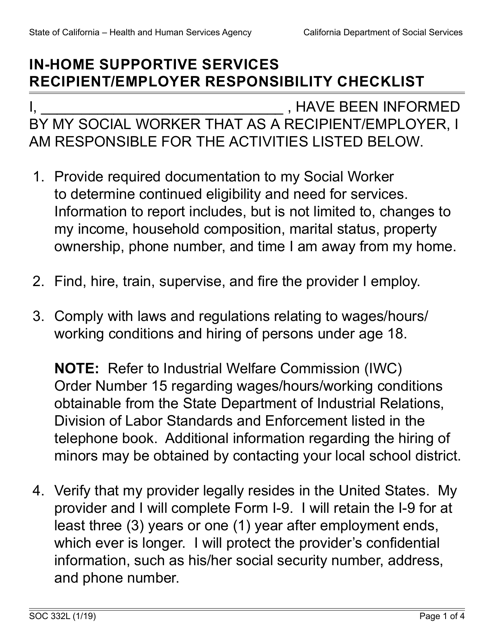

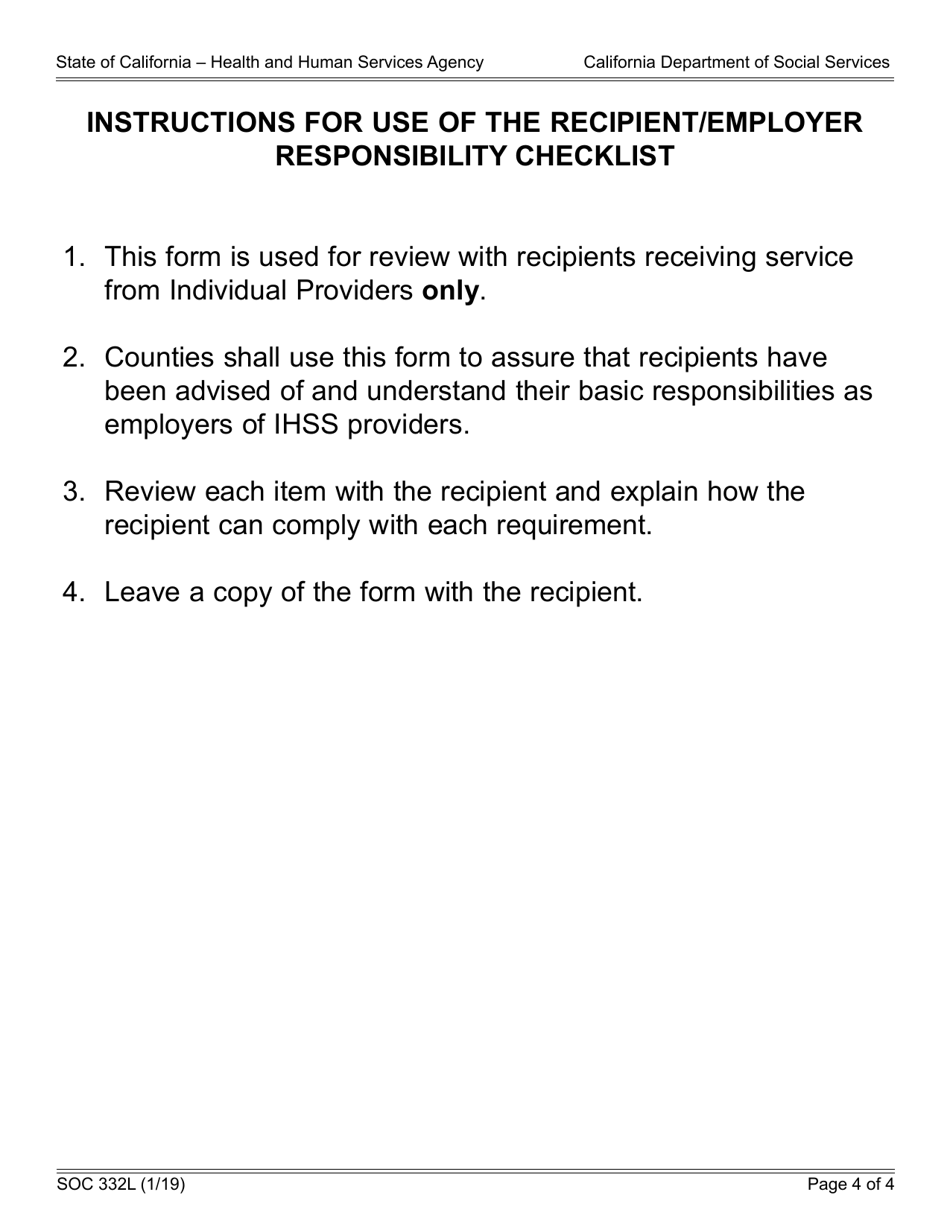

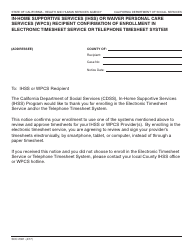

Form SOC332L In-home Supportive Services Recipient / Employer Responsibility Checklist - California

What Is Form SOC332L?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the SOC332L form?

