Adverse Action Letter Template

What Is an Adverse Action Letter?

During an application for a loan or financial assistance, you might have a situation where the applicant's credit report does not meet your minimum eligibility requirements. In this situation, an Adverse Action Letter will need to be sent, which will explain your reasoning for not approving the application and include steps they can complete to reapply again or contest the report's information. An Adverse Action Letter template can be found through the link below.

How to Write an Adverse Action Letter?

An Adverse Action Letter can also be used when you are conducting a background check of a prospective job candidate through the Fair Credit Reporting Act (FCRA) and discovered inconsistencies in the report that could dismiss them as a potential new hire. In this case, a Pre-Adverse Action Letter needs to be mailed to the applicant that notifies them that there was information found in the report that is inconsistent with the information provided in the original application.

The design of this first letter is for the potential future employer to notify the applicant that they will need to review the information in their application against the report received before the employer mails the adverse action letter confirming the rejection due to the background investigation.

Here are tips for what to include in a Pre-Adverse Action Letter:

- Today's date;

- The applicant's name and address;

- Salutations to the recipient;

- Opening wording that the candidate will find a copy of their report conducted through the FCRA enclosed alongside the letter.

- An explanation that the results from the report conflict with the information provided by the applicant and must be addressed before the employer/lender will move forward in the hiring/loan approval case. The letter needs to be sent to the applicant before a hiring manager or loan agency can make a decision based on the report's results. The applicant has the ability to contest the information in the report to correct any mistakes;

- Phone and address for the Reporting Agency;

- Closing salutation.

If the applicant decides not to contest the information in the report, then you can decide to refuse the applicant the job position or loan based on the results of the report.

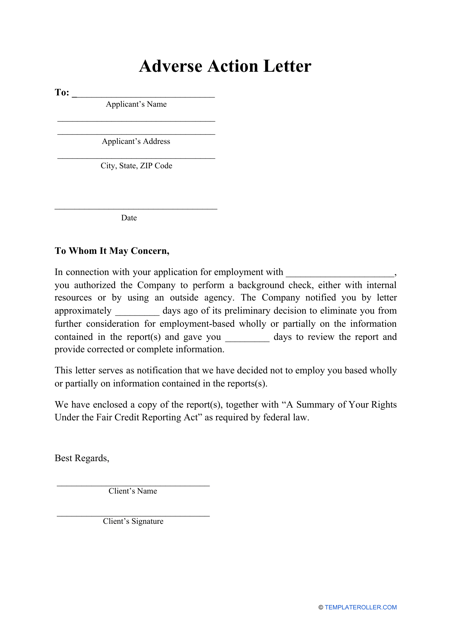

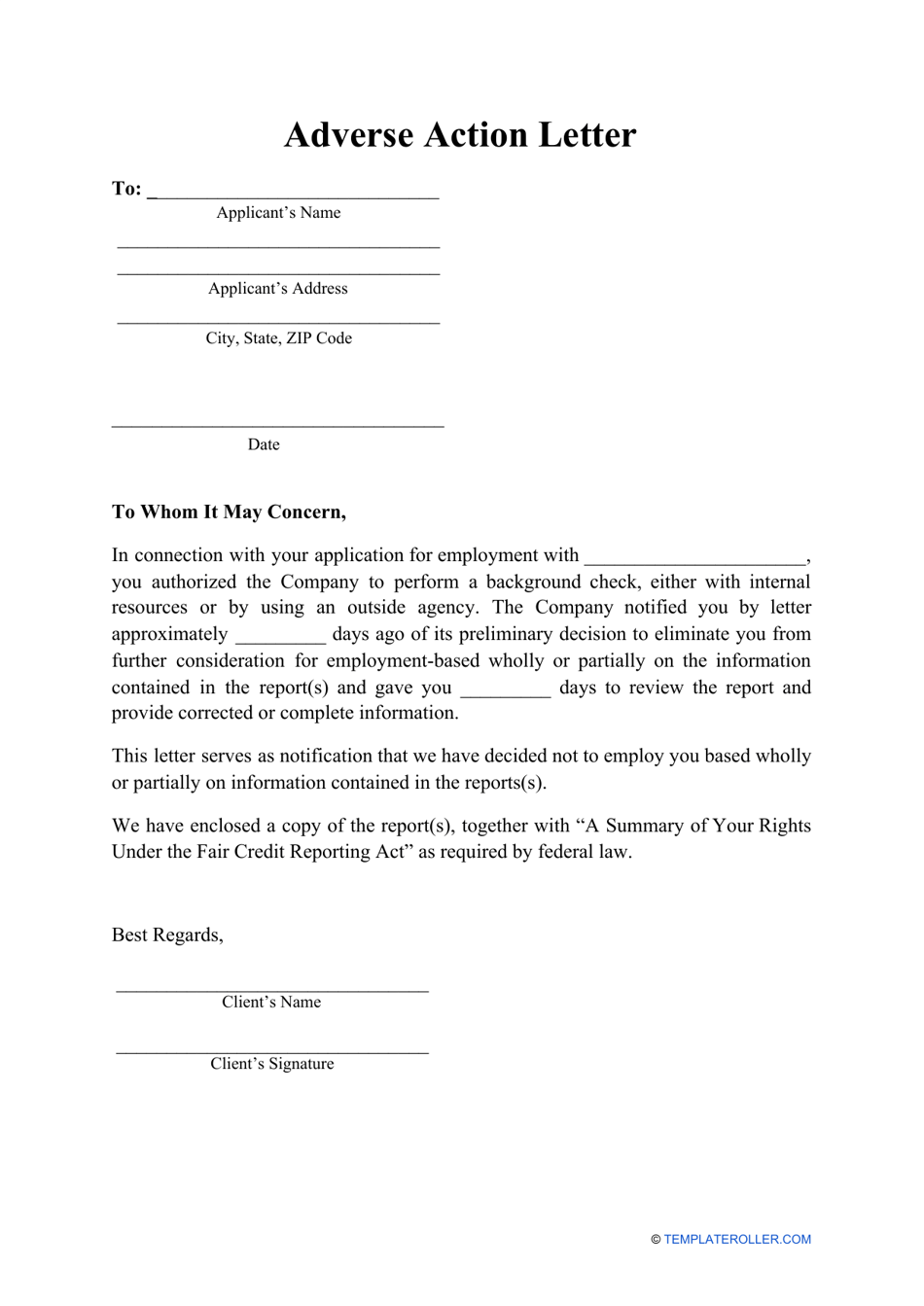

Here are tips for what to include in an Adverse Action Letter:

- The date;

- The Applicant's name and address;

- Salutations to the applicant;

- Opening wording that due to the FCRA report's information, your organization will be proceeding with a denial of their loan or job application. You can also reiterate that they had an opportunity to contest the information presented, but as of the date on this letter, you nor your organization have received notice contesting the results of the report and have made the decision to deny the application;

- Closing salutation;

- Your name and signature.

Still looking for a particular template? Take a look at these related templates: