This version of the form is not currently in use and is provided for reference only. Download this version of

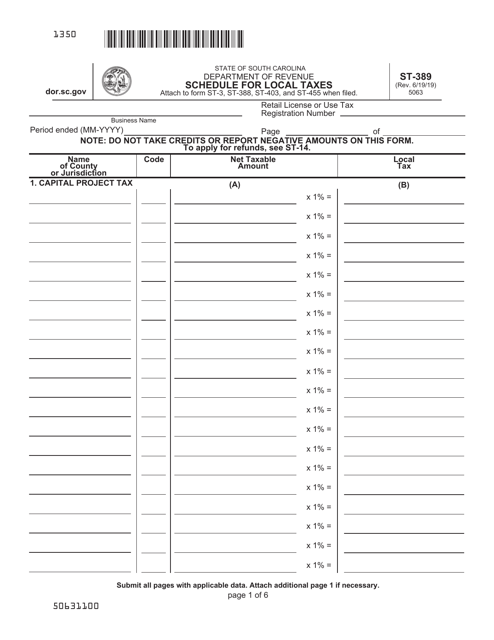

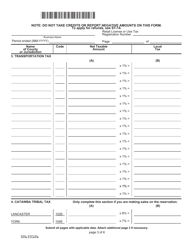

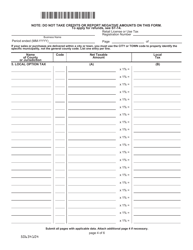

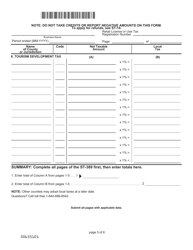

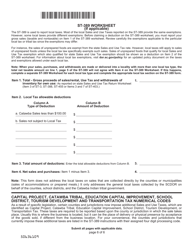

