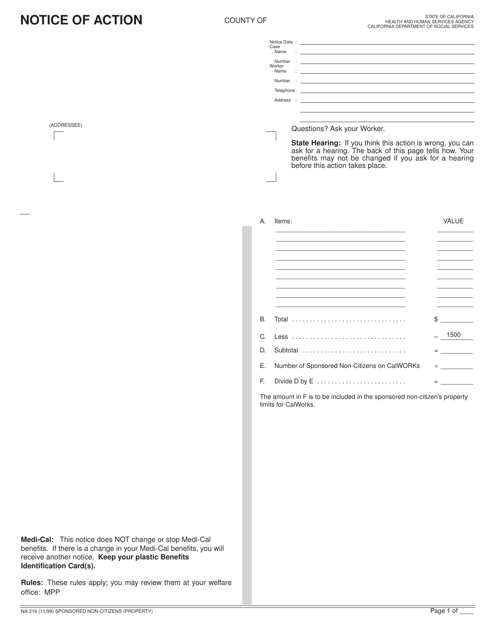

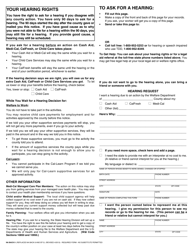

Form NA216 Sponsored Non Citizens Property - California

What Is Form NA216?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NA216?

A: Form NA216 is a form for sponsored non-citizens to report their property in California.

Q: Who needs to file Form NA216?

A: Sponsored non-citizens who own property in California need to file Form NA216.

Q: What is a sponsored non-citizen?

A: A sponsored non-citizen is someone who is not a U.S. citizen but has been sponsored by someone to live in the United States.

Q: Why do sponsored non-citizens need to report their property?

A: Sponsored non-citizens need to report their property to comply with California law and to ensure accurate property tax assessments.

Q: When is the deadline to file Form NA216?

A: The deadline to file Form NA216 is typically by April 1st of each year, but it is always best to check with your local county assessor's office for specific deadlines.

Q: What information do I need to complete Form NA216?

A: You will need information about the property you own, such as its address, the date you acquired it, and its assessed value.

Q: What happens if I don't file Form NA216?

A: Failure to file Form NA216 may result in penalties and fines, and may also impact the accuracy of your property tax assessments.

Q: Can I get help with filing Form NA216?

A: Yes, you can seek assistance from the California State Board of Equalization or your local county assessor's office to help you with filing Form NA216.

Form Details:

- Released on November 1, 1999;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NA216 by clicking the link below or browse more documents and templates provided by the California Department of Social Services.