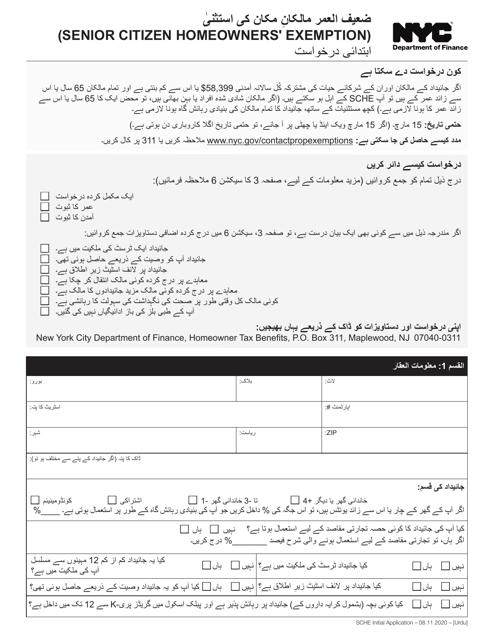

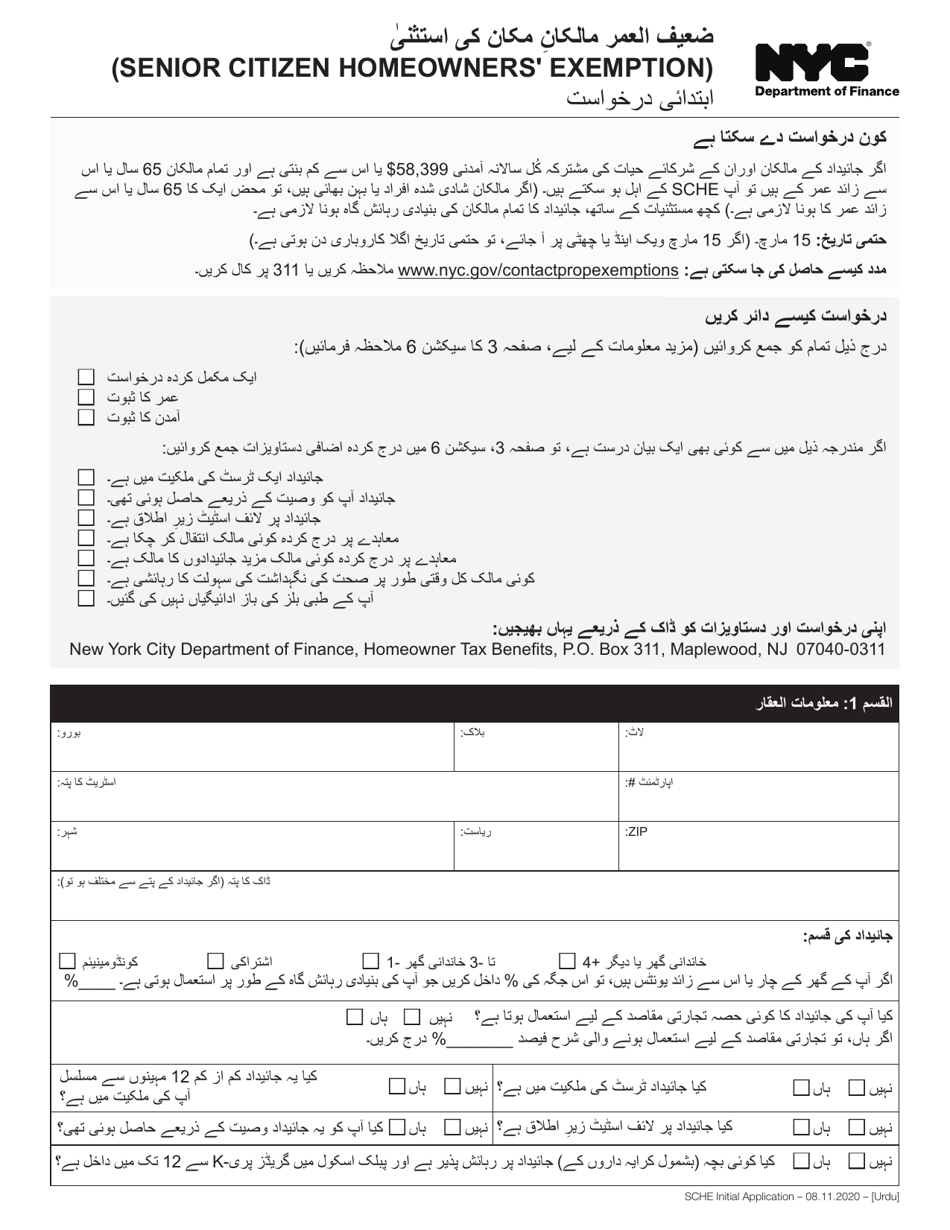

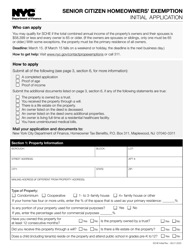

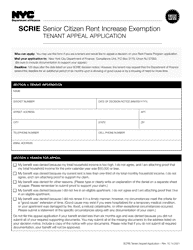

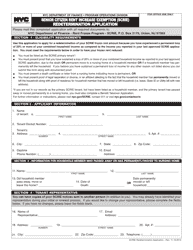

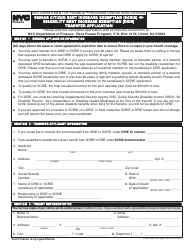

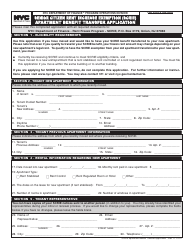

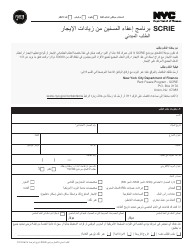

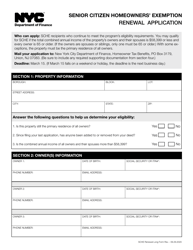

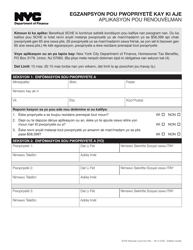

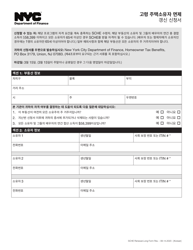

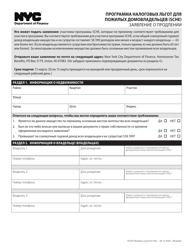

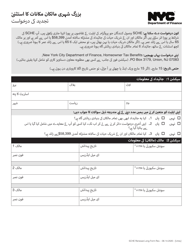

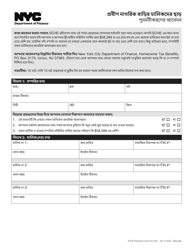

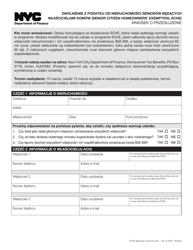

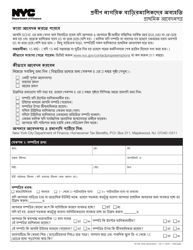

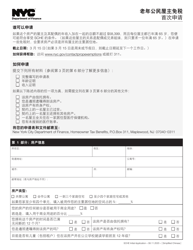

Senior Citizen Homeowners' Exemption Initial Application - New York City (Urdu)

This is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

The document is provided in Urdu.

FAQ

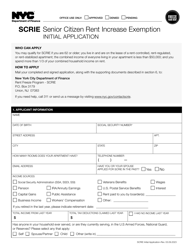

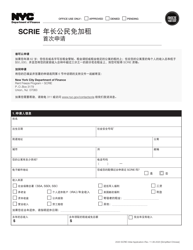

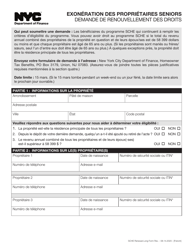

Q: What is the Senior Citizen Homeowners' Exemption Initial Application?

A: It is an application for senior citizens in New York City to receive a property tax exemption.

Q: Who is eligible for the Senior Citizen Homeowners' Exemption?

A: Senior citizens aged 65 or older who own and live in a 1-3 family home or condominium in New York City and meet certain income requirements.

