This version of the form is not currently in use and is provided for reference only. Download this version of

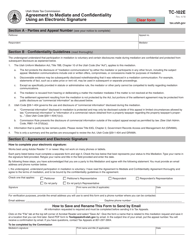

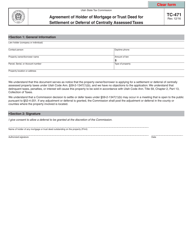

Form TC-763E

for the current year.

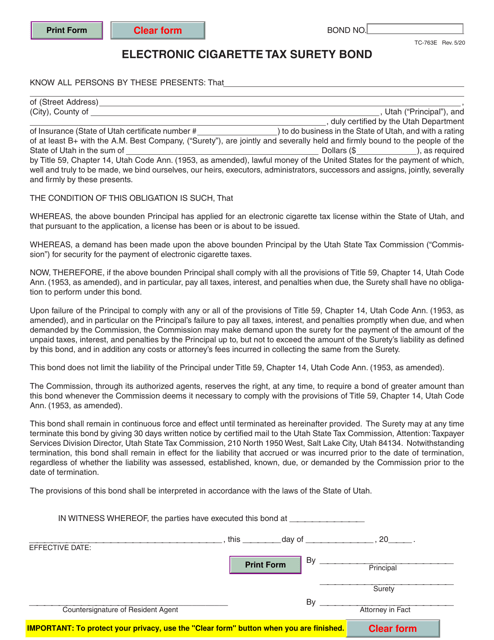

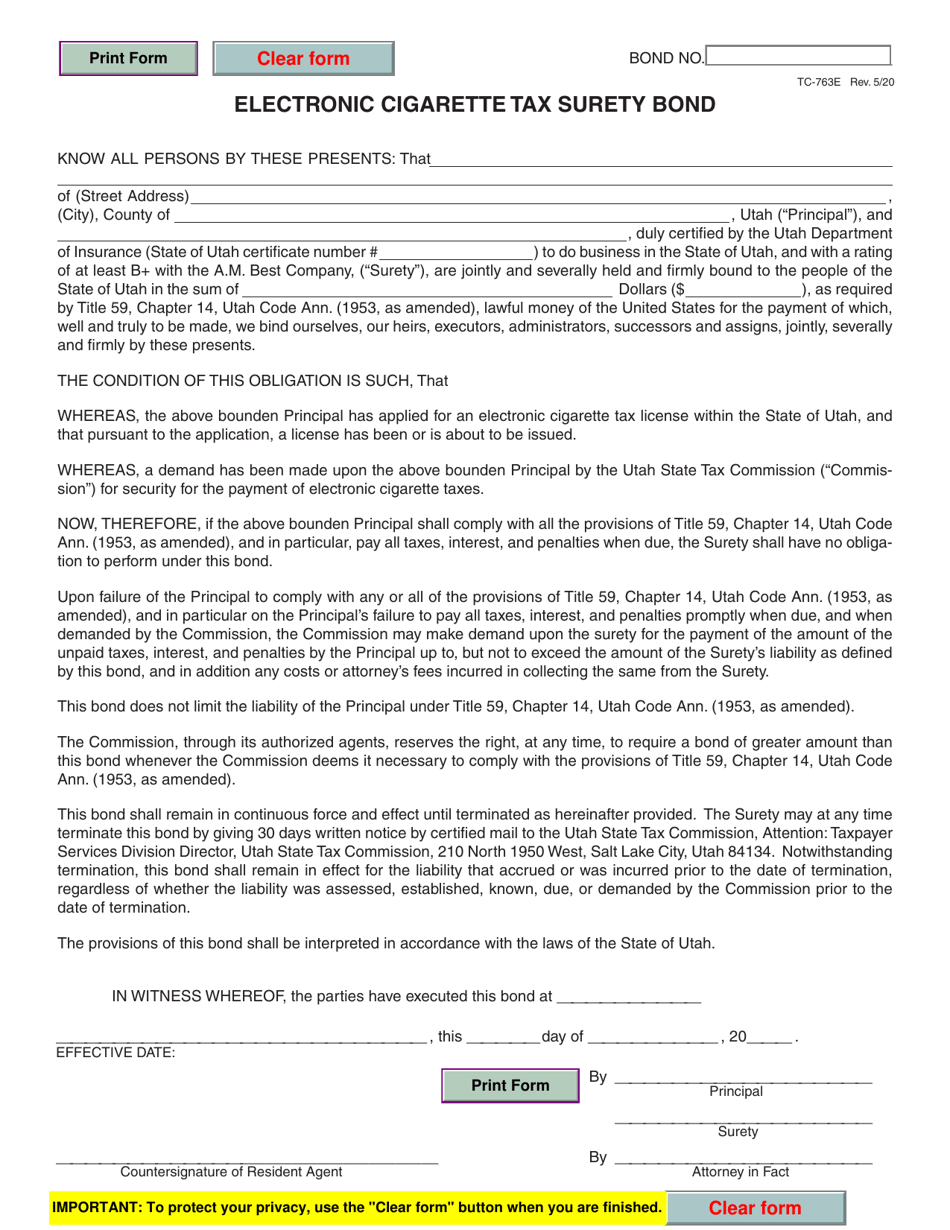

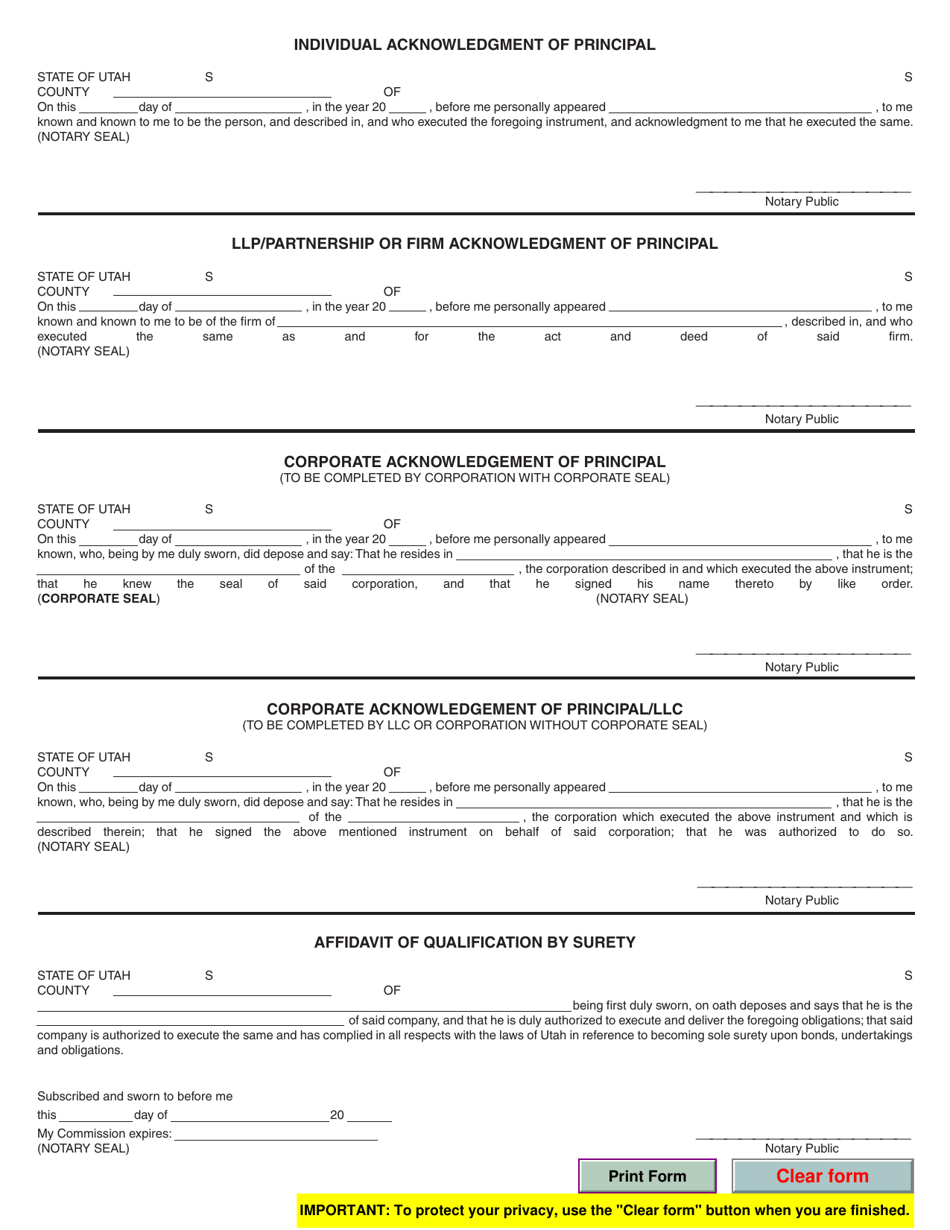

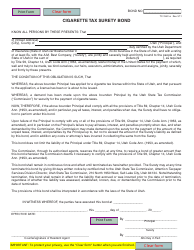

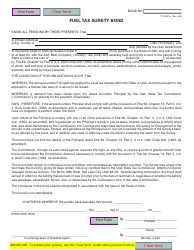

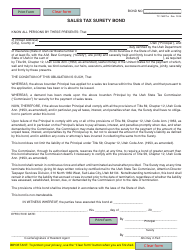

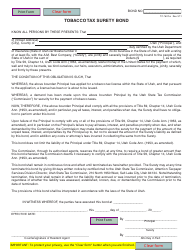

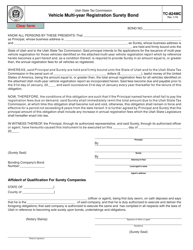

Form TC-763E Electronic Cigarette Tax Surety Bond - Utah

What Is Form TC-763E?

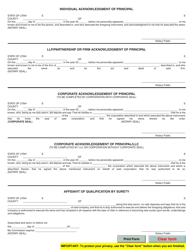

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the TC-763E Form?

A: The TC-763E Form is the Electronic Cigarette Tax Surety Bond in Utah.

Q: What is the purpose of the TC-763E Form?

A: The purpose of the TC-763E Form is to provide a surety bond for electronic cigarette tax compliance in Utah.

Q: Who needs to submit the TC-763E Form?

A: Any business that sells electronic cigarettes in Utah needs to submit the TC-763E Form.

Q: What is the requirement for the TC-763E Form?

A: The requirement for the TC-763E Form is to have a surety bond in the amount of $5000.

Q: Are there any fees associated with the TC-763E Form?

A: Yes, there is a fee of $25 for each bond.

Q: How often do I need to submit the TC-763E Form?

A: The TC-763E Form needs to be submitted annually.

Q: What happens if I fail to submit the TC-763E Form?

A: Failure to submit the TC-763E Form may result in penalties and fines.

Q: Can I submit the TC-763E Form electronically?

A: Yes, the TC-763E Form can be submitted electronically.

Q: Who can I contact for more information about the TC-763E Form?

A: You can contact the Utah State Tax Commission for more information about the TC-763E Form.

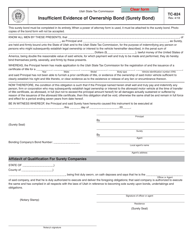

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-763E by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.