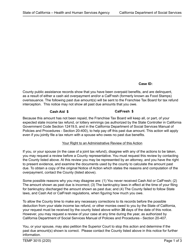

Form TEMP3015A Franchise Tax Board (Ftb) Annual Pre-offset Notice - California

What Is Form TEMP3015A?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

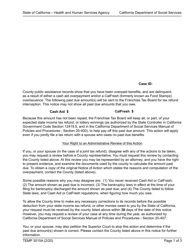

Q: What is the Form TEMP3015A?

A: Form TEMP3015A is the Franchise Tax Board (FTB) Annual Pre-offset Notice for California.

Q: Why did I receive the Form TEMP3015A?

A: You received Form TEMP3015A because you owe unpaid taxes or other debts to the State of California.

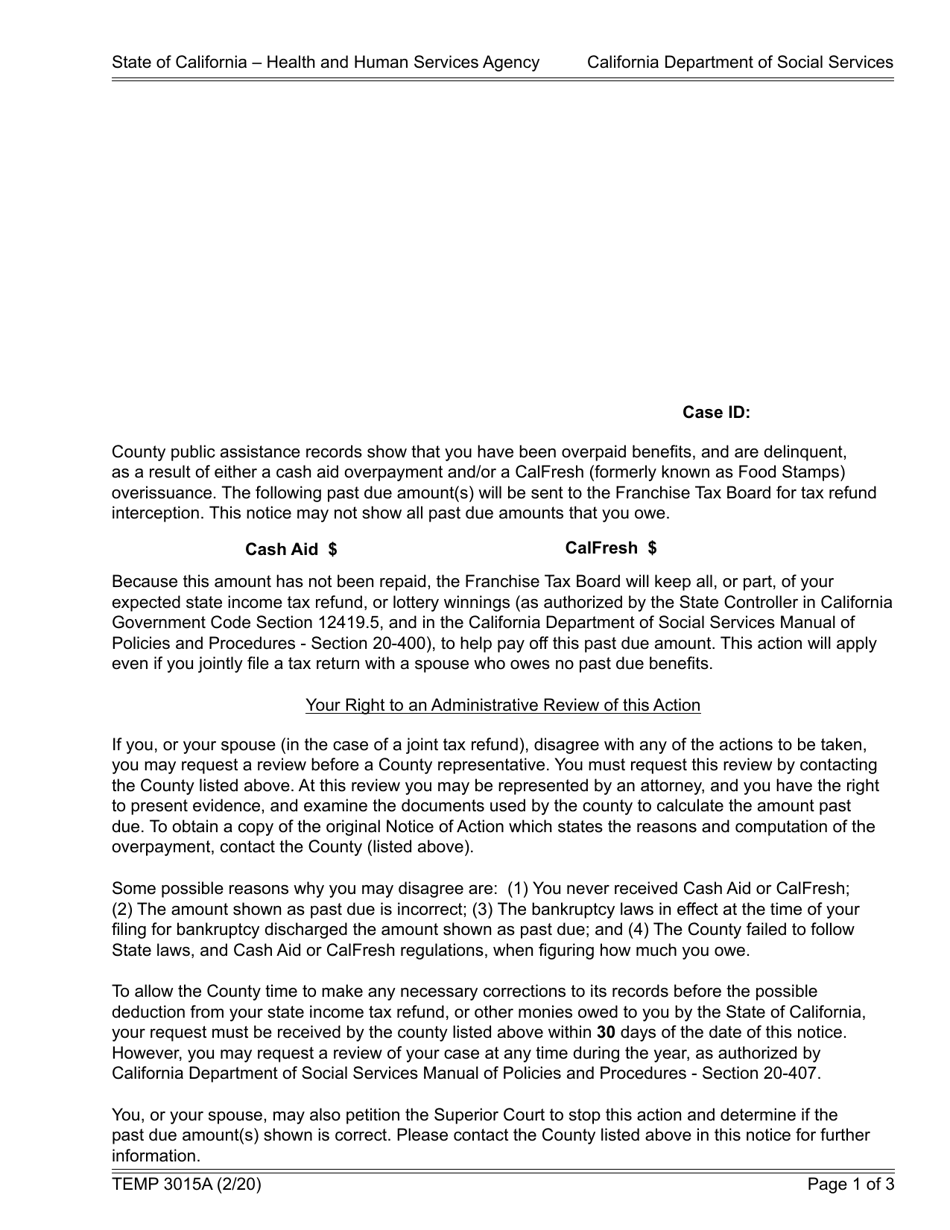

Q: What is the purpose of the Form TEMP3015A?

A: The purpose of Form TEMP3015A is to notify you that your tax refund or other payments may be offset to satisfy your unpaid debts.

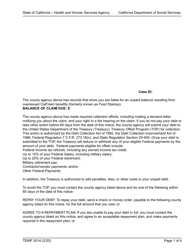

Q: What should I do if I receive the Form TEMP3015A?

A: If you receive Form TEMP3015A, you should review it carefully and take appropriate action to resolve your unpaid debts.

Q: How can I resolve my unpaid debts after receiving the Form TEMP3015A?

A: To resolve your unpaid debts, you can contact the Franchise Tax Board (FTB) for payment options or make arrangements to pay off the debts.

Q: Can I dispute the debts mentioned in the Form TEMP3015A?

A: Yes, you can dispute the debts mentioned in the Form TEMP3015A if you believe there is an error. Contact the FTB for dispute resolution options.

Q: What happens if I don't take any action after receiving the Form TEMP3015A?

A: If you don't take any action after receiving the Form TEMP3015A, the FTB may proceed with offsetting your tax refund or other payments to satisfy the debts.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TEMP3015A by clicking the link below or browse more documents and templates provided by the California Department of Social Services.