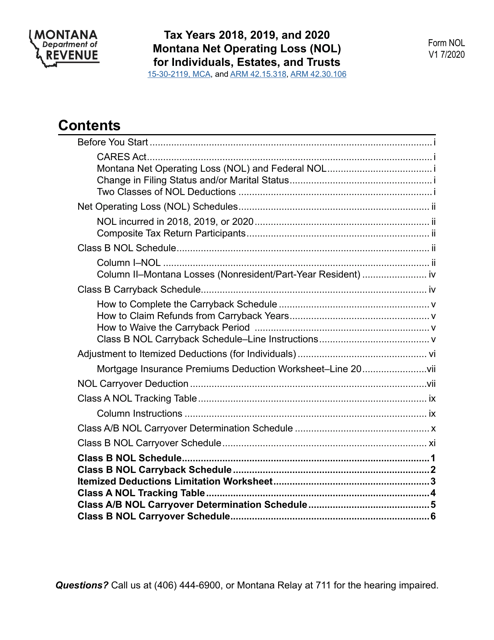

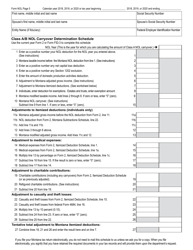

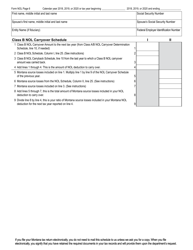

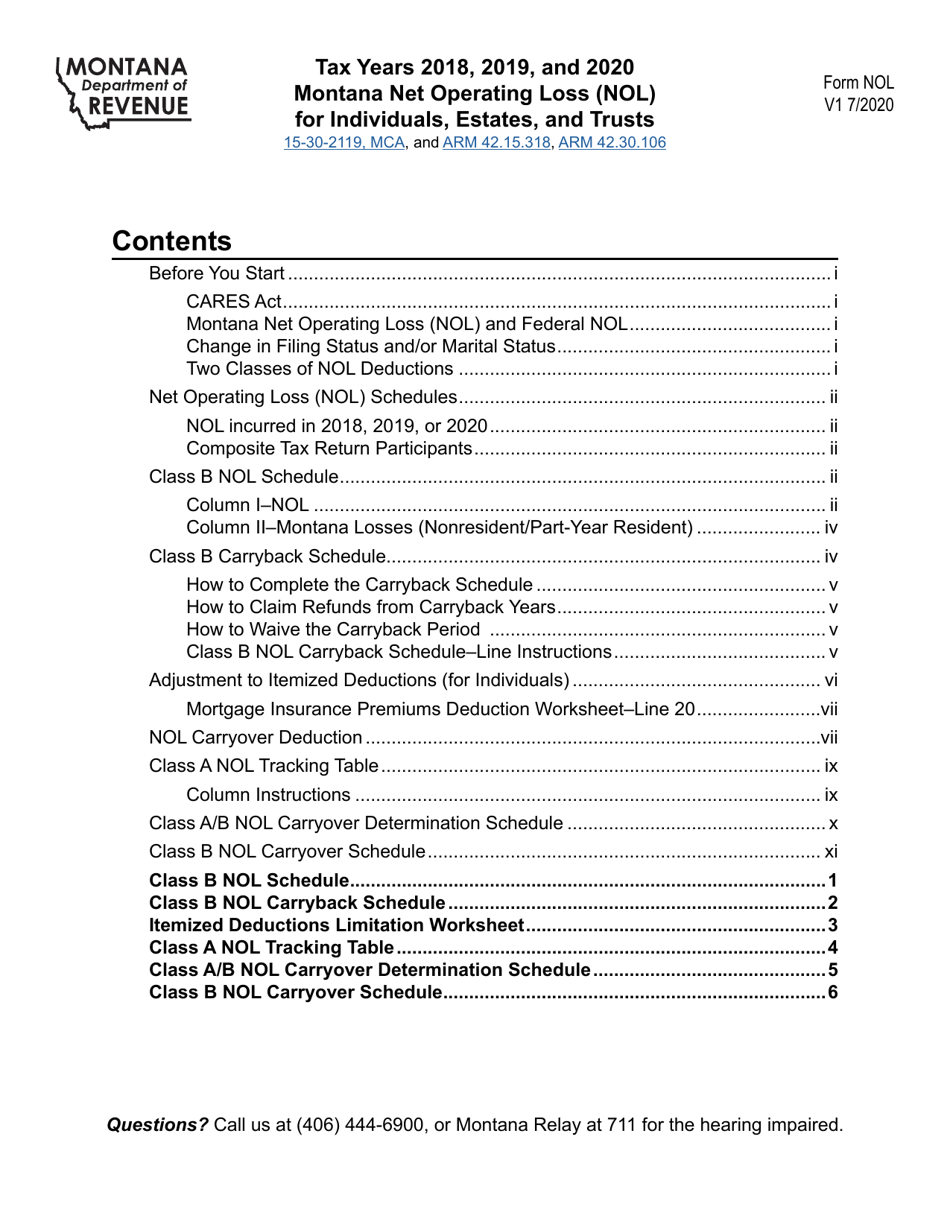

