This version of the form is not currently in use and is provided for reference only. Download this version of

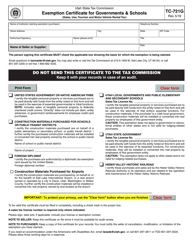

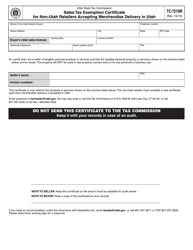

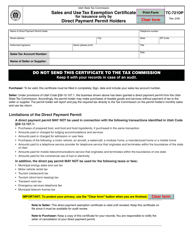

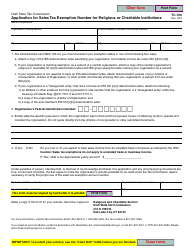

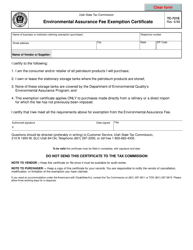

Form TC-721

for the current year.

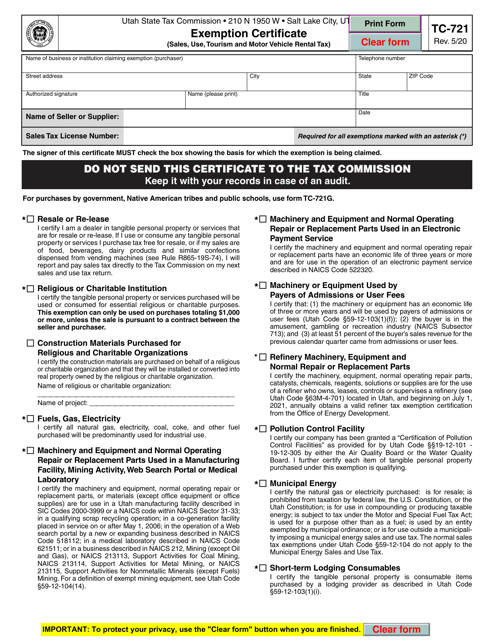

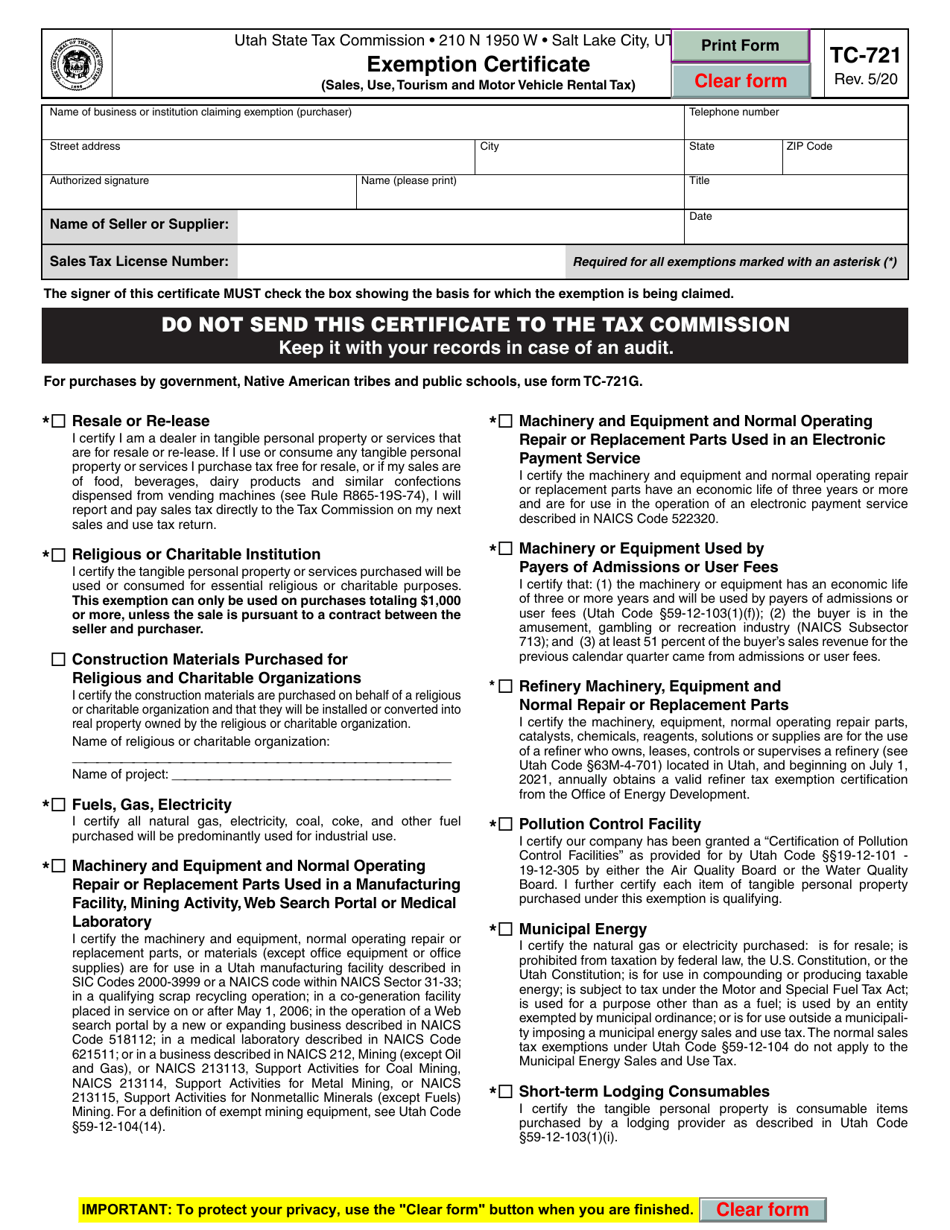

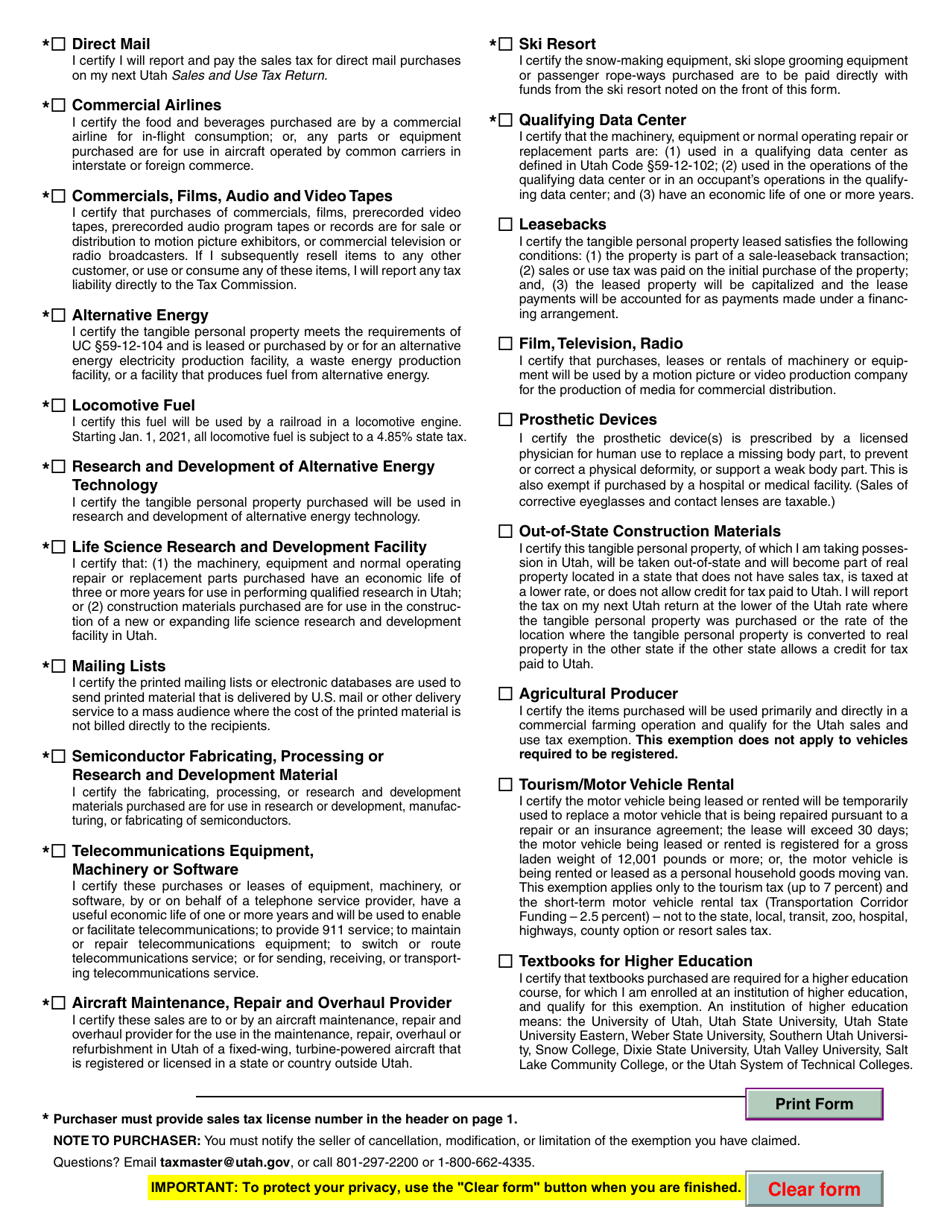

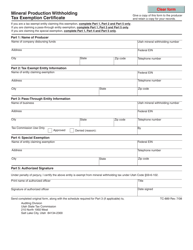

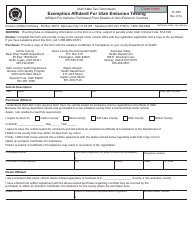

Form TC-721 Exemption Certificate (Sales, Use, Tourism and Motor Vehicle Rental Tax) - Utah

What Is Form TC-721?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-721?

A: Form TC-721 is an Exemption Certificate used for Sales, Use, Tourism and Motor VehicleRental Tax in Utah.

Q: What is an Exemption Certificate?

A: An Exemption Certificate is a document that allows the purchaser to claim exemption from certain taxes.

Q: What taxes does Form TC-721 cover?

A: Form TC-721 covers Sales, Use, Tourism, and Motor Vehicle Rental Tax in Utah.

Q: Who needs to fill out Form TC-721?

A: Anyone who wants to claim exemption from Sales, Use, Tourism, and Motor Vehicle Rental Tax in Utah needs to fill out Form TC-721.

Q: What information is required on Form TC-721?

A: Form TC-721 requires information such as the purchaser's name, address, tax identification number, and a description of the exempt transaction.

Q: Can I use Form TC-721 for all types of purchases?

A: No, Form TC-721 is specific to exemptions for Sales, Use, Tourism, and Motor Vehicle Rental Tax in Utah.

Q: Is Form TC-721 valid for a limited time?

A: Yes, Form TC-721 is generally valid for one year from the date of issuance.

Q: Do I need to submit Form TC-721 with every purchase?

A: No, Form TC-721 only needs to be submitted once and can be used for multiple exempt transactions within the validity period.

Q: Can I claim exemption retroactively with Form TC-721?

A: No, Form TC-721 must be obtained and submitted prior to the exempt transaction taking place.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-721 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.