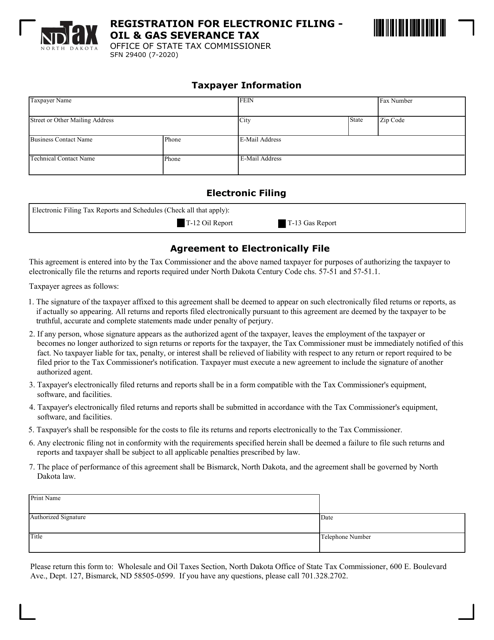

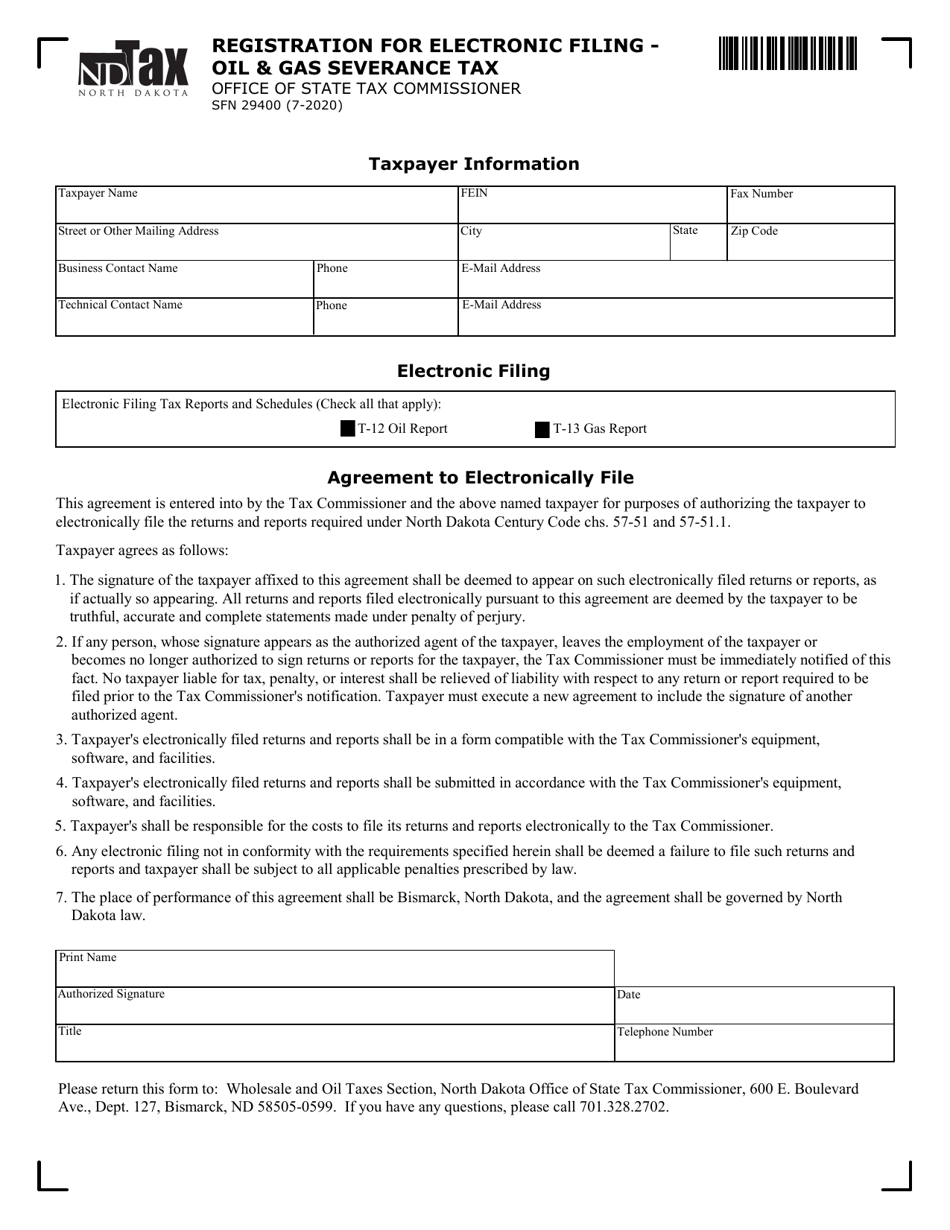

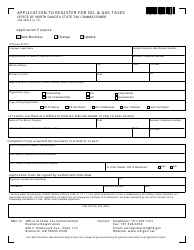

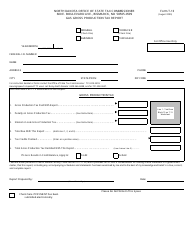

Form SFN29400 Registration for Electronic Filing - Oil & Gas Severance Tax - North Dakota

What Is Form SFN29400?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form SFN29400?

A: Form SFN29400 is the registration form for electronic filing of Oil & Gas Severance Tax in North Dakota.

Q: Who needs to file form SFN29400?

A: Any individual or business that is subject to the Oil & Gas Severance Tax in North Dakota and wants to file electronically needs to complete form SFN29400.

Q: What is the purpose of filing form SFN29400?

A: The purpose of filing form SFN29400 is to register for electronic filing of the Oil & Gas Severance Tax in North Dakota.

Q: Is electronic filing mandatory for Oil & Gas Severance Tax in North Dakota?

A: No, electronic filing is not mandatory. However, completing form SFN29400 is necessary if you want to file electronically.

Q: Are there any fees associated with filing form SFN29400?

A: No, there are no fees associated with filing form SFN29400. It is simply a registration form for electronic filing.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN29400 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.