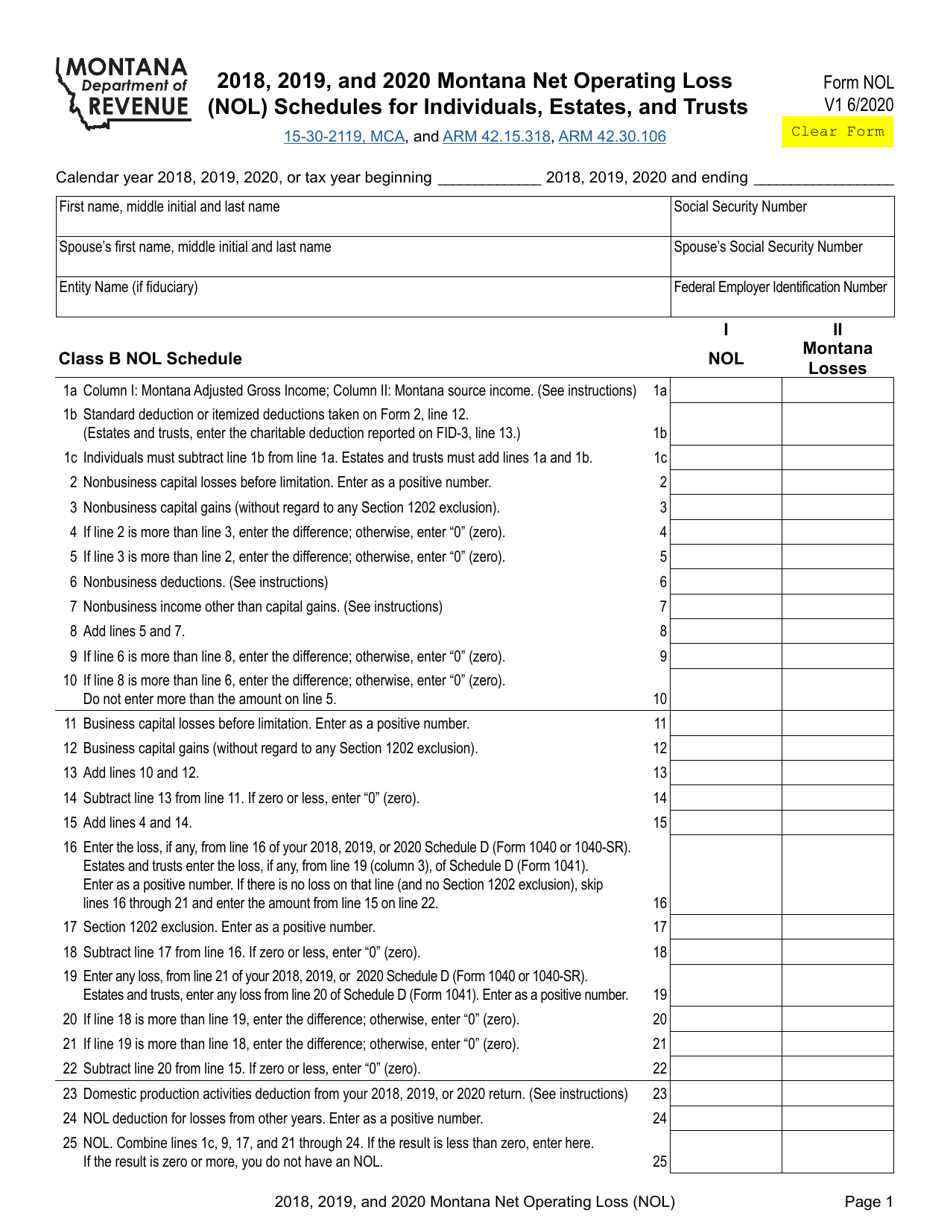

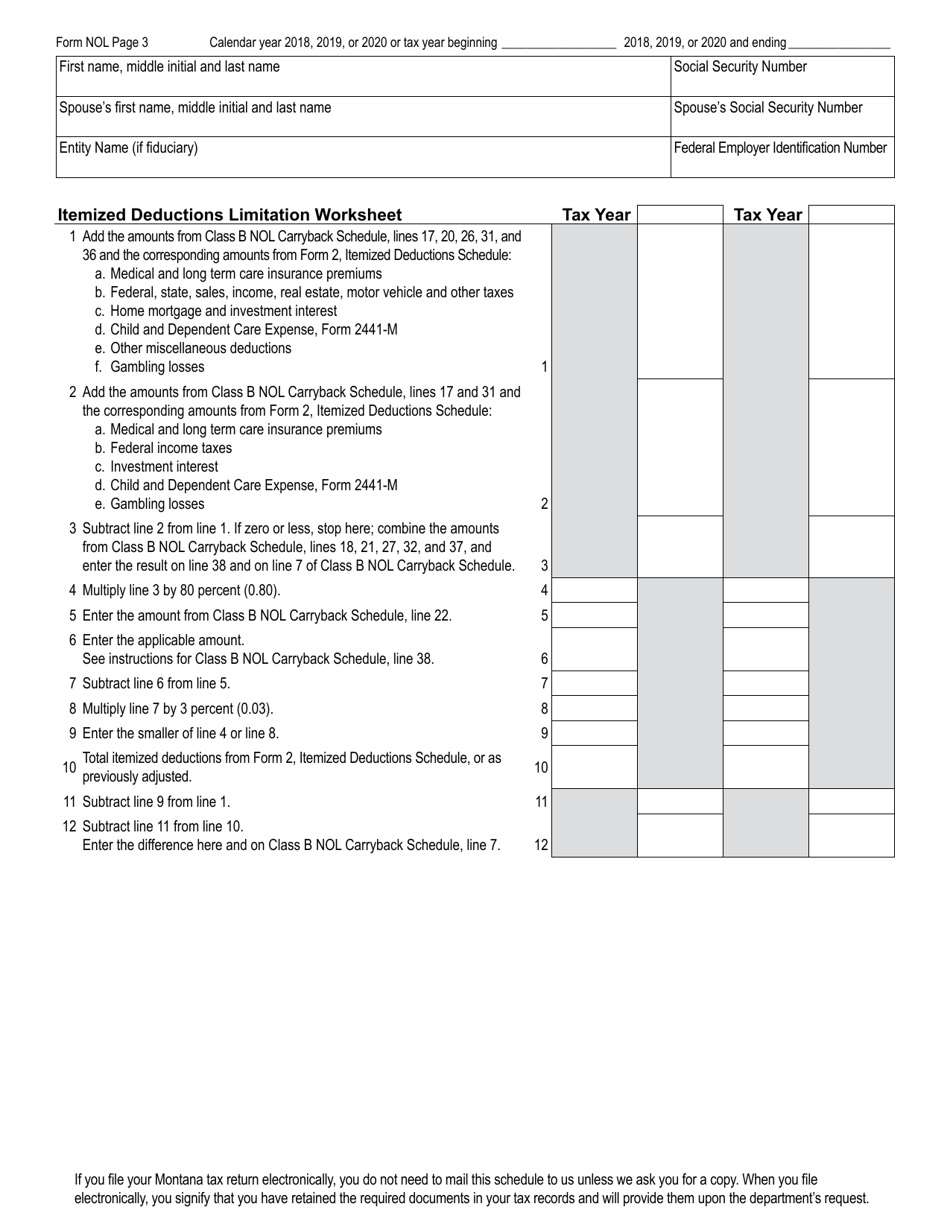

