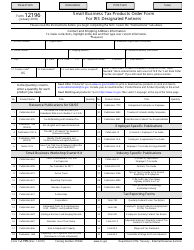

This version of the form is not currently in use and is provided for reference only. Download this version of

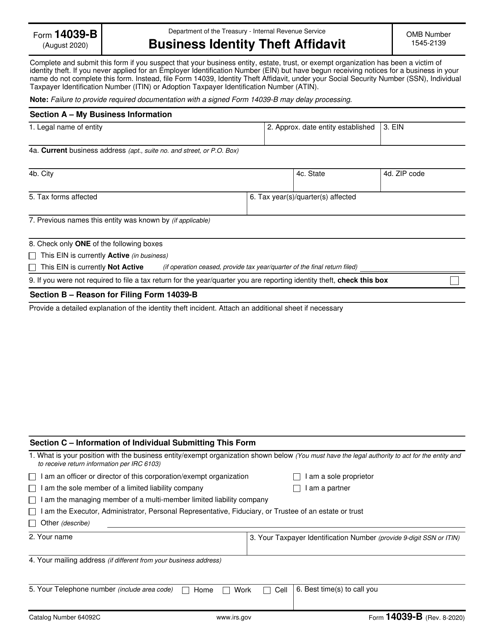

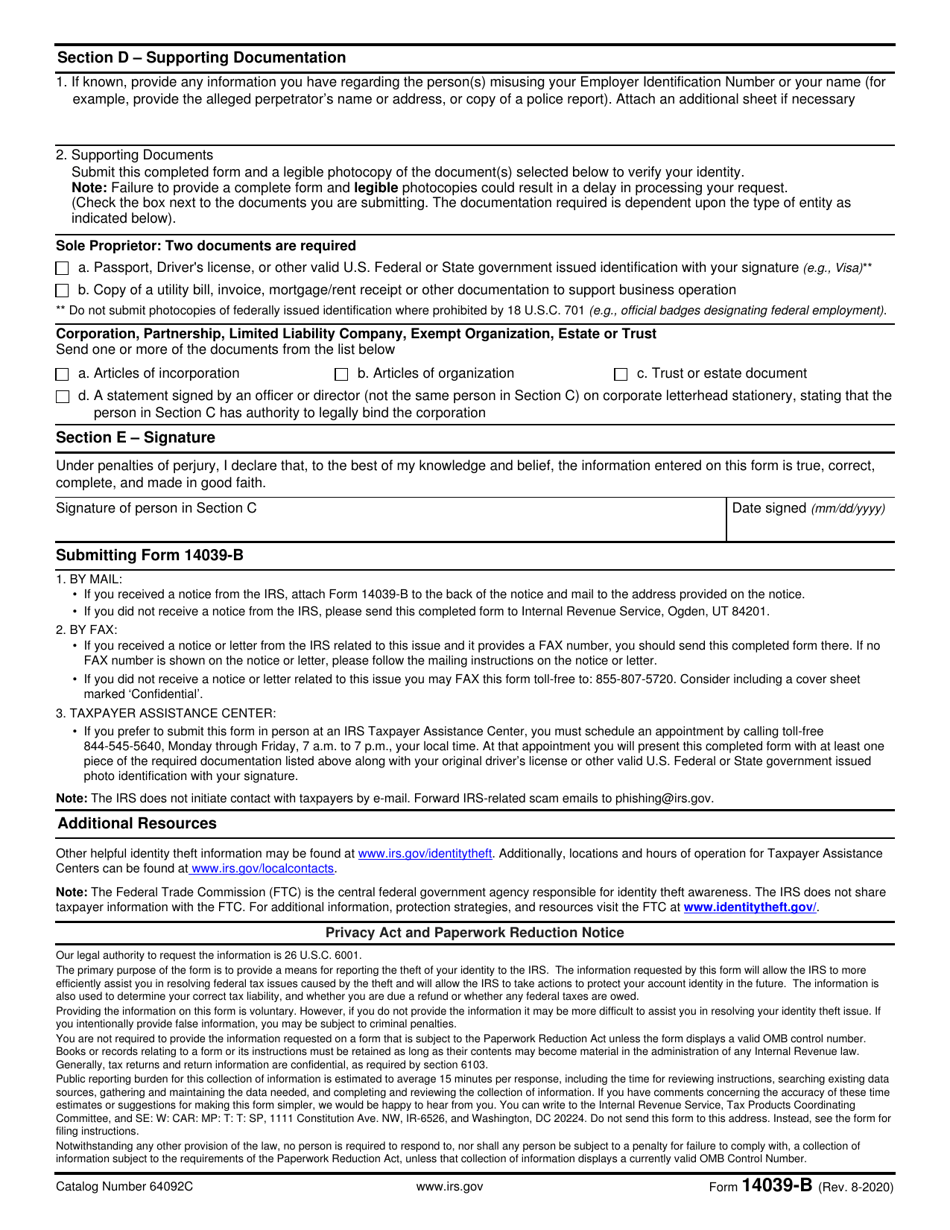

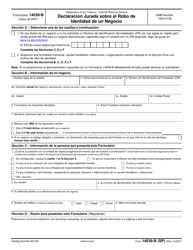

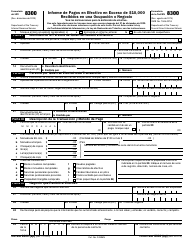

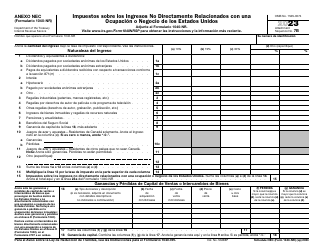

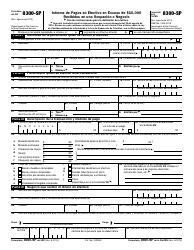

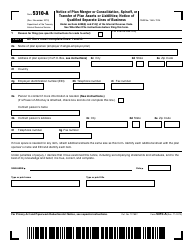

IRS Form 14039-B

for the current year.

