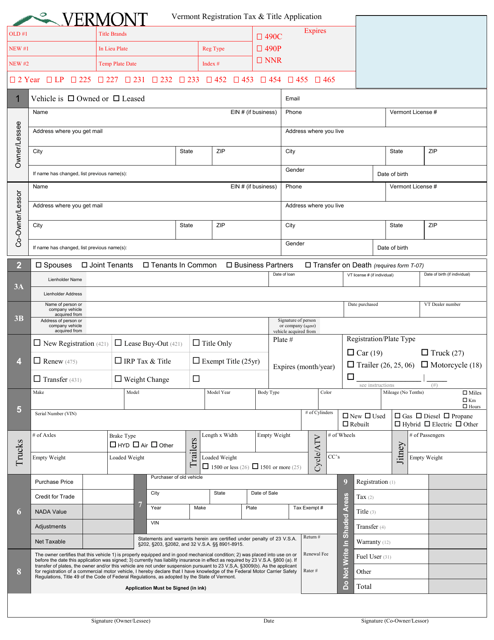

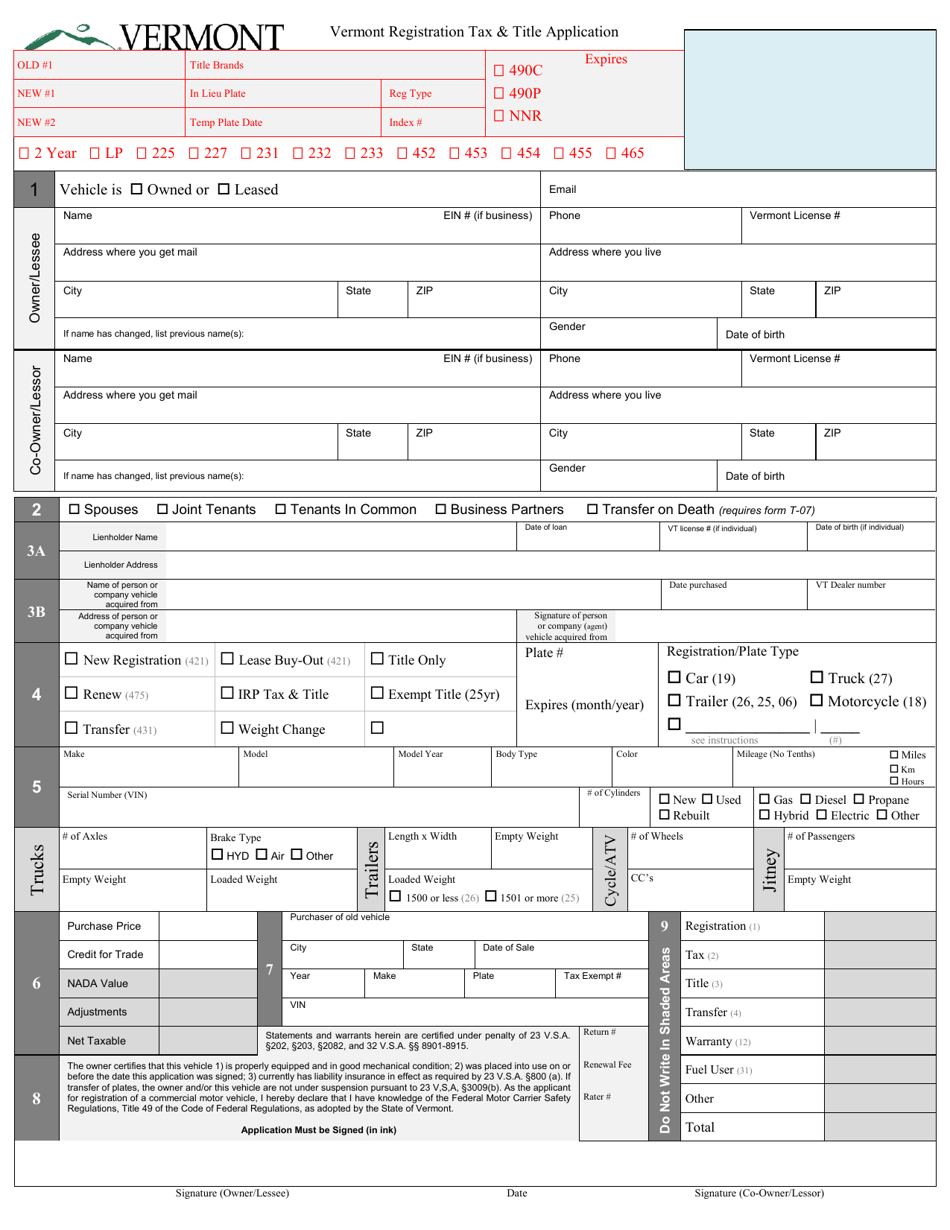

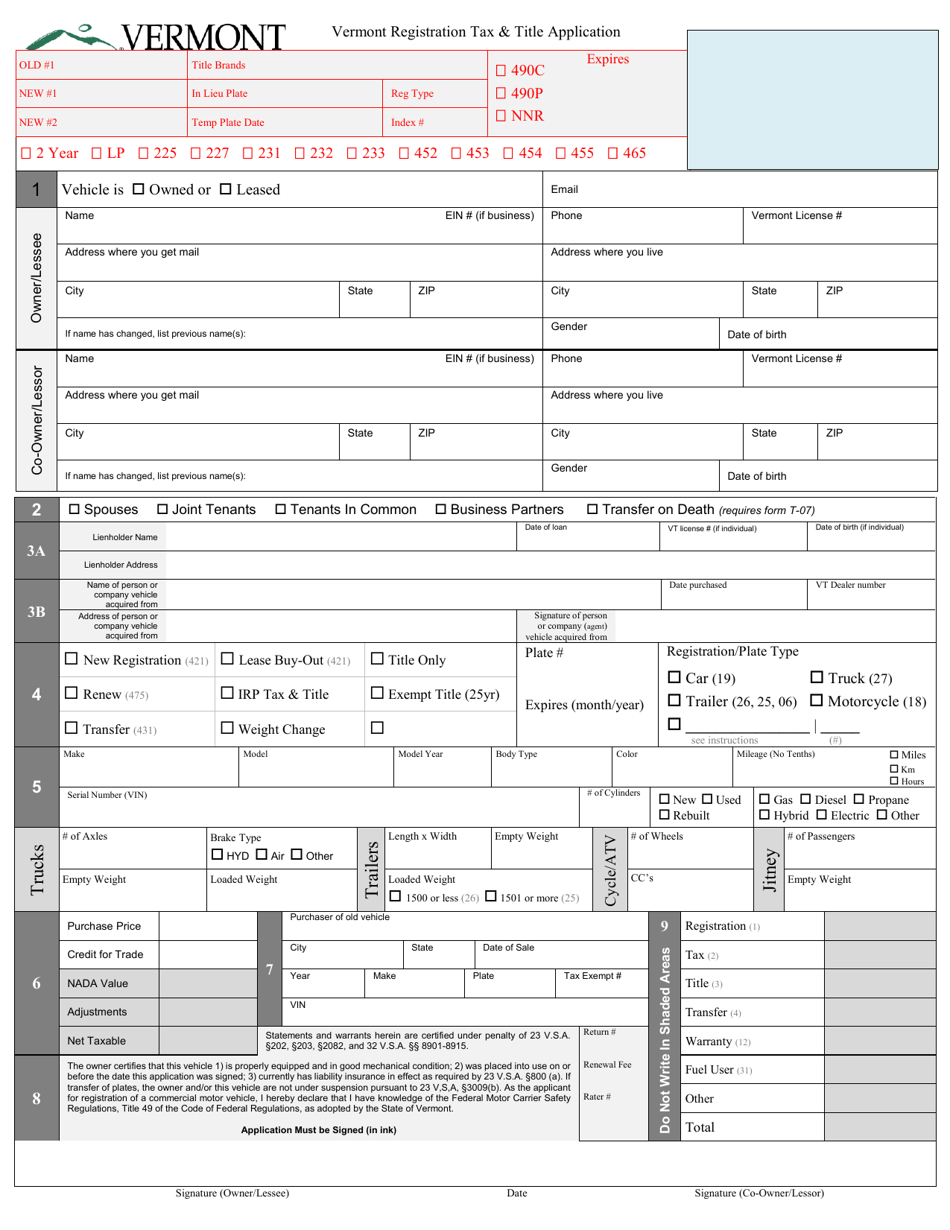

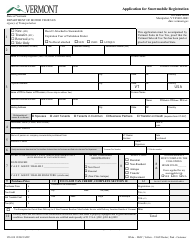

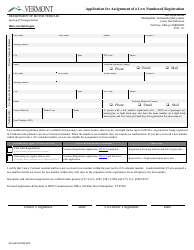

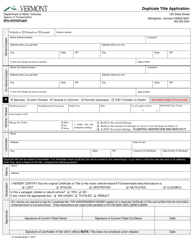

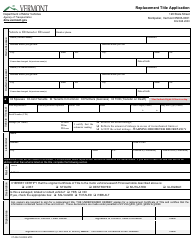

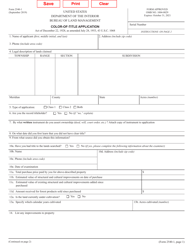

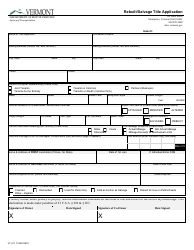

Form VD-119 Vermont Registration Tax & Title Application - Vermont

What Is Form VD-119?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form VD-119?

A: Form VD-119 is the Vermont Registration Tax & Title Application.

Q: What is the purpose of Form VD-119?

A: The purpose of Form VD-119 is to apply for registration, tax, and title for a vehicle in Vermont.

