Ftb Publication 1023s - Resident and Nonresident Withholding Electronic Submission Requirements - California

Ftb Publication 1023s - Resident and Nonresident Withholding Electronic Submission Requirements is a legal document that was released by the California Franchise Tax Board - a government authority operating within California.

FAQ

Q: What is FTB Publication 1023S?

A: FTB Publication 1023S is a document that provides information on resident and nonresident withholding electronic submission requirements in California.

Q: Who is required to submit FTB Publication 1023S?

A: Any individual or entity that is required to withhold California income tax from payments made to nonresident independent contractors or payees.

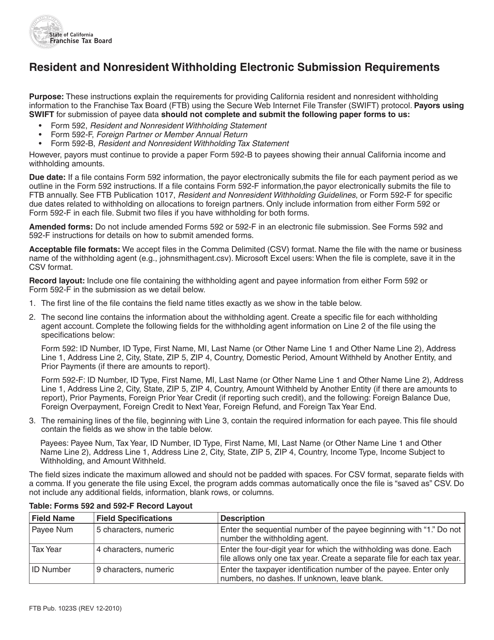

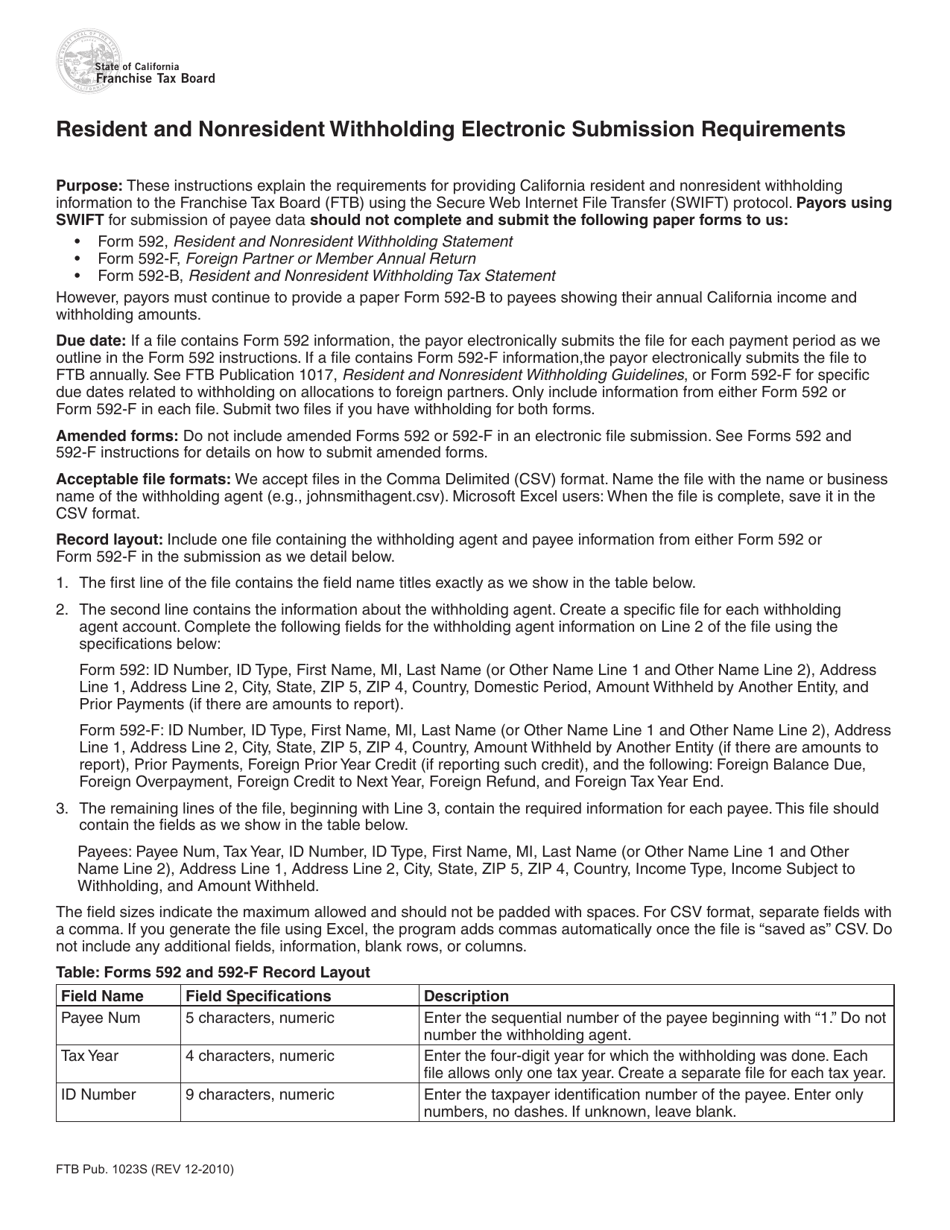

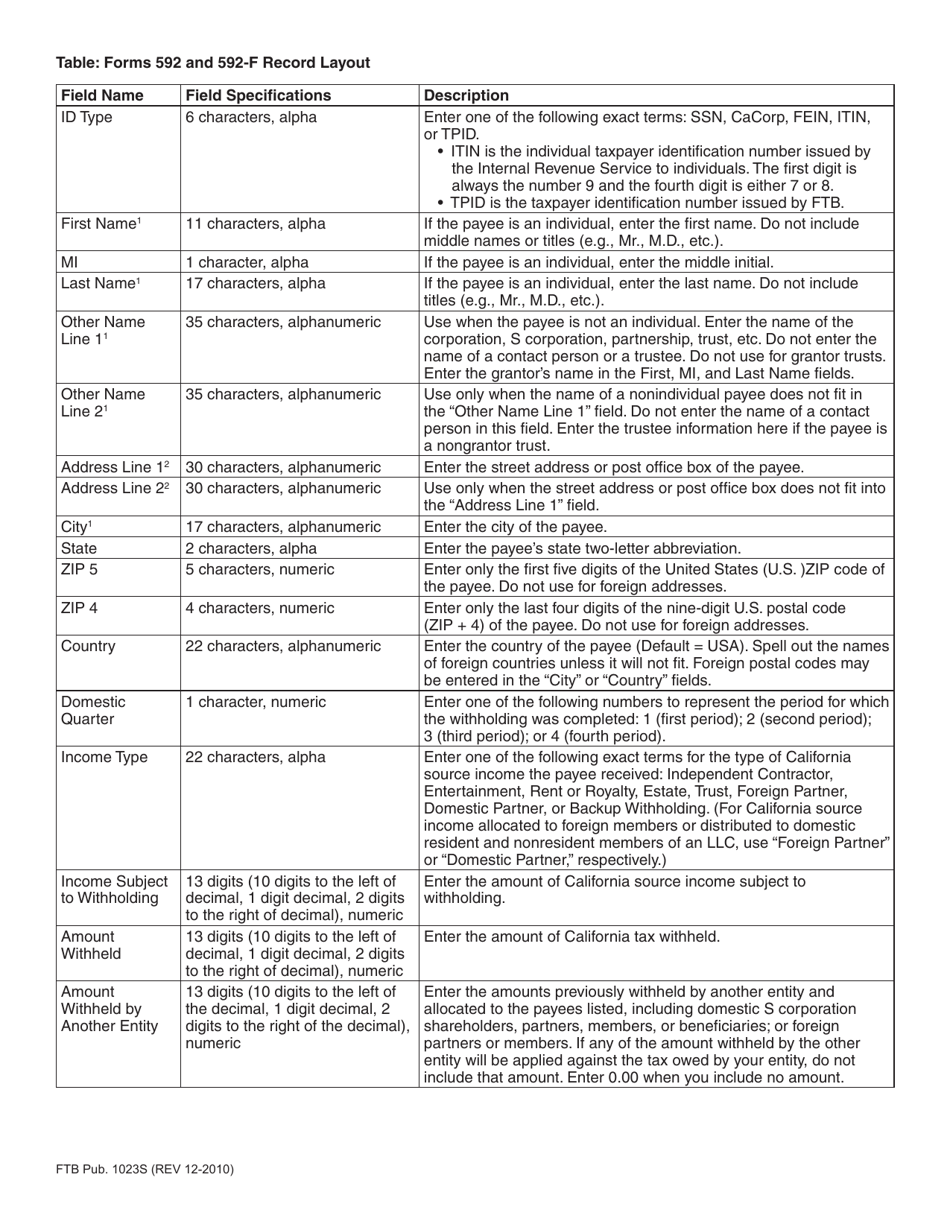

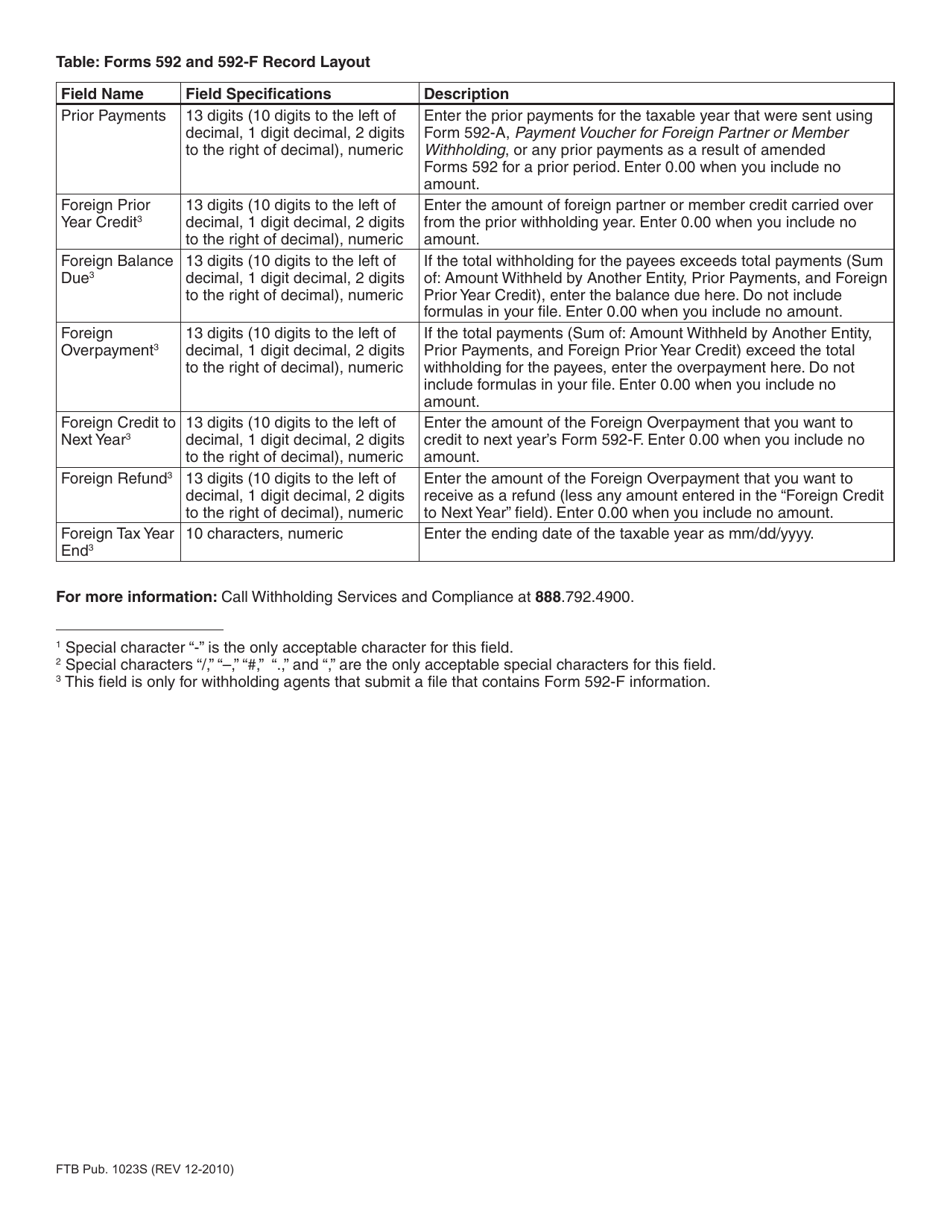

Q: What are the electronic submission requirements for withholding?

A: Electronic submission of Form 592 or Form 592-B is required if you have 100 or more payees in a calendar year or if the total amount withheld is $50,000 or more.

Q: What forms need to be submitted electronically?

A: Form 592, Resident and Nonresident Withholding Statement, and Form 592-B, Nonresident Withholding Tax Statement, need to be submitted electronically.

Q: Can forms be submitted on paper instead of electronically?

A: No, if you meet the electronic submission requirements, you must submit these forms electronically.

Q: Is there a penalty for not complying with the electronic submission requirements?

A: Yes, there may be penalties for failing to comply with the electronic submission requirements, including a penalty of $50 per information return not filed electronically.

Form Details:

- Released on December 1, 2010;

- The latest edition currently provided by the California Franchise Tax Board;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.