This version of the form is not currently in use and is provided for reference only. Download this version of

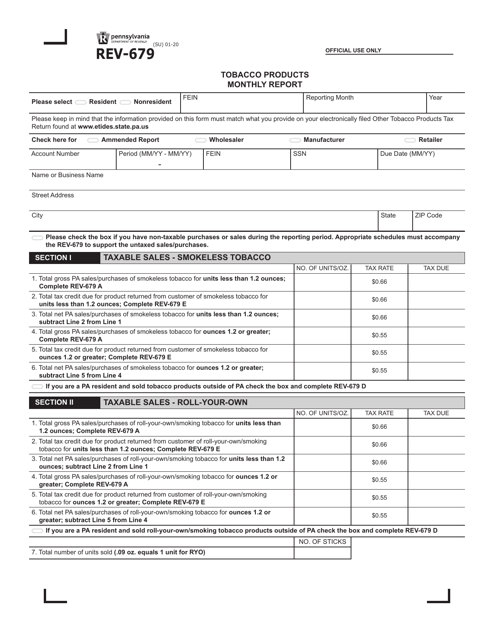

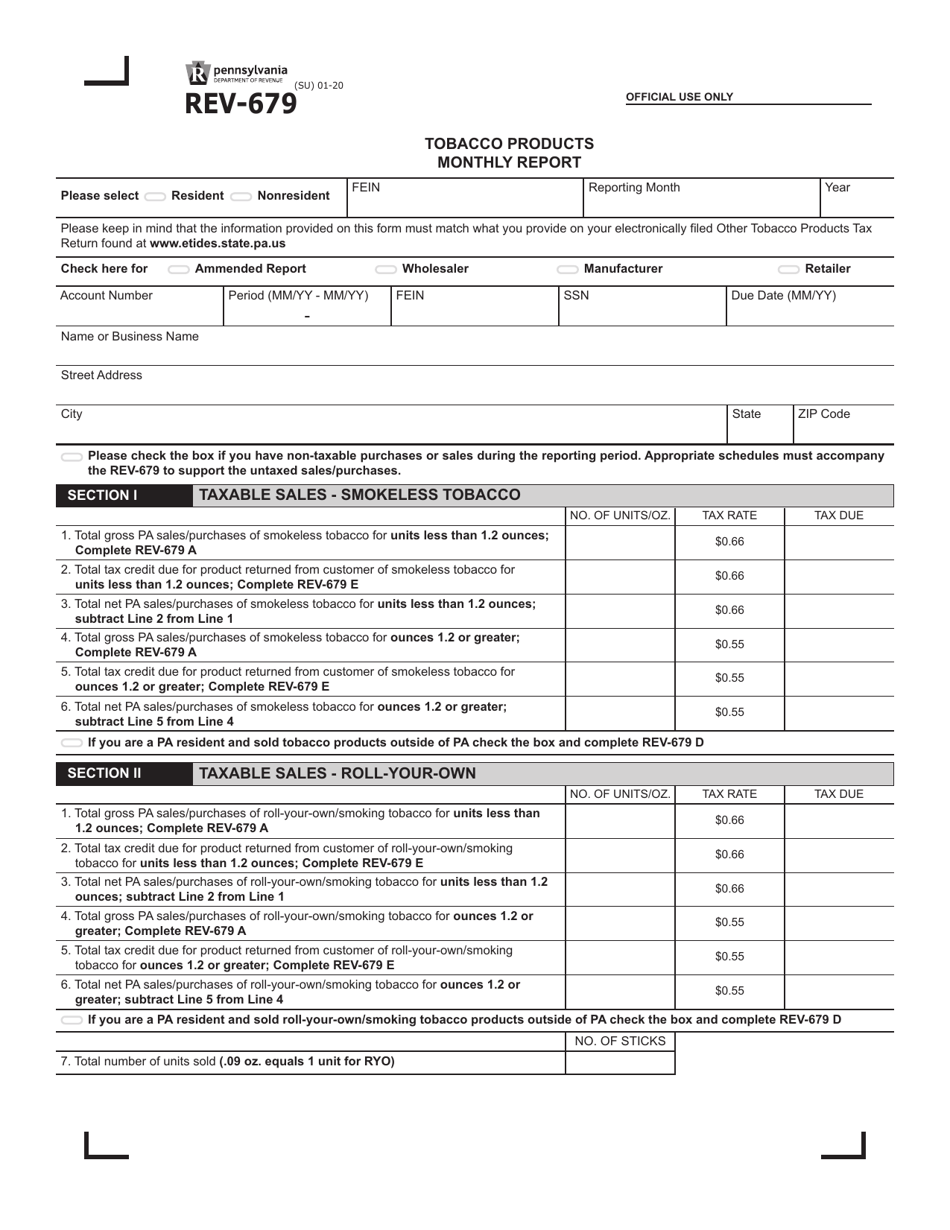

Form REV-679

for the current year.

