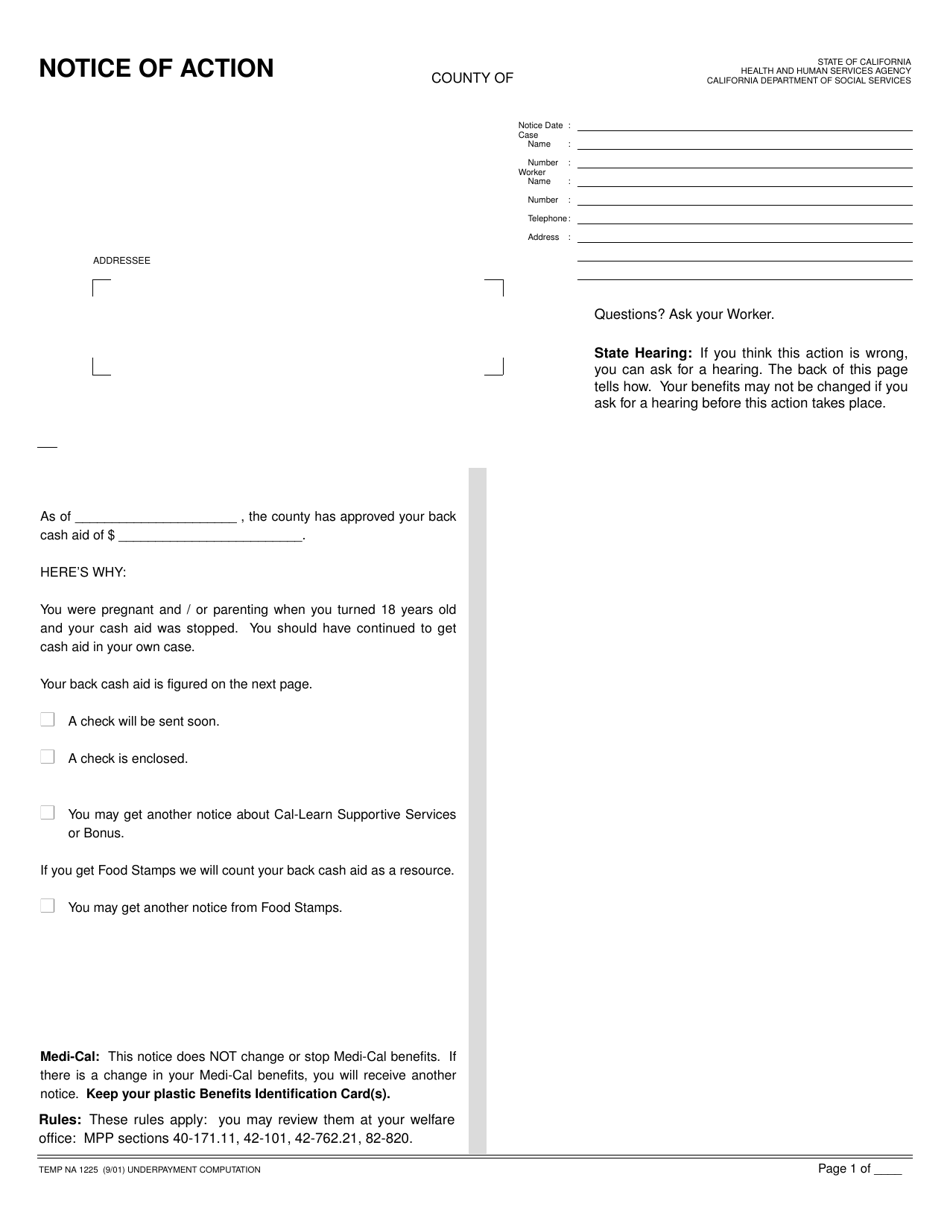

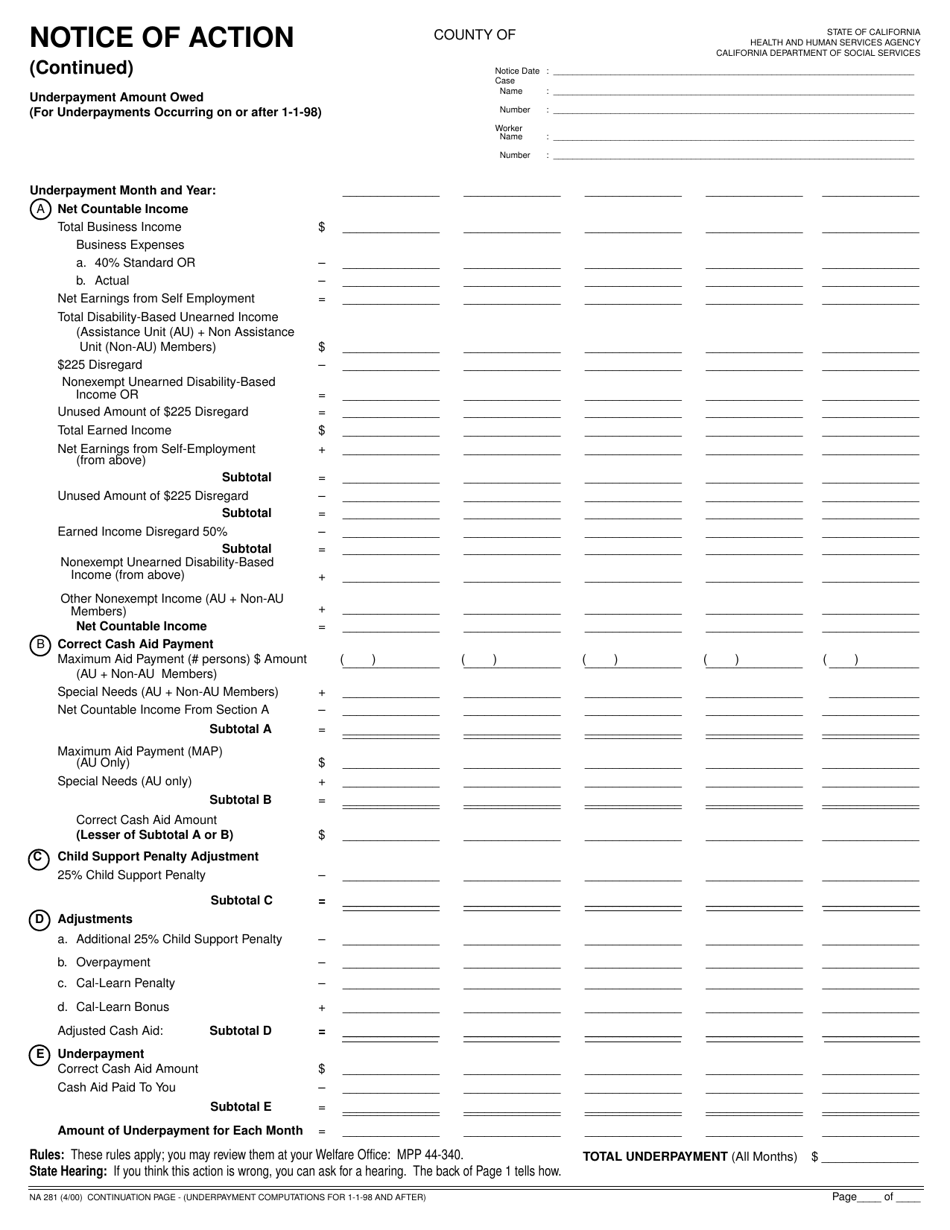

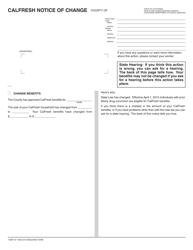

Form TEMP NA1225 Notice of Change - Underpayment Computation - California

What Is Form TEMP NA1225?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

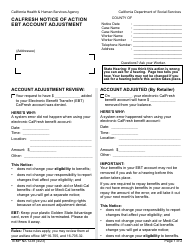

Q: What is the TEMP NA1225 Notice of Change?

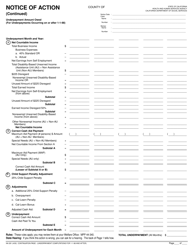

A: The TEMP NA1225 Notice of Change is a form used for underpayment computation in California.

Q: What does the form TEMP NA1225 Notice of Change do?

A: The form TEMP NA1225 Notice of Change is used to calculate underpayment of taxes in California.

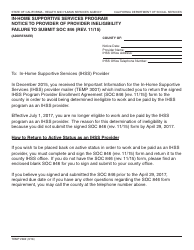

Q: Who uses the TEMP NA1225 Notice of Change form?

A: The TEMP NA1225 Notice of Change form is used by individuals and businesses in California.

Q: What is underpayment computation?

A: Underpayment computation is the calculation of any unpaid taxes that should have been paid throughout the year.

Q: Why would someone receive a TEMP NA1225 Notice of Change?

A: Someone may receive a TEMP NA1225 Notice of Change if they have underreported or underpaid their taxes in California.

Q: How should someone respond to a TEMP NA1225 Notice of Change?

A: Someone should carefully review the notice, verify the information, and respond accordingly, providing any necessary documentation or payment.

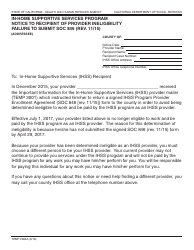

Q: Are there any penalties for underpayment of taxes in California?

A: Yes, there may be penalties and interest charges for underpayment of taxes in California. The specific penalties and interest rates can vary depending on the circumstances.

Q: Can the underpayment of taxes in California be resolved without filling out the TEMP NA1225 form?

A: No, the TEMP NA1225 Notice of Change form must be filled out and submitted to properly address the underpayment of taxes in California.

Form Details:

- Released on September 1, 2001;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TEMP NA1225 by clicking the link below or browse more documents and templates provided by the California Department of Social Services.