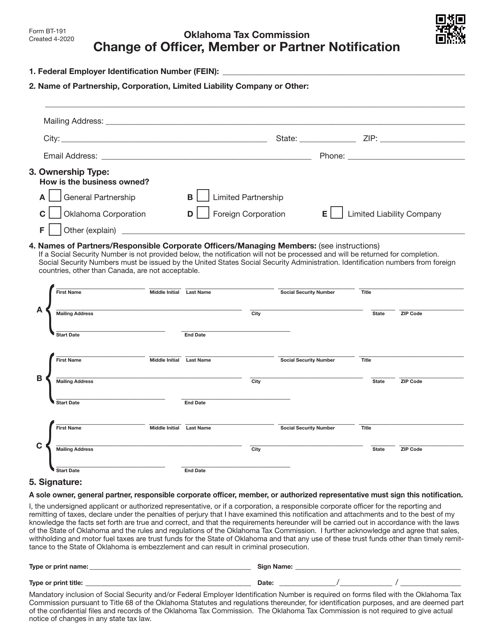

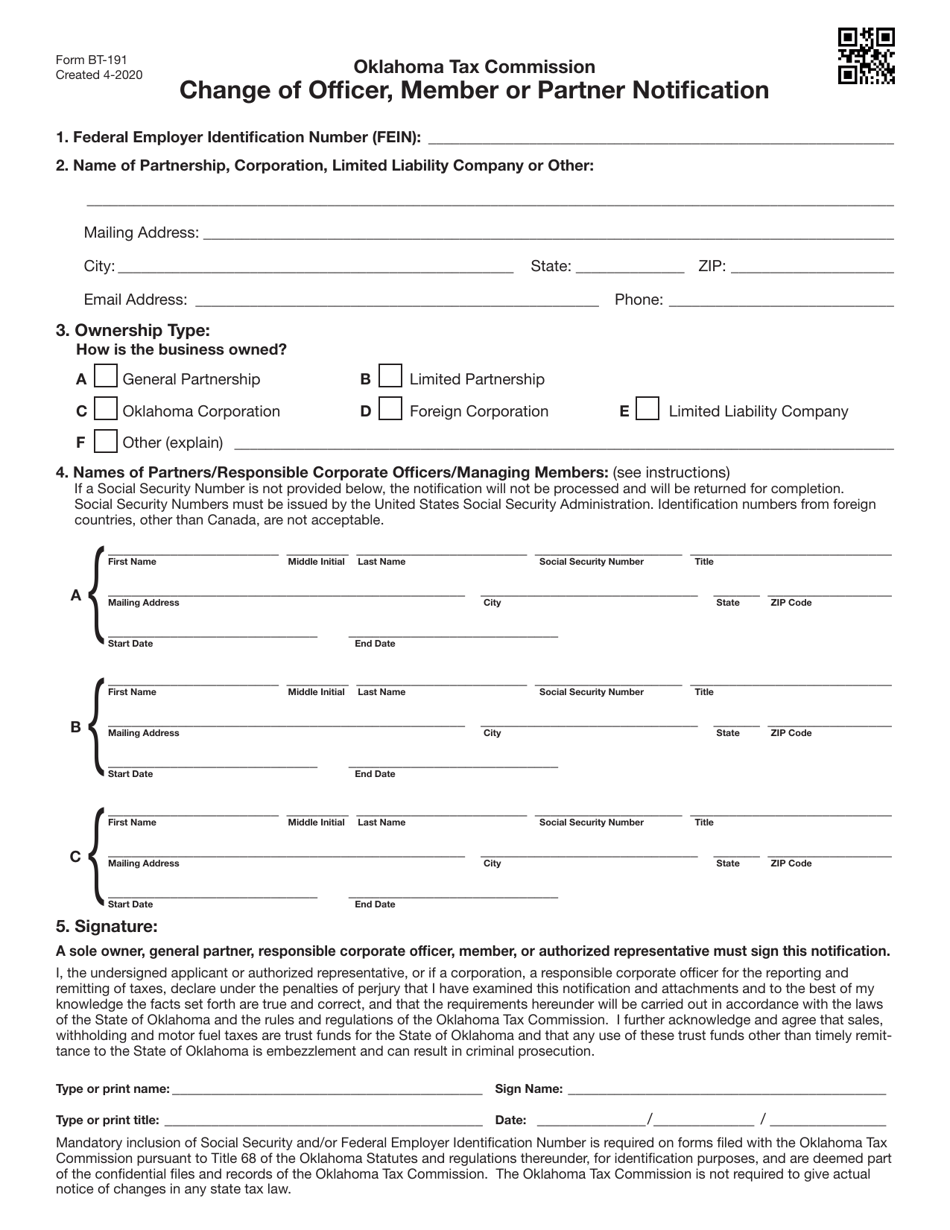

Form BT-191 Change of Officer, Member or Partner Notification - Oklahoma

What Is Form BT-191?