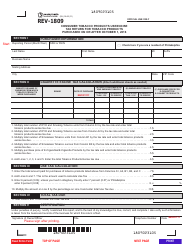

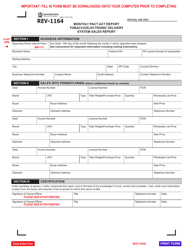

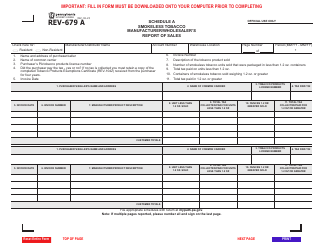

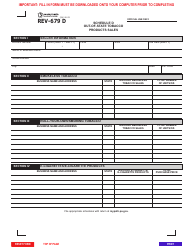

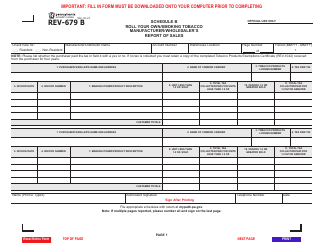

Form REV-679 Tobacco Products Monthly Report - Pennsylvania

What Is Form REV-679?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

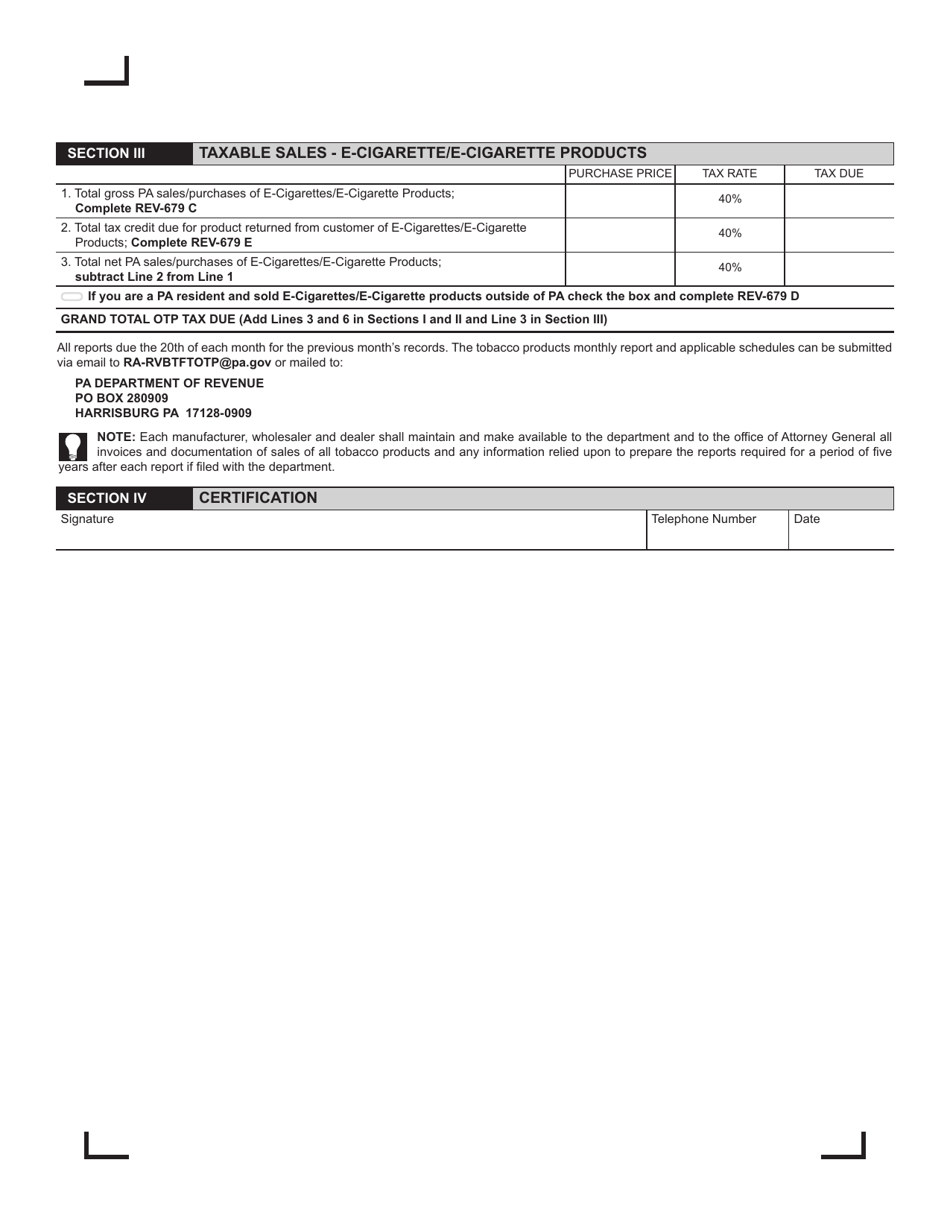

Q: What is the REV-679 Tobacco Products Monthly Report?

A: The REV-679 Tobacco Products Monthly Report is a form used by businesses in Pennsylvania to report their sales and use of tobacco products.

Q: Who needs to file the REV-679 Tobacco Products Monthly Report?

A: Any business in Pennsylvania that sells or uses tobacco products is required to file the REV-679 Tobacco Products Monthly Report.

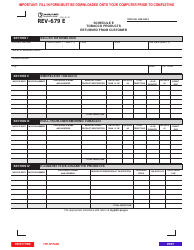

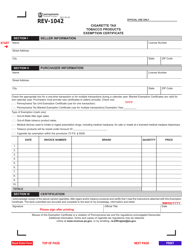

Q: What information is required on the REV-679 Tobacco Products Monthly Report?

A: The report requires information such as the quantity of tobacco products sold or used, the amount of tax due, and other related details.

Q: When is the deadline to file the REV-679 Tobacco Products Monthly Report?

A: The deadline to file the REV-679 Tobacco Products Monthly Report is usually the 20th day of the month following the reporting period.

Q: Are there any penalties for not filing the REV-679 Tobacco Products Monthly Report?

A: Yes, businesses that fail to file the REV-679 Tobacco Products Monthly Report may be subject to penalties and interest on unpaid taxes.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV-679 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.