This version of the form is not currently in use and is provided for reference only. Download this version of

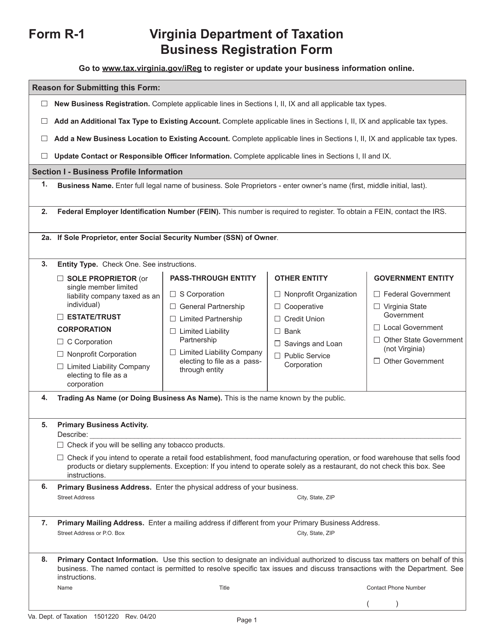

Form R-1

for the current year.

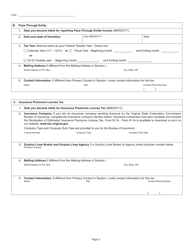

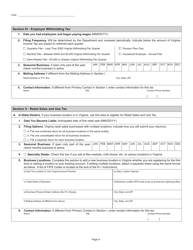

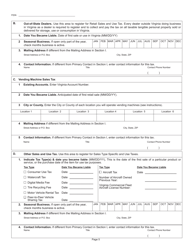