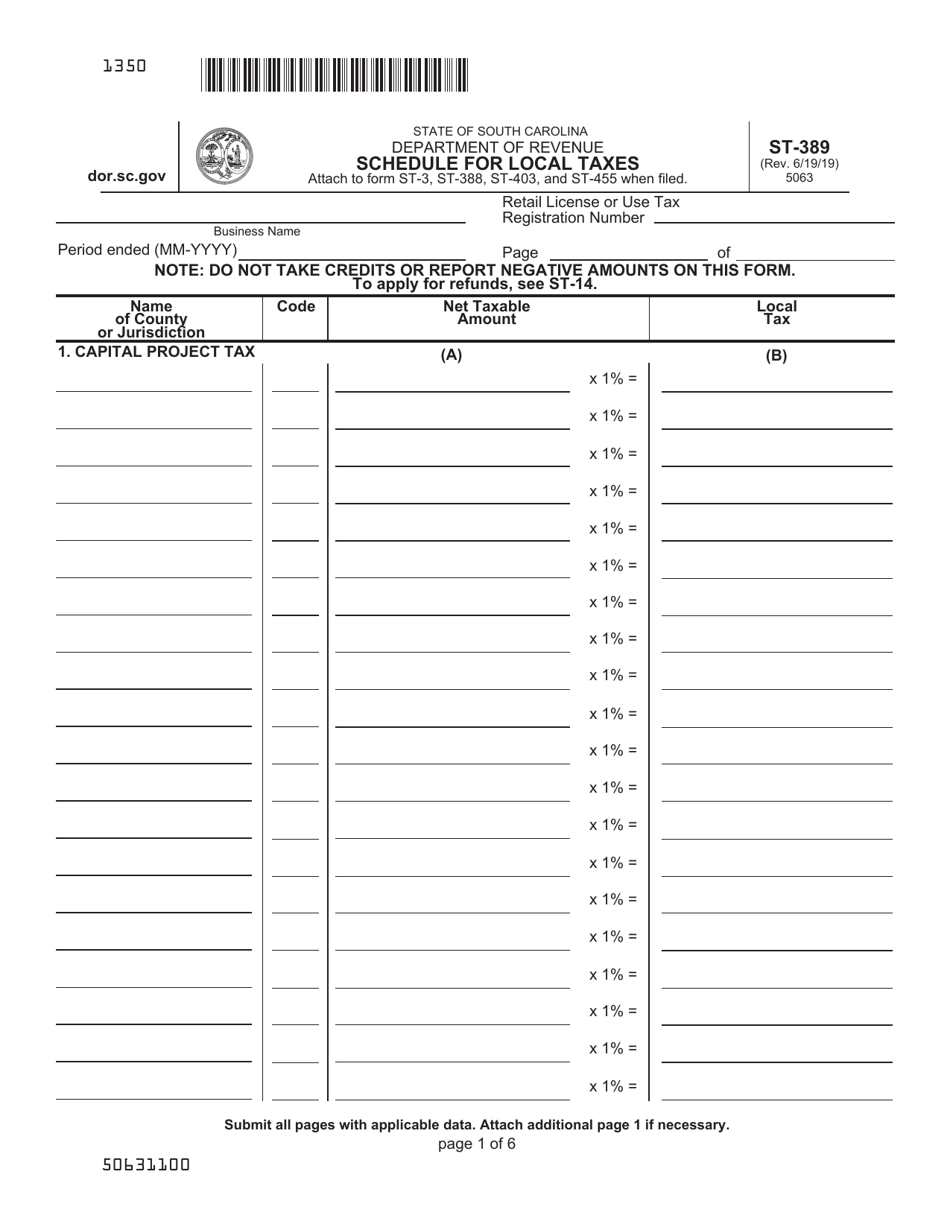

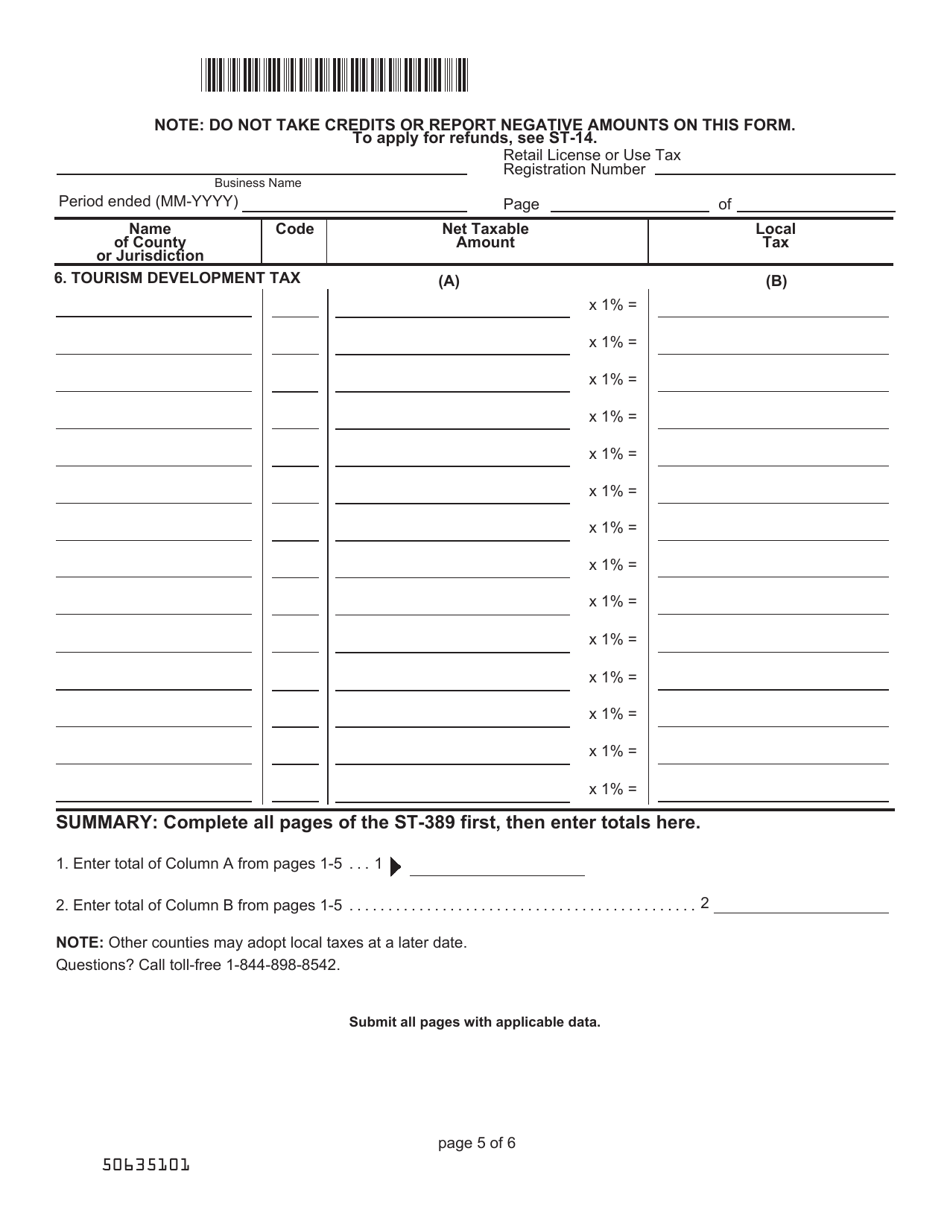

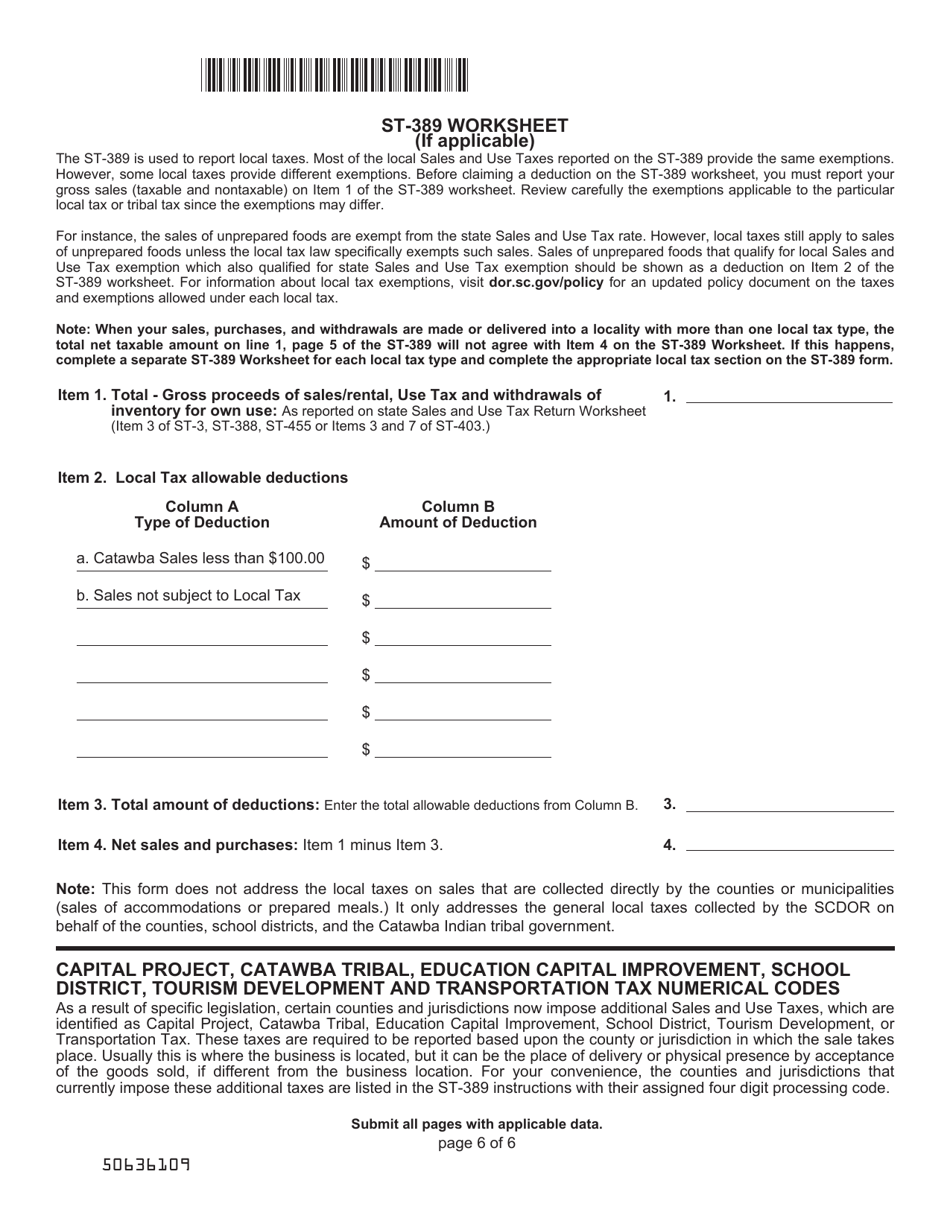

Form ST-389

for the current year.

