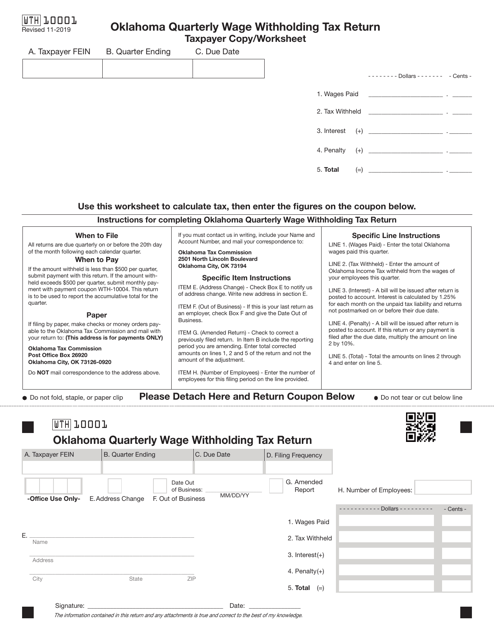

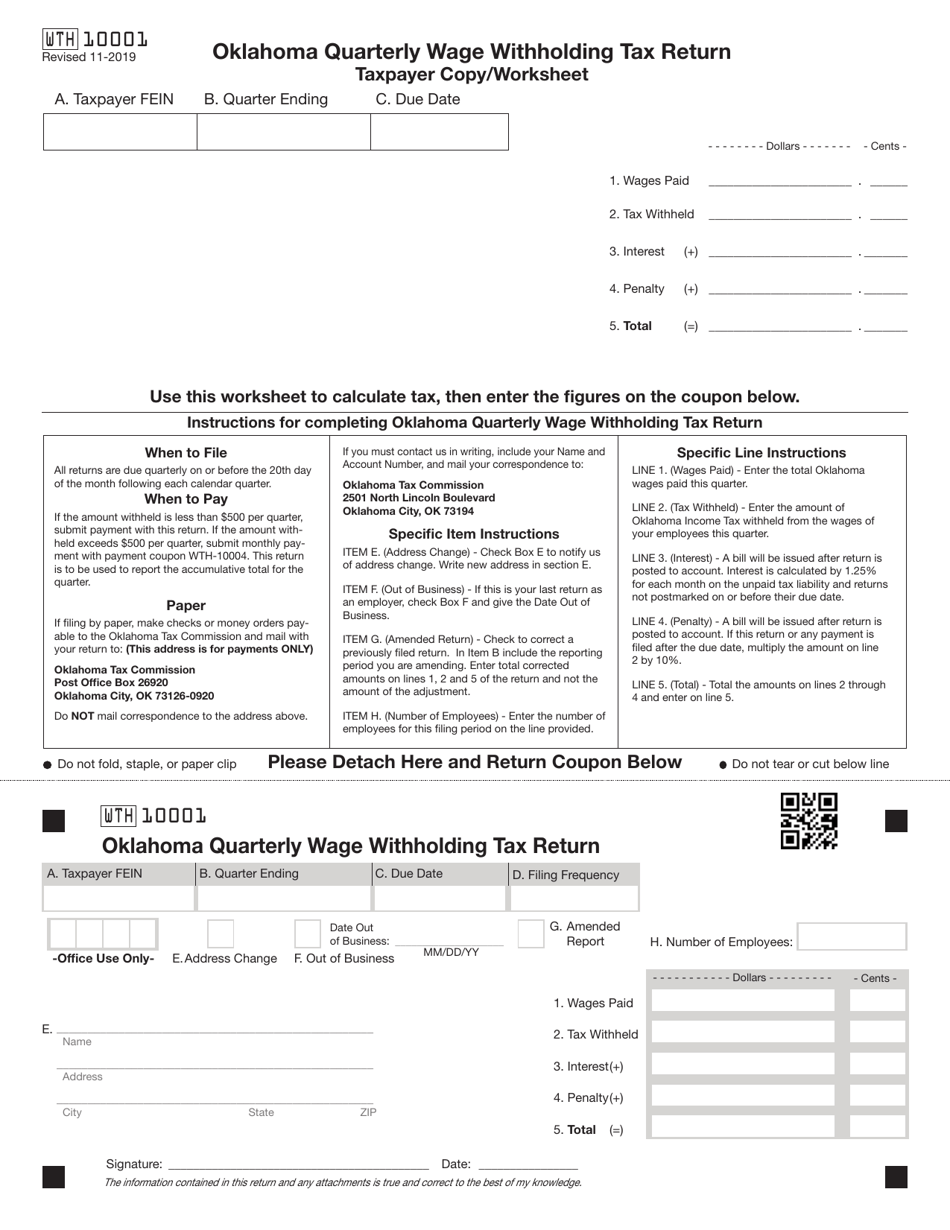

Form WTH10001 Oklahoma Quarterly Wage Withholding Tax Return - Oklahoma

What Is Form WTH10001?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WTH10001?

A: Form WTH10001 is the Oklahoma Quarterly WageWithholding Tax Return.

Q: Who needs to file Form WTH10001?

A: Employers in Oklahoma who withhold income tax from their employees' wages are required to file Form WTH10001.

Q: What is the purpose of filing Form WTH10001?

A: The purpose of filing Form WTH10001 is to report the amount of income tax withheld from employees' wages and remit the tax to the state of Oklahoma.

Q: When is Form WTH10001 due?

A: Form WTH10001 is due on a quarterly basis. The due dates are April 30th, July 31st, October 31st, and January 31st.

Q: How do I fill out Form WTH10001?

A: Form WTH10001 requires you to provide information about your business, employee wages, and the amount of income tax withheld. It is important to complete all sections accurately and thoroughly.

Q: What happens if I fail to file Form WTH10001?

A: Failure to file Form WTH10001 or pay the required amount of income tax may result in penalties and interest charges.

Q: Can I amend Form WTH10001 if I made a mistake?

A: Yes, you can file an amended Form WTH10001 to correct any errors or omissions. Be sure to clearly indicate that it is an amended return.

Q: Who can I contact for more information about Form WTH10001?

A: You can contact the Oklahoma Tax Commission directly for more information or assistance with Form WTH10001.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WTH10001 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.