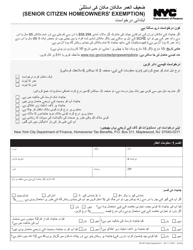

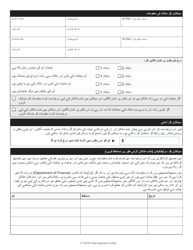

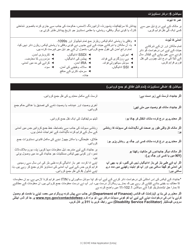

Q: What documents are required for the application?

A: You need to submit proof of age, proof of ownership, proof of residency, and proof of income.

Q: What is the benefit of the Senior Citizen Homeowners' Exemption?

A: If approved, you may receive a reduction in your property taxes.

Q: Is there an income limit to be eligible for the exemption?

A: Yes, there is an income limit. It varies depending on factors such as marital status and whether you receive Social Security benefits.

Q: When should I submit the application?

A: It is recommended to submit the application as soon as possible, preferably before the tax period begins.

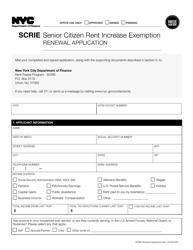

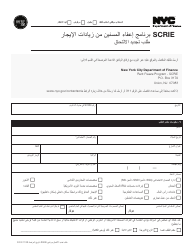

Q: What if I have already received the exemption, but need to make changes or renew it?

A: You should submit a Renewal Application or Change Application form, depending on your needs.

Q: Who can I contact for more information?

A: You can contact the Department of Finance for more information on the Senior Citizen Homeowners' Exemption.

Form Details:

- Released on August 11, 2020;

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.