This version of the form is not currently in use and is provided for reference only. Download this version of

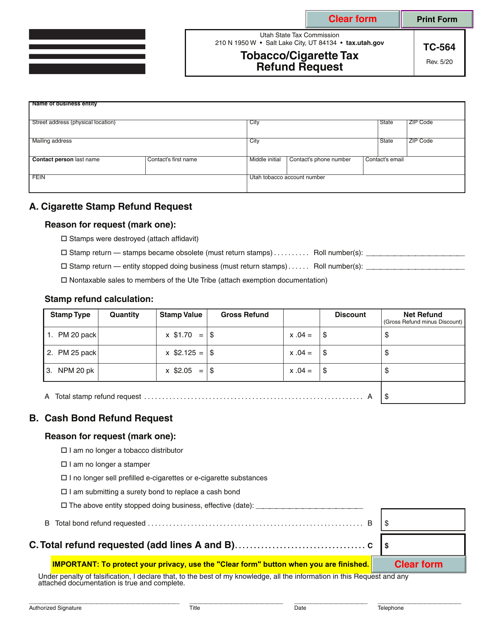

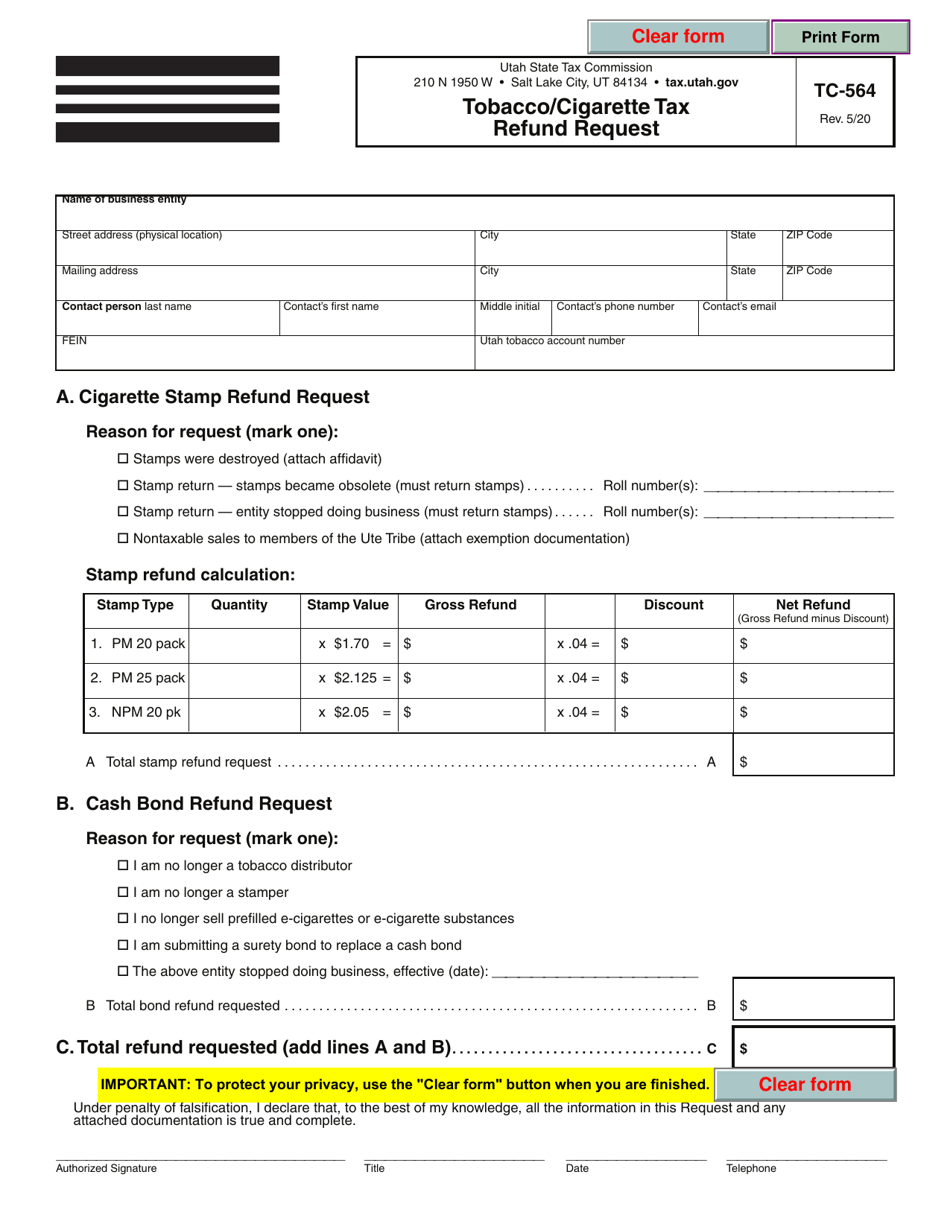

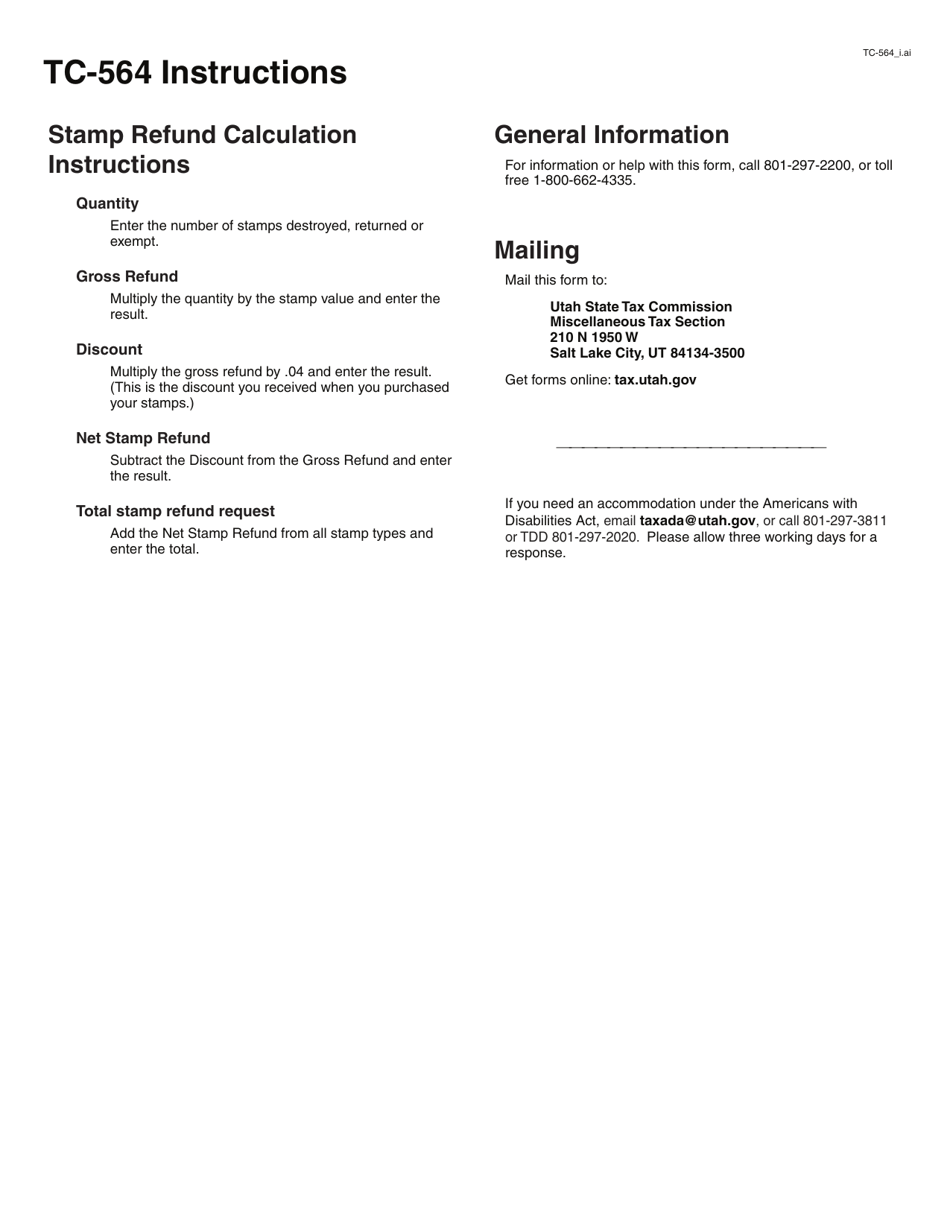

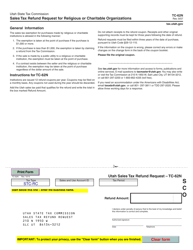

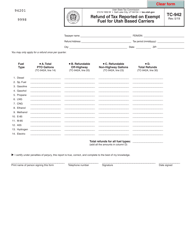

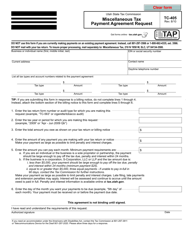

Form TC-564

for the current year.

Form TC-564 Tobacco / Cigarette Tax Refund Request - Utah

What Is Form TC-564?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TC-564 form?

A: TC-564 form is the Tobacco/Cigarette Tax Refund Request form used in Utah.

Q: What is the purpose of the TC-564 form?

A: The TC-564 form is used to request a refund of tobacco/cigarette taxes paid in Utah.

Q: Who can use the TC-564 form?

A: The TC-564 form can be used by individuals or businesses who have paid tobacco/cigarette taxes in Utah.

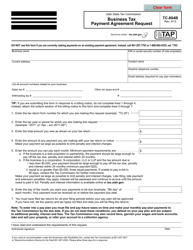

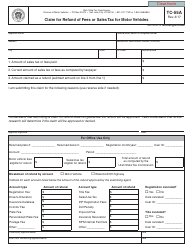

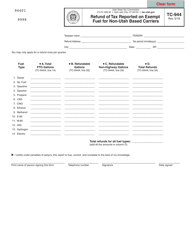

Q: What information is required on the TC-564 form?

A: The TC-564 form requires information such as the name, address, and tax ID number of the claimant, as well as details about the tobacco/cigarette purchases and taxes paid.

Q: Is there a deadline for submitting the TC-564 form?

A: Yes, the TC-564 form must be submitted within one year from the date the tax was paid.

Q: How long does it take to receive a refund after submitting the TC-564 form?

A: The processing time for TC-564 form refunds can vary, but it typically takes several weeks to receive a refund.

Q: Are there any additional requirements or documents needed to file the TC-564 form?

A: Yes, the TC-564 form may require supporting documents such as receipts or invoices for the tobacco/cigarette purchases.

Q: Can I file the TC-564 form electronically?

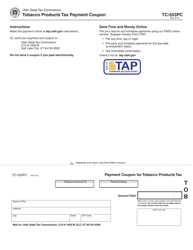

A: No, currently the TC-564 form can only be filed by mail.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-564 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.