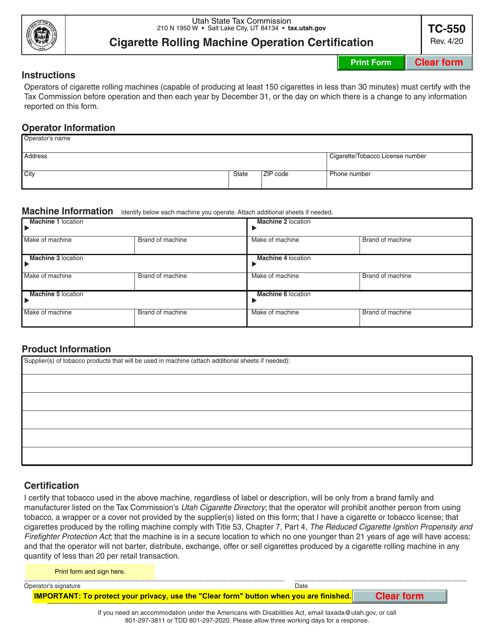

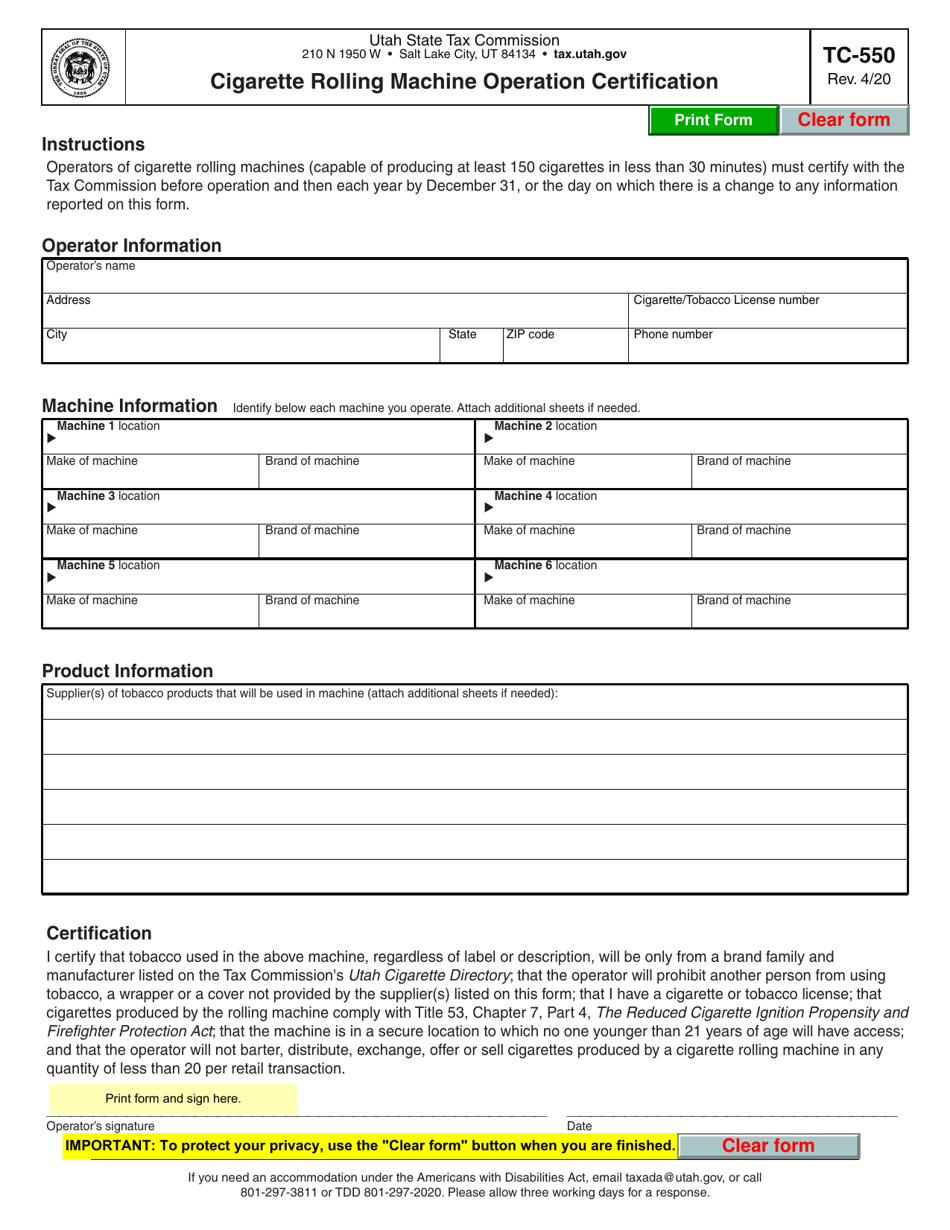

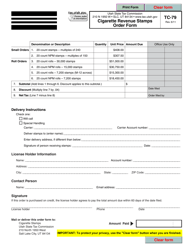

Form TC-550 Cigarette Rolling Machine Operation Certification - Utah

What Is Form TC-550?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-550?

A: Form TC-550 is the Cigarette Rolling Machine Operation Certification form in Utah.

Q: What is the purpose of Form TC-550?

A: The purpose of Form TC-550 is to certify the operation of cigarette rolling machines in Utah.

Q: Who needs to complete Form TC-550?

A: Anyone operating a cigarette rolling machine in Utah needs to complete Form TC-550.

Q: Are there any penalties for not submitting Form TC-550?

A: Yes, failure to submit Form TC-550 or providing false information may result in penalties and potential legal consequences.

Q: How often do I need to renew the Cigarette Rolling Machine Operation Certification?

A: The Cigarette Rolling Machine Operation Certification needs to be renewed annually.

Q: Can I operate a cigarette rolling machine without completing Form TC-550?

A: No, it is illegal to operate a cigarette rolling machine in Utah without completing Form TC-550 and obtaining the certification.

Q: What information is required on Form TC-550?

A: Form TC-550 requires information about the business operating the cigarette rolling machine, the location of the machine, and the type of machine being used.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-550 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.