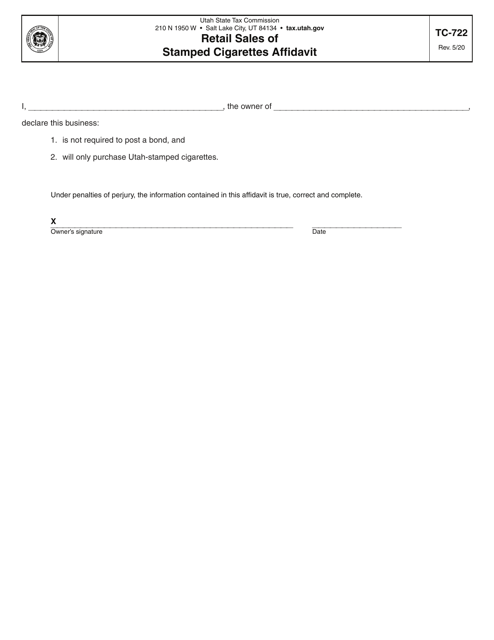

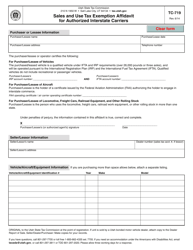

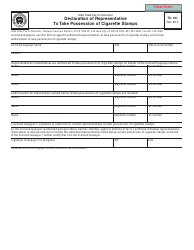

Form TC-722 Retail Sales of Stamped Cigarettes Affidavit - Utah

What Is Form TC-722?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-722?

A: Form TC-722 is the Retail Sales of Stamped Cigarettes Affidavit for Utah.

Q: What is the purpose of Form TC-722?

A: The purpose of Form TC-722 is to report and certify sales of stamped cigarettes in Utah.

Q: Who needs to file Form TC-722?

A: Retailers who sell stamped cigarettes in Utah need to file Form TC-722.

Q: When is Form TC-722 due?

A: Form TC-722 is due on or before the 20th day of the month following the reporting period.

Q: Are there any penalties for not filing Form TC-722?

A: Yes, there are penalties for not filing Form TC-722, including fines and possible suspension of your cigarette retail license.

Q: What information do I need to include on Form TC-722?

A: You will need to provide information about your business, total stamped cigarette sales, and the number of stamped cigarettes purchased.

Q: Do I need to keep a copy of Form TC-722 for my records?

A: Yes, it is recommended to keep a copy of Form TC-722 for your records.

Q: Who can I contact for more information about Form TC-722?

A: You can contact the Utah State Tax Commission for more information about Form TC-722.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TC-722 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.