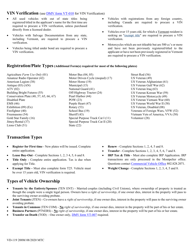

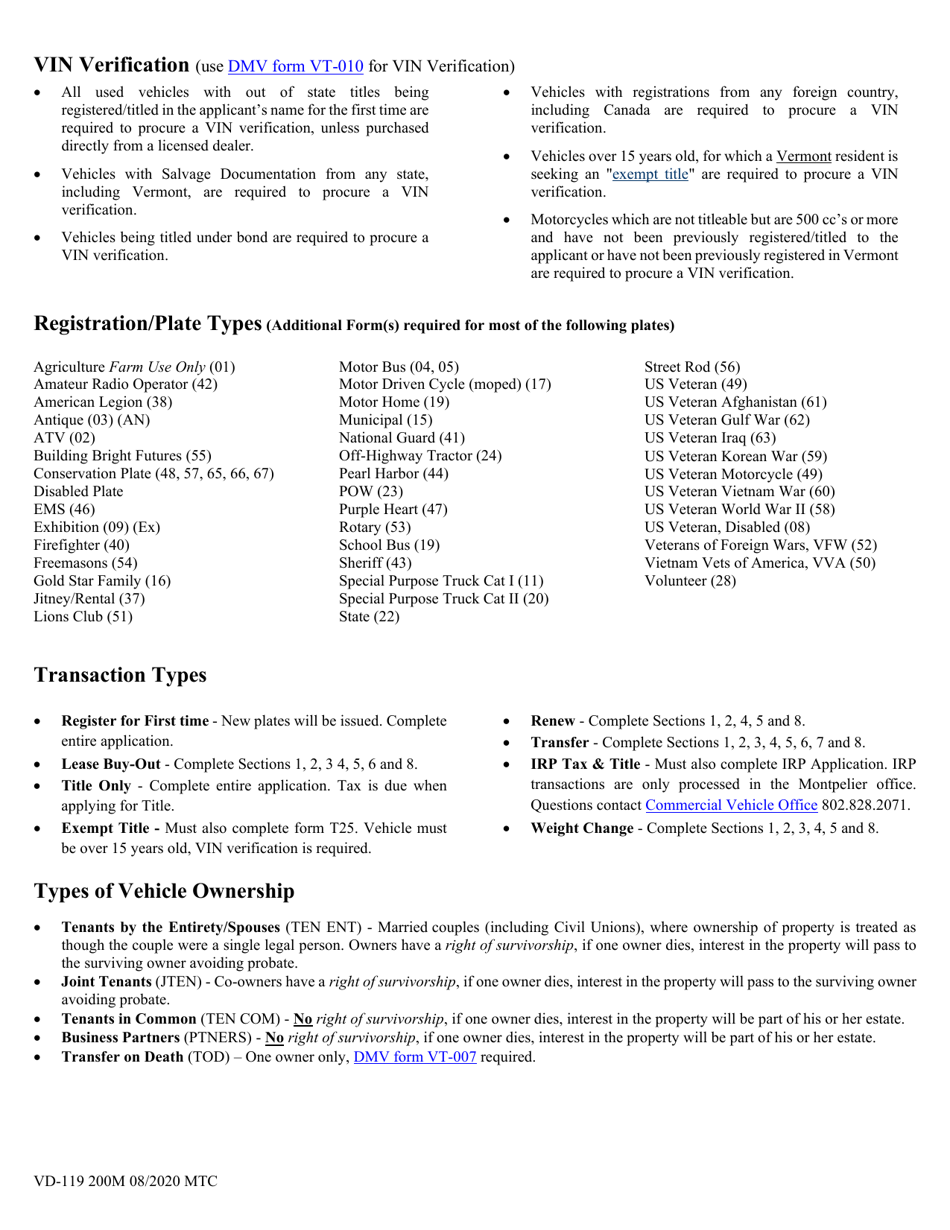

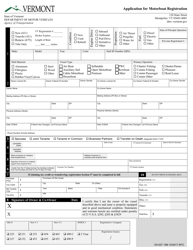

Q: What information is required on Form VD-119?

A: Form VD-119 requires information such as vehicle identification number (VIN), make and model of the vehicle, owner's information, and payment details.

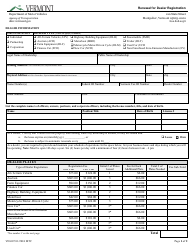

Q: What fees are associated with Form VD-119?

A: The fees associated with Form VD-119 include registration fees, tax fees, and title fees. The exact amount depends on the type and value of the vehicle.

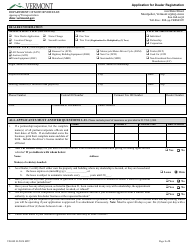

Q: Are there any additional documents required with Form VD-119?

A: Yes, you will need to provide supporting documents such as proof of ownership, proof of insurance, and any applicable lien release documents.

Q: How long does it take to process Form VD-119?

A: Processing times for Form VD-119 vary, but it typically takes around 7 to 10 business days.

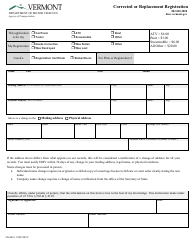

Q: What should I do if there is an error on my Form VD-119?

A: If there is an error on your Form VD-119, you should contact the Vermont DMV to correct the mistake and submit a corrected form, if necessary.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VD-119 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.