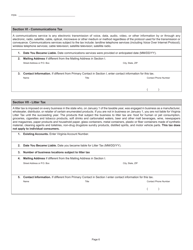

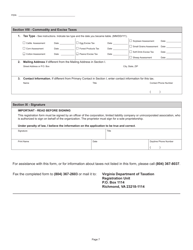

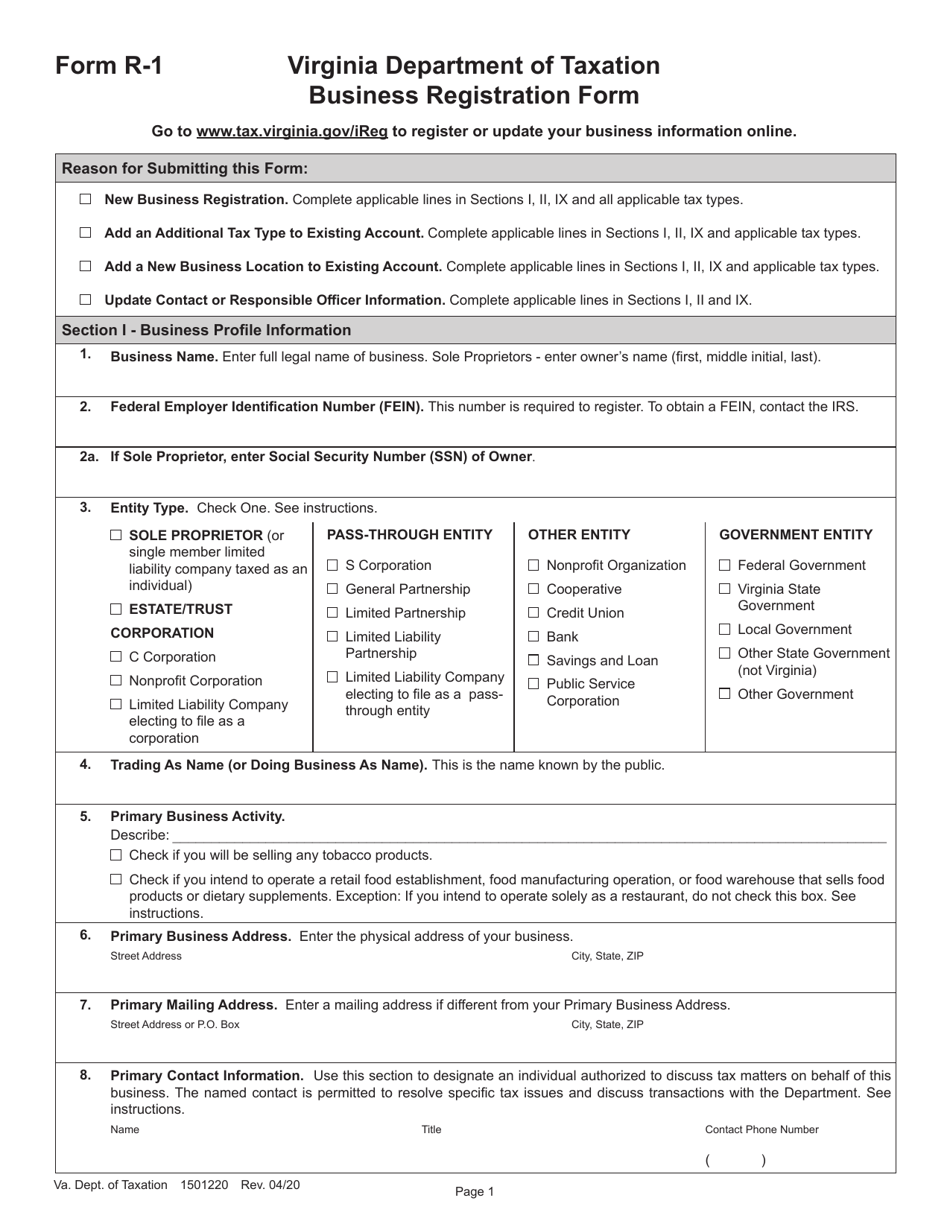

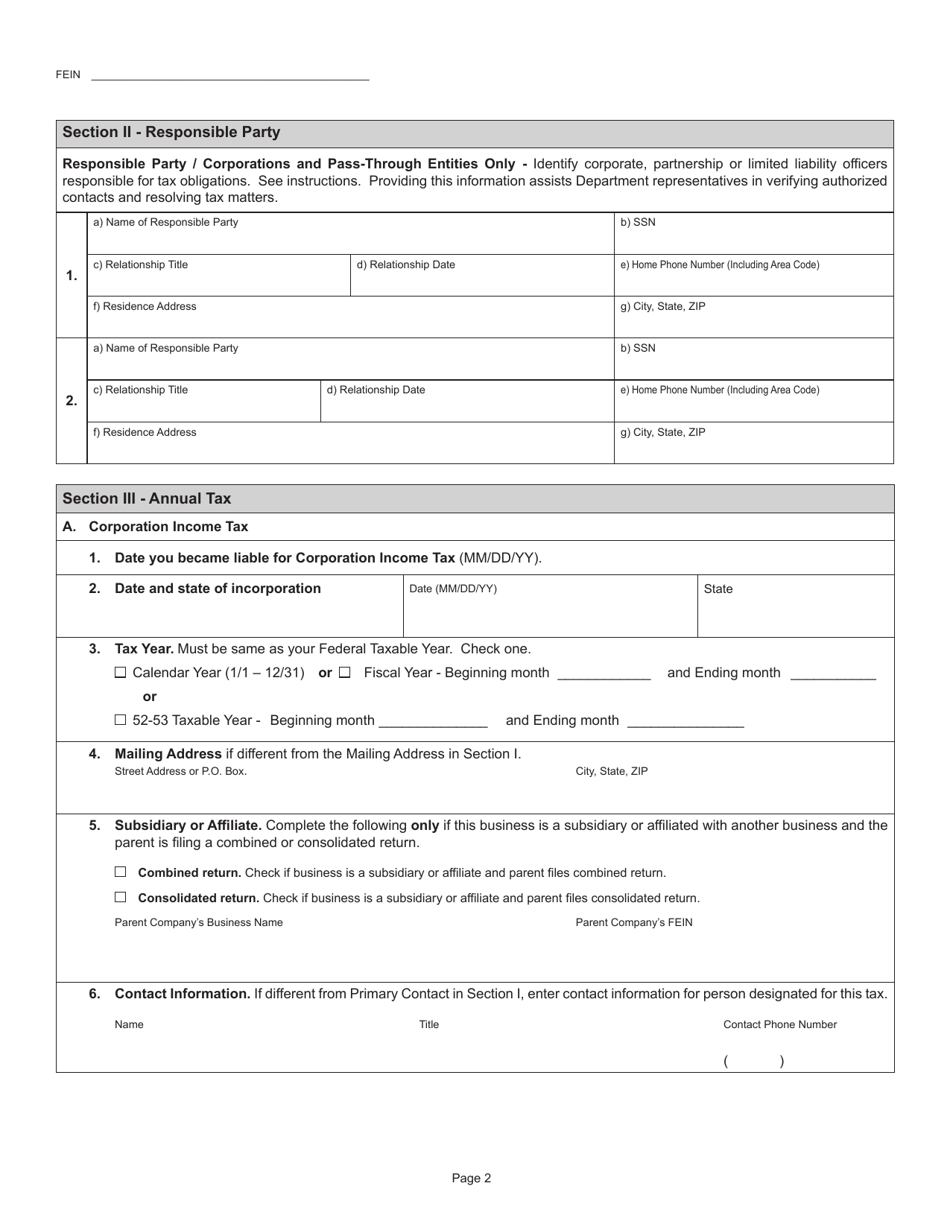

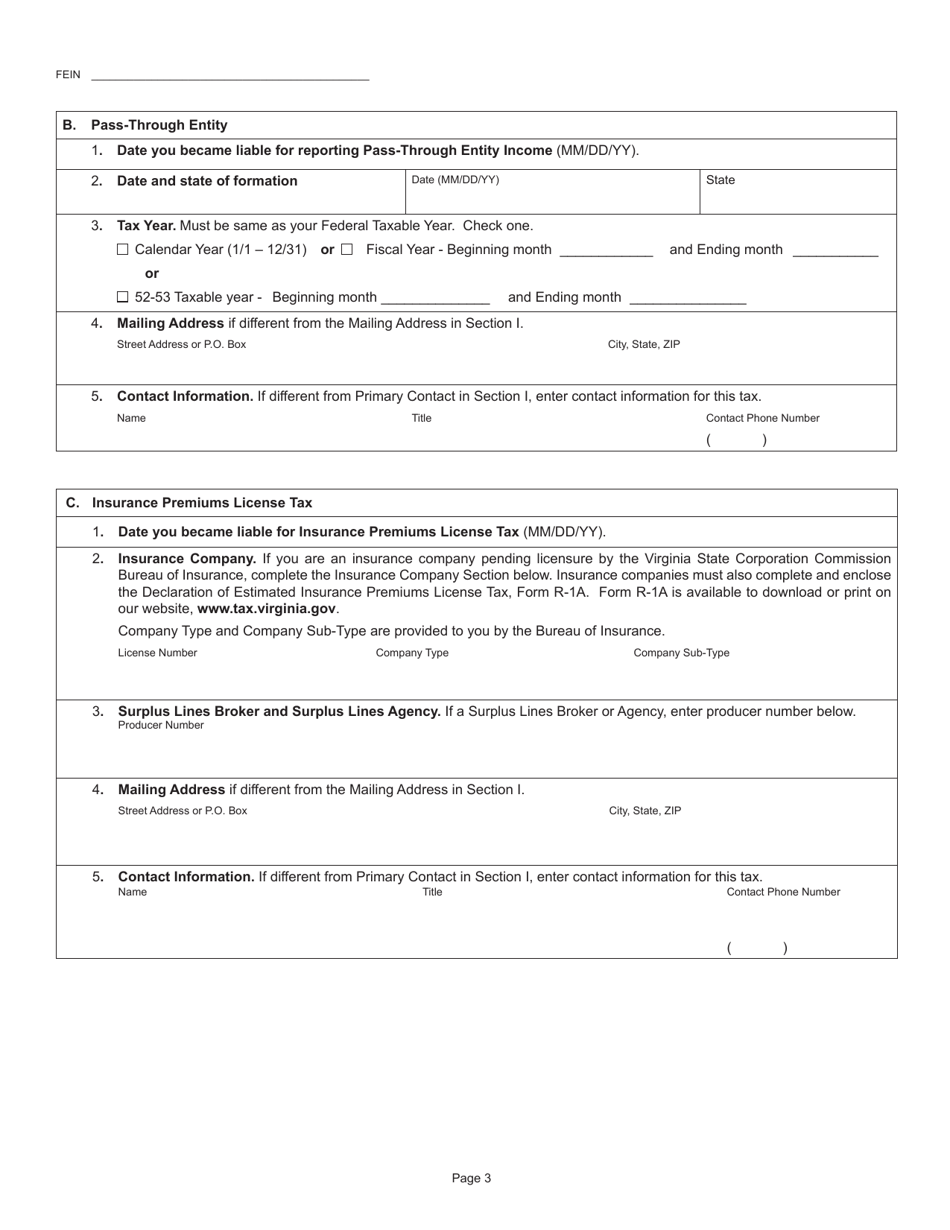

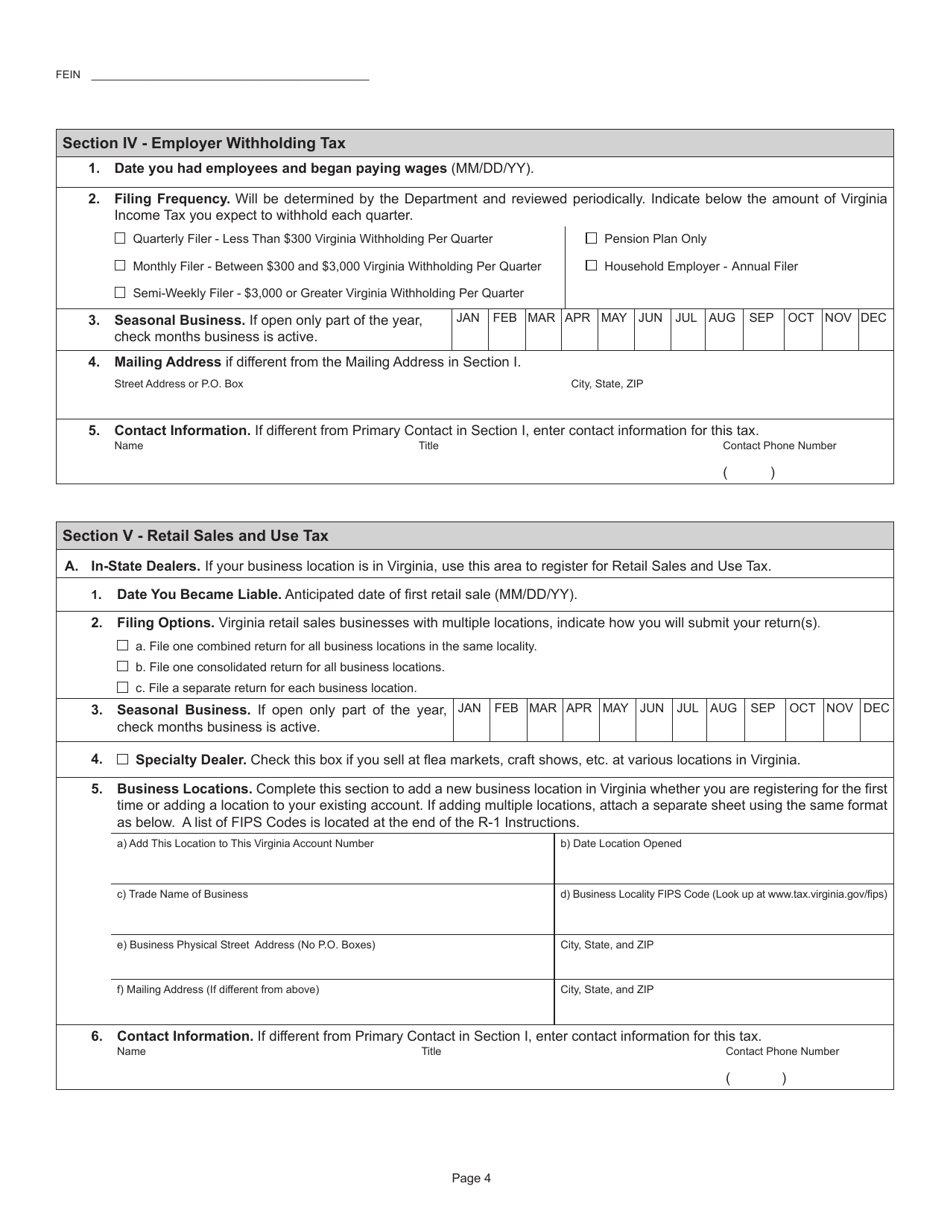

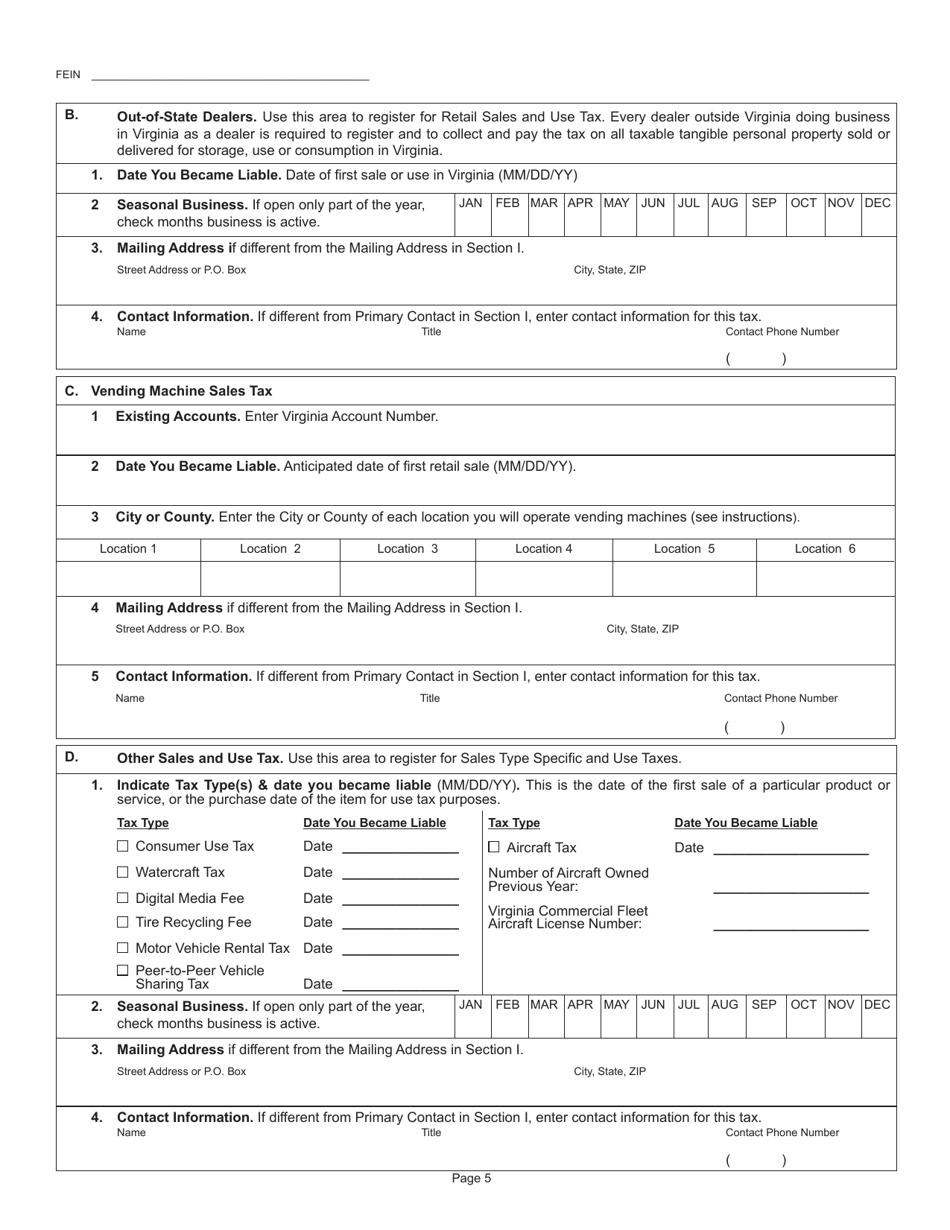

