This version of the form is not currently in use and is provided for reference only. Download this version of

Form 550

for the current year.

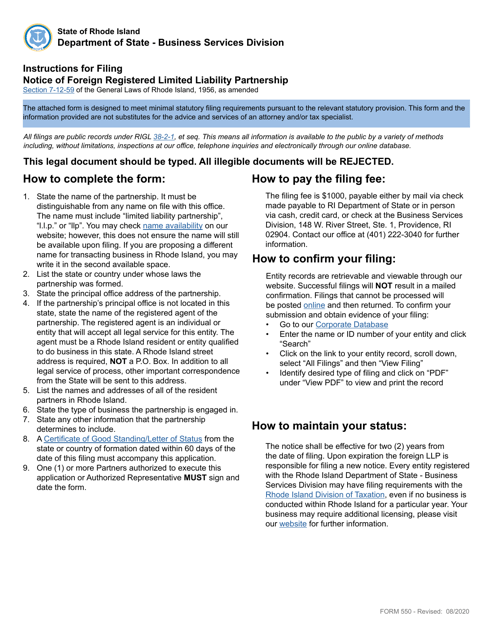

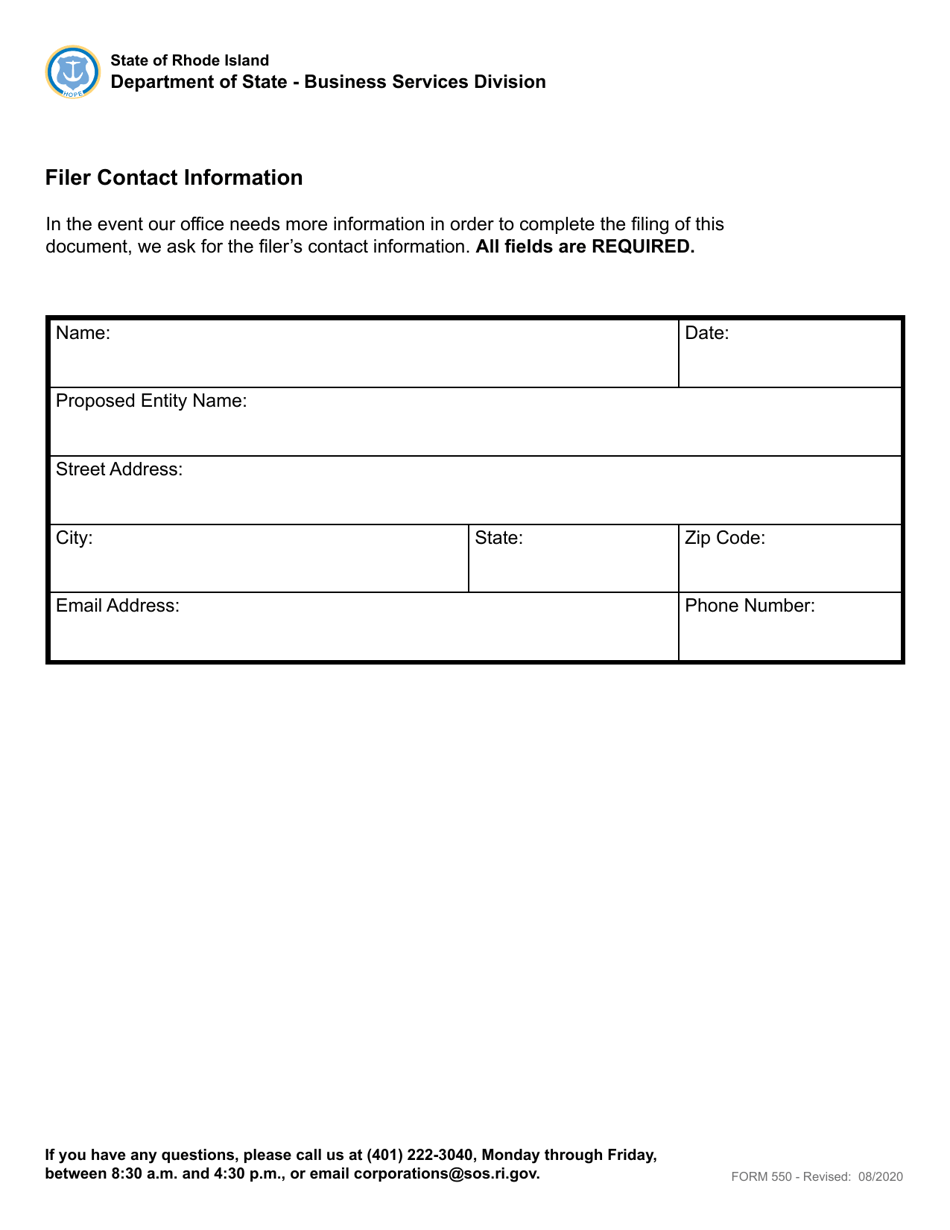

Form 550 Notice of Foreign Registered Limited Liability Partnership - Rhode Island

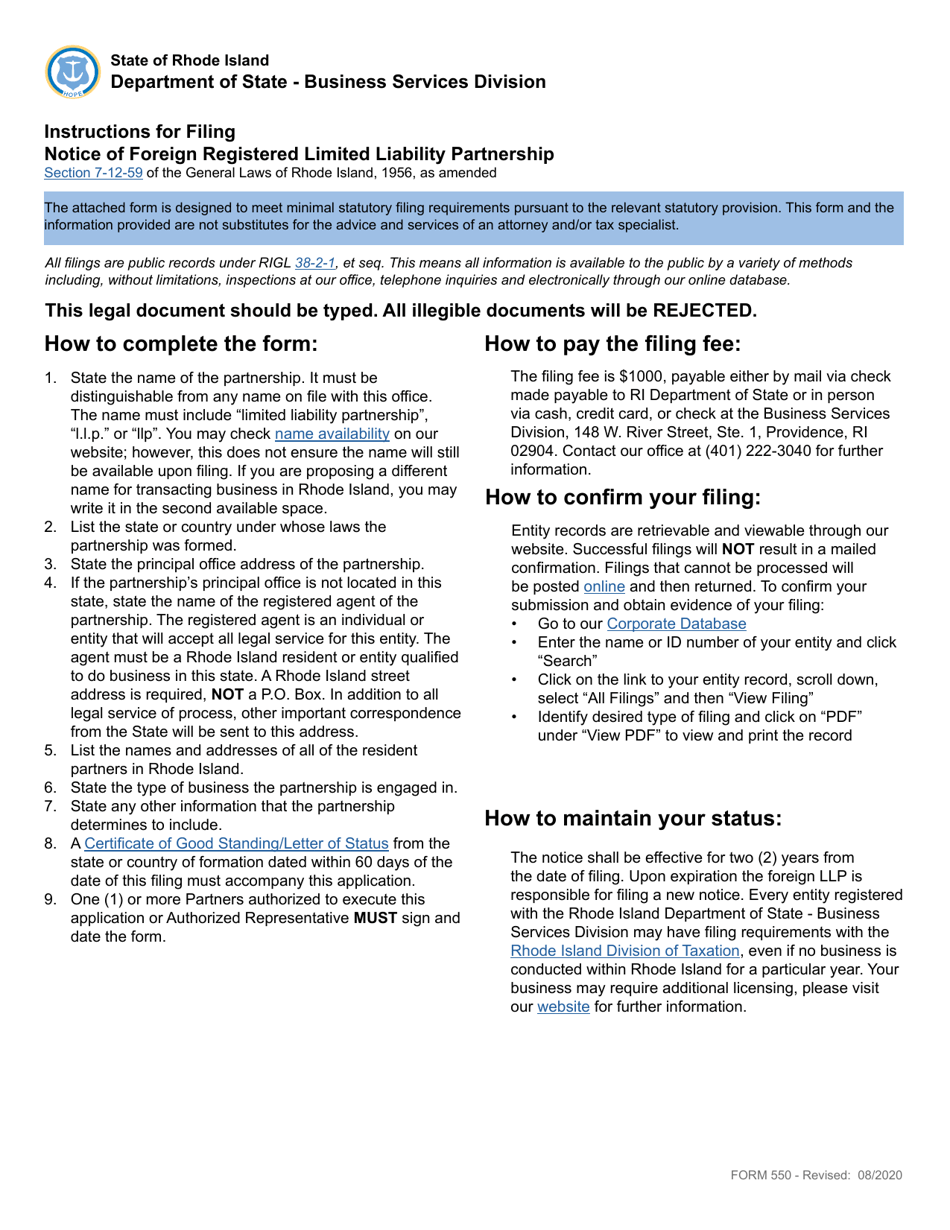

What Is Form 550?

