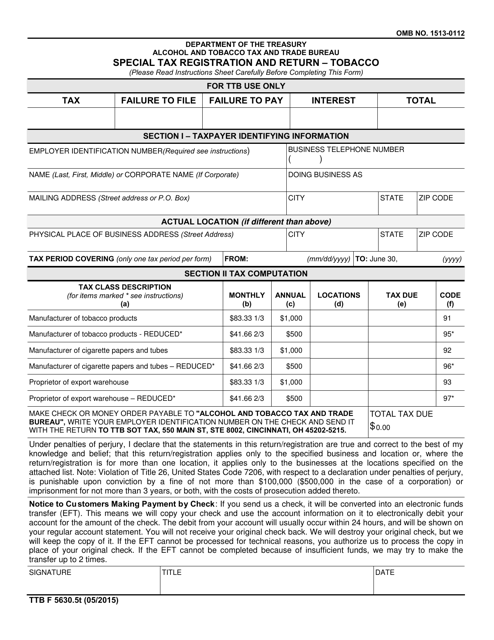

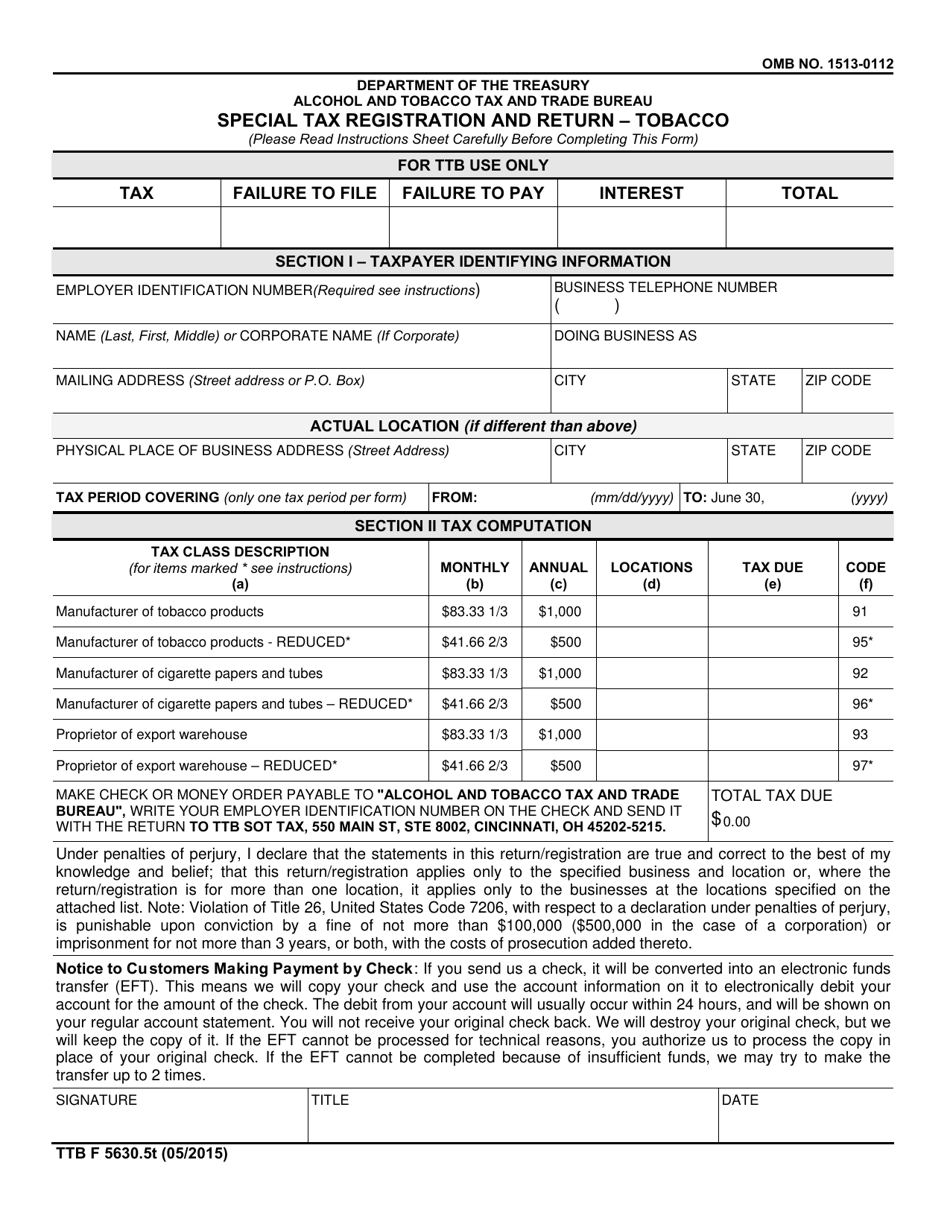

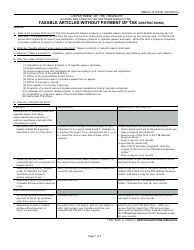

Form TTB F5630.5T Special Tax Registration and Return - Tobacco

What Is Form TTB F5630.5T?

