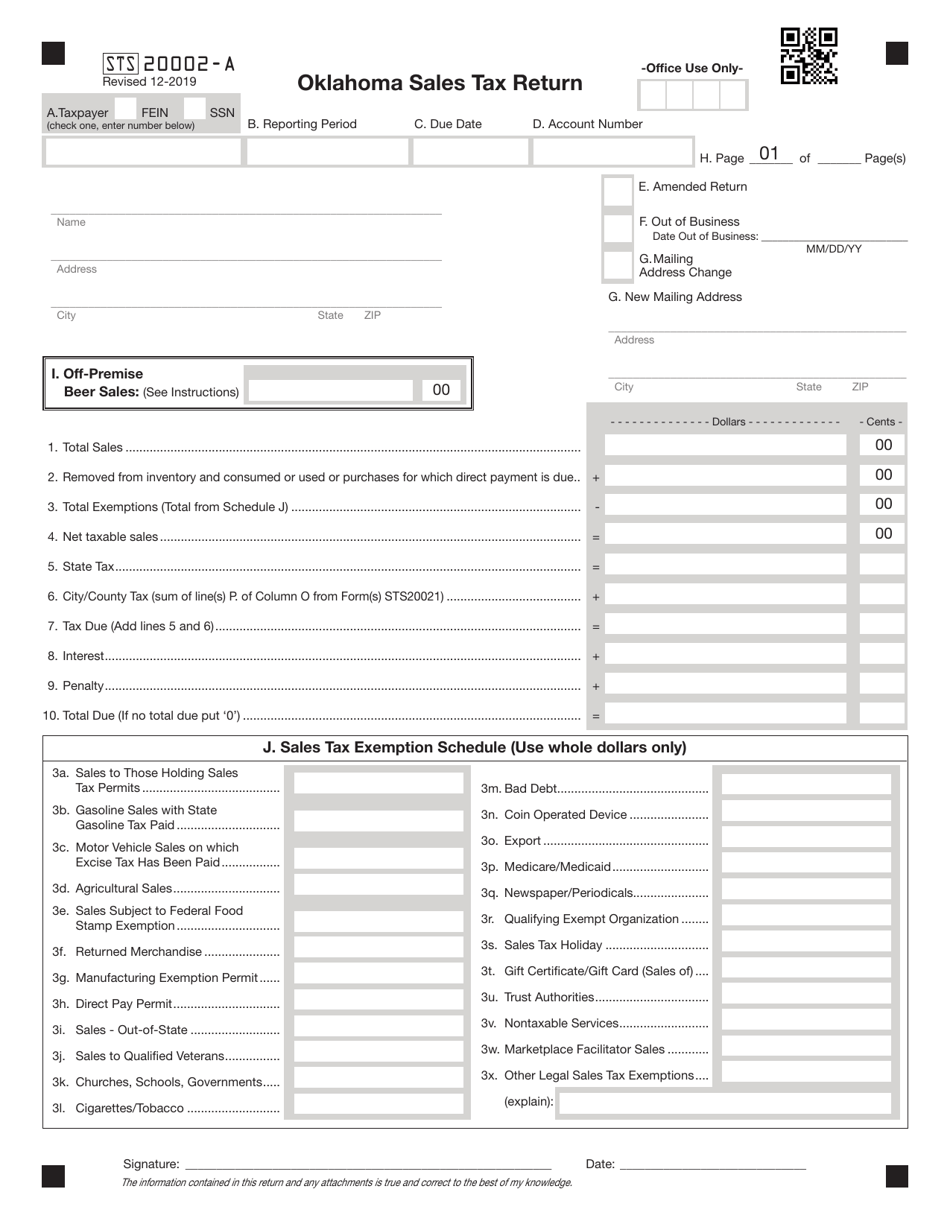

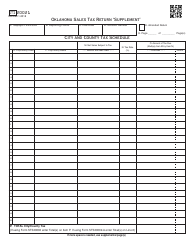

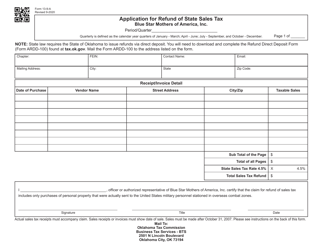

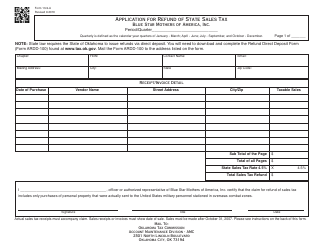

Form STS20002-A Oklahoma Sales Tax Return - Oklahoma

What Is Form STS20002-A?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

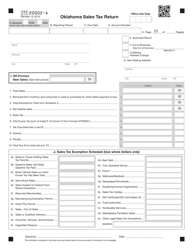

Q: What is Form STS20002-A?

A: Form STS20002-A is the Oklahoma Sales Tax Return.