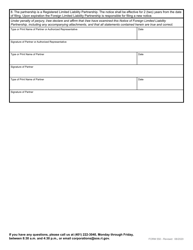

This is a legal form that was released by the Rhode Island Secretary of State - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 550?

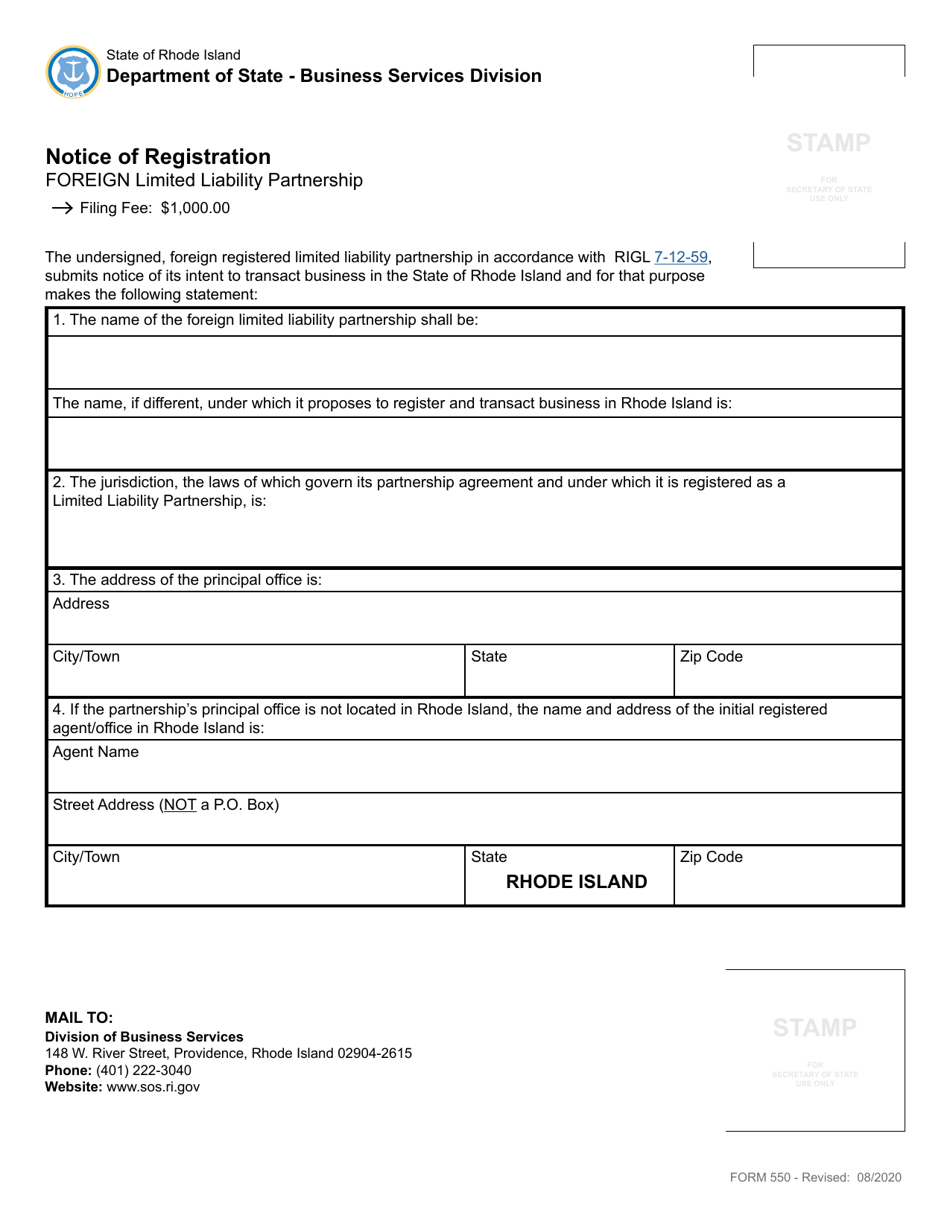

A: Form 550 is a notice of a foreign registered limited liability partnership in Rhode Island.