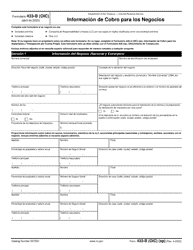

IRS Form 14039-B Business Identity Theft Affidavit

What Is IRS Form 14039-B?

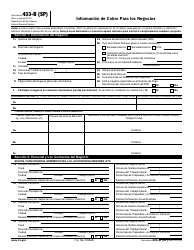

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on August 1, 2020. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

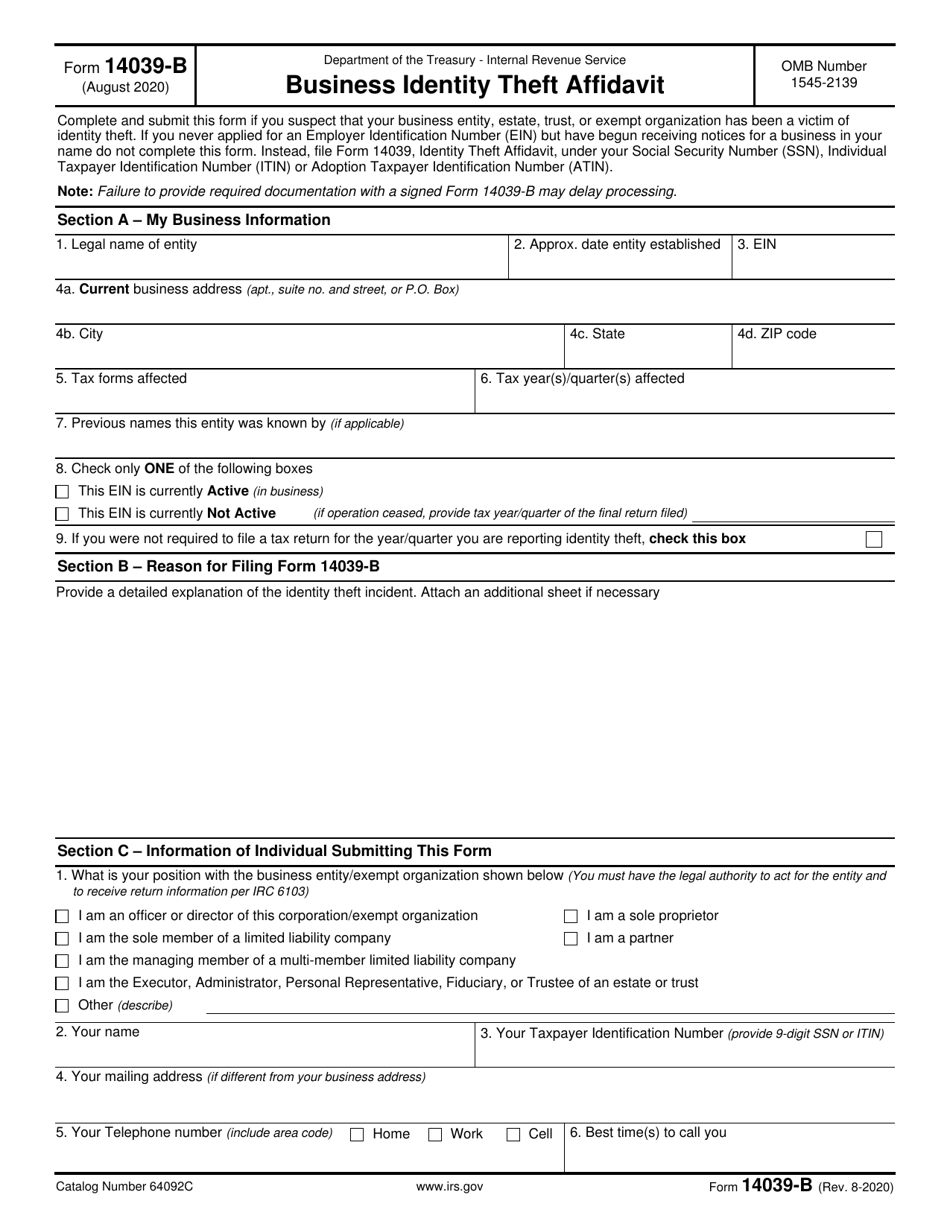

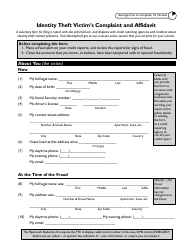

Q: What is IRS Form 14039-B?

A: IRS Form 14039-B is the Business Identity Theft Affidavit.

Q: What is the purpose of Form 14039-B?

A: The purpose of Form 14039-B is to report suspected business identity theft to the IRS.

Q: Who should use Form 14039-B?

A: Businesses that suspect they are victims of identity theft should use Form 14039-B.

Q: Do I need to file Form 14039-B if I'm an individual?

A: No, Form 14039-B is specifically for businesses.

Q: Is there a fee to file Form 14039-B?

A: No, filing Form 14039-B is free of charge.

Q: What information is needed to complete Form 14039-B?

A: You will need to provide details about your business, the suspected identity theft, and any previous reporting of the incident.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14039-B through the link below or browse more documents in our library of IRS Forms.