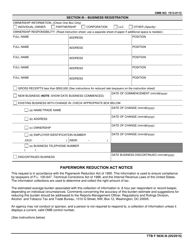

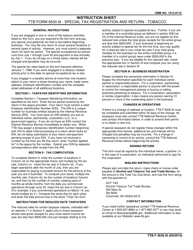

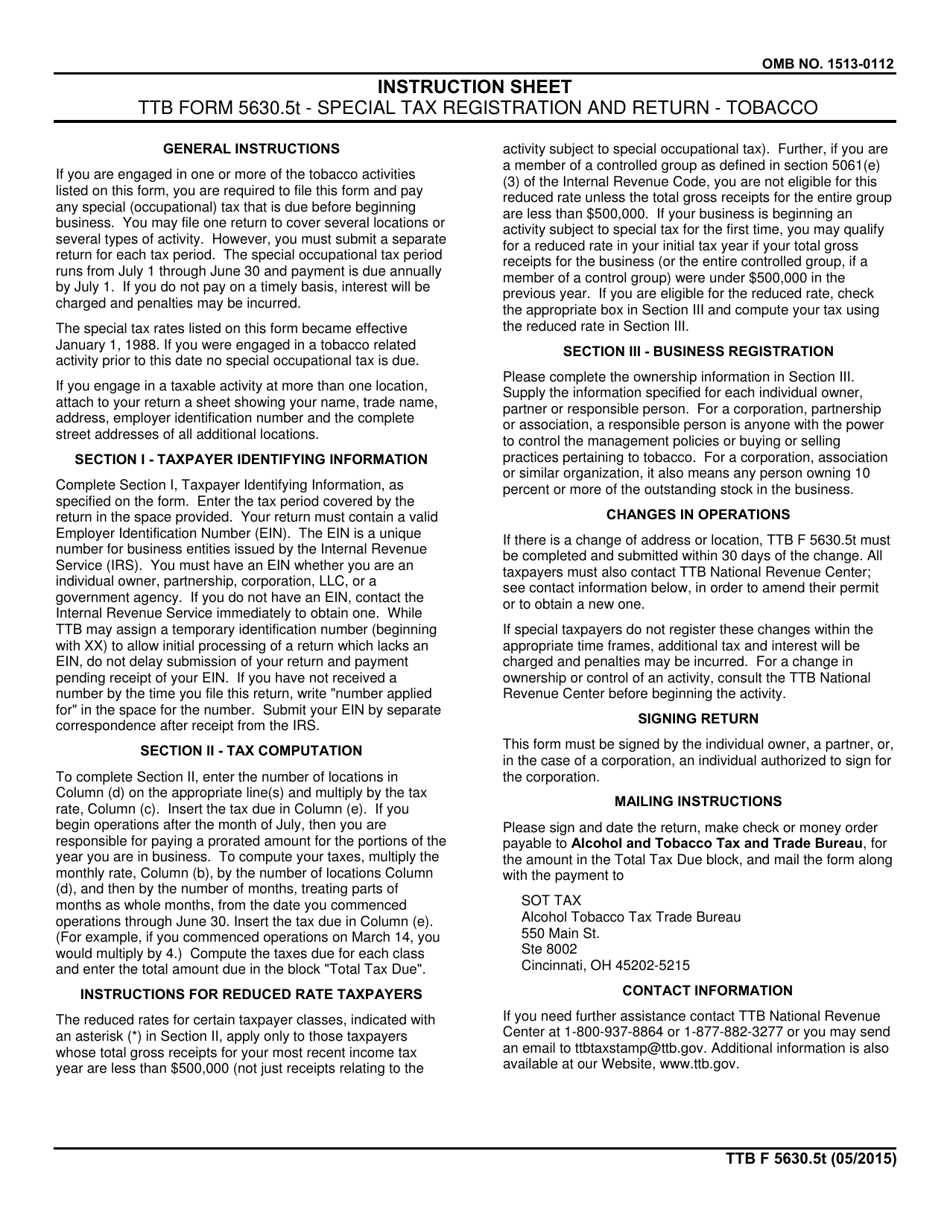

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on May 1, 2015 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TTB F5630.5T?

A: Form TTB F5630.5T is a Special Tax Registration and Return form for Tobacco.