Q: What is a foreign registered limited liability partnership?

A: A foreign registered limited liability partnership is a partnership formed in another state or country and registered to do business in Rhode Island.

Q: Why would a partnership need to file Form 550?

A: Partnerships need to file Form 550 to notify the state of Rhode Island that they are a foreign registered limited liability partnership.

Q: When is Form 550 due?

A: Form 550 is due annually by the date specified by the Rhode Island Secretary of State.

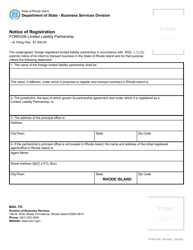

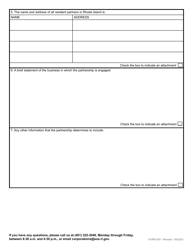

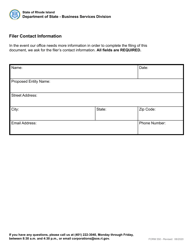

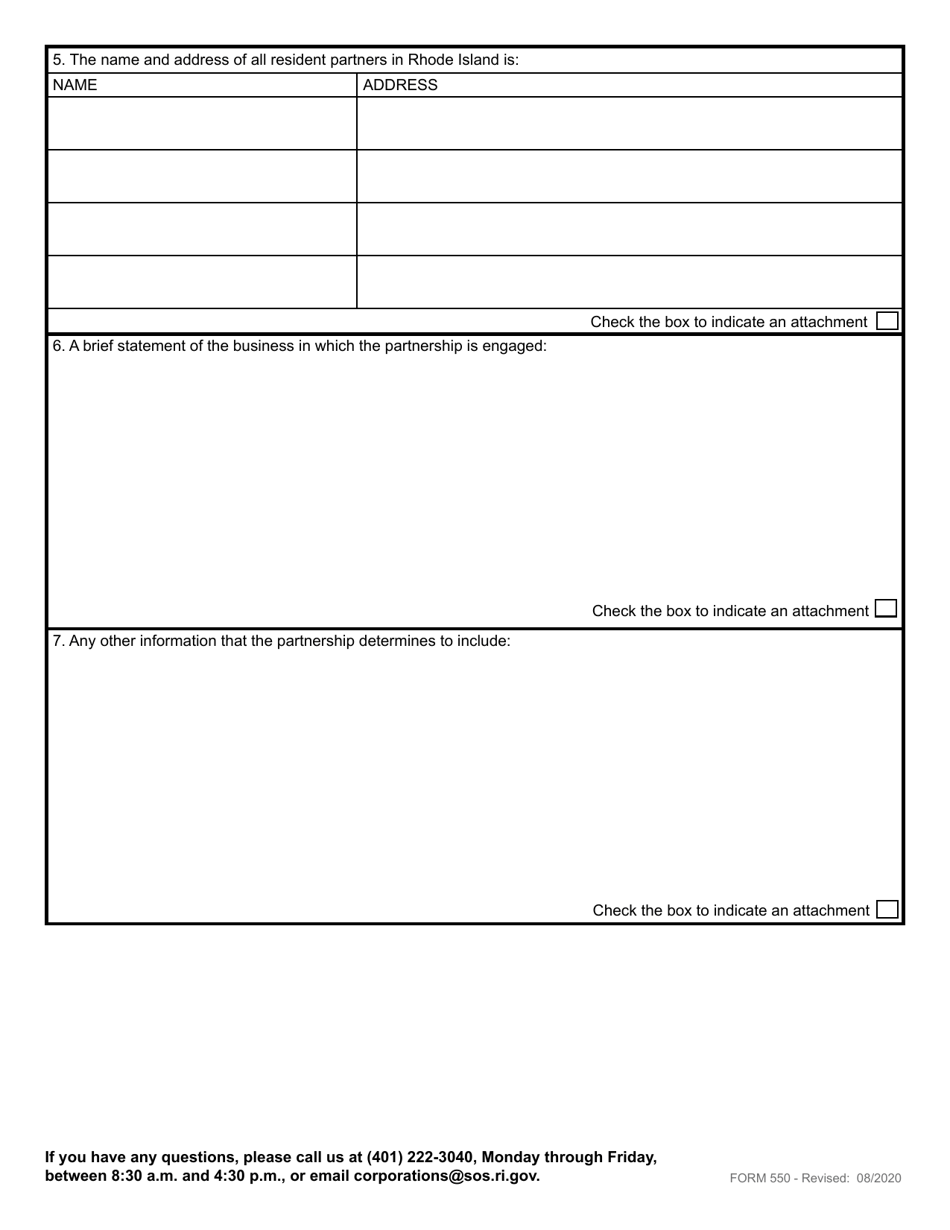

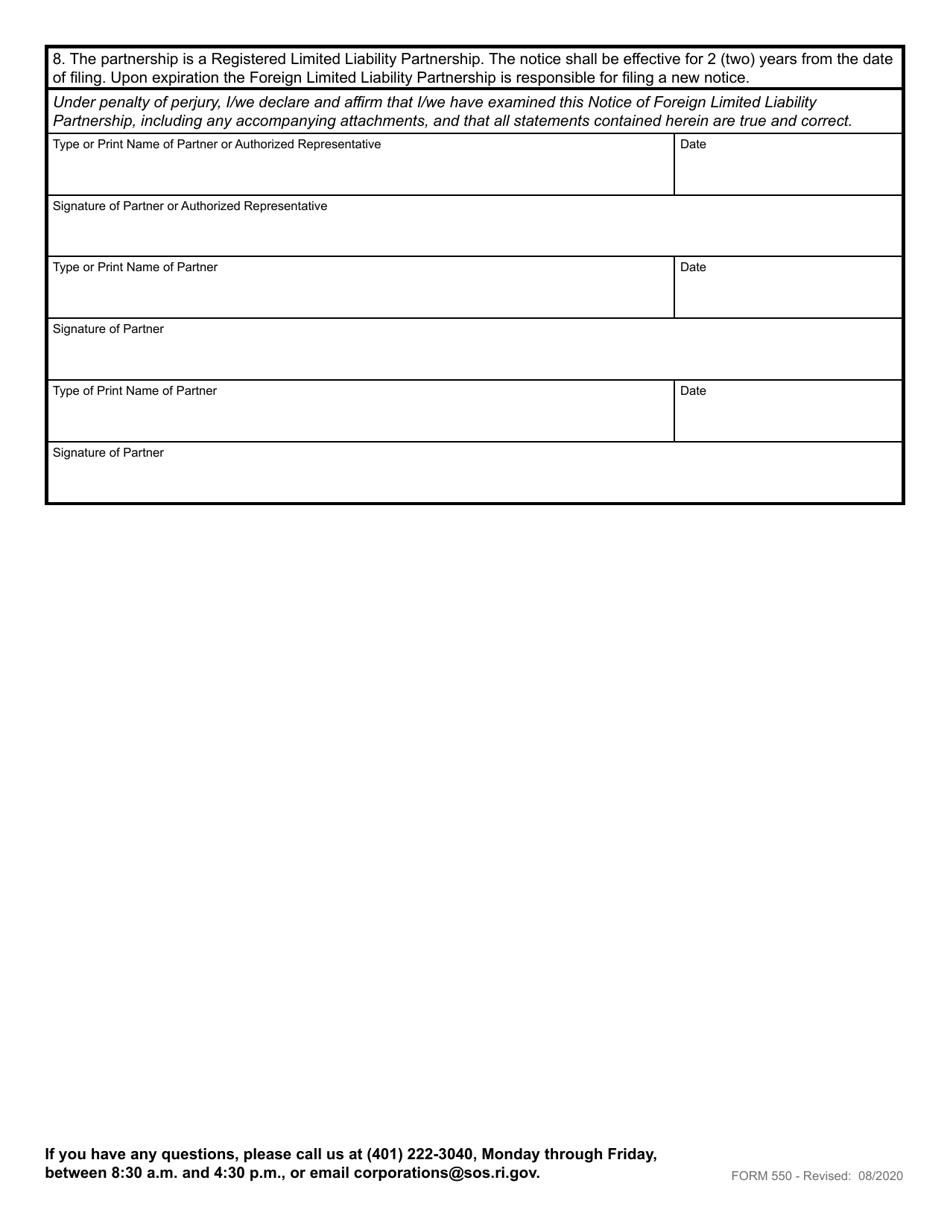

Q: What information is required on Form 550?

A: Form 550 requires information about the partnership's name, address, registered agent, and other details.

