Mortgage Credit Certificate (Mcc) Tax Credit Program Handbook - California

Mortgage Credit Certificate (Mcc) Tax Credit Program Handbook is a legal document that was released by the California Housing Finance Agency - a government authority operating within California.

FAQ

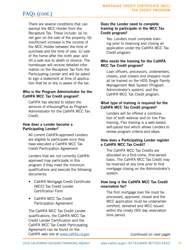

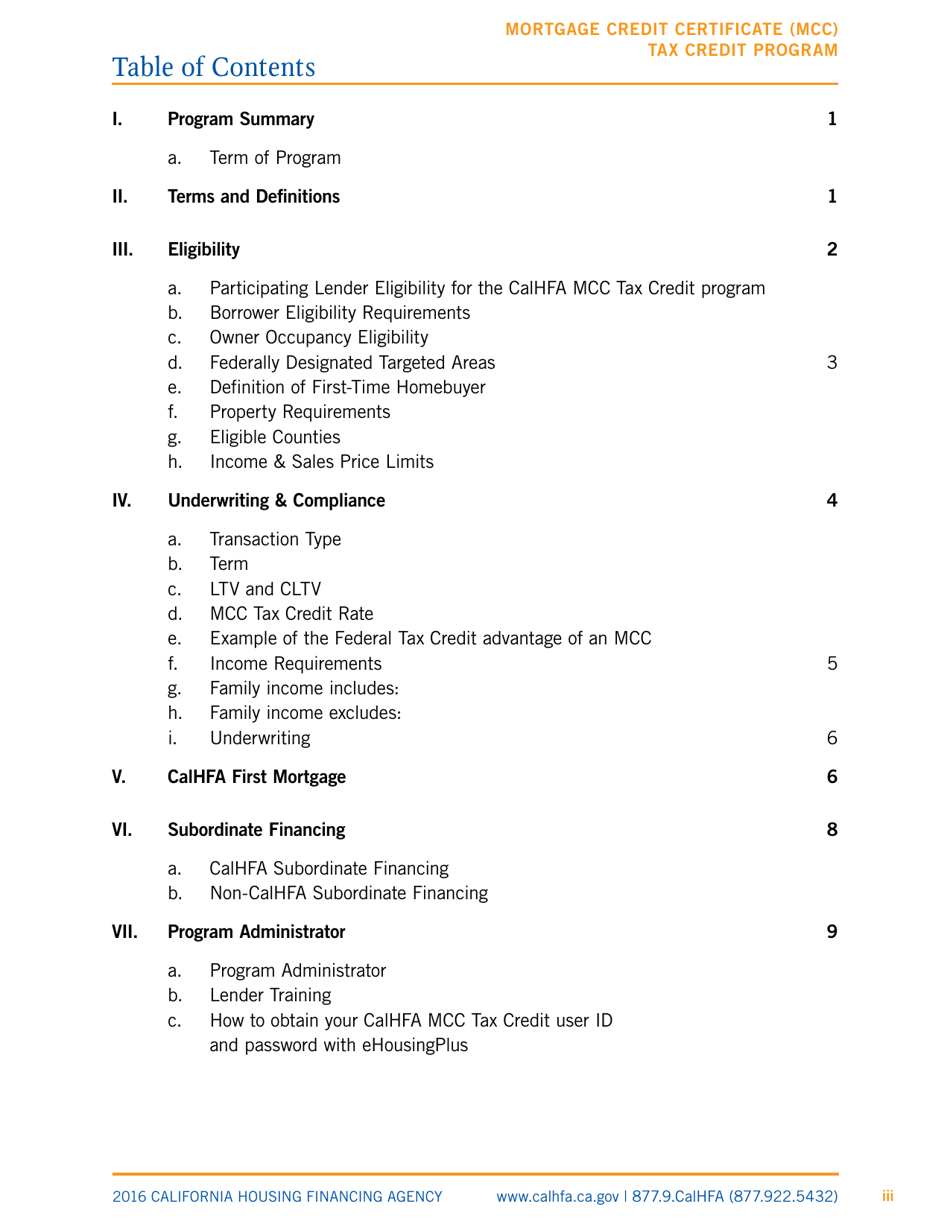

Q: What is the Mortgage Credit Certificate (MCC) Tax Credit Program?

A: The MCC Tax Credit Program provides a federal income tax credit for first-time homebuyers in California.

Q: Who is eligible for the MCC Tax Credit Program?

A: First-time homebuyers who meet the income and purchase price limits set by the program.