Form ST-389 Schedule for Local Taxes - South Carolina

What Is Form ST-389?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. Check the official instructions before completing and submitting the form.

FAQ

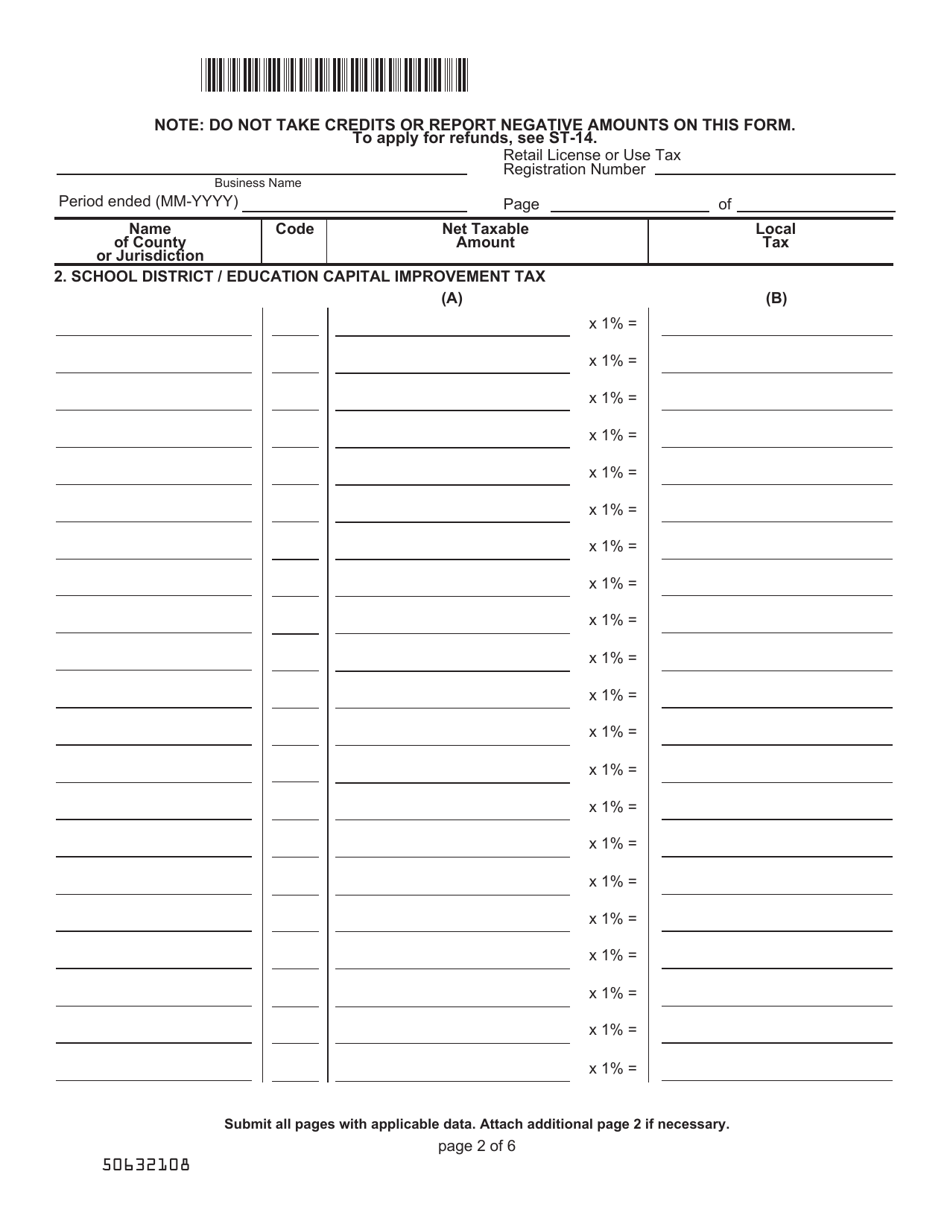

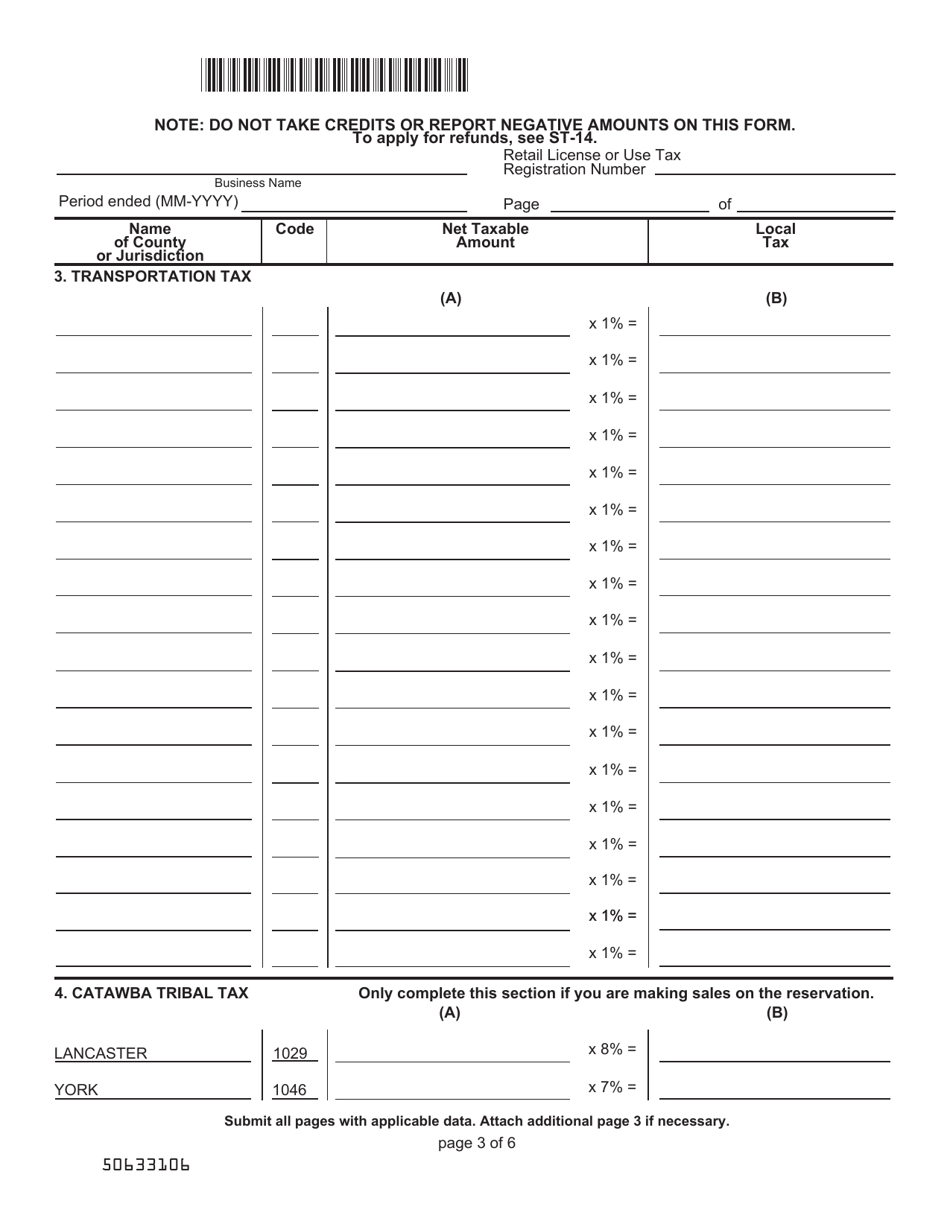

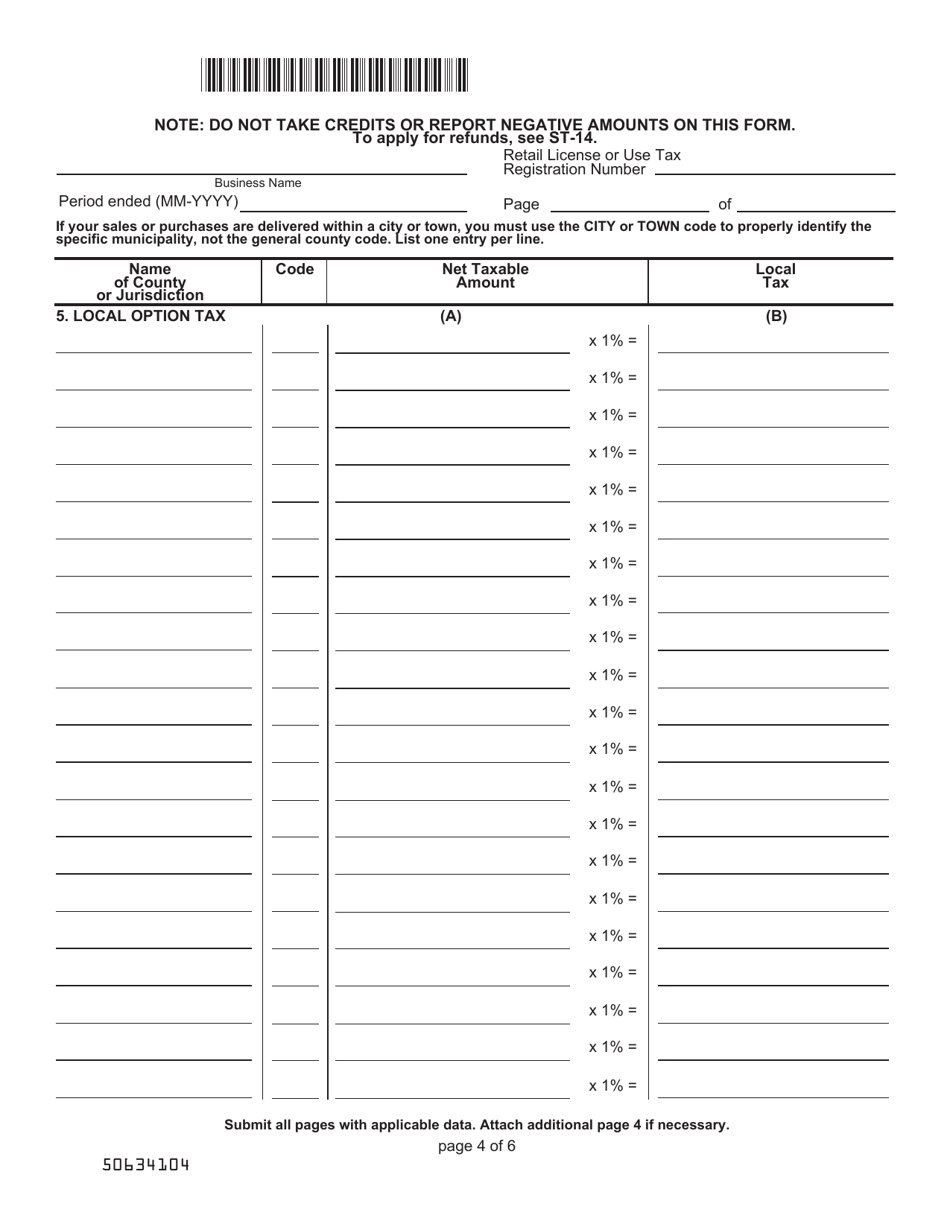

Q: What is the Form ST-389 Schedule for Local Taxes?

A: The Form ST-389 Schedule for Local Taxes is a form used in South Carolina to report local taxes.

Q: Who needs to file the Form ST-389 Schedule for Local Taxes?

A: Businesses in South Carolina that are subject to local taxes need to file the Form ST-389 Schedule.

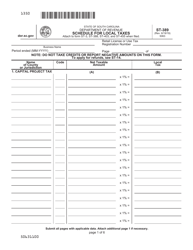

