This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 941 Schedule B

for the current year.

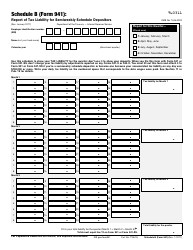

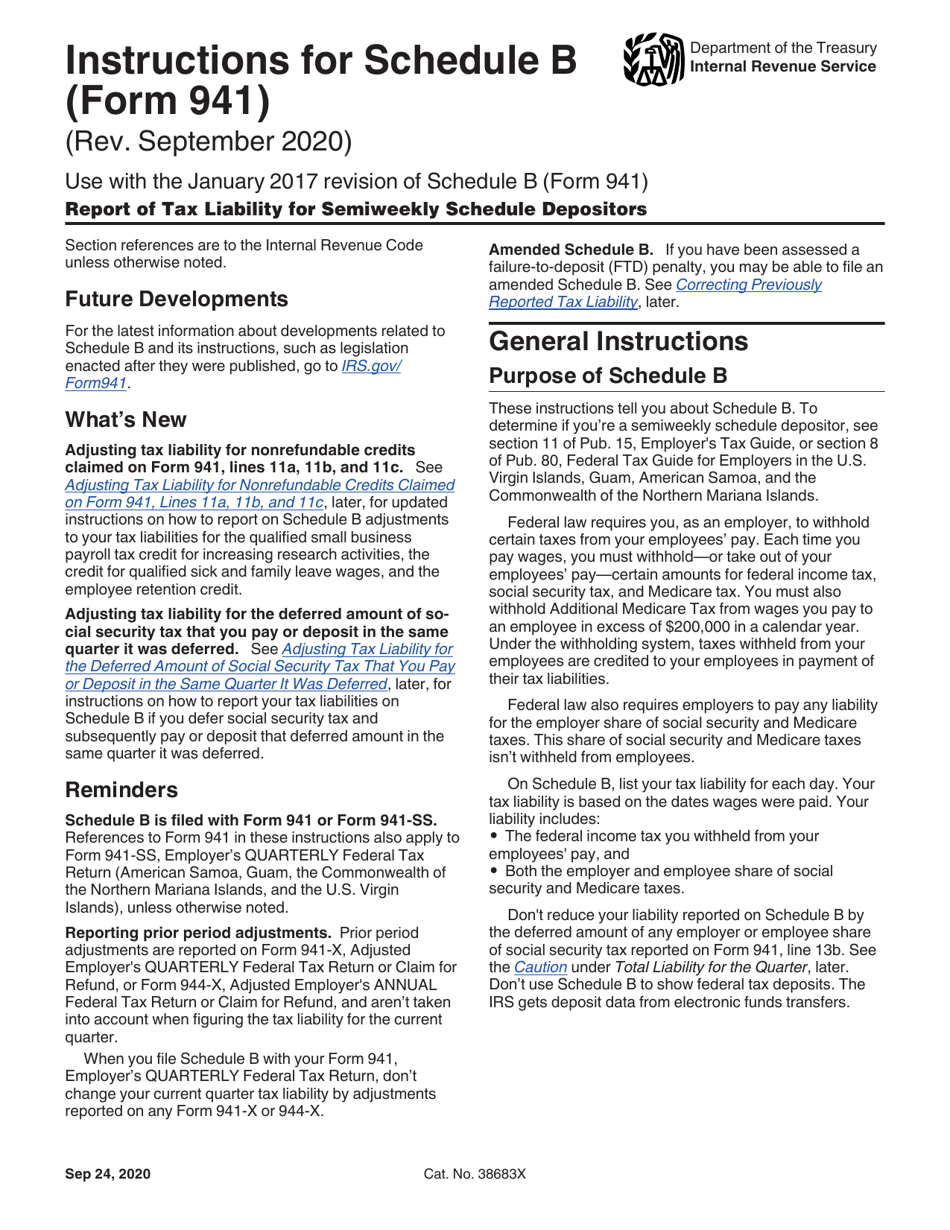

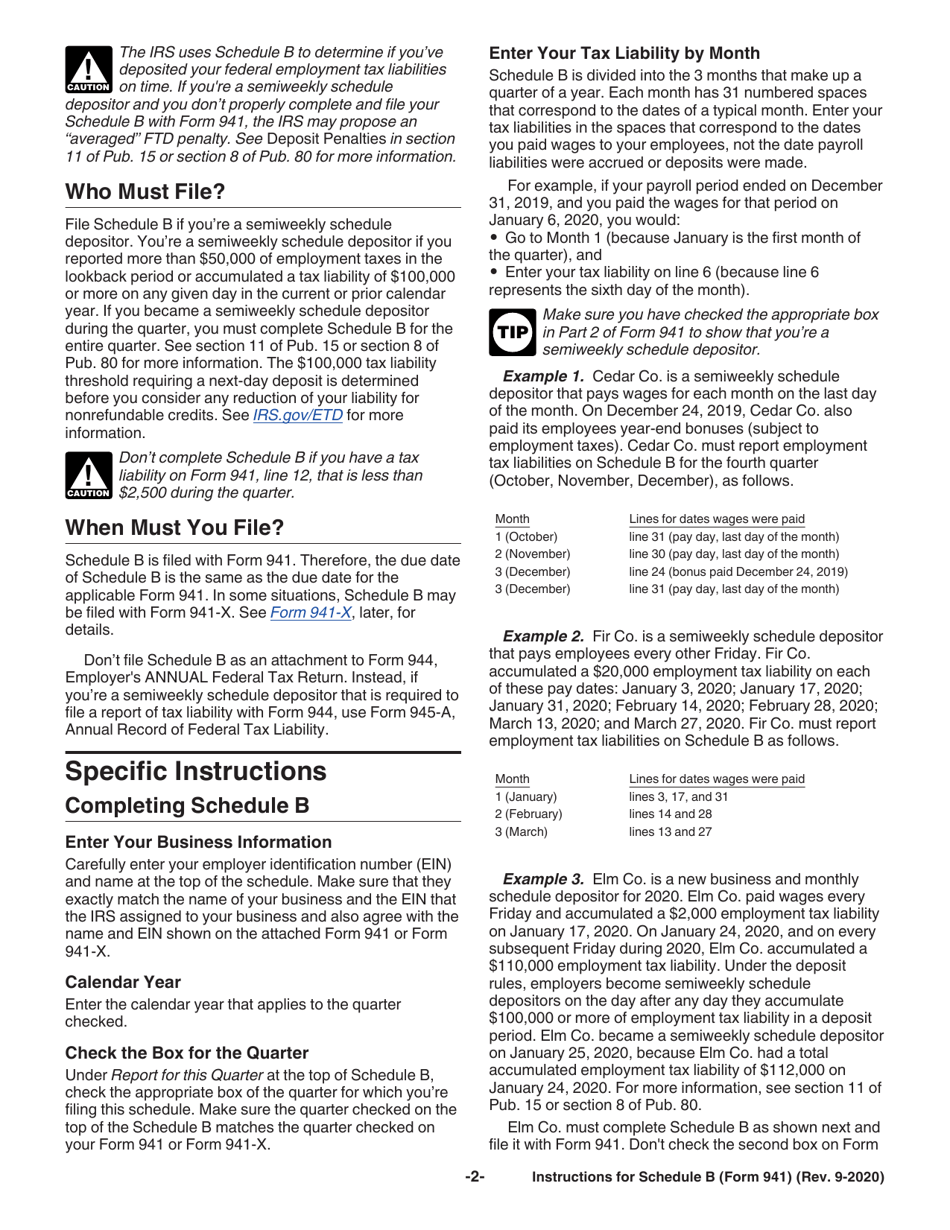

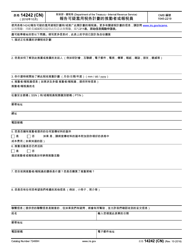

Instructions for IRS Form 941 Schedule B Report of Tax Liability for Semiweekly Schedule Depositors

This document contains official instructions for IRS Form 941 Schedule B, Report of Tax Liability for Semiweekly Schedule Depositors - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 941 Schedule B is available for download through this link.

FAQ

Q: What is IRS Form 941 Schedule B?

A: IRS Form 941 Schedule B is a report used by semiweekly schedule depositors to report tax liabilities.

Q: Who needs to file IRS Form 941 Schedule B?

A: Semiweekly schedule depositors (employers) need to file IRS Form 941 Schedule B.

Q: What is the purpose of IRS Form 941 Schedule B?

A: The purpose of IRS Form 941 Schedule B is to report tax liabilities for semiweekly schedule depositors.

Q: What information is required on IRS Form 941 Schedule B?

A: IRS Form 941 Schedule B requires information such as tax liability amounts for each semiweekly deposit period.

Q: When is IRS Form 941 Schedule B due?

A: IRS Form 941 Schedule B is generally due at the same time as IRS Form 941, which is quarterly.

Q: Are there any penalties for not filing IRS Form 941 Schedule B?

A: Yes, there can be penalties for not filing IRS Form 941 Schedule B or for filing it late.

Q: Can I file IRS Form 941 Schedule B electronically?

A: Yes, IRS Form 941 Schedule B can be filed electronically.

Q: What happens if there are errors on my IRS Form 941 Schedule B?

A: If there are errors on your IRS Form 941 Schedule B, you may need to file an amended return and correct the errors.

Q: Can I get an extension to file IRS Form 941 Schedule B?

A: Extensions for filing IRS Form 941 Schedule B may be available in certain circumstances, but it's best to consult the IRS for specific instructions.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.