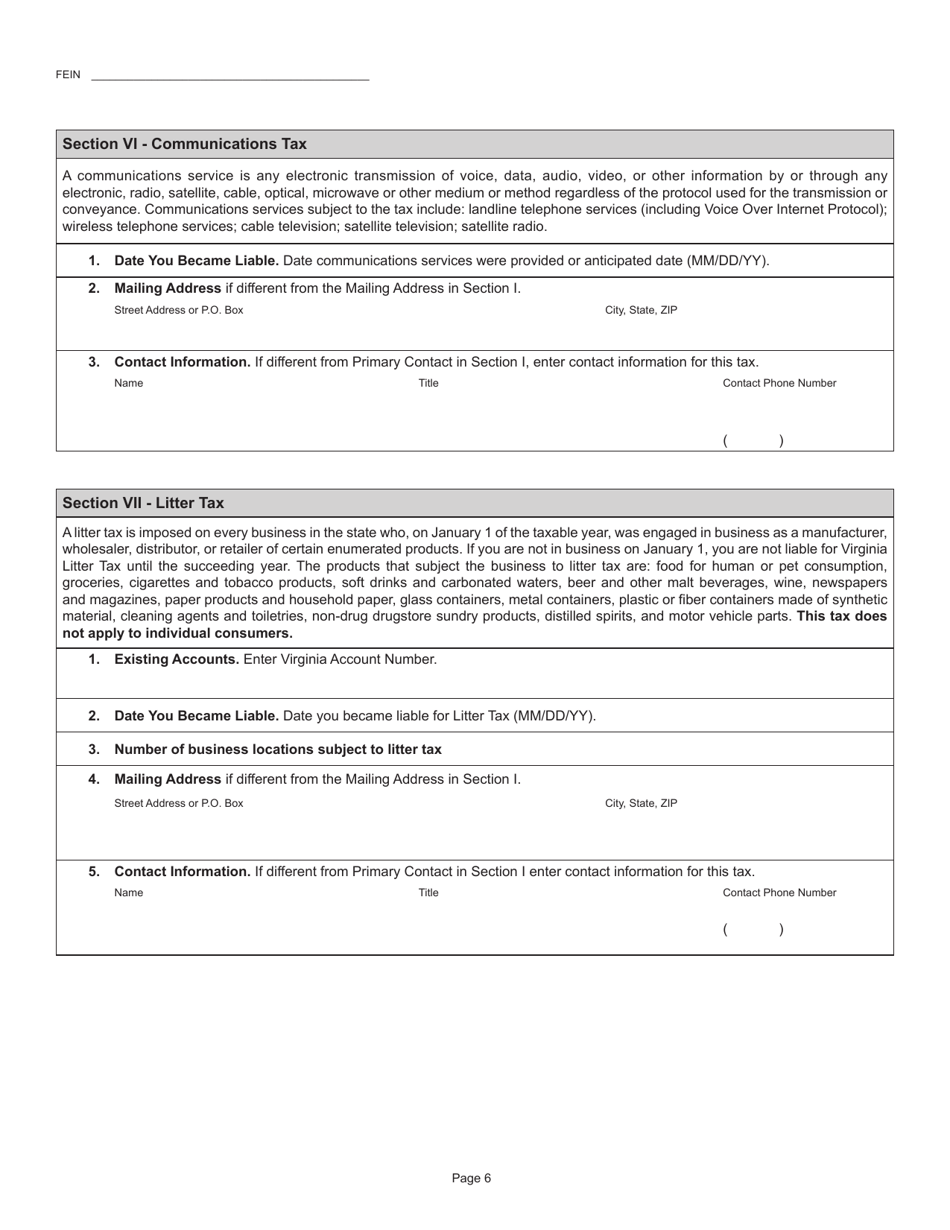

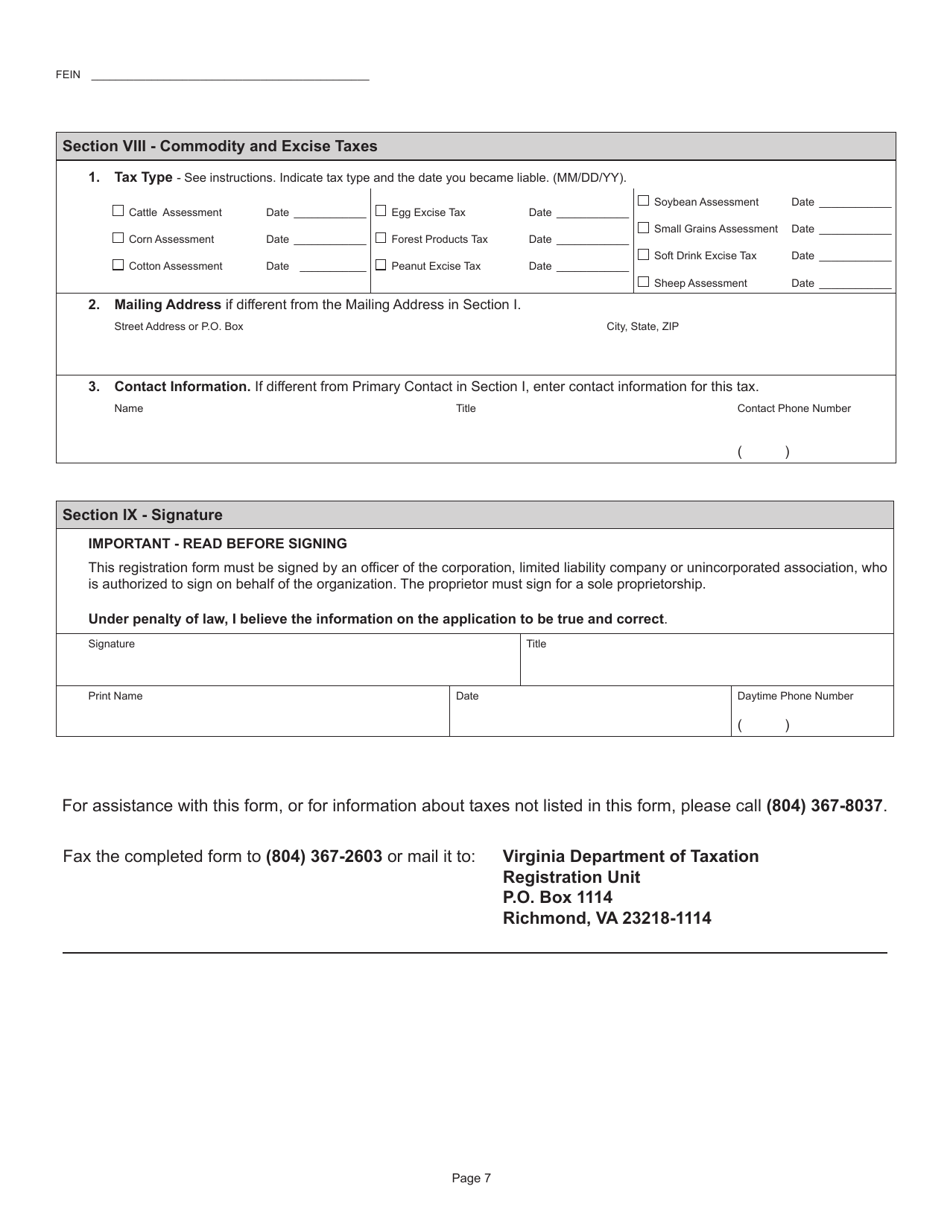

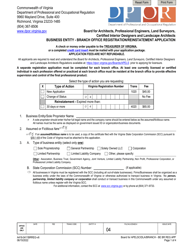

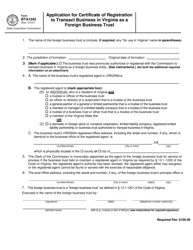

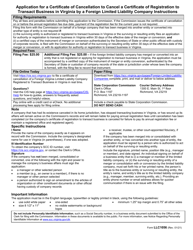

Form R-1 Business Registration Form - Virginia

What Is Form R-1?