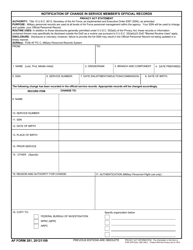

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BT-191?

A: Form BT-191 is a Change of Officer, Member, or Partner Notification form used in Oklahoma.

Q: Why would I need to fill out Form BT-191?

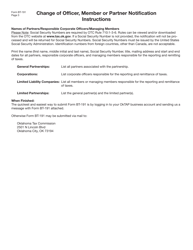

A: You would need to fill out Form BT-191 if there are any changes to the officers, members, or partners of your business in Oklahoma.

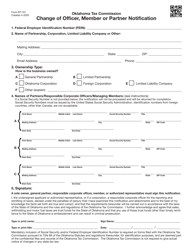

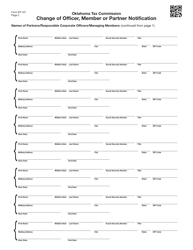

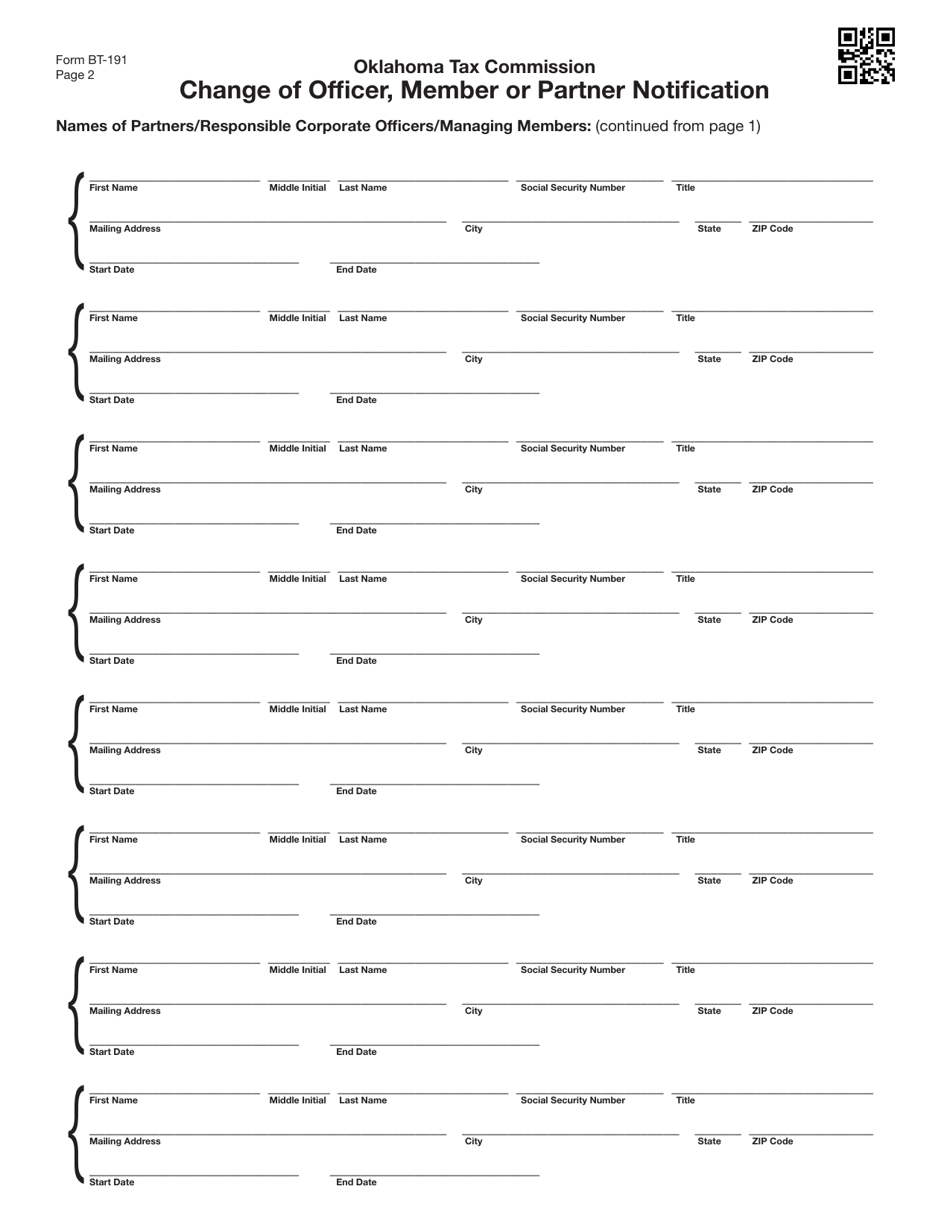

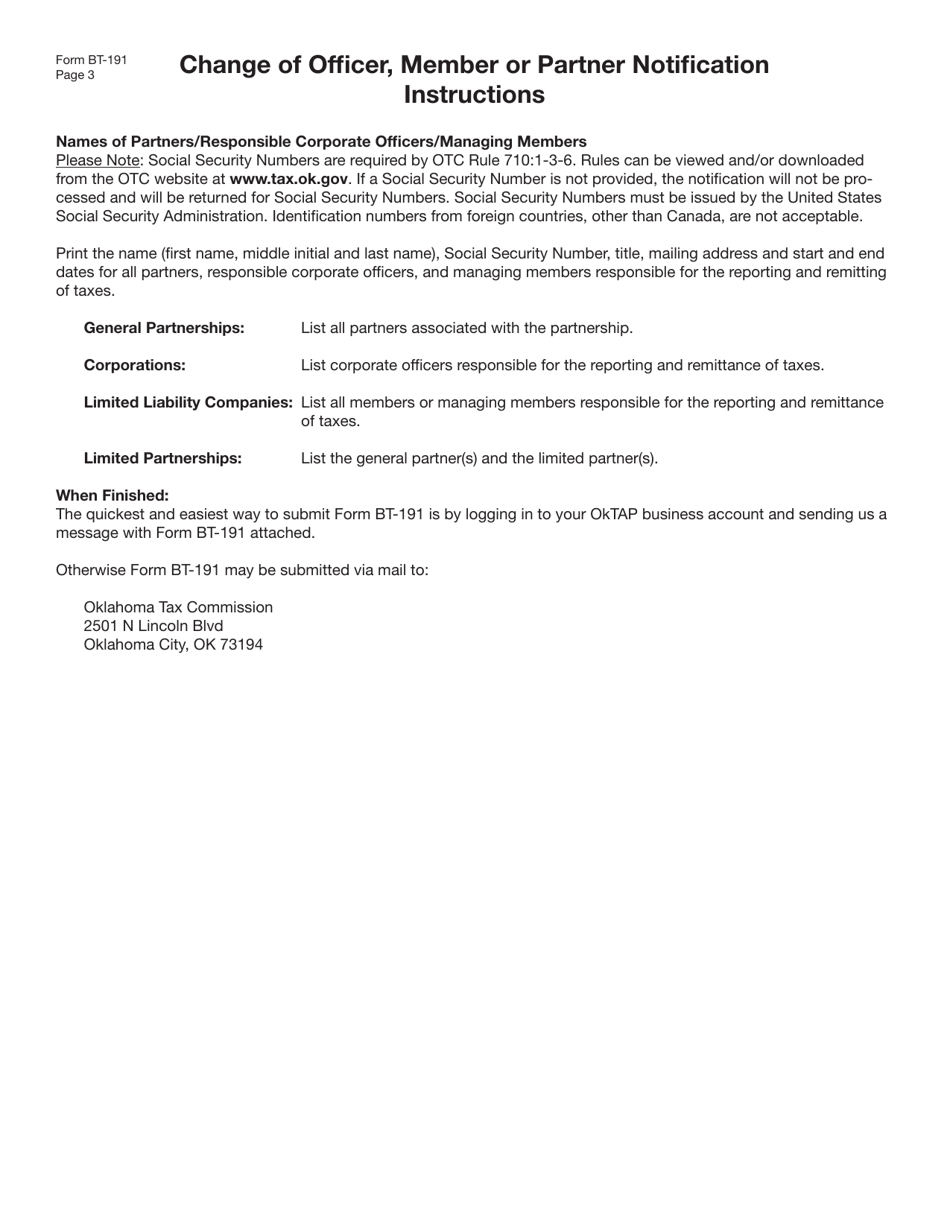

Q: What information do I need to provide on Form BT-191?

A: You will need to provide information such as the name of the business, the old and new officers, members, or partners, and their respective positions or ownership percentages.

Q: Is Form BT-191 only for businesses registered in Oklahoma?

A: Yes, Form BT-191 is specifically for businesses registered in Oklahoma.

Q: Are there any penalties for not filing Form BT-191?

A: Failure to file Form BT-191 and update the changes in officers, members, or partners of your business can result in penalties and legal consequences.

Q: How long does it take for Form BT-191 to be processed?

A: The processing time for Form BT-191 can vary, but it typically takes several business days.

Q: Can I make changes to Form BT-191 after submitting?

A: Once you submit Form BT-191, it may not be possible to make changes. It is important to review the form before submission to ensure accuracy.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BT-191 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.