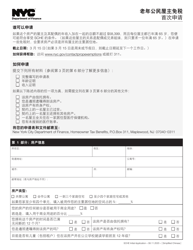

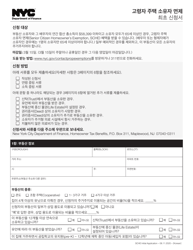

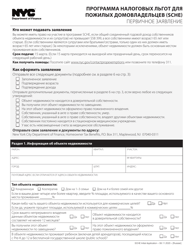

Disabled Homeowners' Exemption Initial Application - New York City (Chinese Simplified)

This is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

The document is provided in Chinese Simplified.

FAQ

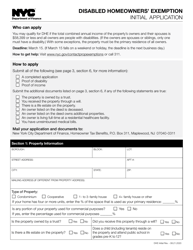

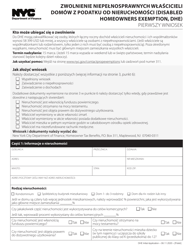

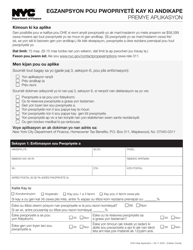

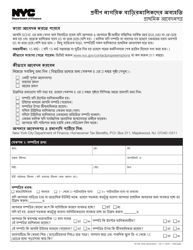

Q: What is the Disabled Homeowners' Exemption Initial Application?

A: It is an application for a property tax exemption available to disabled homeowners in New York City.

Q: Who is eligible for the Disabled Homeowners' Exemption?

A: Disabled homeowners in New York City who meet certain requirements are eligible.

Q: What are the requirements for the Disabled Homeowners' Exemption?

A: To be eligible, homeowners must have a qualifying disability and meet income and other criteria.

Q: How can I apply for the Disabled Homeowners' Exemption?

A: You can apply by completing and submitting the initial application form to the NYC Department of Finance.

Form Details:

- Released on August 11, 2020;

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.