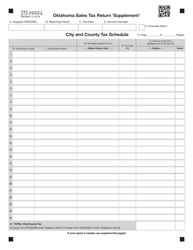

Q: What is the purpose of Form STS20002-A?

A: The purpose of Form STS20002-A is to report and pay sales tax collected on taxable sales in Oklahoma.

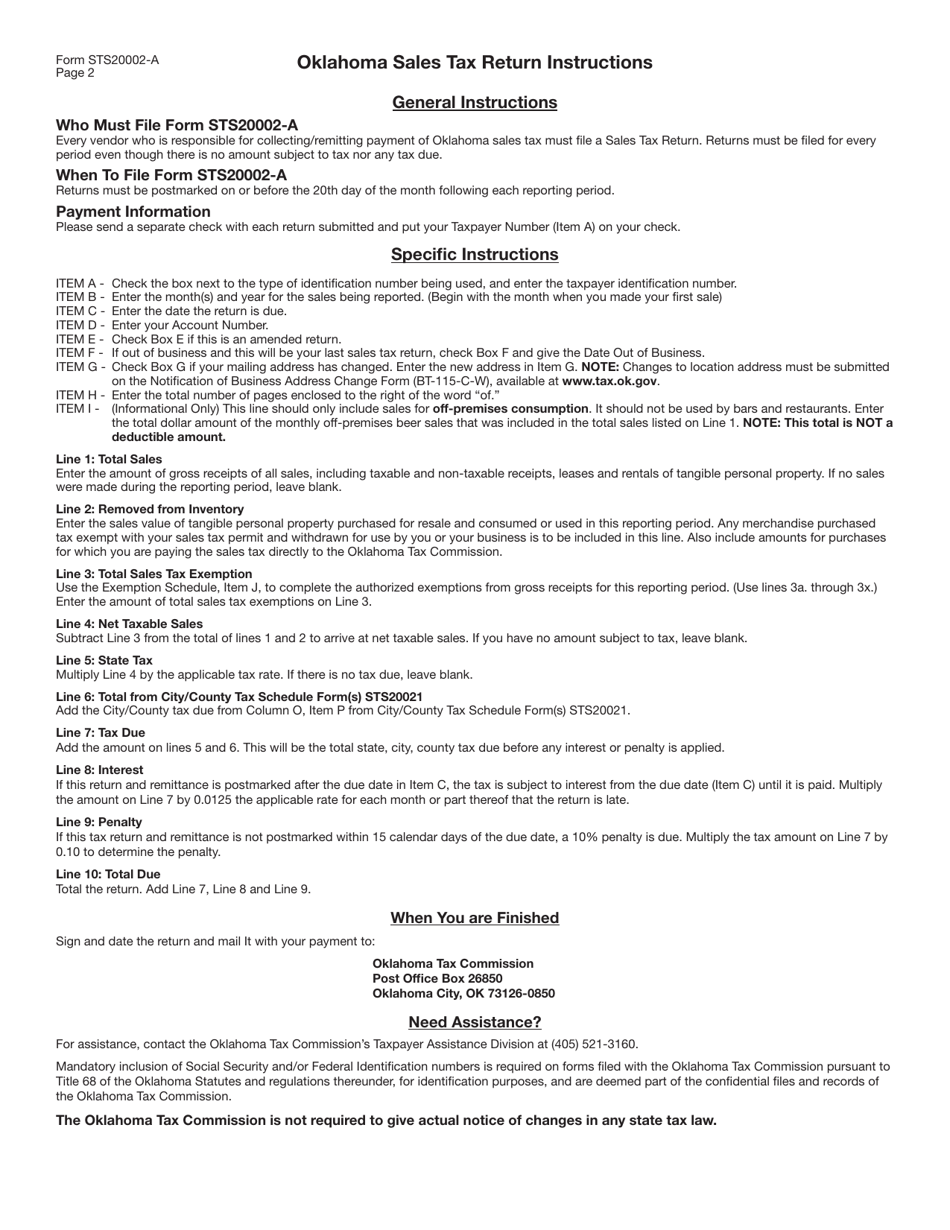

Q: Who needs to file Form STS20002-A?

A: Businesses that are registered for sales tax purposes in Oklahoma and have collected sales tax during the reporting period need to file Form STS20002-A.

Q: When is Form STS20002-A due?

A: Form STS20002-A is due on the 20th day of the month following the end of the reporting period.

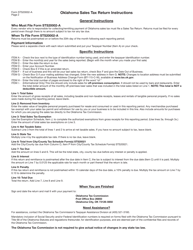

Q: Are there any penalties for late filing of Form STS20002-A?

A: Yes, there are penalties for late filing, including interest charges on the unpaid tax amount.

Q: What should I do if I have questions about Form STS20002-A?

A: If you have questions about Form STS20002-A, you can contact the Oklahoma Tax Commission for assistance.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STS20002-A by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.