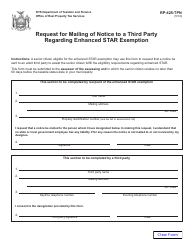

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form RP-425-GC

for the current year.

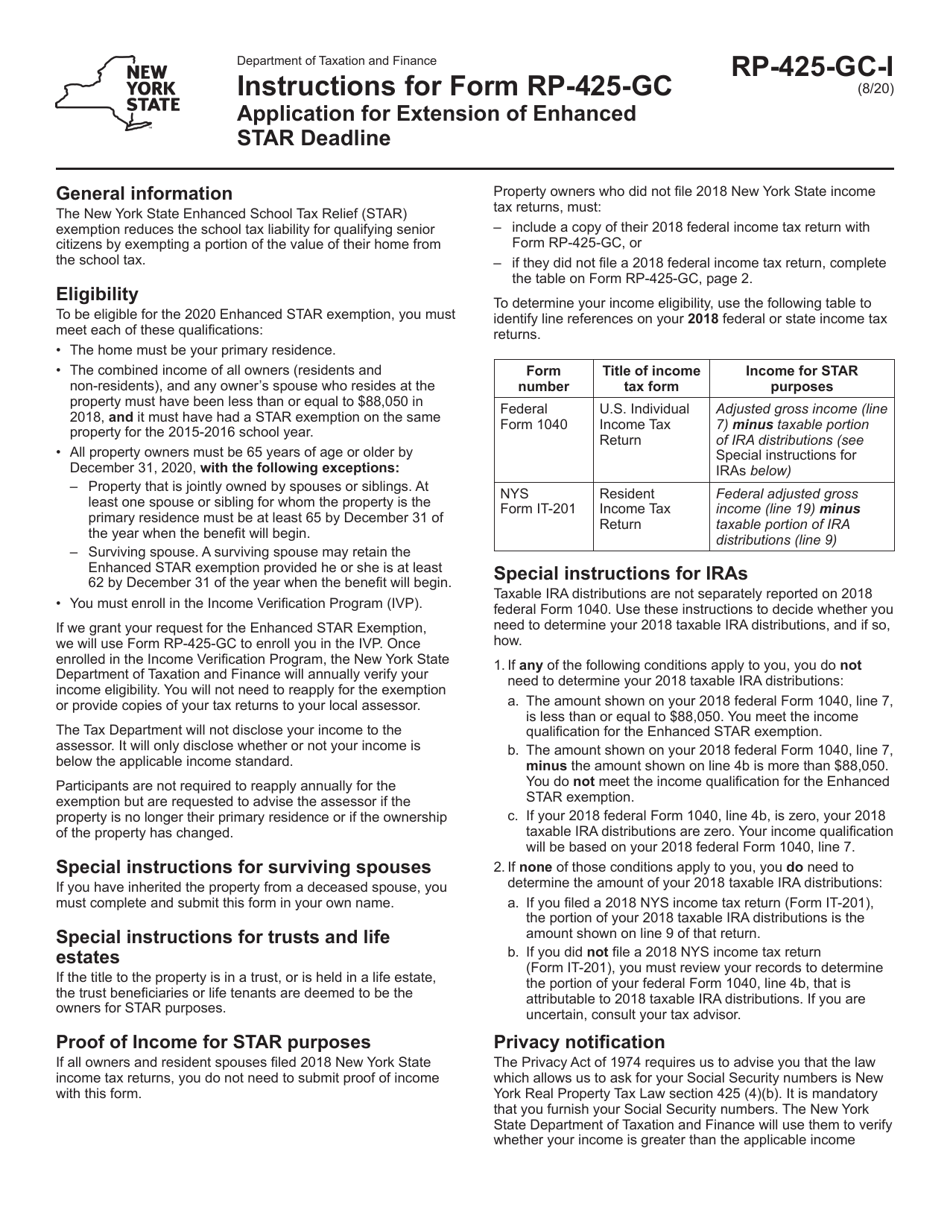

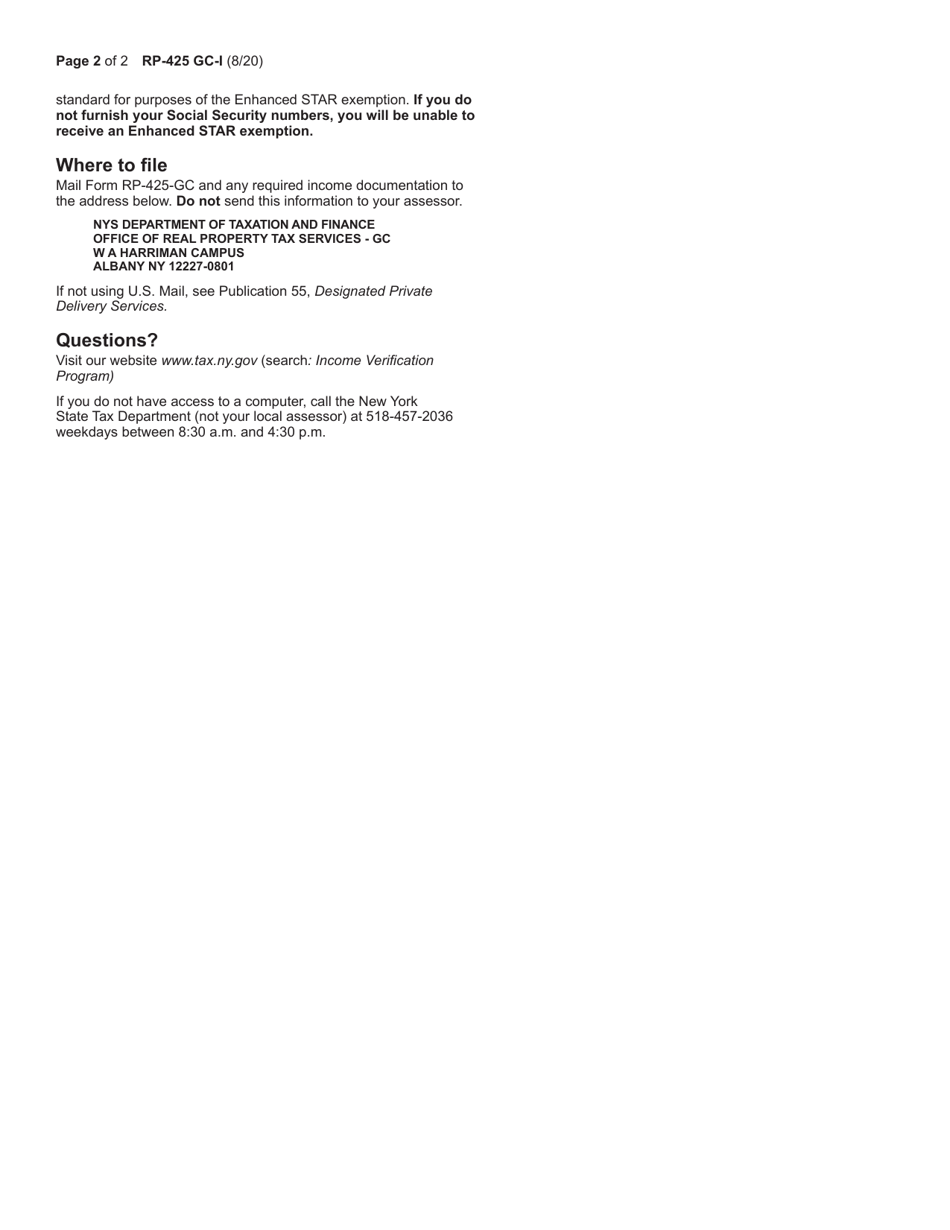

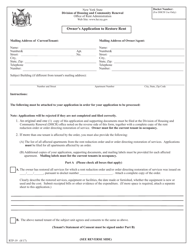

Instructions for Form RP-425-GC Application for Extension of Enhanced Star Deadline - New York

This document contains official instructions for Form RP-425-GC , Application for Extension of Enhanced Star Deadline - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form RP-425-GC is available for download through this link.

FAQ

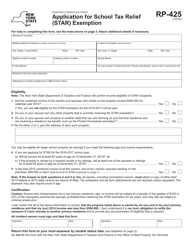

Q: What is Form RP-425-GC?

A: Form RP-425-GC is an application for extension of Enhanced Star deadline in New York.

Q: Who is eligible to use Form RP-425-GC?

A: Homeowners in New York who are eligible for the Enhanced Star exemption and are unable to meet the original deadline.

Q: What is the purpose of Form RP-425-GC?

A: Form RP-425-GC allows eligible homeowners to request an extension for applying for the Enhanced Star exemption.

Q: What information is required on Form RP-425-GC?

A: Form RP-425-GC requires personal information, property information, and a reason for the extension request.

Q: When is the deadline to submit Form RP-425-GC?

A: The deadline to submit Form RP-425-GC is typically March 1st, but this form allows for an extension if approved.

Q: What happens after submitting Form RP-425-GC?

A: After submitting Form RP-425-GC, you will receive a determination from your local assessor regarding whether your extension request is approved or denied.

Q: Can I still receive the Enhanced Star exemption if my extension request is approved?

A: Yes, if your extension request is approved and you meet all the eligibility requirements, you can still receive the Enhanced Star exemption.

Q: What should I do if my extension request is denied?

A: If your extension request is denied, you must file a regular application for the Enhanced Star exemption by the original deadline.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.