A: The SOC332L form is the In-home Supportive Services Recipient/Employer Responsibility Checklist.

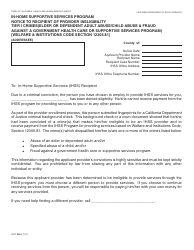

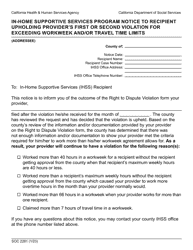

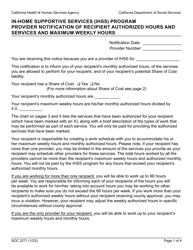

Q: What is the purpose of the SOC332L form?

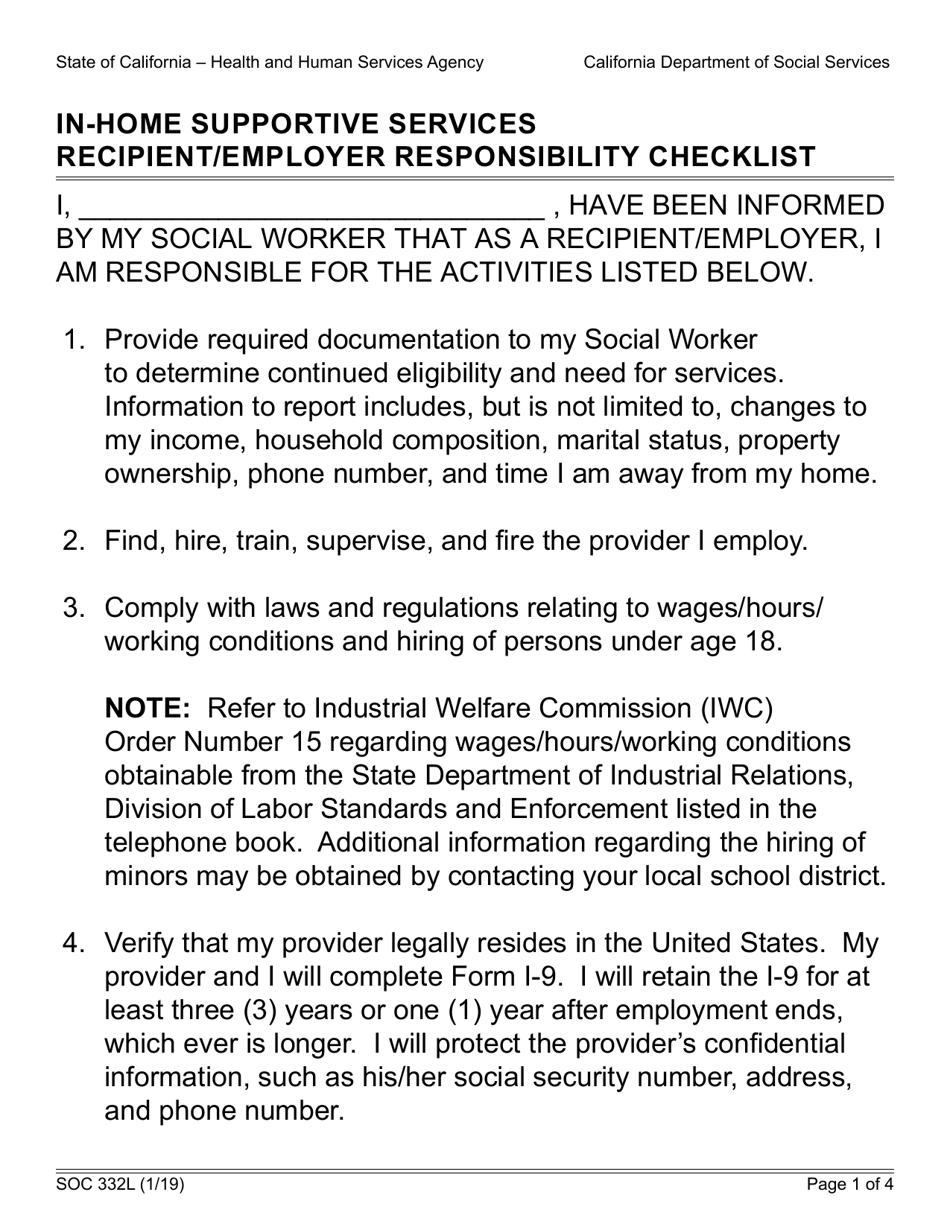

A: The purpose of the SOC332L form is to outline the responsibilities of the recipient/employer in the In-home Supportive Services program.

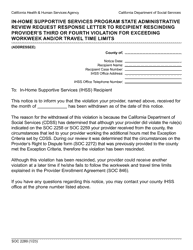

Q: Who needs to complete the SOC332L form?

A: The SOC332L form needs to be completed by the recipient/employer in the In-home Supportive Services program.

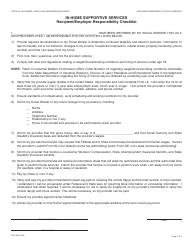

Q: What information is included in the SOC332L form?