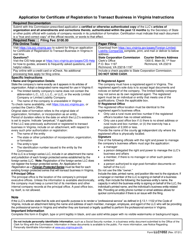

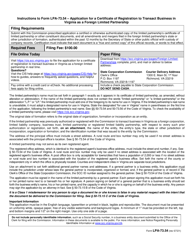

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form R-1?

A: Form R-1 is the Business Registration Form in Virginia.

Q: Who needs to fill out Form R-1?

A: Any business operating in Virginia needs to fill out Form R-1.

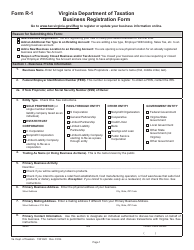

Q: What information is required on Form R-1?

A: Form R-1 requires basic information about the business, including the business name, address, and owner information.

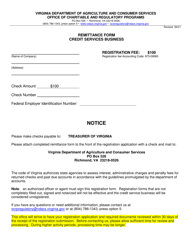

Q: Is there a fee for filing Form R-1?

A: There is no fee for filing Form R-1.

Q: When is Form R-1 due?

A: Form R-1 needs to be filed within 30 days of starting a business in Virginia.

Q: Are there any penalties for not filing Form R-1?

A: Yes, there are penalties for not filing Form R-1, including fines and potential suspension of business licenses.

Q: Do I need to renew Form R-1?

A: No, Form R-1 does not need to be renewed annually.

Q: Can I make changes to Form R-1 after it is filed?

A: Yes, changes can be made to Form R-1 by filing an amended form with the Virginia Department of Taxation.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.