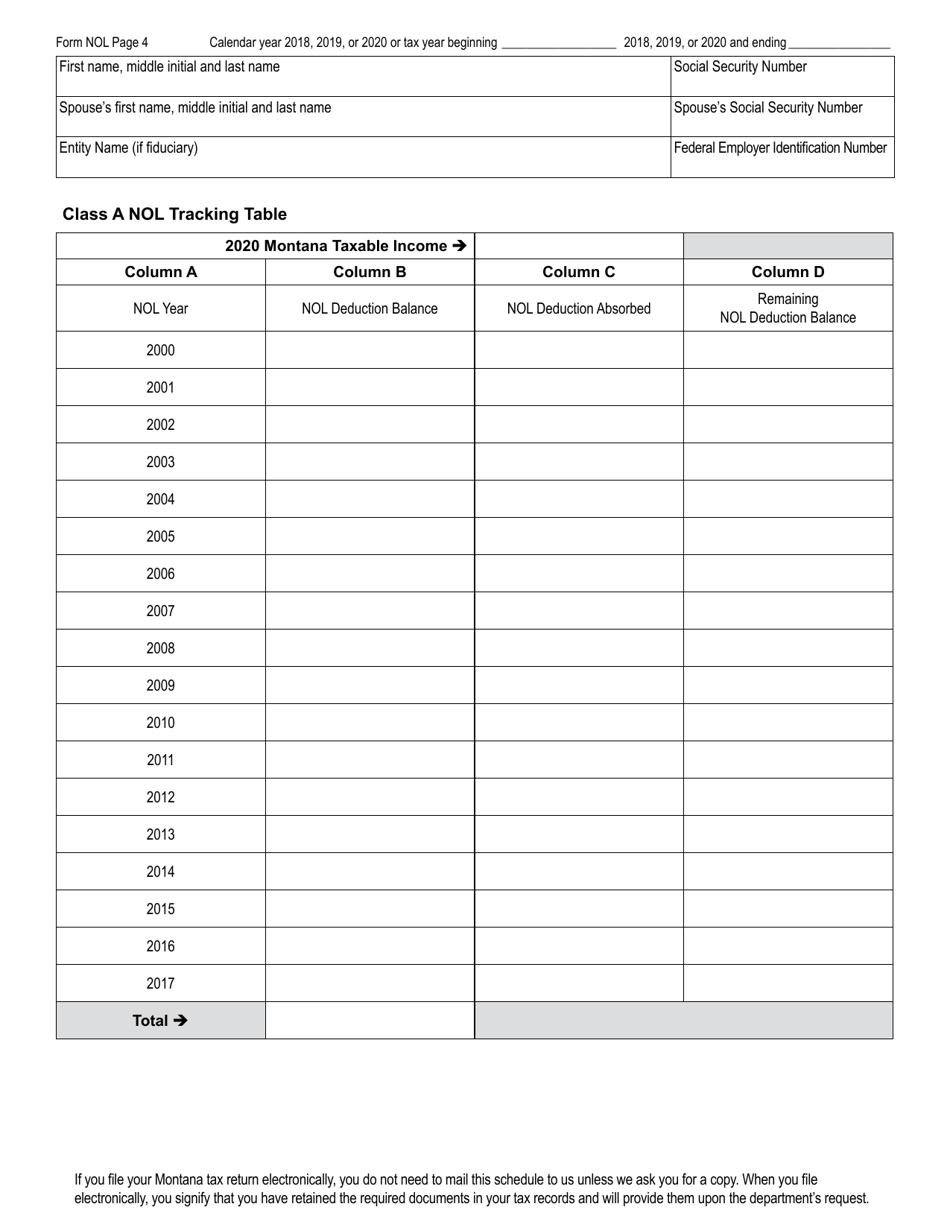

