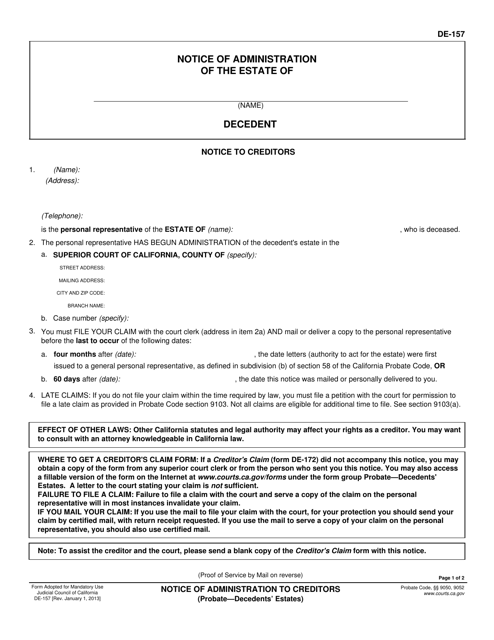

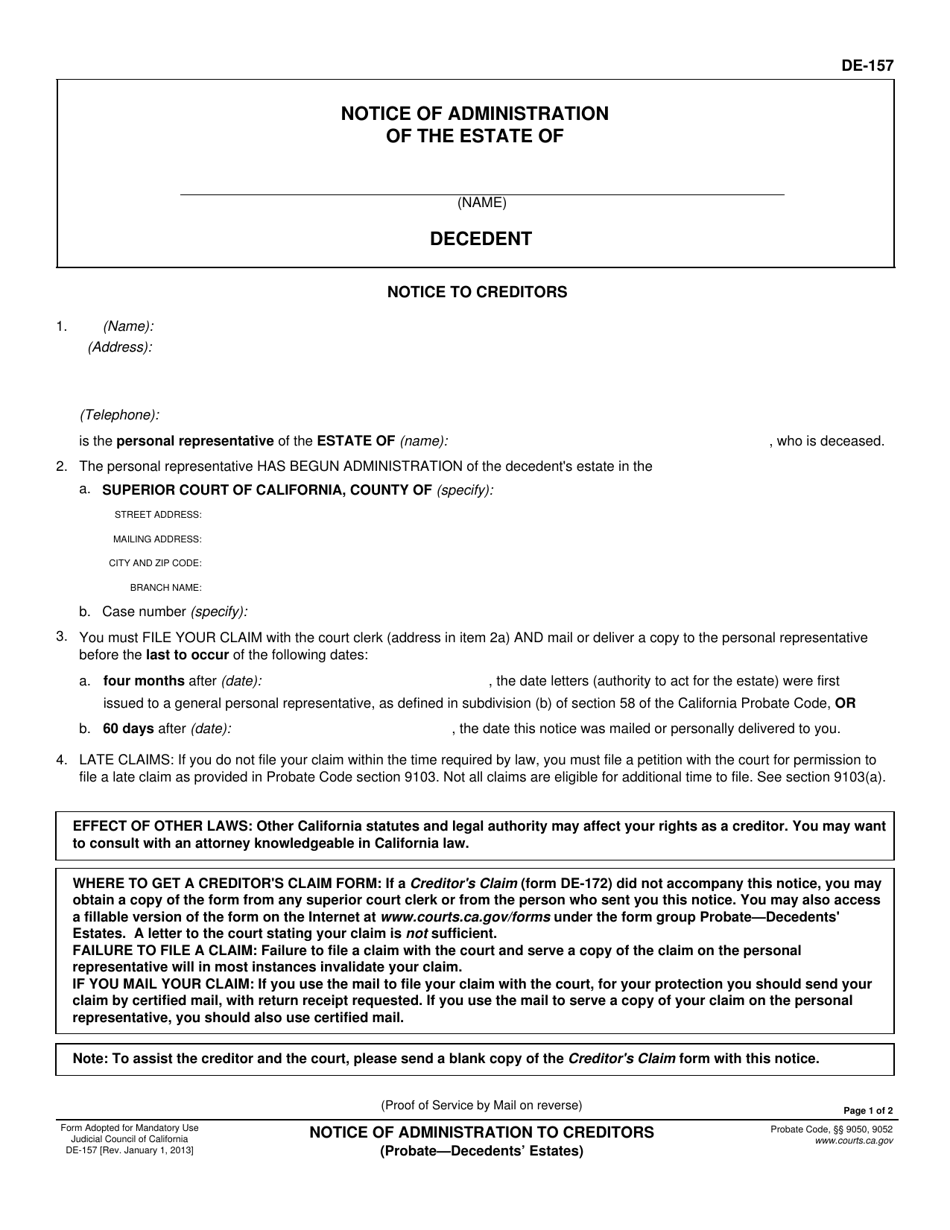

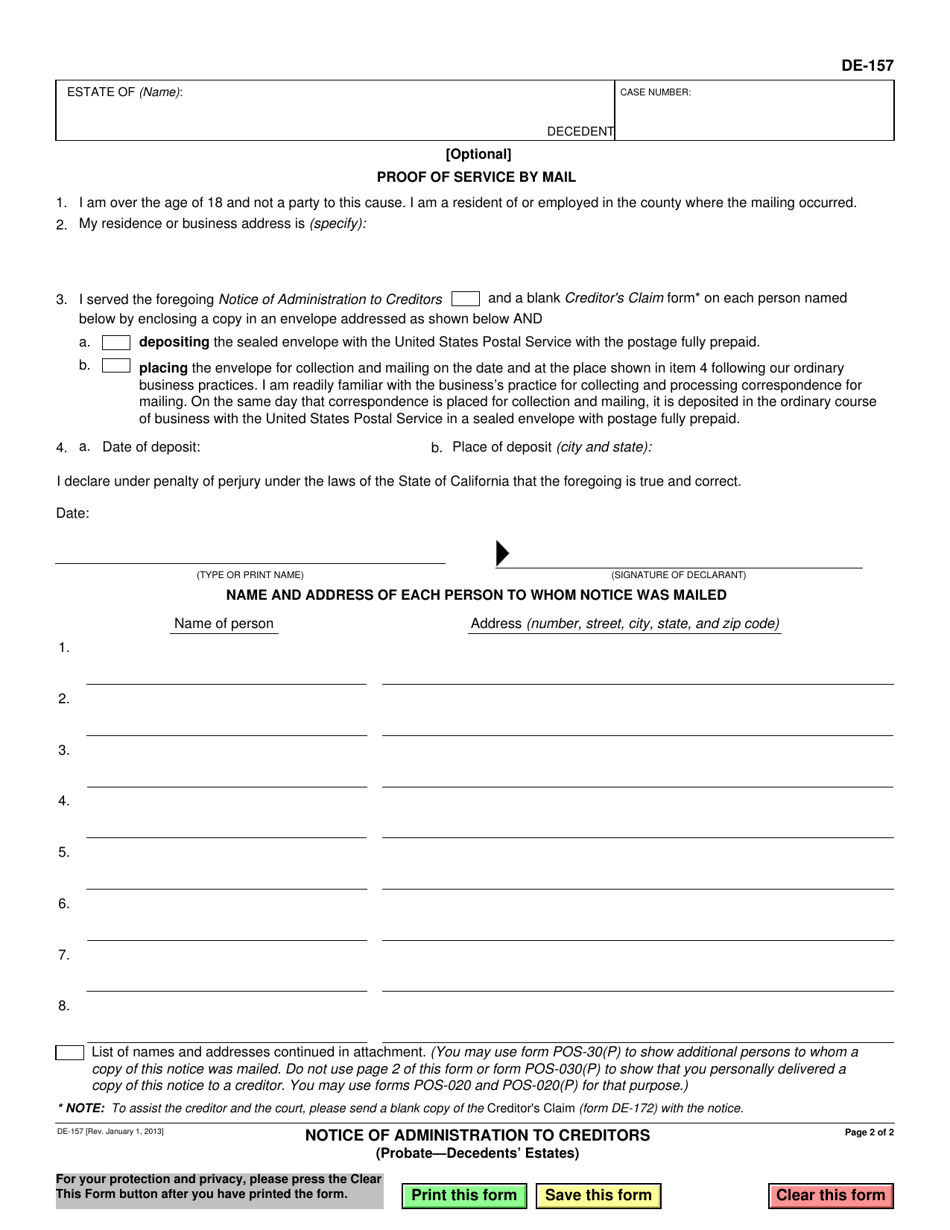

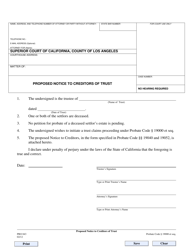

Form DE-157 Notice of Administration to Creditors - California

What Is Form DE-157?

This is a legal form that was released by the California Judicial Branch - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DE-157?

A: Form DE-157 is a Notice of Administration to Creditors form in California.

Q: What is the purpose of Form DE-157?

A: The purpose of Form DE-157 is to notify creditors of the administration of a decedent's estate.

Q: Who needs to file Form DE-157?

A: The Personal Representative of the decedent's estate is responsible for filing Form DE-157.

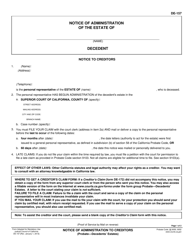

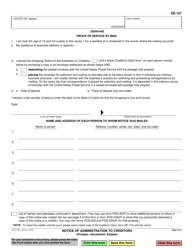

Q: What information is required on Form DE-157?

A: Form DE-157 requires information about the decedent, the Personal Representative, the estate assets, and the creditors.

Q: Is there a deadline for filing Form DE-157?

A: Yes, Form DE-157 should be filed within 60 days from the date Letters of Administration or Letters Testamentary are issued.

Q: What happens after filing Form DE-157?

A: After filing Form DE-157, the Personal Representative is required to publish the notice in a newspaper of general circulation in the county where the decedent resided.

Q: Are there any fees associated with filing Form DE-157?

A: Yes, there may be filing fees associated with submitting Form DE-157. The fees vary by county, so it is best to check with the local Superior Court for the exact amount.

Q: Are there any additional requirements for notifying creditors?

A: Yes, in addition to filing Form DE-157, the Personal Representative must also send a copy of the notice to any known creditors by mail.

Q: What happens if a creditor fails to submit a claim?

A: If a creditor fails to submit a claim within the required time frame, they may be barred from collecting any debts from the decedent's estate.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the California Judicial Branch;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DE-157 by clicking the link below or browse more documents and templates provided by the California Judicial Branch.