An Employee's Guide to Health Benefits Under Cobra

An Employee's Guide to Health Benefits Under Cobra is a 20-page legal document that was released by the U.S. Department of Labor - Employee Benefits Security Administration on September 1, 2019 and used nation-wide.

FAQ

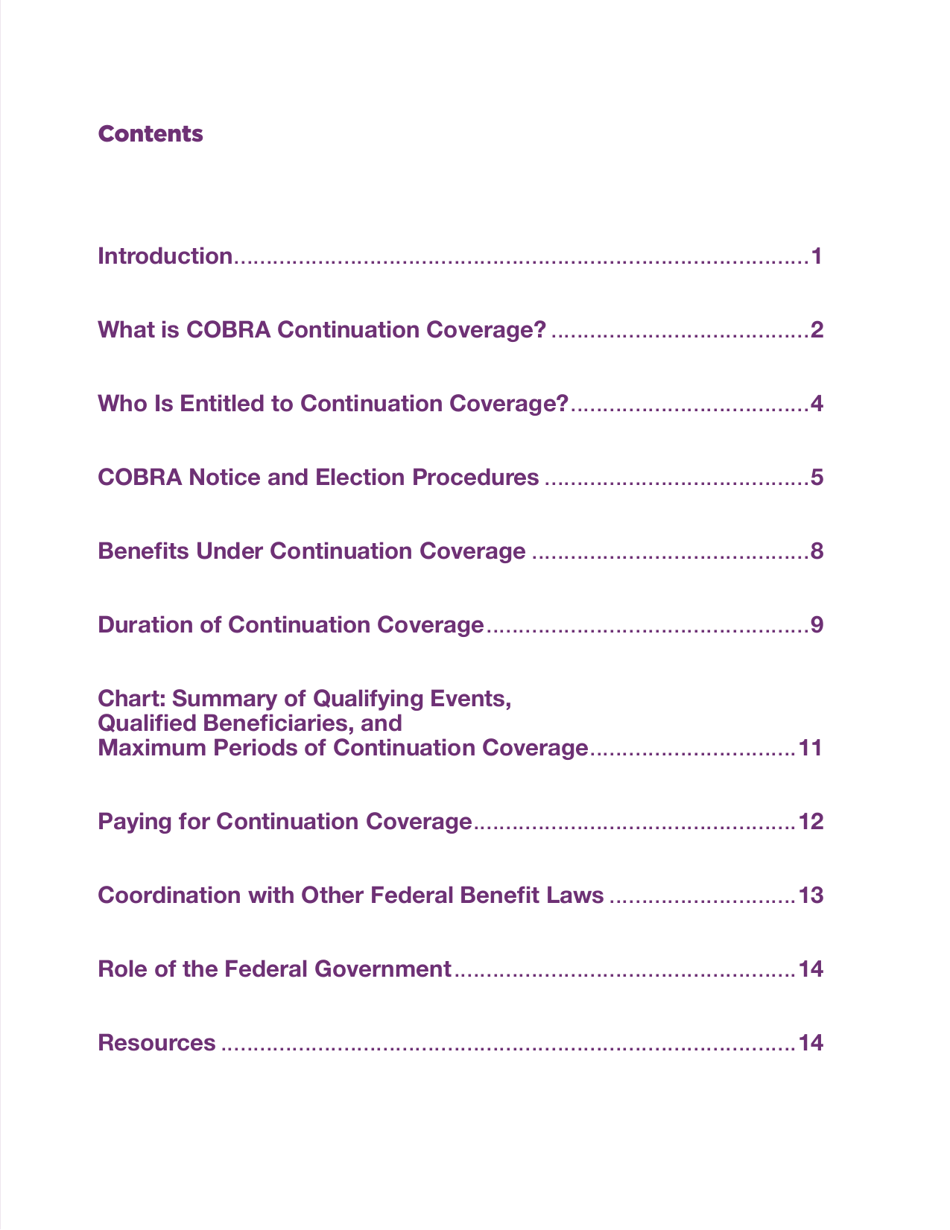

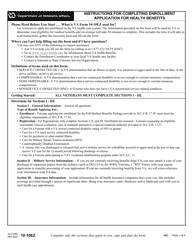

Q: What is COBRA?

A: COBRA stands for the Consolidated Omnibus Budget Reconciliation Act. It is a federal law that gives employees the option to continue their health insurance coverage when they lose their job or experience a qualifying event.

Q: Who is eligible for COBRA?

