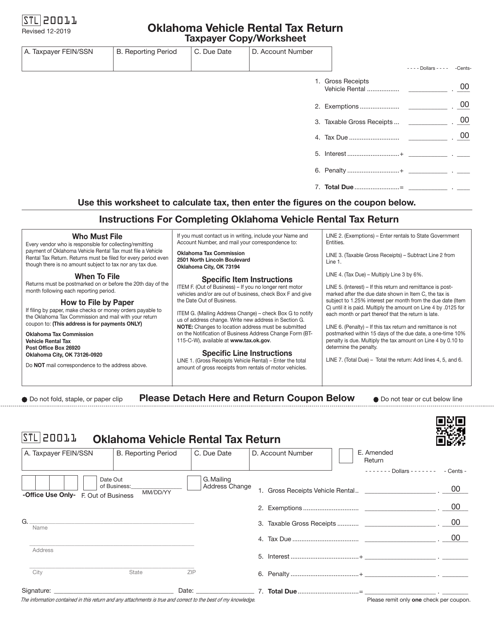

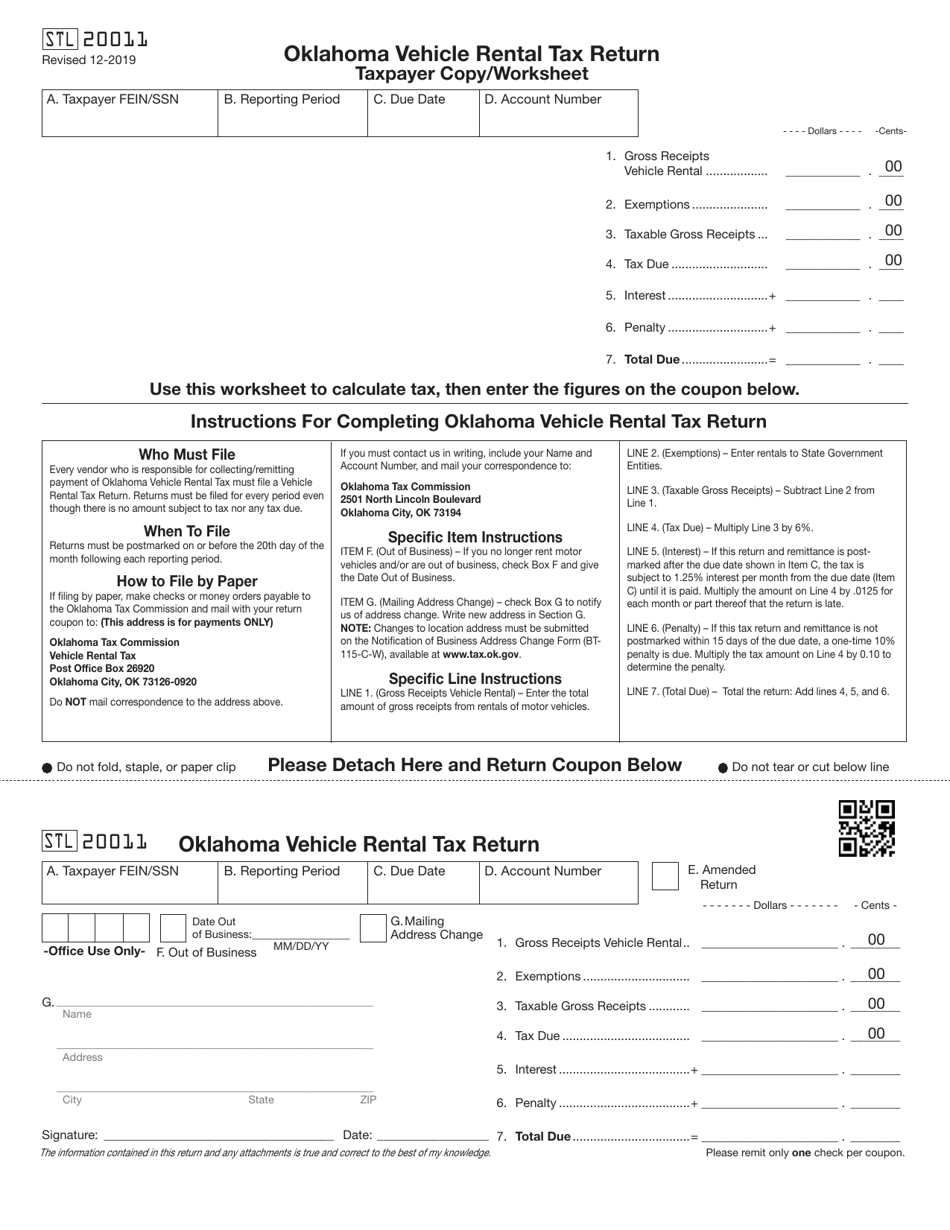

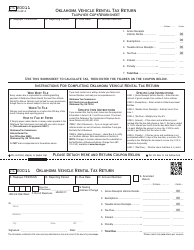

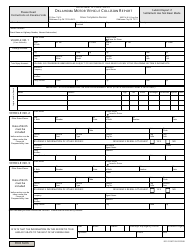

Form STL20011 Oklahoma Vehicle Rental Tax Return (Taxpayer Copy / Worksheet) - Oklahoma

What Is Form STL20011?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is STL20011?

A: STL20011 is the form to file the Oklahoma Vehicle Rental Tax Return.

Q: Who should use STL20011?

A: Any individual or business that rents vehicles in Oklahoma should use STL20011.

Q: What is the purpose of filing the Oklahoma Vehicle Rental Tax Return?

A: The purpose is to report and pay the vehicle rental tax owed to the state of Oklahoma.

Q: What is the due date for filing the Oklahoma Vehicle Rental Tax Return?

A: The due date is the 20th of each month for the previous month's rentals.

Q: How do I calculate the amount of vehicle rental tax owed?

A: The tax rate is 3.25% of the rental charges. Multiply the rental charges by 0.0325 to determine the tax amount.

Q: Are there any exemptions or deductions available for the vehicle rental tax?

A: No, there are no exemptions or deductions available for the vehicle rental tax.

Q: What should I do if I have multiple rental locations in Oklahoma?

A: You should total the rental charges and tax collected from all locations and report them on one STL20011 form.

Q: What happens if I fail to file the Oklahoma Vehicle Rental Tax Return or pay the tax by the due date?

A: You may be subject to penalties and interest charges for late filing or payment.

Q: Can I file the Oklahoma Vehicle Rental Tax Return electronically?

A: Yes, you can file the return electronically through the Oklahoma Taxpayer Access Point (OKTAP) system.

Q: Can I claim a refund for overpaid vehicle rental tax?

A: Yes, if you have overpaid the tax, you can claim a refund by filing an amended return.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STL20011 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.