Q: What happens if a partnership fails to file Form 550?

A: Failure to file Form 550 may result in penalties or the revocation of the partnership's authority to do business in Rhode Island.

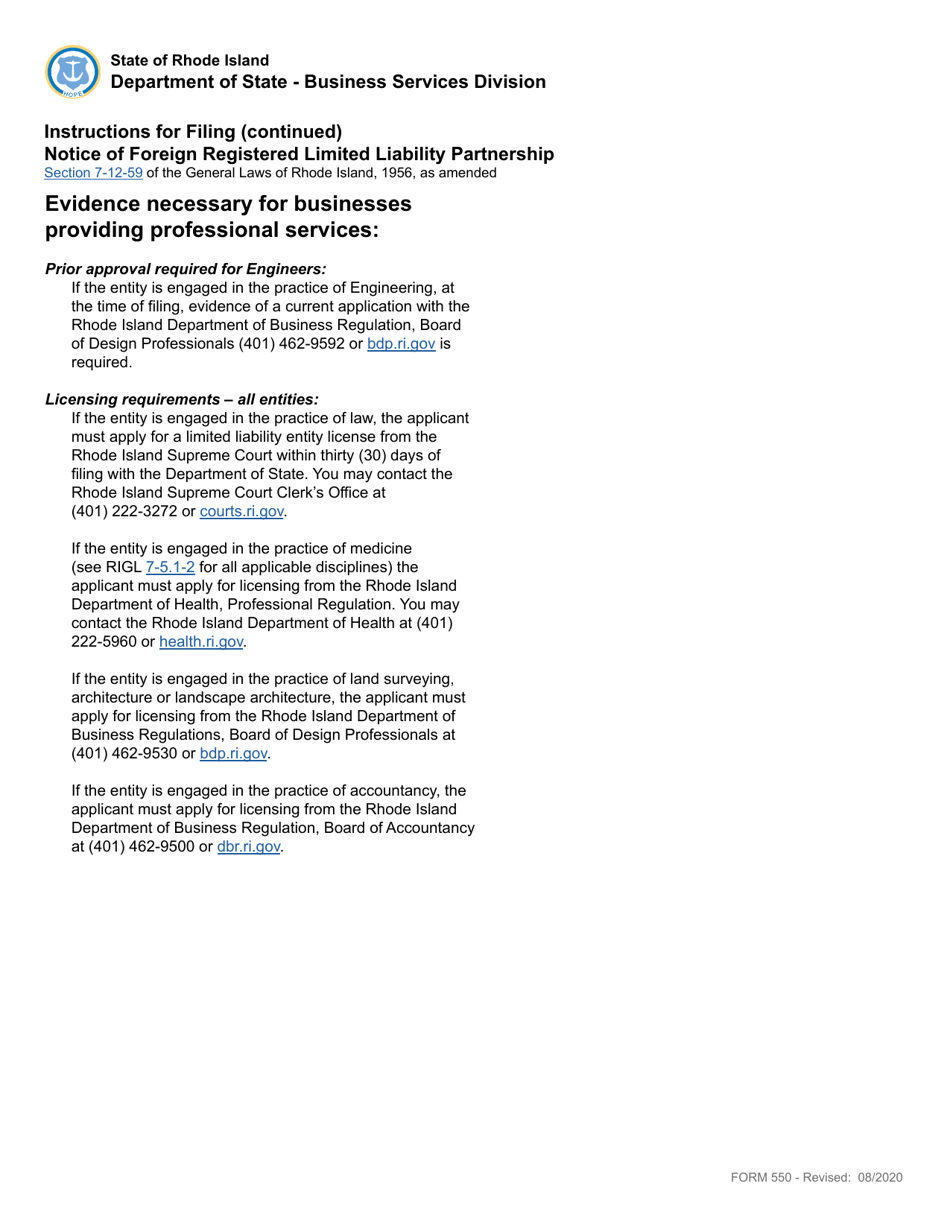

Q: Are there any other requirements for foreign registered limited liability partnerships in Rhode Island?

A: Foreign registered limited liability partnerships may have additional requirements, such as maintaining a registered agent in the state. It is recommended to consult with an attorney or the Rhode Island Secretary of State for specific requirements.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Rhode Island Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 550 by clicking the link below or browse more documents and templates provided by the Rhode Island Secretary of State.