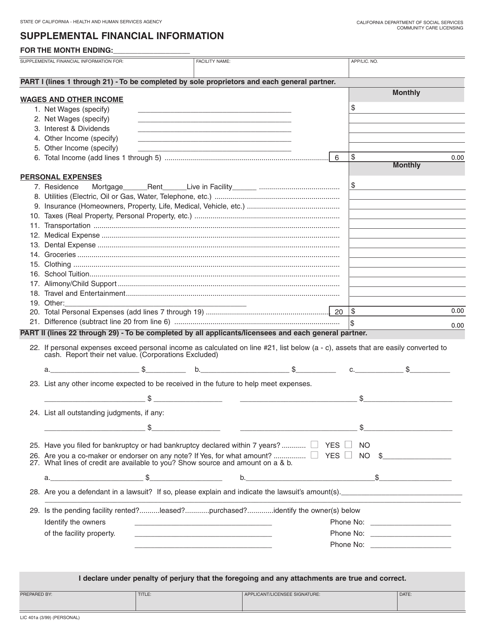

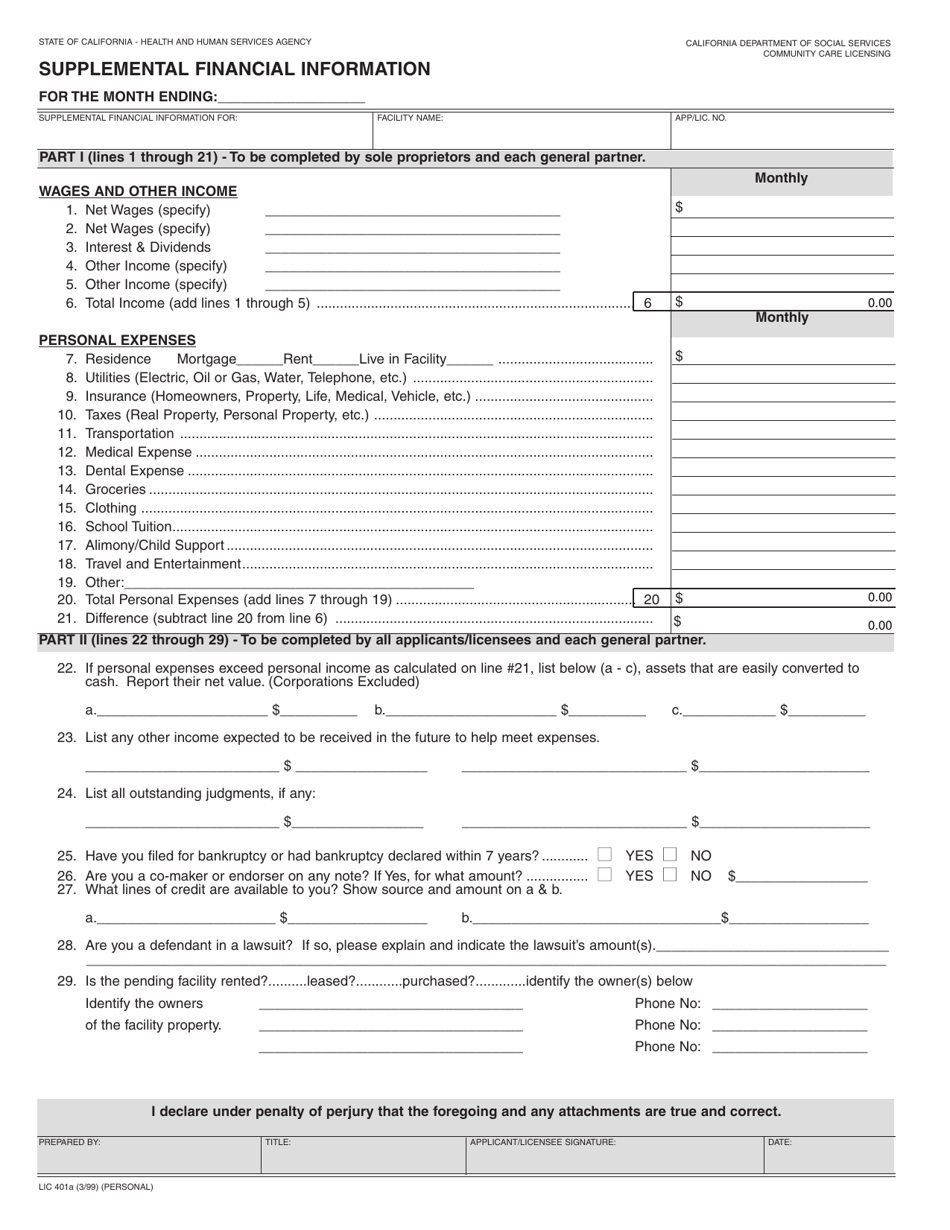

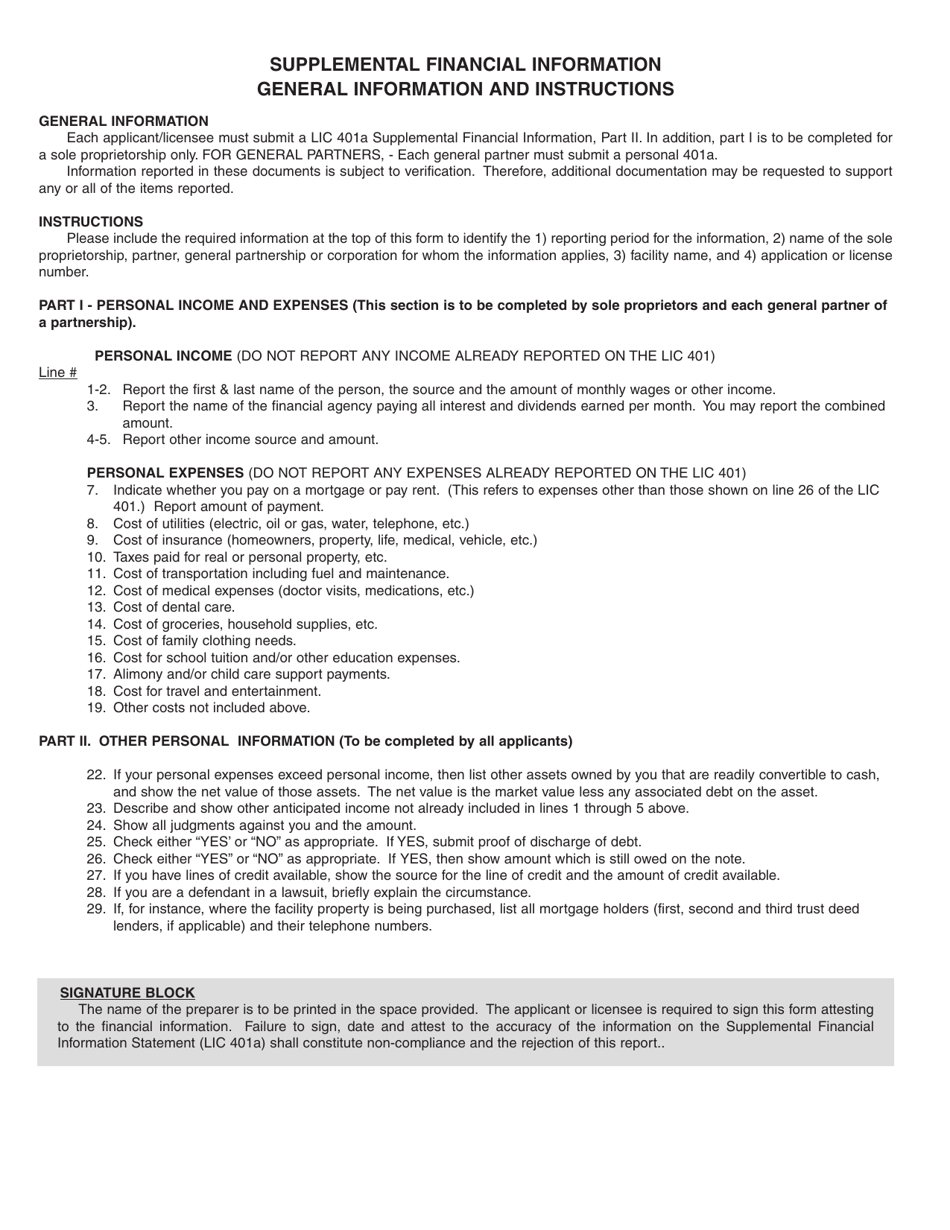

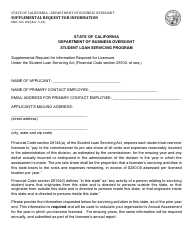

Form LIC401A Supplemental Financial Information - California

What Is Form LIC401A?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

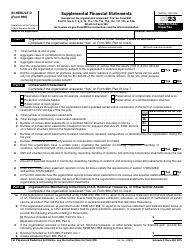

Q: What is the Form LIC401A?

A: Form LIC401A is the Supplemental Financial Information form in the state of California.

Q: What is the purpose of Form LIC401A?

A: The purpose of Form LIC401A is to provide additional financial information to the California Department of Insurance.

Q: Who needs to file Form LIC401A?

A: Insurance companies that are licensed in California need to file Form LIC401A.

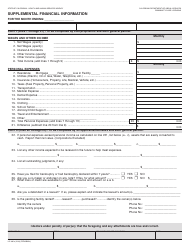

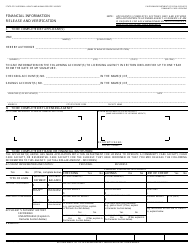

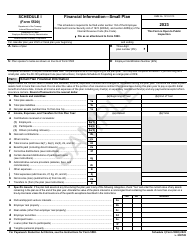

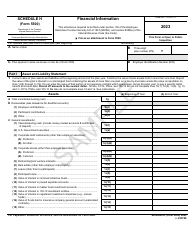

Q: What information is required on Form LIC401A?

A: Form LIC401A requires information about the insurance company's financial condition, such as assets, liabilities, and income.

Q: When is Form LIC401A due?

A: The due date for Form LIC401A varies depending on the insurance company's fiscal year-end, but it is typically due within 90 days after the end of the fiscal year.

Q: Is there a fee for filing Form LIC401A?

A: Yes, there is a fee for filing Form LIC401A. The fee amount is determined by the California Department of Insurance.

Form Details:

- Released on March 1, 1999;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LIC401A by clicking the link below or browse more documents and templates provided by the California Department of Social Services.