IRS Publication 5121 - Affordable Care Act: Individuals and Families

IRS Publication 5121 - Affordable Care Act: Individuals and Families is a 2-page tax-related document that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2016.

FAQ

Q: What is IRS Publication 5121?

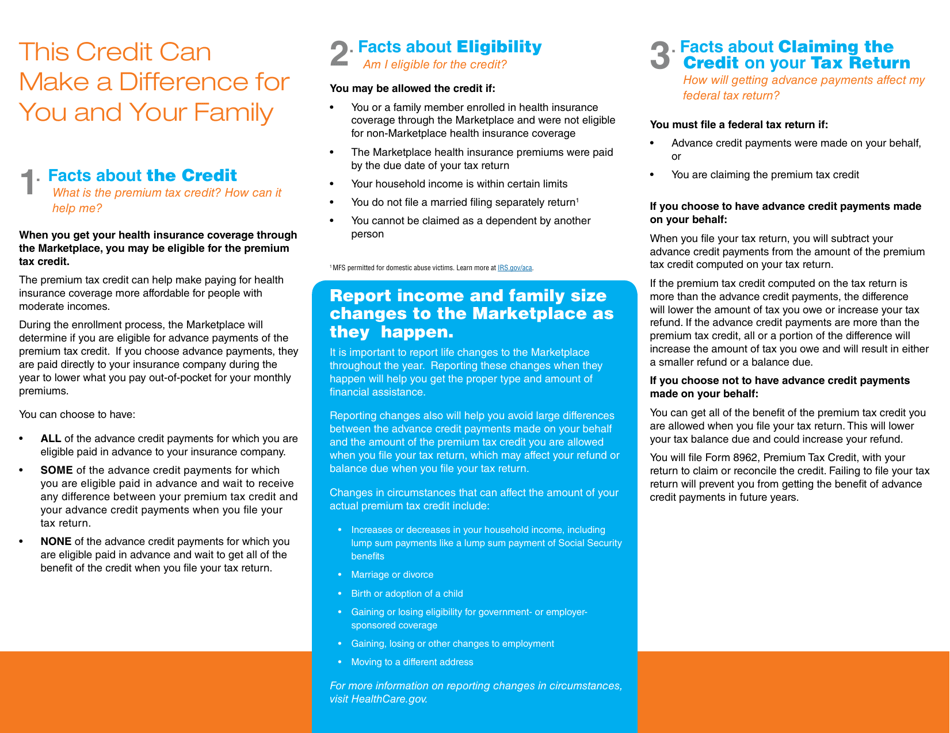

A: IRS Publication 5121 is a document that provides information about the Affordable Care Act for individuals and families.

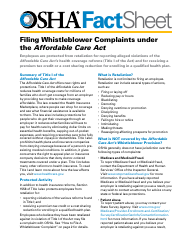

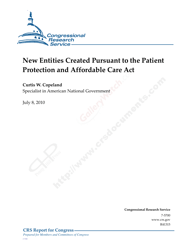

Q: What is the Affordable Care Act?

A: The Affordable Care Act, also known as Obamacare, is a law aimed at making healthcare more affordable and accessible for individuals and families.

Q: What does IRS Publication 5121 cover?

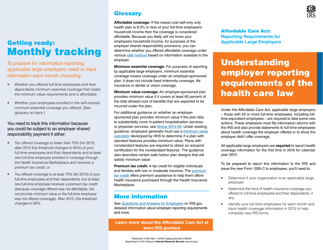

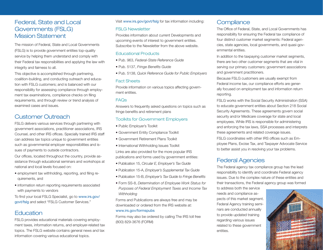

A: IRS Publication 5121 covers various aspects of the Affordable Care Act, including eligibility requirements, premium tax credits, and exemptions.

Q: Who should read IRS Publication 5121?

A: IRS Publication 5121 is intended for individuals and families who want to understand how the Affordable Care Act affects their healthcare coverage and taxes.

Q: How can I get help with IRS Publication 5121?

A: If you have questions or need assistance with IRS Publication 5121, you can contact the IRS directly or consult with a tax professional.

Form Details:

- Available for download in PDF;

- Actual and valid for 2023;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a printable version of the form through the link below or browse more documents in our library of IRS Forms.