A: Employees who work for companies with 20 or more employees and have health insurance through their employer are generally eligible for COBRA.

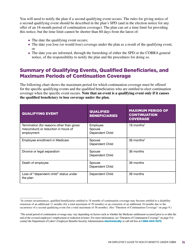

Q: What types of job loss qualify for COBRA coverage?

A: Job loss due to voluntary or involuntary termination, reduction in working hours, or certain other qualifying events can make an employee eligible for COBRA.

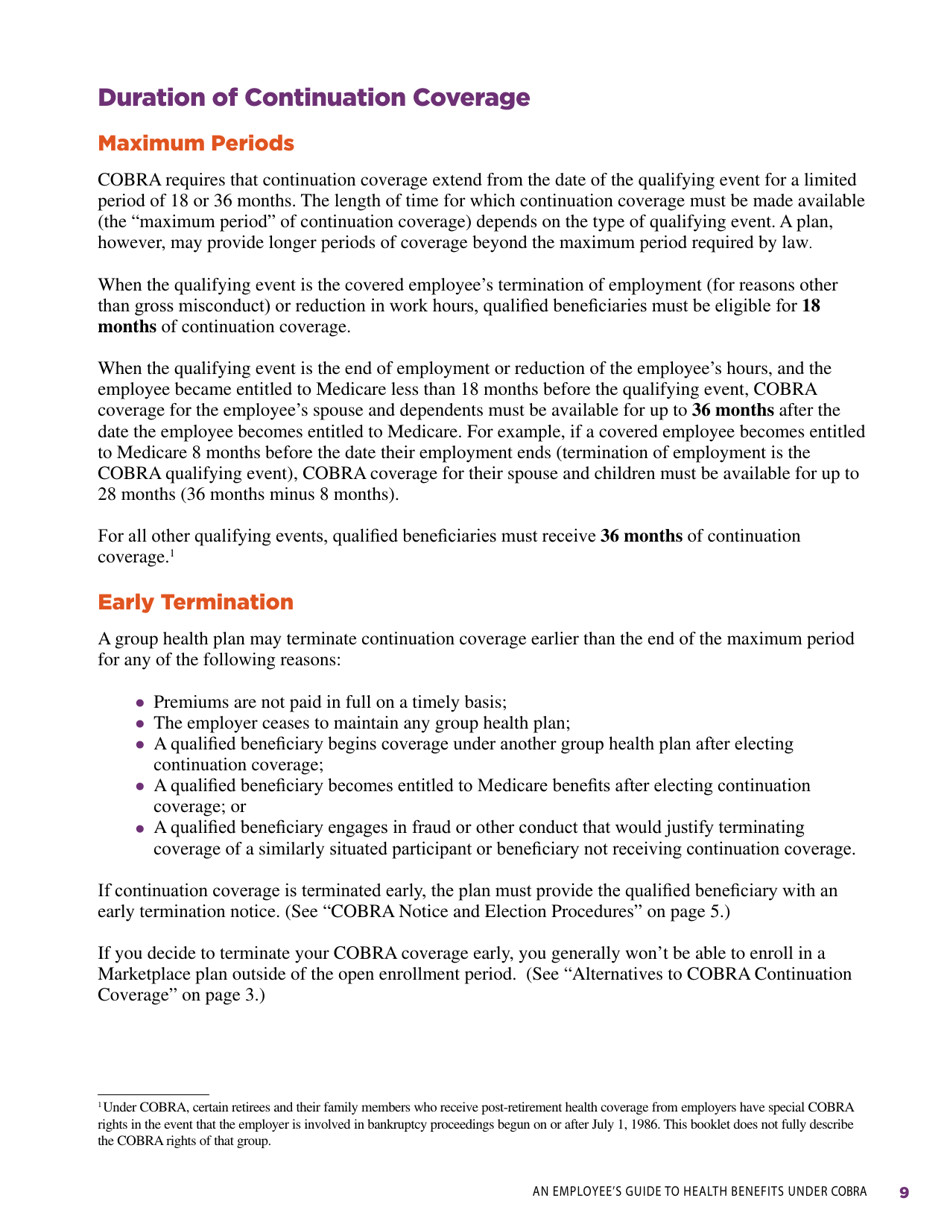

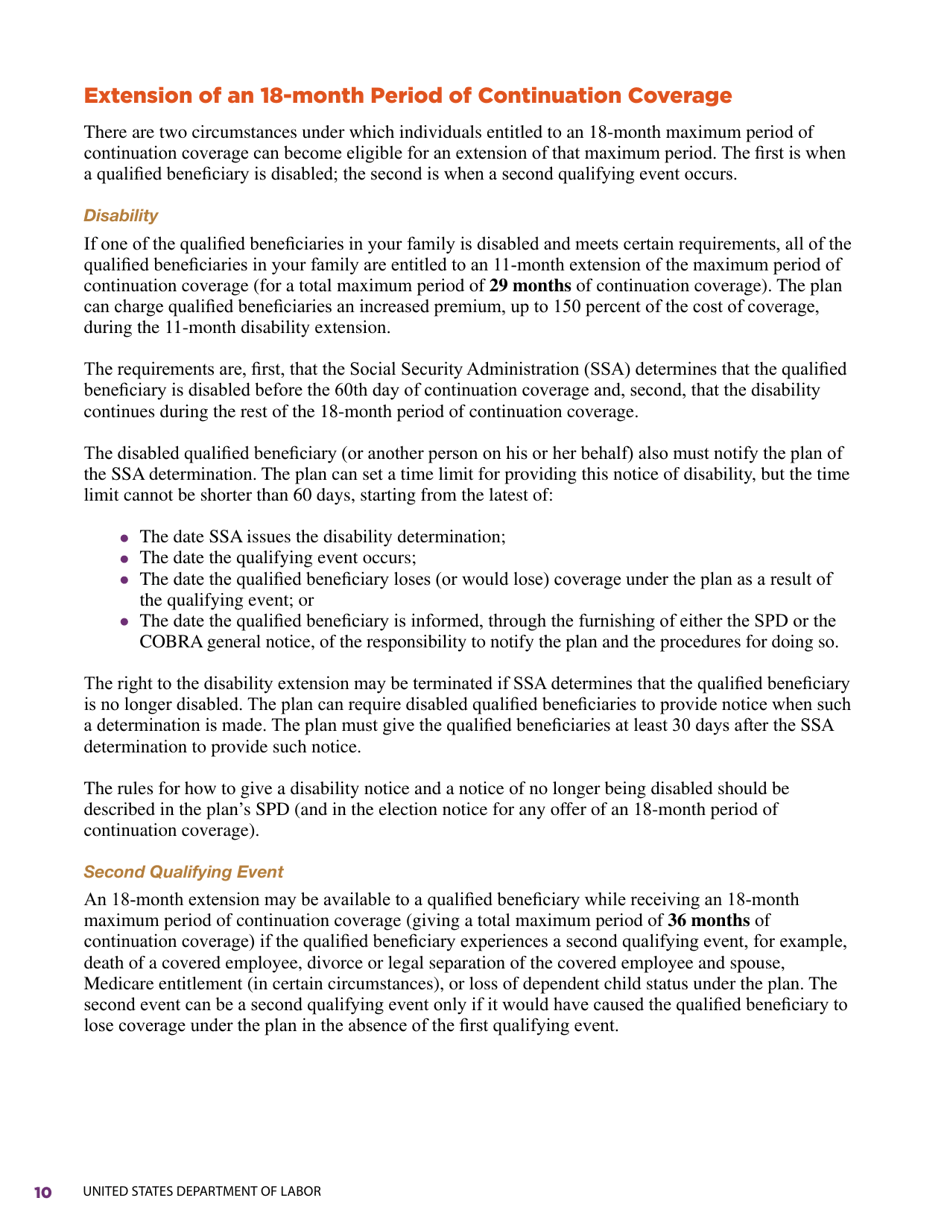

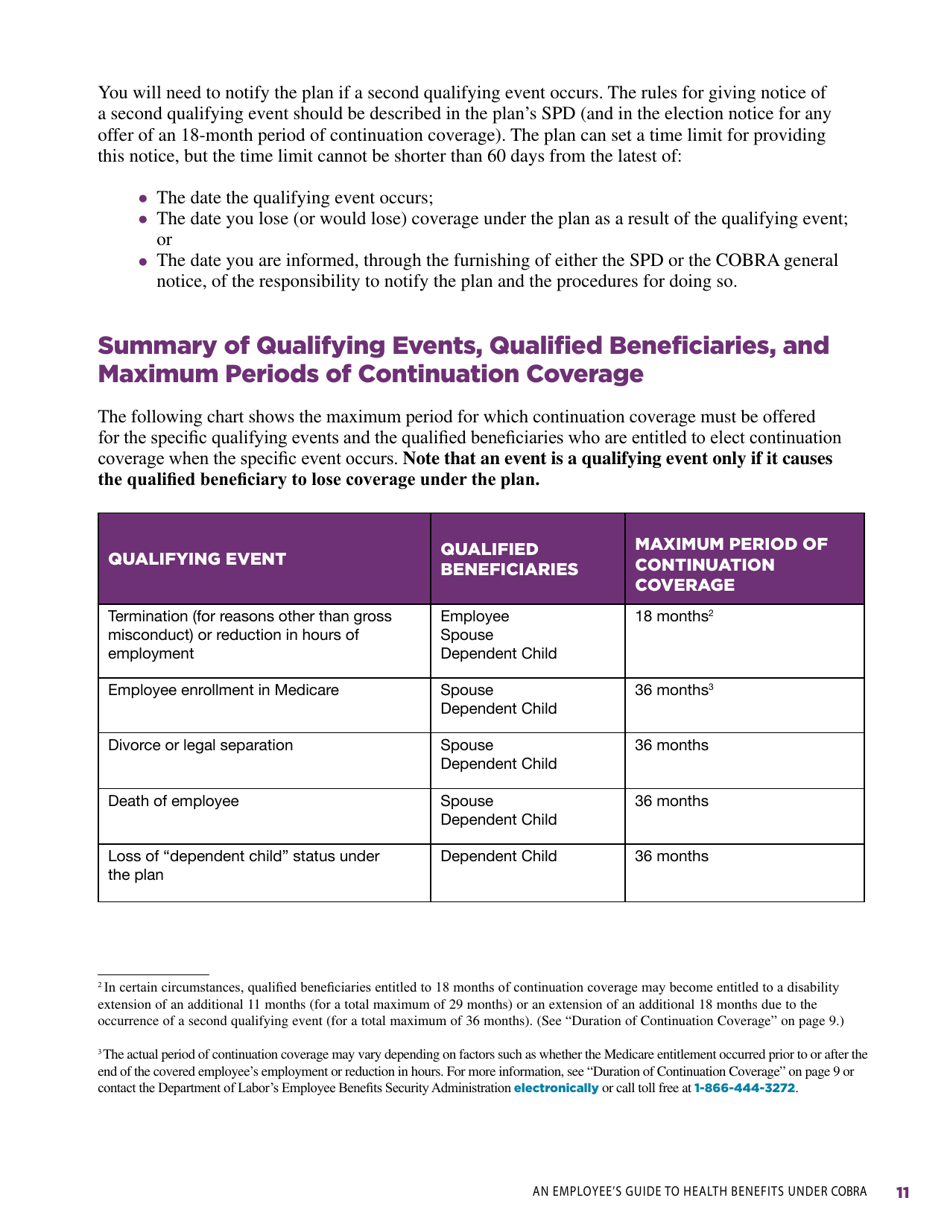

Q: How long does COBRA coverage last?

A: COBRA coverage can generally last up to 18 months, but in some cases, it can be extended to 36 or even 29 months.

Q: How much does COBRA coverage cost?