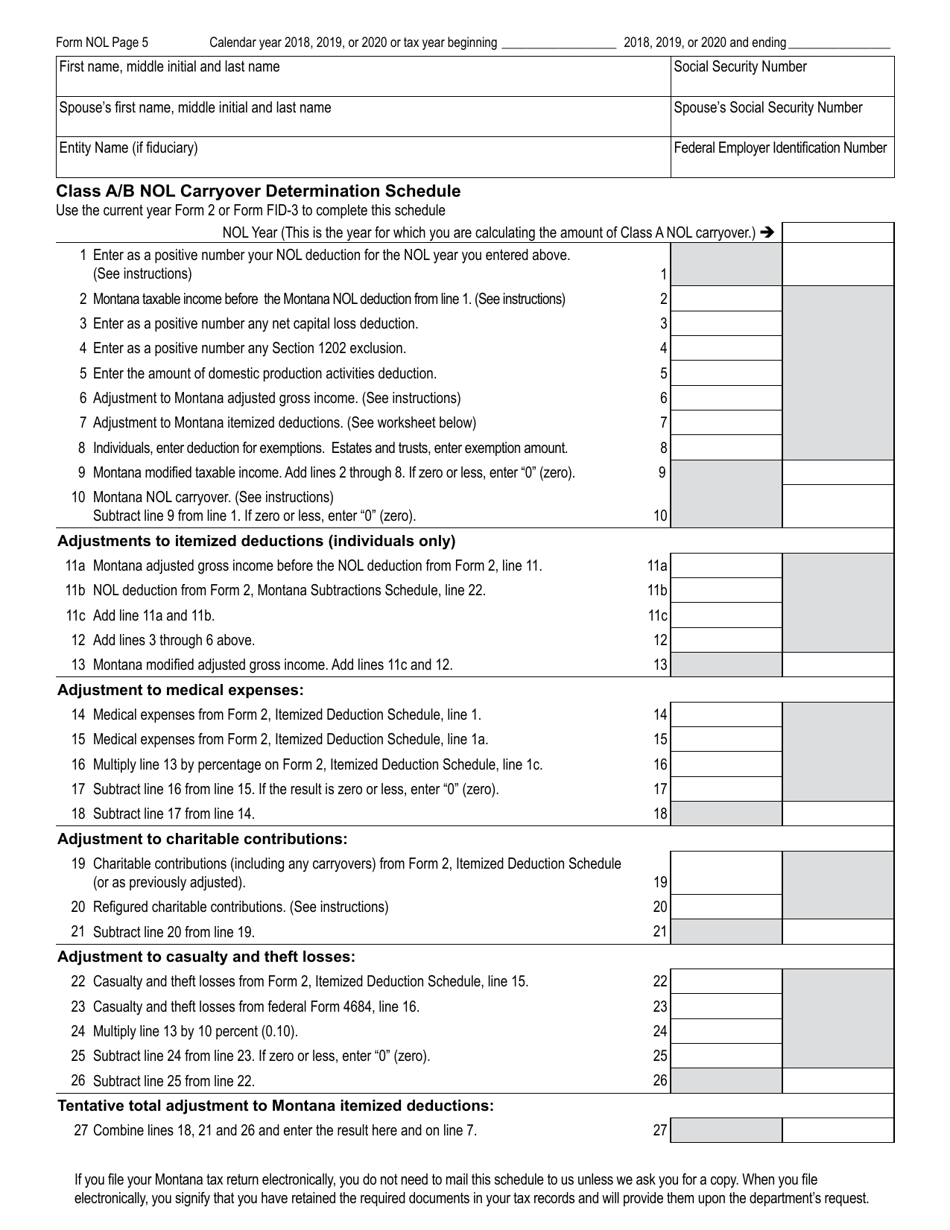

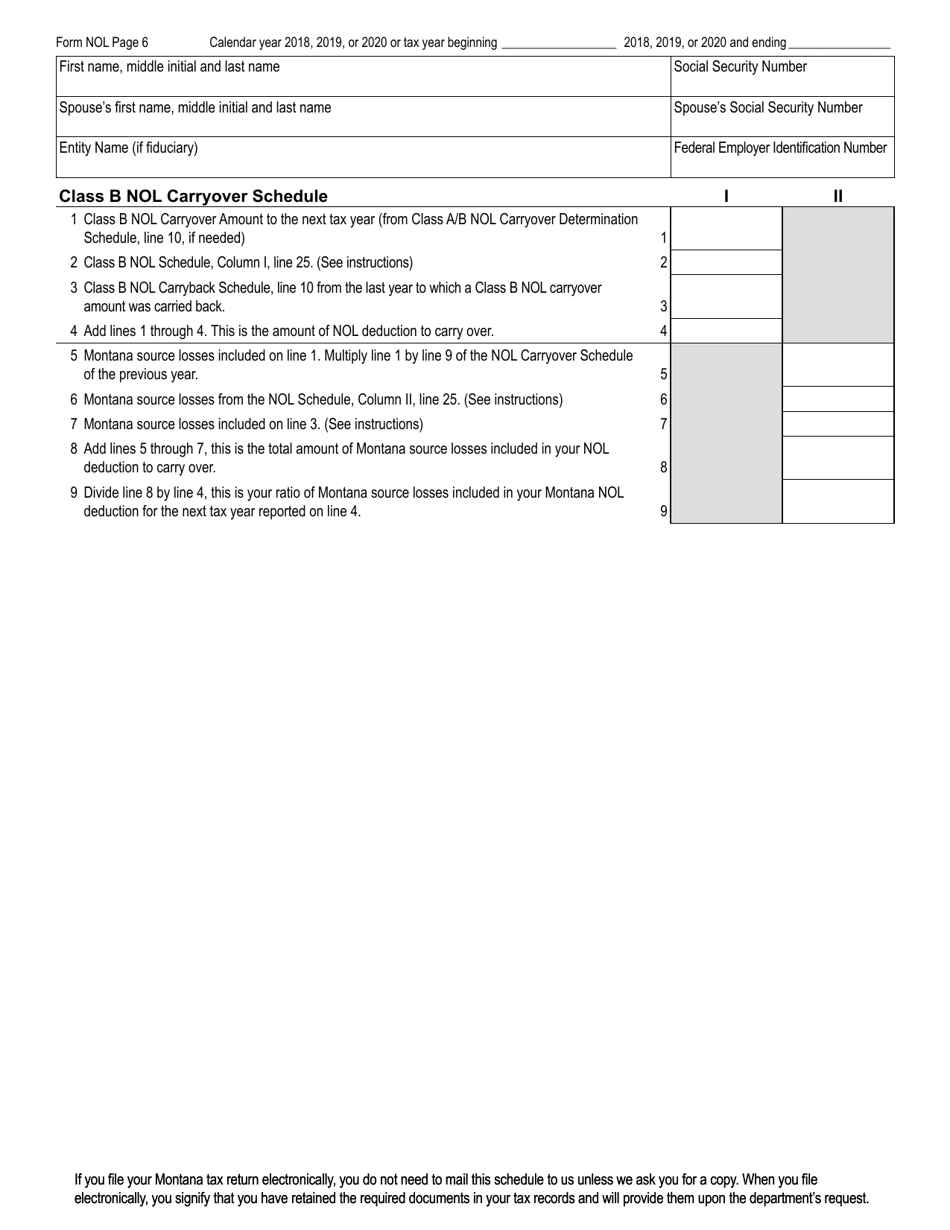

Form NOL Montana Net Operating Loss (Nol) for Individuals, Estates and Trusts - Montana