Q: Who needs to file Form TTB F5630.5T?

A: Any person who is engaged in the business of manufacturing, importing, or dealing in tobacco products needs to file Form TTB F5630.5T.

Q: What is the purpose of Form TTB F5630.5T?

A: The purpose of Form TTB F5630.5T is to register for special tax and report the tobacco products activities.

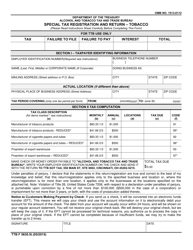

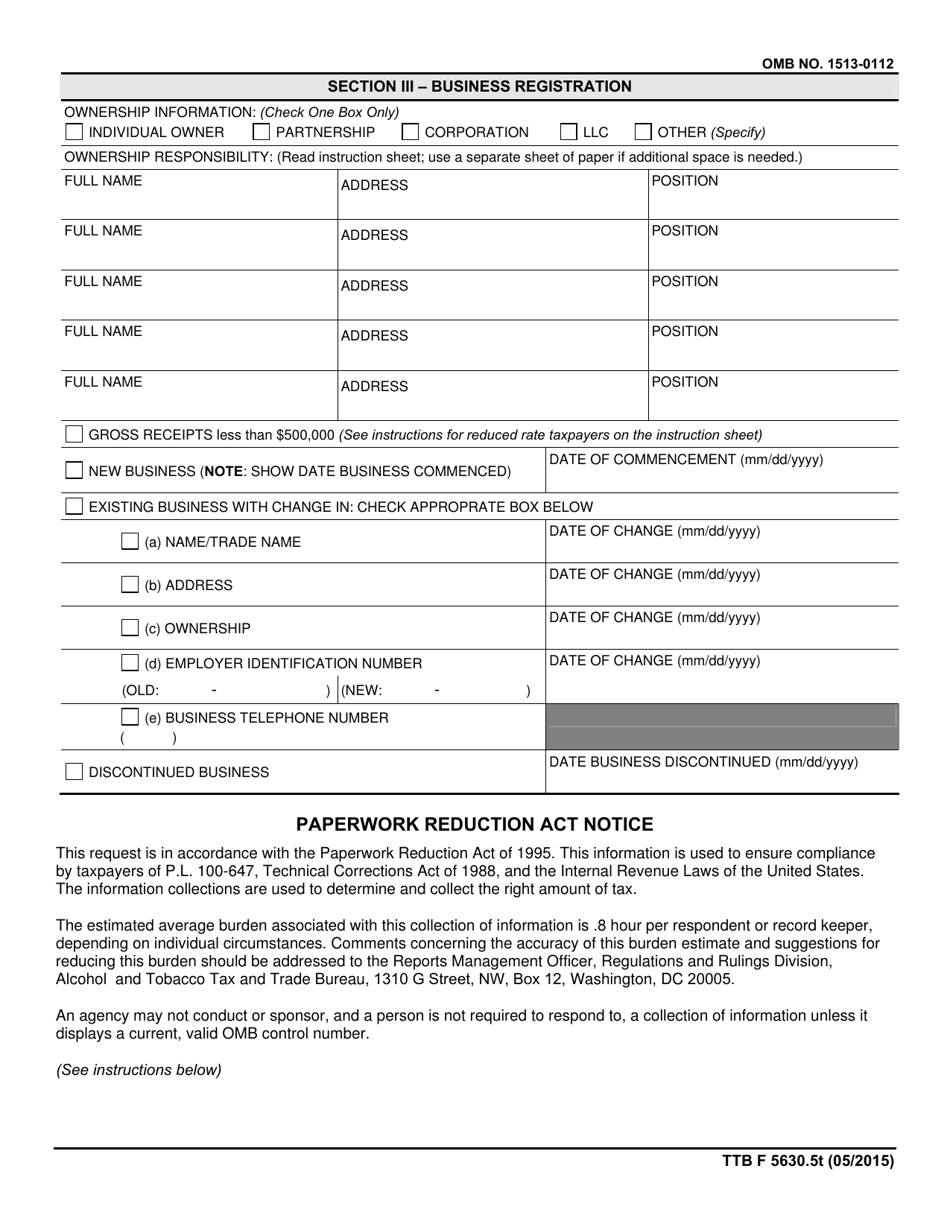

Q: What information is required on Form TTB F5630.5T?

A: The form requires information such as the name, address, and TTB number of the registrant, as well as details about the tobacco products transactions.

Q: How often do I need to file Form TTB F5630.5T?

A: Form TTB F5630.5T must be filed annually, on or before the due date of the return.

Form Details:

- Released on May 1, 2015;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TTB F5630.5T by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.