A: COBRA coverage can be expensive as the employee is required to pay the full premium, including the portion previously covered by the employer. However, it provides continued access to the same health insurance coverage.

Q: Are there alternatives to COBRA coverage?

A: Yes, if you are not eligible for COBRA or find it too expensive, you may explore other options such as individual health insurance plans, Medicaid, or the Health Insurance Marketplace.

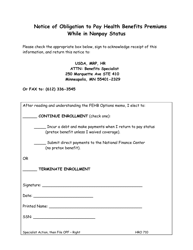

Q: Can I apply for COBRA coverage after the deadline?

A: No, it is important to apply for COBRA coverage within the specified timeframe, typically within 60 days of job loss or the qualifying event.

Q: What happens if I don't elect COBRA coverage?

A: If you don't elect COBRA coverage within the specified timeframe, you may lose the option to continue your health insurance coverage.

Q: Can my dependents also get COBRA coverage?

A: Yes, if your dependents were covered by your health insurance plan before the qualifying event, they may also be eligible for COBRA coverage.

Q: Can I switch to a different health insurance plan while on COBRA?

A: No, you are generally required to continue with the same health insurance plan while on COBRA.

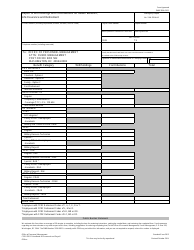

Form Details:

- The latest edition currently provided by the U.S. Department of Labor - Employee Benefits Security Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.