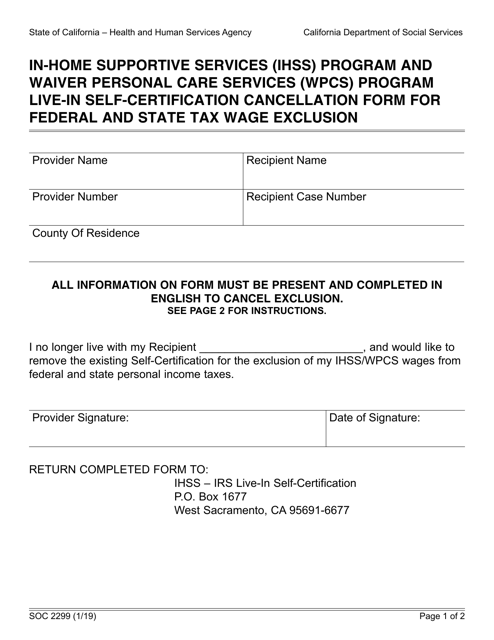

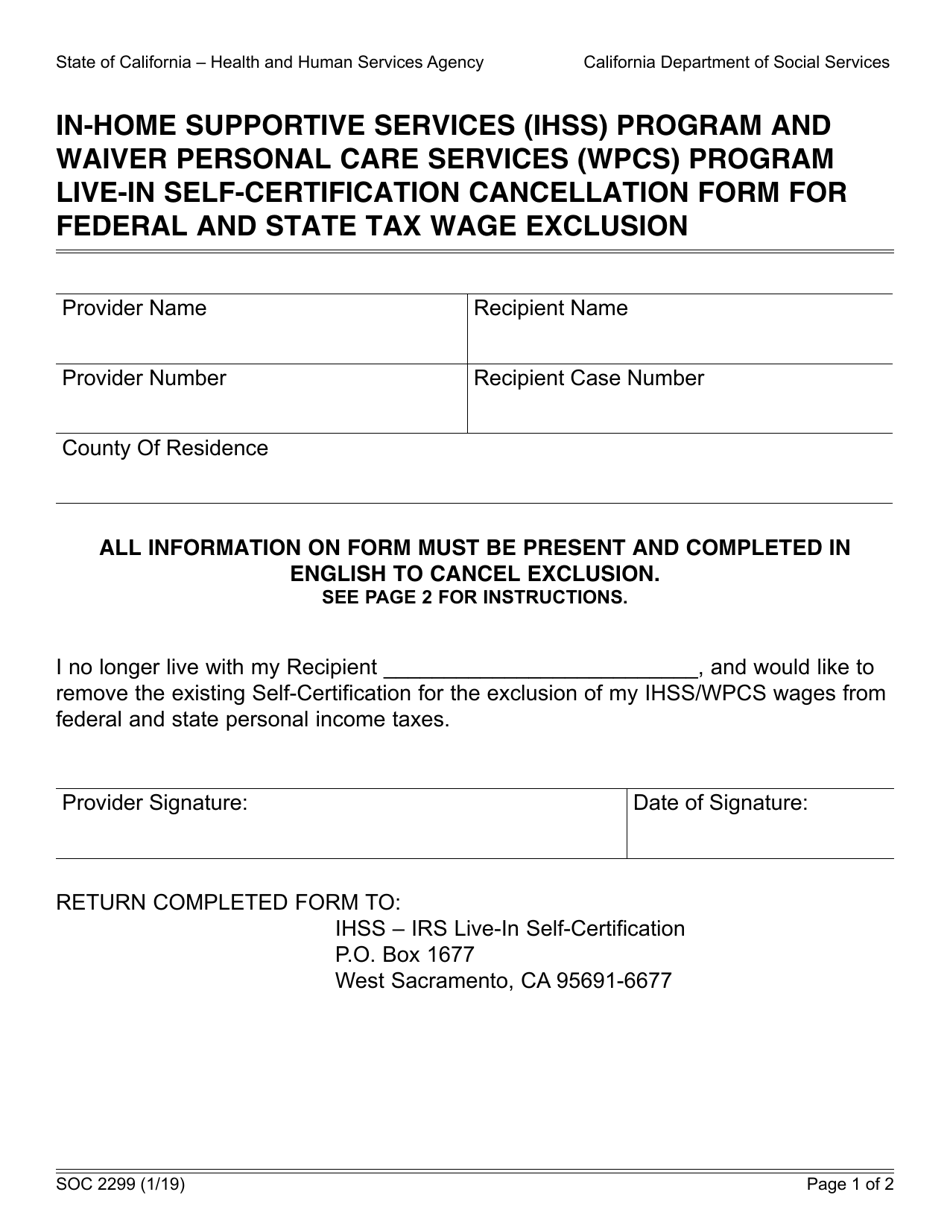

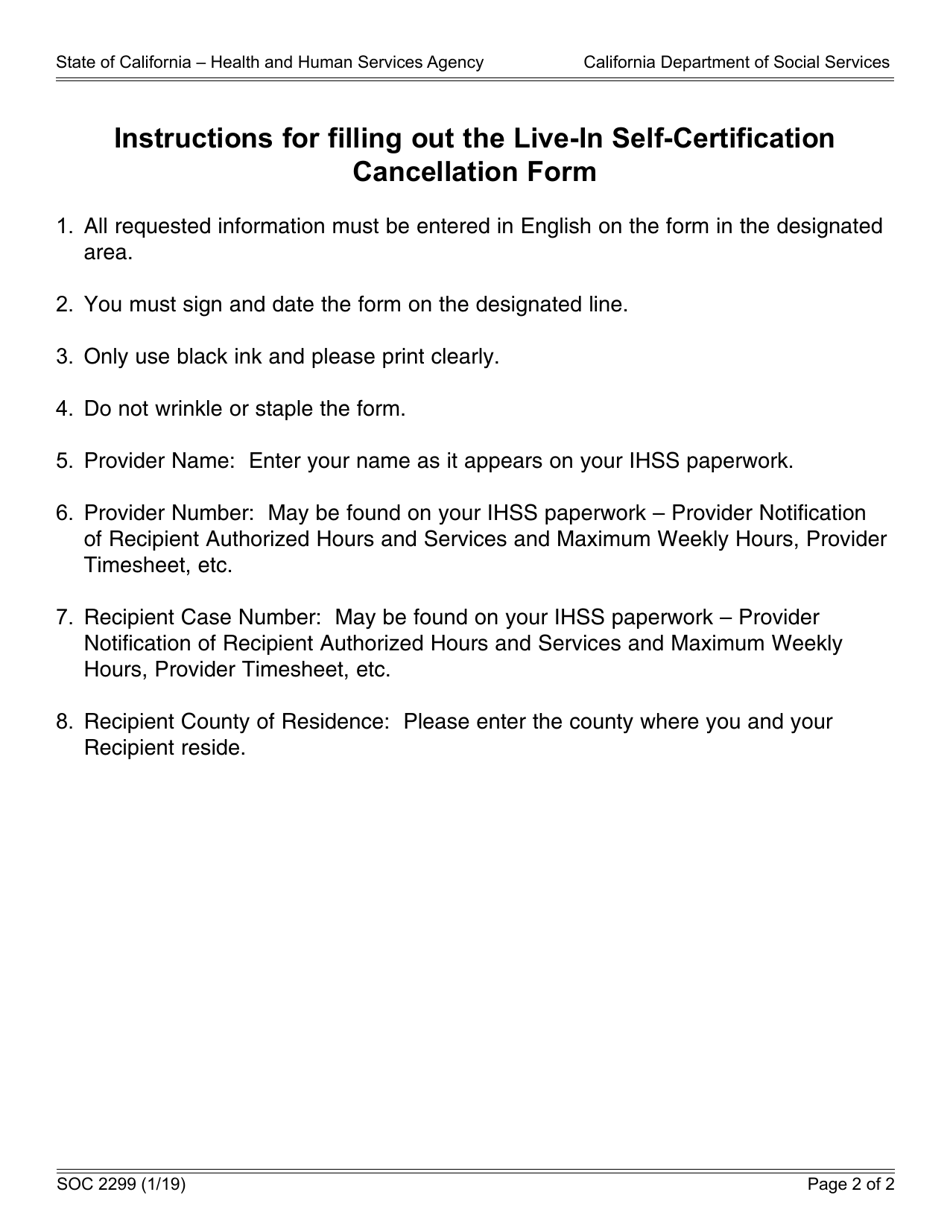

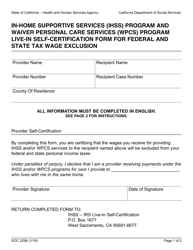

Form SOC2299 In-home Supportive Services (Ihss) Program and Waiver Personal Care Services (Wpcs) Program Live-In Self-certification Cancellation Form for Federal and State Tax Wage Exclusion - California

What Is Form SOC2299?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the SOC2299 form?

A: The SOC2299 form is the In-home Supportive Services (IHSS) Program and Waiver Personal Care Services (WPCS) Program Live-In Self-certification Cancellation Form for Federal and State Tax Wage Exclusion in California.

Q: What is the purpose of the SOC2299 form?

A: The purpose of the SOC2299 form is to cancel the live-in self-certification for federal and state tax wage exclusion in California for the IHSS and WPCS programs.

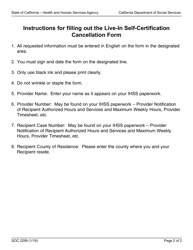

Q: How do I cancel the live-in self-certification for tax wage exclusion?

A: To cancel the live-in self-certification for tax wage exclusion, you need to fill out the SOC2299 form.

Q: Do I need to submit the SOC2299 form every year?

A: No, you only need to submit the SOC2299 form if you want to cancel your live-in self-certification for tax wage exclusion.

Q: Are there any important deadlines for submitting the SOC2299 form?

A: There are no specific deadlines mentioned for submitting the SOC2299 form. However, it is recommended to submit the form as soon as you decide to cancel your live-in self-certification.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SOC2299 by clicking the link below or browse more documents and templates provided by the California Department of Social Services.