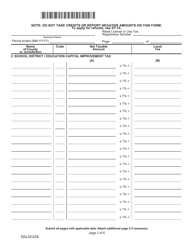

Q: What information is required on the Form ST-389 Schedule for Local Taxes?

A: The form requires information about the business's gross proceeds from sales, leases, or rentals within each jurisdiction where local taxes are due.

Q: When is the deadline to file the Form ST-389 Schedule for Local Taxes?

A: The form is due on or before the 20th day of the month following the month for which the local taxes are due.

Q: Are there any penalties for late filing of the Form ST-389 Schedule for Local Taxes?

A: Yes, there are penalties for late filing, including a late filing fee and interest on the unpaid taxes.

Q: Do I need to include payment with the Form ST-389 Schedule for Local Taxes?

A: Yes, if you have a liability for local taxes, you need to include payment along with the form.

Q: What if I have no local taxes to report on the Form ST-389 Schedule?

A: If you have no local taxes to report for a particular jurisdiction, you should still file a zero return for that jurisdiction.

Q: Who do I contact if I have questions about the Form ST-389 Schedule for Local Taxes?

A: You can contact the South Carolina DOR's Taxpayer Service Center at (844) 898-8542 if you have any questions about the form.

Form Details:

- Released on June 19, 2019;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-389 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.