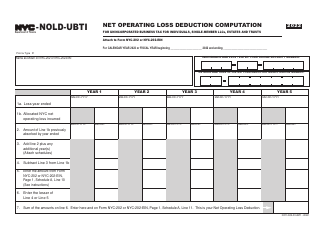

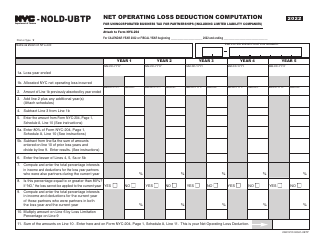

This version of the form is not currently in use and is provided for reference only. Download this version of

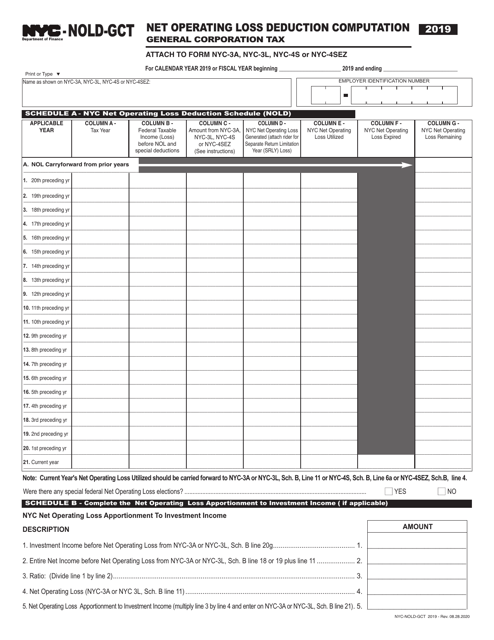

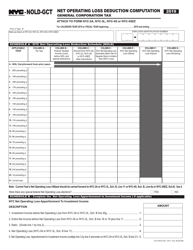

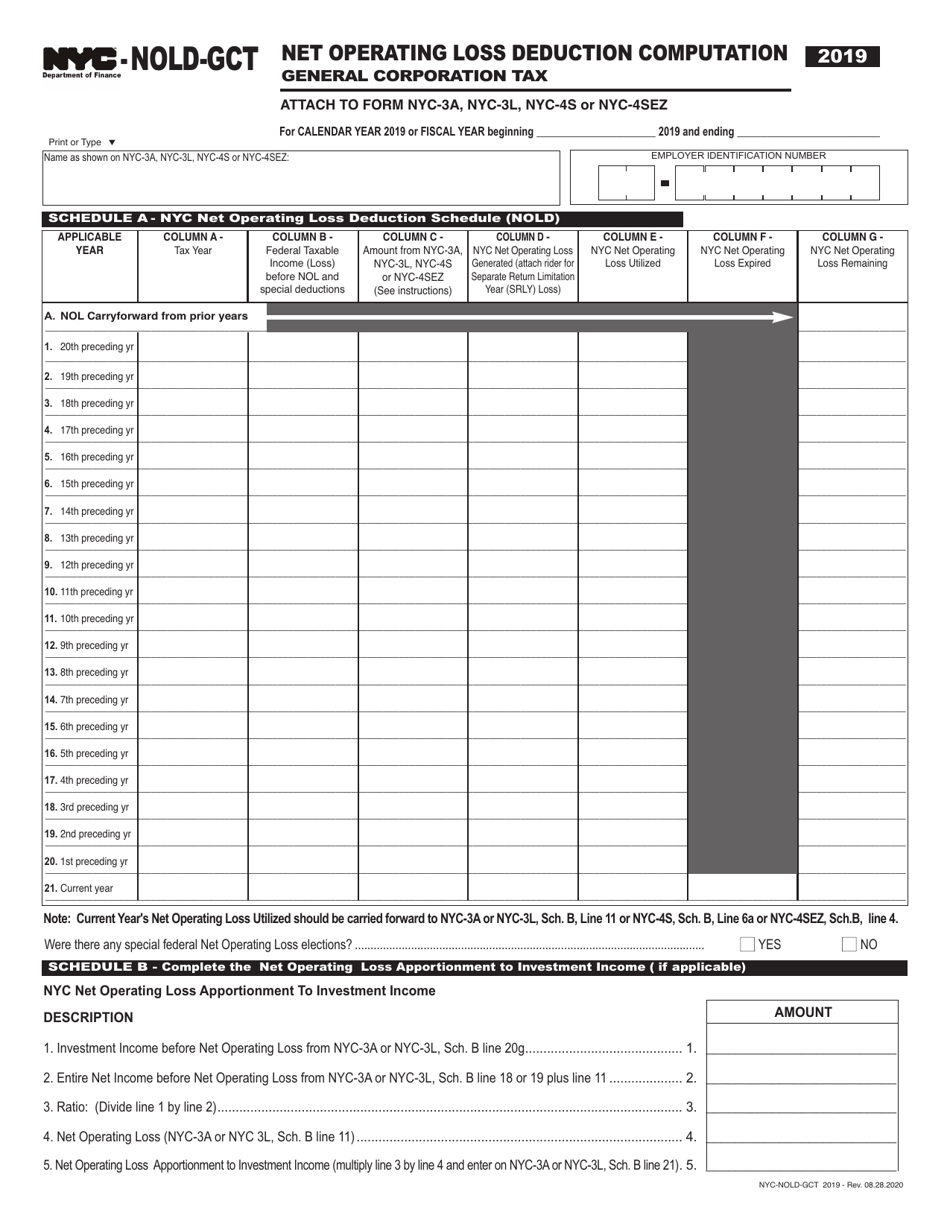

Form NYC-NOLD-GCT

for the current year.

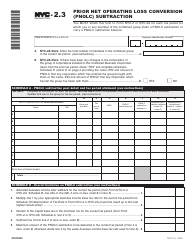

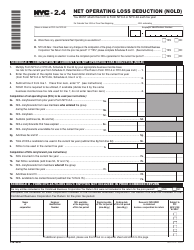

Form NYC-NOLD-GCT Net Operating Loss Deduction Computation - New York City

What Is Form NYC-NOLD-GCT?

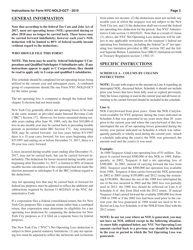

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NYC-NOLD-GCT Net Operating Loss Deduction?

A: The NYC-NOLD-GCT Net Operating Loss Deduction is a deduction available to businesses in New York City to offset their net operating losses.

Q: Who is eligible for the NYC-NOLD-GCT Net Operating Loss Deduction?

A: Businesses that operate in New York City and have incurred net operating losses are eligible for this deduction.

Q: What can the NYC-NOLD-GCT Net Operating Loss Deduction be used for?

A: This deduction can be used to reduce the taxable income of a business in New York City.

Q: What is the computation process for the NYC-NOLD-GCT Net Operating Loss Deduction?

A: The computation process involves applying the net operating loss deduction to the business's taxable income in New York City.

Q: Are there any limitations or restrictions on the NYC-NOLD-GCT Net Operating Loss Deduction?

A: Yes, there are limitations and restrictions on the deduction, including the carryback and carryforward rules for net operating losses in New York City.

Form Details:

- Released on August 28, 2020;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-NOLD-GCT by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.