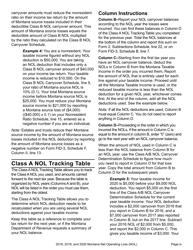

What Is Form NOL?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

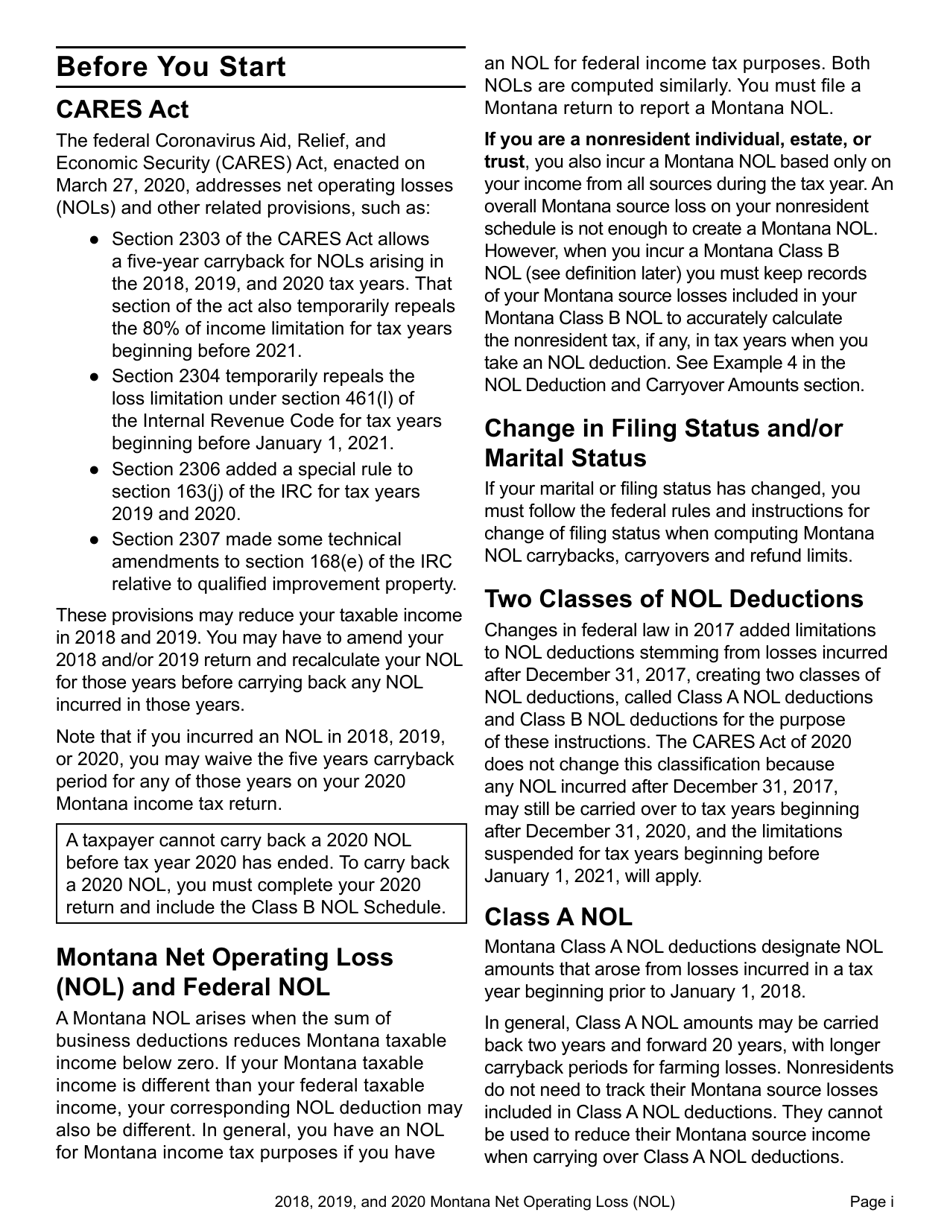

Q: What is Form NOL Montana?

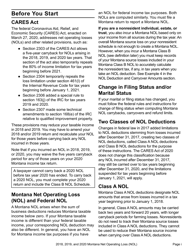

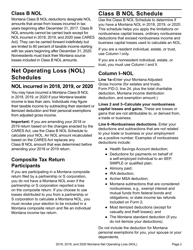

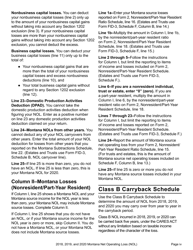

A: Form NOL Montana is a form used to report the net operating loss (NOL) for individuals, estates, and trusts in Montana.

Q: Who should use Form NOL Montana?

A: Individuals, estates, and trusts in Montana who have a net operating loss (NOL) should use Form NOL Montana to report it.

Q: What is a net operating loss (NOL)?

A: A net operating loss (NOL) occurs when a taxpayer's deductible expenses exceed their taxable income.

Q: Why is it important to report a net operating loss (NOL)?

A: Reporting a net operating loss (NOL) allows taxpayers to offset future taxable income and potentially receive a tax refund.

Q: Are there any eligibility requirements to use Form NOL Montana?

A: Yes, individuals, estates, and trusts must meet certain eligibility requirements to use Form NOL Montana. These requirements can be found in the form instructions.

Q: Are there any filing deadlines for Form NOL Montana?

A: Yes, Form NOL Montana must be filed by the due date of the taxpayer's Montana individual income tax return or extended due date, if applicable.

Q: What supporting documentation is required for Form NOL Montana?

A: Taxpayers must attach a copy of their federal Form 1040, Schedule A, and any other schedules or forms required by the Montana Department of Revenue.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NOL by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.