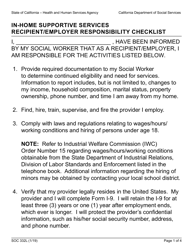

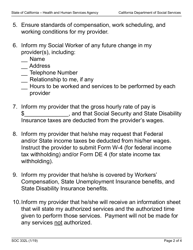

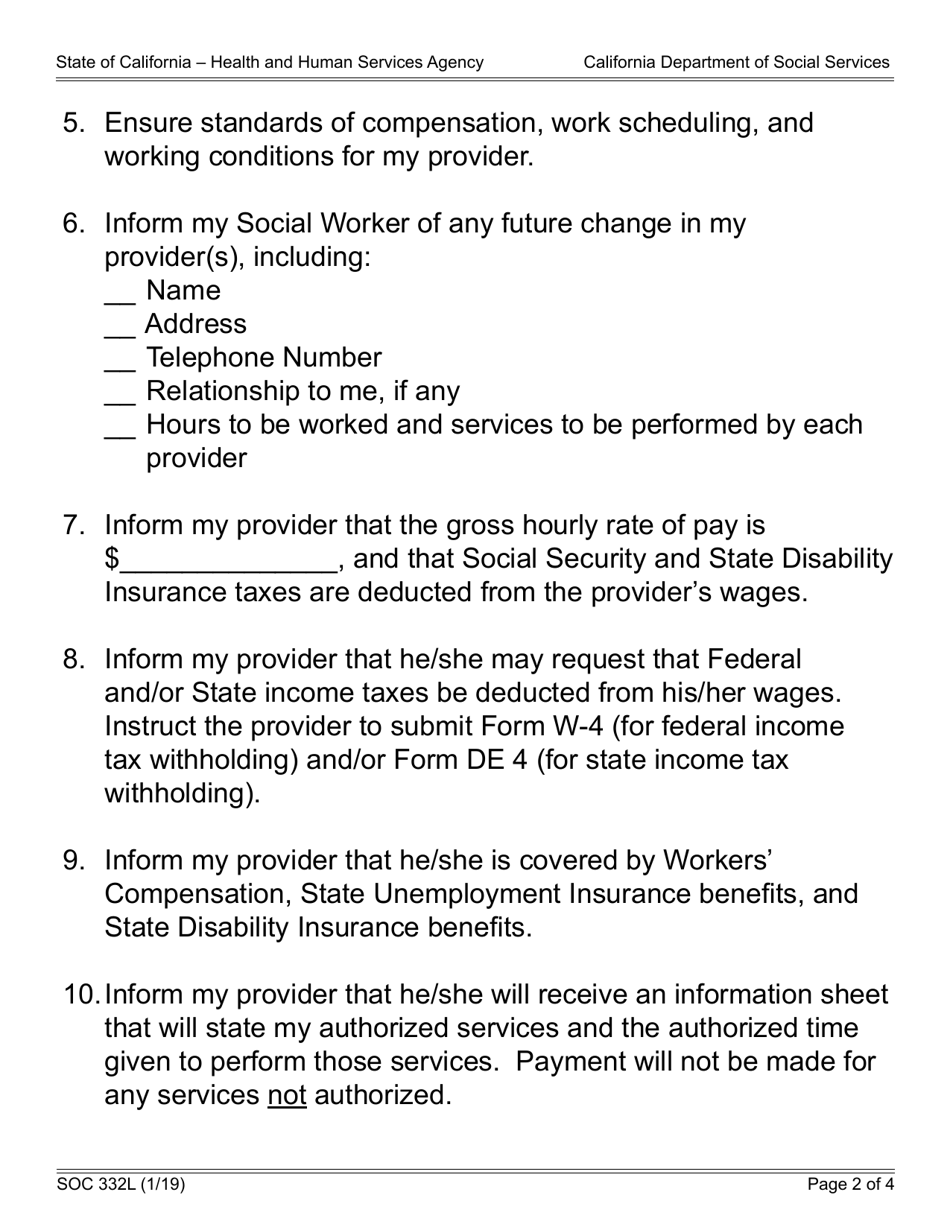

A: The SOC332L form includes information about the recipient/employer's responsibilities, such as reporting changes in income or household composition, maintaining accurate records, and complying with program rules.

Q: What are some examples of recipient/employer responsibilities outlined in the SOC332L form?

A: Some examples of recipient/employer responsibilities outlined in the SOC332L form include reporting changes in income, reporting changes in household composition, maintaining accurate records, and attending mandatory program orientations or trainings.

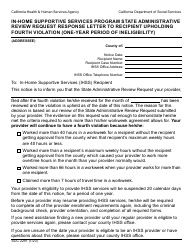

Q: Is the SOC332L form mandatory?

A: Yes, the SOC332L form is mandatory for recipients/employers in the In-home Supportive Services program.

Q: What happens if I don't complete the SOC332L form?

A: Failure to complete the SOC332L form may result in delays or interruptions in receiving In-home Supportive Services benefits.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SOC332L by clicking the link below or browse more documents and templates provided by the California Department of Social Services.