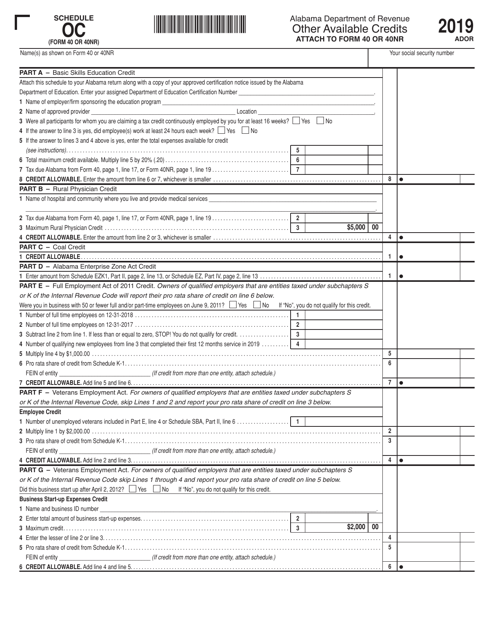

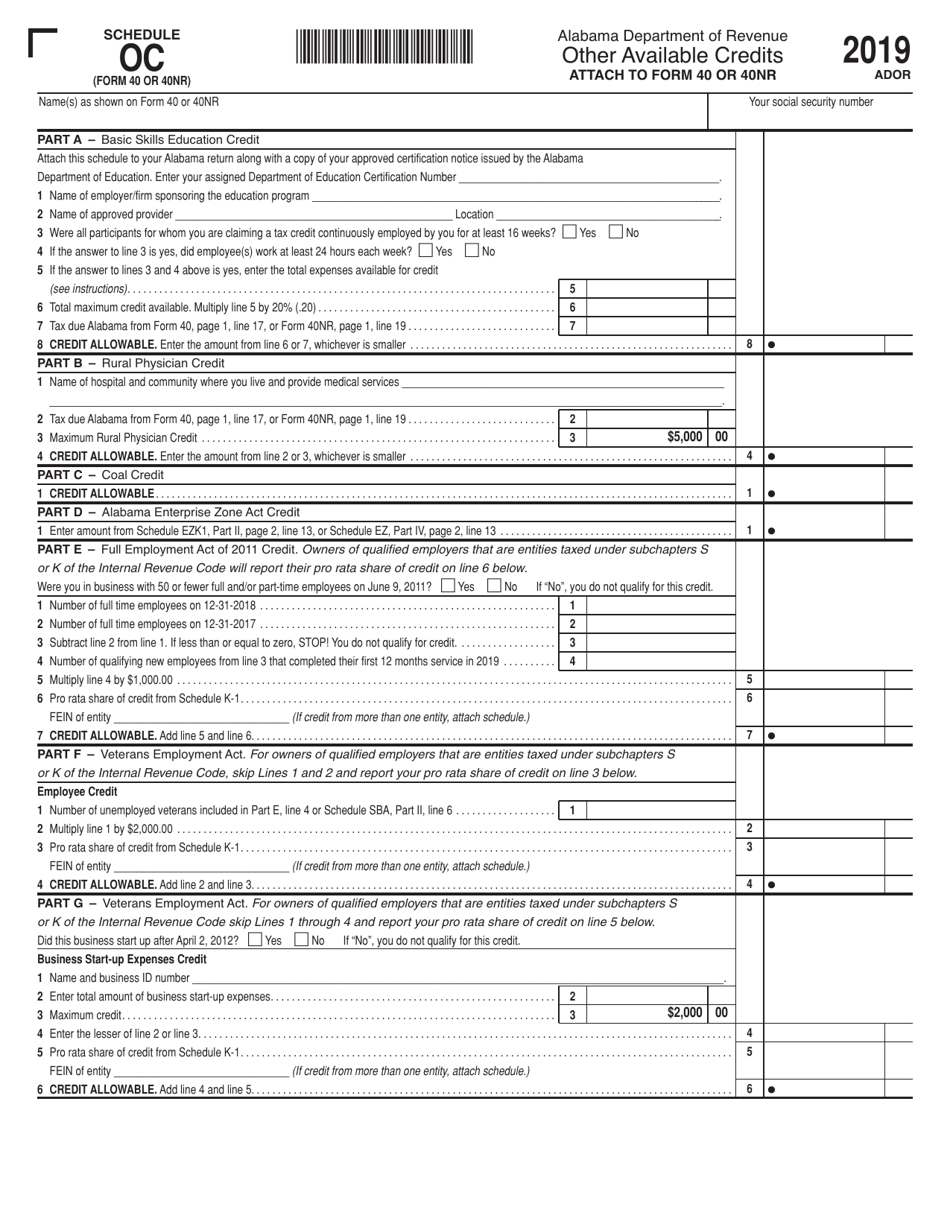

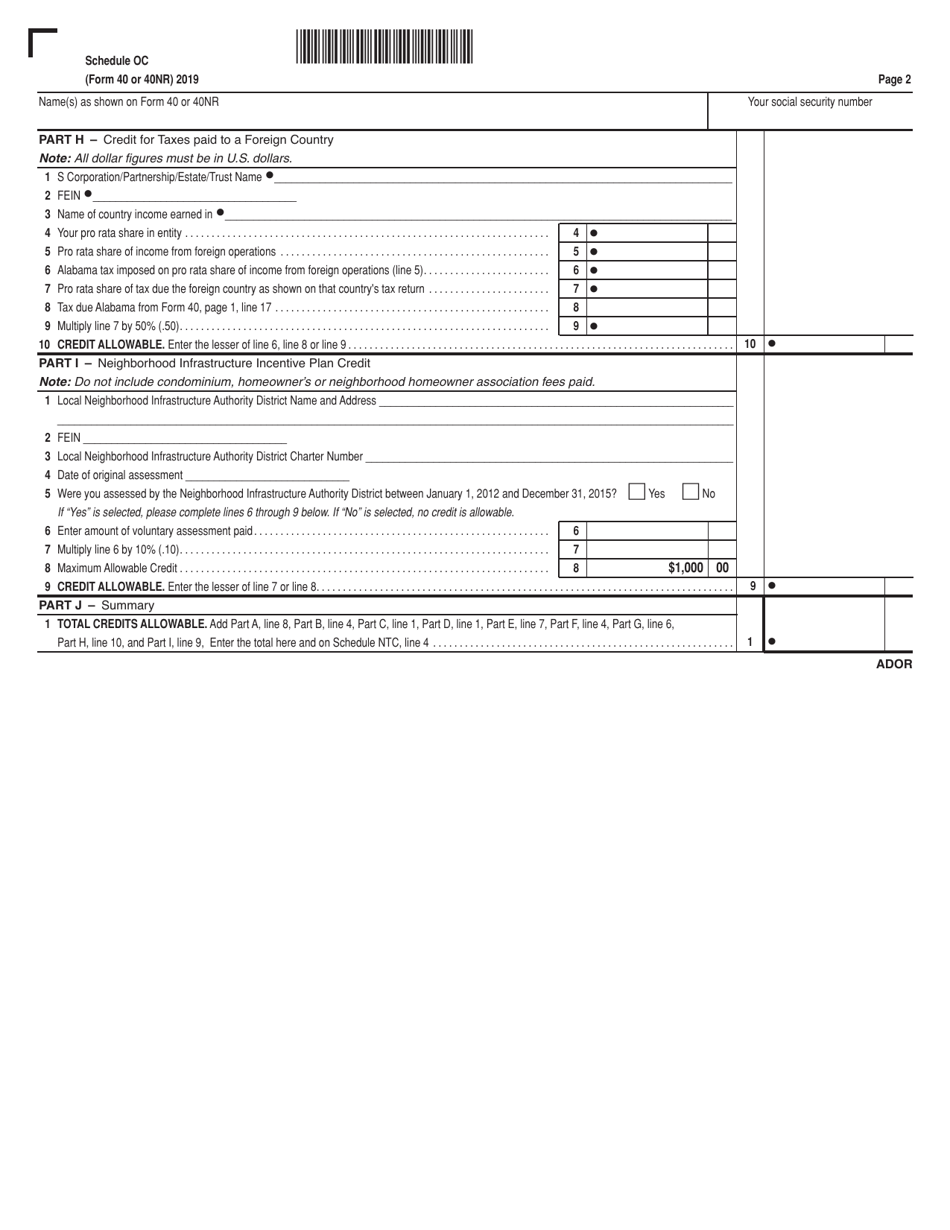

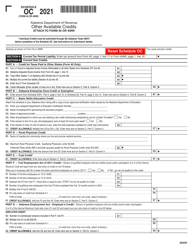

Schedule OC Other Available Credits - Alabama

What Is Schedule OC?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule OC?

A: Schedule OC is a part of the tax return form in Alabama.

Q: What are Other Available Credits?

A: Other Available Credits are tax credits that individuals can claim on their Alabama tax returns.

Q: How do I know if I am eligible for Other Available Credits?

A: You can check the instructions on Schedule OC or consult a tax professional for eligibility requirements.

Q: What types of credits can I claim on Schedule OC?

A: Some common types of credits that can be claimed on Schedule OC include the Adoption Credit, Contribution to Scholarship Granting Organization Credit, or the Residential Energy Credit.

Q: Is there a limit to the amount of credits I can claim?

A: Yes, there may be limitations on the amount of credits you can claim. Refer to the instructions on Schedule OC or consult a tax professional for more information.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule OC by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.