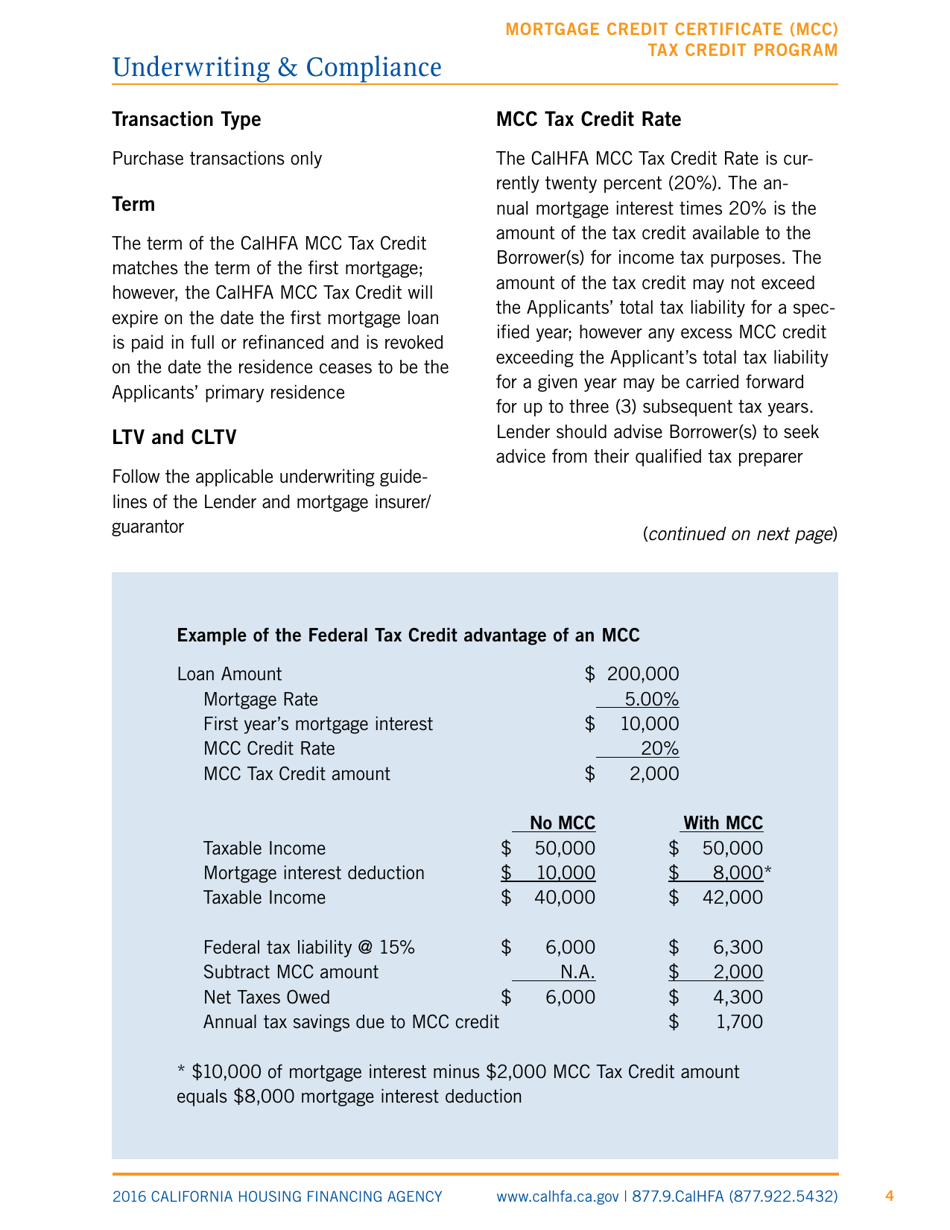

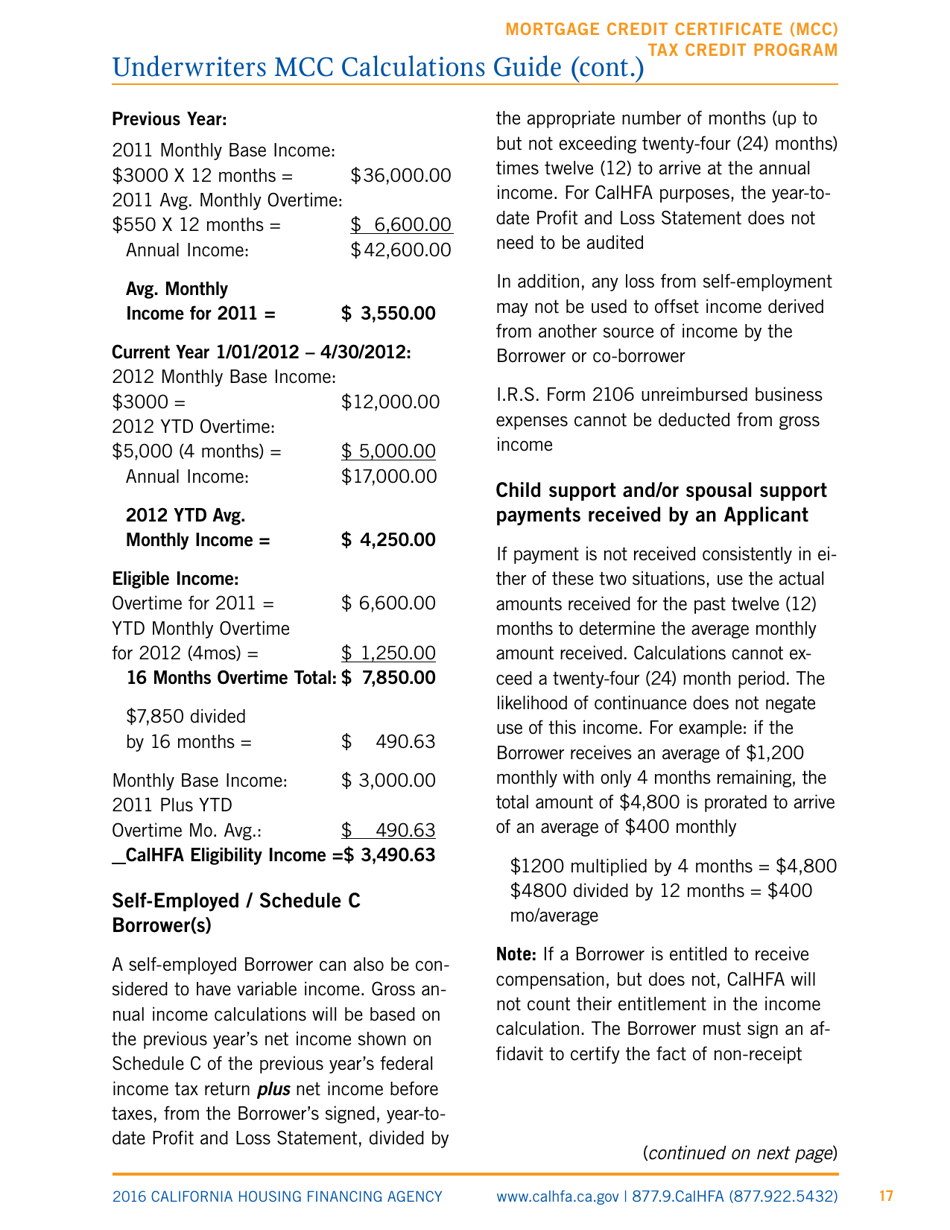

Q: How does the MCC Tax Credit work?

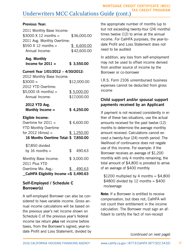

A: The MCC allows eligible homebuyers to claim a portion of the mortgage interest they pay as a tax credit on their federal income taxes.

Q: How much is the tax credit?

A: The tax credit is equal to a percentage of the mortgage interest paid, up to a maximum of $2,000 per year.

Q: What are the income and purchase price limits for the program?

A: Income and purchase price limits vary depending on the county in California. Details can be found in the MCC Tax Credit Program Handbook.

Q: How can I apply for the MCC Tax Credit?

A: Homebuyers must work with a participating lender to apply for the MCC Tax Credit.

Q: Is the MCC Tax Credit refundable?

A: The MCC Tax Credit is non-refundable, but any unused credit can be carried forward for up to three years.

Q: Can the MCC Tax Credit be combined with other programs?

A: Yes, the MCC Tax Credit can be combined with other homebuyer assistance programs and mortgage types.

Q: Does the MCC Tax Credit have to be repaid?

A: No, the MCC Tax Credit does not have to be repaid as long as the homebuyer continues to meet the program requirements.

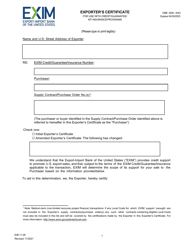

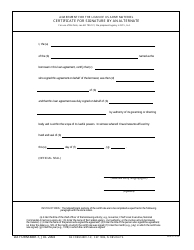

Form Details:

- Released on February 1, 2016;

- The latest edition currently provided by the California Housing Finance Agency;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the California Housing Finance Agency.